by Calculated Risk on 10/29/2019 08:51:00 PM

Tuesday, October 29, 2019

Wednesday: GDP, FOMC Announcement, ADP Employment

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 139,000 jobs added, up from 135,000 in September.

• At 8:30 AM, Gross Domestic Product, 3rd quarter 2019 (advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3, down from 2.0% in Q2.

• At 2:00 PM, FOMC Meeting Announcement. The Fed is expected to lower the Fed Funds rate 25bps at this meeting..

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 10/29/2019 04:24:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

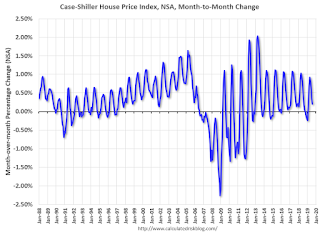

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through August 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

HVS: Q3 2019 Homeownership and Vacancy Rates

by Calculated Risk on 10/29/2019 11:42:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2019.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. he Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

"National vacancy rates in the third quarter 2019 were 6.8 percent for rental housing and 1.4 percent for homeowner housing. The rental vacancy rate of 6.8 percent was not statistically different from the rate in the third quarter 2018 (7.1 percent) and virtually unchanged from the rate in the second quarter 2019. The homeowner vacancy rate of 1.4 percent was 0.2 percentage points lower than the rate in the third quarter 2018 (1.6 percent) and was 0.1 percentage points higher than the rate in the second quarter 2019 (1.3 percent).

The homeownership rate of 64.8 percent was not statistically different from the rate in the third quarter 2018 (64.4 percent), but was 0.7 percentage points higher than the rate in the second quarter 2019 (64.1 percent)."

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 64.8% in Q2, from 64.2% in Q3.

I'd put more weight on the decennial Census numbers. However, given changing demographics, the homeownership rate has bottomed.

The HVS homeowner vacancy increased to 1.4% in Q3.

The HVS homeowner vacancy increased to 1.4% in Q3. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

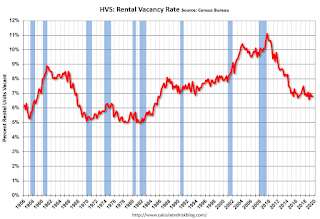

The rental vacancy rate was unchanged at 6.8% in Q3.

The rental vacancy rate was unchanged at 6.8% in Q3.The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate is close to the bottom for this cycle.

NAR: "Pending Home Sales Rise 1.5% in September"

by Calculated Risk on 10/29/2019 10:08:00 AM

From the NAR: Pending Home Sales Rise 1.5% in September

Pending home sales grew in September, marking two consecutive months of increases, according to the National Association of Realtors. The four major regions were split last month, as the Midwest and South recorded gains but the Northeast and West reported declines in month-over-month contract activity.This was above expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, rose 1.5% to 108.7 in September. Year-over-year contract signings jumped 3.9%. An index of 100 is equal to the level of contract activity in 2001.

...

Regional indices in September were mixed, with the Northeast experiencing the smallest change of the four regions. The PHSI in the Northeast fell 0.4% to 93.9 in September, but is still 1.3% higher than a year ago. In the Midwest, the index increased 3.1% to 104.4 in September, 2.7% higher than September 2018.

Pending home sales in the South increased 2.6% to an index of 127.5 in September, a 5.7% jump from last September. The index in the West declined 1.3% in September 2019 to 95.1, which is an increase of 3.4% from a year ago.

emphasis added

Case-Shiller: National House Price Index increased 3.2% year-over-year in August

by Calculated Risk on 10/29/2019 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Las Vegas Drops Out Of Top Three Cities In Annual Gains According To S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.2% annual gain in August, up from 3.1% in the previous month. The 10-City Composite annual increase came in at 1.5%, down from 1.6% in the previous month. The 20-City Composite posted a 2.0% year-over-year gain, no change from the previous month.

Phoenix, Charlotte, and Tampa reported the highest year-over-year gains among the 20 cities. In August, Phoenix led the way with a 6.3% year-over-year price increase, followed by Charlotte with a 4.5% increase and Tampa with a 4.3% increase. Seven of the 20 cities reported greater price increases in the year ending August 2019 versus the year ending July 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.2% in August. The 10-City and 20-City Composites did not post any gains for the month. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase in August. The 10-City Composite posted a 0.1% decrease and the 20-City Composite posted a 0.2% decrease. In August, 11 of 20 cities reported increases both before seasonal adjustment while 17 of 20 cities reported increases after seasonal adjustment.

The U.S. National Home Price NSA Index trend remained intact with a year-over-year price change of 3.2%” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “However, a shift in regional leadership may be underway beneath the headline national index.

“Phoenix saw an increase in its YOY price change to 6.3% and retained its leading position. However, Las Vegas dropped from number two to number eight among the cities of the 20-City Composite, falling from a 4.7% YOY change in July to only 3.3% in August. Meanwhile, the Southeast region included three of the top four cities. Charlotte, Tampa, and Atlanta all recorded solid YOY performance with price changes of 4.5%, 4.3%, and 4.0%, respectively. In the Northwest, Seattle’s YOY change turned positive (0.7%) after three consecutive months of negative YOY price changes. The 10-City Composite YOY price change declined slightly from July to 1.5%, while the 20-City Composite YOY price change remained steady at 2.0%. San Francisco was the only city to record a negative YOY price change (-0.1%).”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.8% from the bubble peak, and down 0.1% in August (SA) from June.

The Composite 20 index is 4.4% above the bubble peak, and down 0.2% (SA) in August.

The National index is 13.8% above the bubble peak (SA), and up 0.3% (SA) in August. The National index is up 53.9% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 1.6% compared to August 2018. The Composite 20 SA is up 2.1% year-over-year.

The National index SA is up 3.2% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, October 28, 2019

Tuesday: Case-Shiller House Prices, Pending Home Sales

by Calculated Risk on 10/28/2019 07:12:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Near 3-Month Highs

Mortgage rates increased again today as lenders continued to get caught up with 2 days of bond market weakness. … With the early October lows representing a modest increase from the early September lows, there's a risk that a bigger-picture shift is taking place. Simply put, the long-term trend of falling rates that began roughly 1 year ago could be in the process of shifting toward a trend of rising rates. [Most Prevalent Rates 30YR FIXED 3.75-3.875%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 0.2% decrease in the index.

• At 10:00 AM, The Q3 2019 Housing Vacancies and Homeownership report from the Census Bureau.

FOMC Preview

by Calculated Risk on 10/28/2019 02:43:00 PM

Expectations are the FOMC will cut the Fed Funds rate 25bp at the meeting this week.

Here are some comments from Goldman Sachs chief economist Jan Hatzius:

We expect the FOMC to deliver a third and final 25bp rate cut at the upcoming meeting. … We believe the mixed growth data since the last meeting more closely resembles the Committee’s baseline forecast than the downside scenarios under discussion. … We expect a somewhat hawkish rewording, with “act as appropriate to sustain the expansion” replaced by a reference to recent easing and the less committal “will act as needed to promote its objectives.”For review, here are the September FOMC projections. In general the data has been close to expectations, suggesting a rate cut at this meeting (since the projections mostly assume a rate cut).

Everyone will be looking for hints of a fourth rate cut - or if the Fed thinks this is the end of the "mid-cycle" rate cuts as Hatzius thinks.

Q1 real GDP growth was at 3.1% annualized, Q2 at 2.0%, and Q3 is projected to be around 1.7%. So GDP is probably close to expectations.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Sept 2019 | 2.1 to 2.3 | 1.8 to 2.1 | 1.8 to 2.0 |

| Jun 2019 | 2.0 to 2.2 | 1.8 to 2.2 | 1.8 to 2.0 |

The unemployment rate was at 3.5% in September. So the unemployment rate is lower than projected for Q4.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Sept 2019 | 3.6 to 3.7 | 3.6 to 3.8 | 3.6 to 3.9 |

| Jun 2019 | 3.6 to 3.7 | 3.5 to 3.9 | 3.6 to 4.0 |

As of August 2019, PCE inflation was up 1.4% from August 2018 So PCE inflation is on the low end of projections.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.8% in August year-over-year. So Core PCE inflation is at the top end of the projected range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 to 2.1 |

Dallas Fed: "Pace of Texas Manufacturing Expansion Slows"

by Calculated Risk on 10/28/2019 10:36:00 AM

From the Dallas Fed: Pace of Texas Manufacturing Expansion Slows, but Outlook Improves

Texas factory activity continued to expand in October, albeit at a markedly slower pace, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell nine points to 4.5, suggesting a moderation in output growth in October.This was the last of the regional Fed surveys for September.

Other measures of manufacturing activity also suggested slower expansion in October, and demand declined. The new orders index turned negative for the first time in three years, falling 11 points to -4.2. The growth rate of orders index also fell into negative territory, coming in at -5.9. The capacity utilization index retreated from 12.0 to 3.6, reaching a three-year low. The shipments index fell nine points to 6.0.

Perceptions of broader business conditions were mixed in October. The general business activity index fell from 1.5 to -5.1, returning to negative territory after two months of positive readings. The company outlook index continued to increase, inching up to 8.8 this month. The index measuring uncertainty regarding companies’ outlooks remained slightly elevated at 12.1.

Labor market measures suggested slower growth in employment and work hours this month. The employment index remained positive but retreated from 18.8 to 11.0, a reading still above average.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index for October will be weak again.

Chicago Fed "Index Points to Slower Economic Growth in September"

by Calculated Risk on 10/28/2019 08:44:00 AM

From the Chicago Fed: Index Points to Slower Economic Growth in September

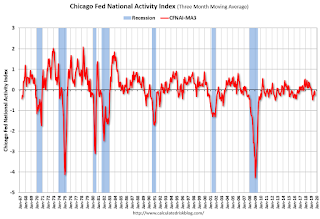

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.45 in September from +0.15 in August. Three of the four broad categories of indicators that make up the index decreased from August, and all four categories made negative contributions to the index in September. The index’s three-month moving average, CFNAI-MA3, decreased to –0.24 in September from –0.06 in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in September (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, October 27, 2019

Sunday Night Futures

by Calculated Risk on 10/27/2019 06:59:00 PM

Weekend:

• Schedule for Week of October 27, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3 and DOW futures are up 42 (fair value).

Oil prices were up over the last week with WTI futures at $56.75 per barrel and Brent at $62.07 barrel. A year ago, WTI was at $67, and Brent was at $78 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.59 per gallon. A year ago prices were at $2.81 per gallon, so gasoline prices are down 22 cents year-over-year.