by Calculated Risk on 11/10/2019 12:04:00 PM

Sunday, November 10, 2019

Update on Yield Curve

Back in August I wrote: Don't Freak Out about the Yield Curve

I noted that I wasn't even on recession watch!

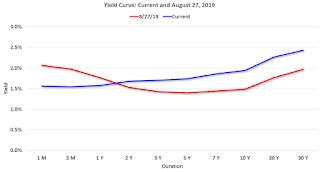

First, here is a graph of the current yield curve, and the yield curve back on August 27, 2019.

The current yield curve (blue) is upward sloping (longer duration notes and bonds yield more than short term bills and notes).

In August, the yield curve was inverted (red).

However - as I noted in August - the Fed was cutting rates this year.

Source: Daily Treasury Yield Curve Rates

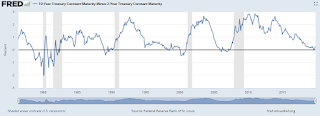

And here is an updated graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.

In mid-1998 the spread between the 10 year and the 2 year went slightly negative, and a recession didn't start until 2001 - over 2 1/2 years later. Of course the Fed cut rates in 1998 - just like the current situation.

Saturday, November 09, 2019

Schedule for Week of November 10, 2019

by Calculated Risk on 11/09/2019 08:11:00 AM

The key economic reports this week are October CPI and Retail Sales.

For manufacturing, October industrial production, and the November New York Fed survey, will be released this week.

Fed Chair Jerome Powell will provide testimony to Congress on the Economic Outlook, on Wednesday and Thursday.

Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

6:00 AM: NFIB Small Business Optimism Index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for October from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

11:00 AM: NY Fed: Q3 Quarterly Report on Household Debt and Credit

11:00 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Congress

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 211,000 last week.

8:30 AM: The Producer Price Index for October from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the House Budget Committee, Washington, D.C.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.2% increase in retail sales.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.2% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.7% on a YoY basis.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 5.0, up from 4.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.4% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.2%.

Friday, November 08, 2019

AAR: October Rail Carloads down 8.4% YoY, Intermodal Down 7.8% YoY

by Calculated Risk on 11/08/2019 12:42:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

A combination of a weak domestic manufacturing sector, feeble economic growth abroad that’s limiting exports, continued trade spats that are disrupting global supply chains, and general economic uncertainty are creating strong headwinds for U.S. rail volumes.

In October 2019, total U.S. rail carloads were down 8.4% from October 2018, their ninth straight decline. ... Intermodal won no prizes in October either: it was down 7.8%, its biggest percentage decline since January 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the year-over-year changes in U.S. Carloads.

Total carloads originated by U.S. railroads in October 2019 were down 8.4%, or 112,703 carloads, from October 2018. That’s the ninth straight yearover- year decline and the biggest percentage decline since March 2019. For the first ten months of 2019, total carloads were down 4.3%, or 497,121 carloads, from the same period last year. Year-to-date carloads were slightly lower in 2016, but other than that, 2019’s year-to-date total is the lowest since sometime prior to 1988, when our data begin.

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):U.S. intermodal originations in October 2019 were 7.8% lower than in October 2018, their ninth straight monthly decline — something that hasn’t happened since 2009 during the Great Recession. Year-to-date intermodal volume through October was down 4.5%, or 553,863 containers and trailers, from 2018.

Early Q4 GDP Forecasts: 0.7% to 2.1%

by Calculated Risk on 11/08/2019 11:19:00 AM

From Goldman Sachs:

[O]ur Q4 GDP tracking estimate declined by one-tenth to +2.1% (qoq ar), and we increased our past-quarter GDP tracking estimate for Q3 by one-tenth to +2.1% (qoq ar, compared to +1.9% as originally reported). [November 4 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 0.7% for 2019:Q4. News from this week's data releases decreased the nowcast for 2019:Q4 by 0.1 percentage point. [Nov 8 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.0 percent on November 5, down from 1.1 percent on November 1. [Nov 5 estimate]CR Note: These very early estimates suggest real GDP growth will be between 0.7% and 2.1% annualized in Q4.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 11/08/2019 09:34:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 2 November

The U.S. hotel industry reported nearly flat year-over-year results in the three key performance metrics during the week of 27 October through 2 November 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 28 October through 3 November 2018, the industry recorded the following:

• Occupancy: -0.3% to 62.7%

• Average daily rate (ADR): +0.6% to US$126.04

• Revenue per available room (RevPAR): +0.3% to US$79.05

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into the winter.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, November 07, 2019

Seattle Real Estate in October: Sales up 7.6% YoY, Inventory down 9.3% YoY

by Calculated Risk on 11/07/2019 05:11:00 PM

The Northwest Multiple Listing Service reported Sparse supply spurring more competition among motivated home buyers in Western Washington

"People are moving here, home prices will continue to increase, inventory shortages will occur. That's our future," remarked Dick Beeson, principal managing broker at RE/MAX Northwest in Gig Harbor, upon viewing the October statistics from Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were up 5.3% year-over-year, and active inventory was down 23.5% year-over-year.

Active listings of homes and condos totaled 14,379, the lowest level since April. Compared to a year ago, last month's selection declined more than 21% and was down 10% from September, according to the new report from Northwest MLS. The year-over-year and month-to-month volume of new listings also declined last month. On a positive note, MLS figures show system-wide gains in October's pending sales (up nearly 5.6%), closed sales (up 4.1%) and prices (up nearly 7.7%) compared to a year ago.

emphasis added

In Seattle, sales were up 7.6% year-over-year, and inventory was down 9.3% year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (2.1 months). In many areas it appears the inventory build that started last year is over.

MBA 2020 Economic and Morgage Forecast: Forecasting 0.9% GDP Growth in 2020

by Calculated Risk on 11/07/2019 12:26:00 PM

From the MBA: MBA 2020 Forecast: Purchase Originations to Increase 1.6 Percent to $1.29 Trillion

MBA forecasts total mortgage originations will come in around $2.06 trillion this year - the best since 2007 ($2.31 trillion) - before likely decreasing to around $1.89 trillion in 2020. In 2021, MBA expects purchase originations to total around $1.33 trillion, and refinance originations to reach $432 billion ($1.74 trillion total).Here are Fratantoni's economic forecast. Note that he is expecting GDP to slow to 0.9% next year (2020), and to be especially sluggish in the first half of next year.

Mike Fratantoni, MBA's Chief Economist and Senior Vice President for Research and Industry Technology, says geopolitical uncertainty and a slowdown in the global economy combined to be the driving force behind this year's increased financial market volatility and drop in interest rates. He expects these headwinds to continue, which will lead to slower economic growth in the United States next year.

"Interest rates will, on average, remain lower for longer given the somewhat cloudy economic outlook. These lower rates will in turn support both purchase and refinance origination volume in 2020," said Fratantoni. "Lower-than-expected mortgage rates gave the refinance market a significant boost this year, resulting in it being the strongest year of volume since 2016. Given the capacity constraints in the industry, some of this refinance activity will spill into the first half of next year."

After multiple years of home-price growth above wage gains, several markets in 2019 saw a slight slowdown in price appreciation. Fratantoni expects to see further deceleration in the next few years, as additional housing supply comes on the market.

"Moderating price growth is healthy, as it allows household incomes to catch up with home values. This improvement in affordability will lead to more home sales - especially given the rise in household formation and growing demand from first-time homebuyers," said Fratantoni.

Weekly Initial Unemployment Claims decreased to 211,000

by Calculated Risk on 11/07/2019 08:41:00 AM

The DOL reported:

In the week ending November 2, the advance figure for seasonally adjusted initial claims was 211,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 218,000 to 219,000. The 4-week moving average was 215,250, an increase of 250 from the previous week's revised average. The previous week's average was revised up by 250 from 214,750 to 215,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 215,250.

This was lower than the consensus forecast.

Wednesday, November 06, 2019

Thursday: Unemployment Claims

by Calculated Risk on 11/06/2019 07:49:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, down from 218,000 last week.

First Look: 2020 Housing Forecasts

by Calculated Risk on 11/06/2019 02:33:00 PM

Towards the end of each year I collect some housing forecasts for the following year. This is just a beginning (I'll gather many more).

The table below shows a few forecasts for 2020:

From Fannie Mae: Housing Forecast: October 2019

From Freddie Mac: Freddie Mac October Forecast: Housing Market Remains Strong While Economic Slowdown Looms

From NAHB: Economic and Housing Forecasts

Note: For comparison, new home sales in 2019 will probably be around 633 thousand, and total housing starts around 1.243 million.

| Housing Forecasts for 2020 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 669 | 903 | 1,267 | 1.5%2 |

| Freddie Mac | 2.8%3 | |||

| NAHB | 629 | 902 | 1,286 | |

| 1Case-Shiller unless indicated otherwise 2Median House Prices 3FHFA Purchase-Only Index 4NAR Median Prices | ||||