by Calculated Risk on 12/05/2019 08:44:00 AM

Thursday, December 05, 2019

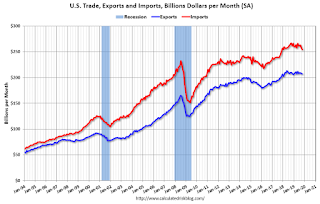

Trade Deficit decreased to $47.2 Billion in October

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $47.2 billion in October, down $3.9 billion from $51.1 billion in September, revised.

October exports were $207.1 billion, $0.4 billion less than September exports. October imports were $254.3 billion, $4.3 billion less than September imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in October.

Exports are 25% above the pre-recession peak and down 1% to October 2018; imports are 10% above the pre-recession peak, and down 5% compared to October 2018.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in September and October.

Oil imports averaged $52.00 per barrel in October, down from $53.12 in September, and down from $61.25 in October 2018.

The trade deficit with China decreased to $31.3 billion in October, from $43.1 billion in October 2018.

Weekly Initial Unemployment Claims decrease to 203,000

by Calculated Risk on 12/05/2019 08:33:00 AM

The DOL reported:

In the week ending November 30, the advance figure for seasonally adjusted initial claims was 203,000, a decrease of 10,000 from the previous week's unrevised level of 213,000. The 4-week moving average was 217,750, a decrease of 2,000 from the previous week's unrevised average of 219,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 217,750.

This was lower than the consensus forecast.

Wednesday, December 04, 2019

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 12/04/2019 07:15:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 213,000 last week.

• At 8:30 AM: Trade Balance report for October from the Census Bureau. The consensus is the trade deficit to be $49.0 billion. The U.S. trade deficit was at $52.5 billion in September.

Black Knight: House Price Index up 0.3% in October, Up 4.3% year-over-year

by Calculated Risk on 12/04/2019 01:12:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight:

Based on the latest data from the Black Knight HPI, October was a strong month for home price gains. And it makes perfect sense.

The annual home price growth rate rose from 3.9% in September to 4.25% in October.

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows their estimate of the MoM and YoY change in House Prices.

This index suggests a pickup in house price appreciation.

ISM Non-Manufacturing Index decreased to 53.9% in November

by Calculated Risk on 12/04/2019 10:05:00 AM

The November ISM Non-manufacturing index was at 53.9%, down from 54.7% in October. The employment index increased to 55.5%, from 53.7%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 118th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM®Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 53.9 percent, which is 0.8 percentage points lower than the October reading of 54.7 percent. This represents continued growth in the non-manufacturing sector, at a slightly slower rate. The Non-Manufacturing Business Activity Index decreased to 51.6 percent, 5.4 percentage points lower than the October reading of 57 percent, reflecting growth for the 124th consecutive month. The New Orders Index registered 57.1 percent; 1.5 percentage points higher than the reading of 55.6 percent in October. The Employment Index increased 1.8 percentage points in November to 55.5 percent from the October reading of 53.7 percent. The Prices Index increased 1.9 percentage points from the October reading of 56.6 percent to 58.5 percent, indicating that prices increased in November for the 30th consecutive month. According to the NMI®, 12 non-manufacturing industries reported growth. The non-manufacturing sector had a slight pullback in November. The respondents hope for a resolution on tariffs and continue to be hampered by constraints in labor resources.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in November than in October.

BEA: November Vehicles Sales increased to 17.1 Million SAAR

by Calculated Risk on 12/04/2019 08:39:00 AM

The BEA released their estimate of November vehicle sales this morning. The BEA estimated sales of 17.09 million SAAR in November 2019 (Seasonally Adjusted Annual Rate), up 3.4% from the October sales rate, and down 1.7% from November 2019.

Sales in 2019 are averaging 16.92 million (average of seasonally adjusted rate), down 1.6% compared to the same period in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for November (red).

Note: The GM strike might have impacted sales in October.

A small decline in sales to date this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 17.09 million SAAR.

ADP: Private Employment increased 67,000 in November

by Calculated Risk on 12/04/2019 08:20:00 AM

Private sector employment increased by 67,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 140,000 private sector jobs added in the ADP report.

...

“In November, the labor market showed signs of slowing,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The goods producers still struggled; whereas, the service providers remained in positive territory driven by healthcare and professional services. Job creation slowed across all company sizes; however, the pattern remained largely the same, as small companies continued to face more pressure than their larger competitors.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is losing its shine. Manufacturers, commodity producers, and retailers are shedding jobs. Job openings are declining and if job growth slows any further unemployment will increase.”

The BLS report will be released Friday, and the consensus is for 180,000 non-farm payroll jobs added in November.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 12/04/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 29, 2019. This week’s results include an adjustment for the Thanksgiving holiday.

... The Refinance Index decreased 16 percent from the previous week and was 61 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 33 percent compared with the previous week and was 24 percent lower than the same week one year ago.

...

U.S. Treasury rates stayed flat last week, as uncertainty surrounding the U.K. elections offset positive domestic news on consumer spending,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the 30-year fixed rate remaining unchanged at 3.97 percent, mortgage applications fell last week, driven down by a 16 percent drop in refinances. Purchase applications were up slightly but declined 24 percent from a year ago. This week’s year-over-year comparisons were distorted by Thanksgiving being a week later this year.”

Added Kan, “The purchase market overall looks healthy as we enter the home stretch of 2019. The seasonally adjusted purchase index was at its highest level since July, as a combination of wage gains, slower home-price appreciation, and slightly easing inventory conditions continue to support increased activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remained unchanged at 3.97 percent, with points increasing to 0.32 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 24% year-over-year unadjusted for the Thanksgiving holiday (the timing of the Holiday was different in 2019 compared to 2018).

Tuesday, December 03, 2019

Wednesday: ADP Employment, ISM Non-Mfg

by Calculated Risk on 12/03/2019 08:15:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 140,000 jobs added, up from 125,000 in October.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for a decrease to 54.5 from 54.7.

Is the Future still Bright?

by Calculated Risk on 12/03/2019 11:26:00 AM

It was almost seven years ago when I wrote "The Future's so Bright …" I noted that I was the most optimistic since the '90s, and that things would only getting better.

I pointed out that housing starts would increase significantly over the next several years, that state and local governments would start hiring again, that the budget deficit would decline sharply, and that household deleveraging was nearing and an end.

As I noted in January 2013: "There are several tailwinds for the economy, and the headwinds (like household deleveraging) are mostly subsiding."

Now the tailwinds are subsiding. Housing starts and new home sales are still positive, but the significant growth is behind us. For vehicle sales, the growth ended a few years ago, and sales are mostly moving sideways recently.

Some commercial real estate sectors - like hotels - growth is slowing. And the Federal budget deficit is increasing sharply.

Fortunately employment is solid, and household debt service and financial obligation ratios are at record lows.

I've also been positive on demographics too, but unfortunately with less immigration and more prime age deaths, the demographic outlook isn't as favorable as a few years ago (See Lawler:Lawler: Updated “Demographic” Outlook Using Recent Population Estimates by Age)

Census 2017 materially over-predicted births, materially under-predicted deaths (mainly for non-elderly adults), and somewhat over-predicted net international migration (NIM) for each of the last several years.And we haven't addressed some of the longer term challenges I mentioned seven years ago - such as rising health care expenditures, climate change, and income and wealth inequality - in fact policy over the last couple of years have made the situation worse.

I'm not on recession watch, and I expect further growth in 2020, but the future isn't as bright now.