by Calculated Risk on 10/03/2019 08:42:00 AM

Thursday, October 03, 2019

Weekly Initial Unemployment Claims increased to 219,000

The DOL reported:

In the week ending September 28, the advance figure for seasonally adjusted initial claims was 219,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 213,000 to 215,000. The 4-week moving average was 212,500, unchanged from the previous week's revised average. The previous week's average was revised up by 500 from 212,000 to 212,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 212,500.

This was higher than the consensus forecast.

Wednesday, October 02, 2019

Thursday: Unemployment Claims, ISM non-Mfg

by Calculated Risk on 10/02/2019 08:08:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 213,000 last week.

• At 10:00 AM, the ISM non-Manufacturing Index for September.

• Early, Reis Q3 2019 Mall Survey of rents and vacancy rates.

Reminder on Temporary Decennial Census Hiring; Expect about 15,000 Temp Jobs in September Report

by Calculated Risk on 10/02/2019 04:15:00 PM

In the August employment report, the BLS reported

In August, employment in federal government increased by 28,000. The gain was mostly due to the hiring of 25,000 temporary workers to prepare for the 2020 Census.Earlier, on August 12th, from the Census Bureau: U.S. Census Bureau Announces the Start of First Major Field Operation for 2020 Census

emphasis added

“We were able to verify 65% of addresses using satellite imagery — a massive accomplishment for us,” said Census Bureau Geography Division Chief Deirdre Bishop during the briefing. “In 2010 we had to hire 150,000 people to verify 100% of the addresses in the field, this decade we will only have to hire about 40,000 employees around the nation to verify the remaining 35% of addresses.”Based on this information, we can estimate:

…

Census Bureau employees (listers) have started walking through neighborhoods across the country checking addresses not verified using BARCA software. In-field address canvassing will continue through mid-October.

• An additional 15,000 or so temporary Census workers will be reported in the September BLS report, bringing the total for this operation to around 40,000.

• There probably be little impact from the Census on the October report (the operation concludes in "mid-October"). However, it is possible some temporary jobs will be terminated prior to the reference week in October.

• There will probably be 30,000 to 40,000 Census jobs terminated in November, and maybe December.

• The major Census hiring will start early next year, and will really ramp up in April and May of 2020.

• The major Decennial Census terminations will happen in June through September of 2020.

Here is the Census webpage listing jobs added and terminated by month for the last several Census (1990, 2000, 2010, and now 2020).

Here is How to Report the Monthly Employment Number excluding Temporary Census Hiring

Lawler: “Off-Calendar” Census Population Projection Update Coming; To Include Alternative Migration Scenarios

by Calculated Risk on 10/02/2019 02:32:00 PM

CR Note: This is a technical "heads-up" for data nerds.

From housing economist Tom Lawler: “Off-Calendar” Census Population Projection Update Coming; To Include Alternative Migration Scenarios

According to a Census “Tip Sheet,” Census next week will be releasing several new and updated population reports. Here is the Census release:

“The U.S. Census Bureau will be releasing several new and updated population projection reports that cover projected life expectancy by nativity, projected population by alternative migration scenarios, and updated population projections by demographic characteristics. Supplemental data files for the alternative migration scenarios and input datasets for the main projections series will be released as well. For more information on past projection reports, go to www.census.gov/programs-surveys/popproj.html. (Tentatively scheduled for release Oct. 10.)”

As I have documented in earlier reports, the latest available “official” intermediate- and long-term population projections, released in early 2018, are out of date. They are based on dated population estimates, have unrealistic assumptions about deaths rates by age, and have projections about net international migration that at least in the short-to-intermediate term are probably too high. Hopefully these new estimates will incorporate updated population estimates (Vintage 2018) and more timely data on deaths than was the case in the latest projections. It will also be interesting to see Census’ population projections under alternative migration scenarios, given the highly uncertain outlook for immigration over the next few years.

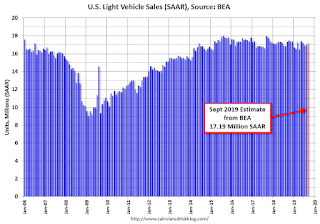

BEA: September Vehicles Sales increased to 17.2 Million SAAR

by Calculated Risk on 10/02/2019 11:05:00 AM

The BEA released their estimate of September vehicle sales this morning. The BEA estimated sales of 17.19 million SAAR in September 2019 (Seasonally Adjusted Annual Rate), up 1.1% from the August sales rate, and down 0.7% from September 2019.

Sales in 2019 are averaging 16.96 million (average of seasonally adjusted rate), down 1.1% compared to the same period in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for September (red).

A small decline in sales to date this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 17.19 million SAAR.

ADP: Private Employment increased 135,000 in September

by Calculated Risk on 10/02/2019 08:19:00 AM

Private sector employment increased by 135,000 jobs from August to September according to the September ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 152,000 private sector jobs added in the ADP report.

...

“The job market has shown signs of a slowdown,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The average monthly job growth for the past three months is 145,000, down from 214,000 for the same time period last year.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses have turned more cautious in their hiring. Small businesses have become especially hesitant. If businesses pull back any further, unemployment will begin to rise.”

The BLS report will be released Friday, and the consensus is for 145,000 non-farm payroll jobs added in September.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 10/02/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 27, 2019.

... The Refinance Index increased 14 percent from the previous week and was 133 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“Mortgage rates mostly decreased last week, with the 30-year fixed rate dropping below 4 percent for the sixth time in the past nine weeks. Borrowers responded to these lower rates, leading to a 14 percent increase in refinance applications,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Although refinance activity slowed in September compared to August, the months together were the strongest since October 2016. The slight changes in rates are still causing large swings in refinance volume, and we expect this sensitivity to persist.”

Added Kan, “Purchase applications also increased and remained more than 9 percent higher than a year ago. Low rates and healthy housing market fundamentals continue to support solid levels of purchase activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.99 percent from 4.02 percent, with points remaining unchanged at 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity. Mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

Tuesday, October 01, 2019

Wednesday: ADP Employment, Vehicle Sales

by Calculated Risk on 10/01/2019 06:32:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 152,000 jobs added, down from 195,000 in August.

• All day: Light vehicle sales for September. The consensus is for sales of 17.0 million SAAR, unchanged from 17.0 million SAAR in August (Seasonally Adjusted Annual Rate).

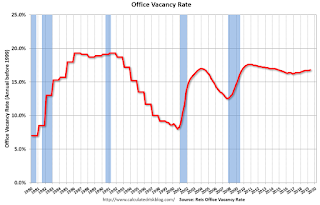

Reis: Office Vacancy Rate unchanged in Q3 at 16.8%

by Calculated Risk on 10/01/2019 01:48:00 PM

Reis reported that the office vacancy rate was at 16.8% in Q3, unchanged from 16.8% in Q2 2019. This is up from 16.7% in Q3 2018, and down from the cycle peak of 17.6%.

From Reis Senior Economist Barbara Byrne Denham:

The Office vacancy rate was flat in the quarter at 16.8%. In the third quarter of 2018 it was 16.7%. Overall vacancy has declined only 0.3% in last five years.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.6% in the third quarter. At $34.06 per square foot (asking) and $27.65 per square foot (effective), the average rents have increased 2.6% from the third quarter of 2018.

...

Office occupancy growth has been sluggish throughout this expansion as firms lease far fewer square feet per added job. Rent growth has also disappointed owners. Each quarter seems to bring more cautiousness as firms weather continued uncertainty from the trade war and global economy. Still, the U.S. has added 350,000 office jobs this year through August, down from 470,000 office jobs added in the first eight months of 2018, but further evidence of steady growth. This should keep office occupancy growth positive. Indeed, the news on the office market has not generated headlines, but growth remains positive and should remain positive this year and next.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.8% in Q3. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased over the last two years.

Office vacancy data courtesy of Reis.

Construction Spending Increased Slightly in August, Down 1.9% YoY

by Calculated Risk on 10/01/2019 11:18:00 AM

From the Census Bureau reported that overall construction spending increased slightly in August:

Construction spending during August 2019 was estimated at a seasonally adjusted annual rate of $1,287.3 billion, 0.1 percent above the revised July estimate of $1,285.6 billion. The August figure is 1.9 percent below the August 2018 estimate of $1,312.2 billion.Private spending decreased and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $955.0 billion, nearly the same as the revised July estimate of $954.8 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $332.3 billion, 0.4 percent above the revised July estimate of $330.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 25% below the bubble peak.

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 2% above the previous peak in March 2009, and 27% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 5%. Non-residential spending is down 3% year-over-year. Public spending is up 5% year-over-year.

This was slightly below consensus expectations. Another somewhat weak construction spending report.