by Calculated Risk on 7/02/2019 12:31:00 PM

Tuesday, July 02, 2019

Reis: Office Vacancy Rate increased in Q2 to 16.8%

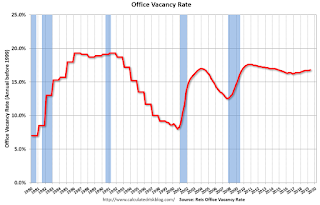

Reis reported that the office vacancy rate was at 16.8% in Q2, up from 16.7% in Q1 2019. This is up from 16.6% in Q2 2018, and down from the cycle peak of 17.6%.

From Reis Chief Economist Victor Calanog:

The office vacancy rate rose slightly over the quarter to 16.8% from 16.7% in the first quarter and 16.6% a year ago. This represents a 50 basis point increase over the sector’s recent low of 16.3% in Q1 2017.

Average asking and effective rents both increased 0.6% in the quarter. At $33.79 per square foot (asking) and $27.43 per square foot (effective), both measures of rent have increased 2.2% from the second quarter of 2018. These rates are in line with previous quarters.

...

As of July 1 we have entered the 121st month in what is now a record-breaking run of economic growth – the longest period of economic expansion in recorded US history. However, despite a healthy job market and strong overall economy, the office market has moved - and continues to move - at a sluggish pace. With vacancies hovering at just 80 basis points below the sector’s cyclical peak of 17.6% in 2010, there is very little to prompt developers to build. Companies are investing in their own owner-occupied space – but few single- and multi-tenant market rate rentals are receiving financing without proof of robust pre-leasing. The office sector is contending with longer-term trends like mechanization and offshoring that are prompting employers to rethink their need for office space.

With relatively flat national numbers, the widening gap between the stronger markets and weaker ones is particularly noteworthy. The underlying data shows that tech firms are fueling much of the growth in the stronger office markets, particularly in west coast metros, parts of Texas and parts of the east coast.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.8% in Q2. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased over the last two years.

Office vacancy data courtesy of Reis.

The Longest Expansions in U.S. History

by Calculated Risk on 7/02/2019 11:39:00 AM

According to NBER, the four longest expansions in U.S. history are:

1) From a trough in June 2009 to today, July 2019 (121 months and counting).

2) From a trough in March 1991 to a peak in March 2001 (120 months).

3) From a trough in February 1961 to a peak in December 1969 (106 months).

4) From a trough in November 1982 to a peak in July 1990 (92 months).

So the current U.S. expansion is the longest on record.

As I noted in late 2017 in Is a Recession Imminent? (one of the five questions I'm frequently asked)

Expansions don't die of old age! There is a very good chance this will become the longest expansion in history.A key reason the current expansion has been so long is that housing didn't contribute for the first few years of the expansion. Also the housing recovery was sluggish for a few more years after the bottom in 2011. This was because of the huge overhang of foreclosed properties coming on the market.

CoreLogic: House Prices up 3.6% Year-over-year in May

by Calculated Risk on 7/02/2019 09:28:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: U.S. Home Price Insights Through May 2019 with Forecasts from June 2019

Home prices nationwide, including distressed sales, increased year over year by 3.6% in May 2019 compared with May 2018 and increased month over month by 0.9% in May 2019 compared with April 2019 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for several years, before slowing last year.

The CoreLogic HPI Forecast indicates that home prices will increase by 5.6% on a year-over-year basis from May 2019 to May 2020. On a month-over-month basis, home prices are expected to increase by 0.8% from May 2019 to June 2019.

“Interest rates on fixed-rate mortgages fell by nearly one percentage point between November 2018 and this May. This has been a shot-in-the-arm for home sales. Sales gained momentum in May and annual home-price growth accelerated for the first time since March 2018.”, Dr. Frank Nothaft, Chief Economist for CoreLogic

emphasis added

The year-over-year comparison has been positive for more than seven years since turning positive year-over-year in February 2012.

Monday, July 01, 2019

30 Year Mortgage Rates at 3.875%

by Calculated Risk on 7/01/2019 06:02:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher to Begin Risky Week

Mortgage rates were slightly higher to start the new week, which is a pretty good outcome considering the underlying events. On Friday, we anticipated a pick-up in volatility as rates were at risk of reacting to any meaningful trade news from the G20 summit or any surprises in economic data. [30YR FIXED - 3.875%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac). Go to MND and you can adjust the graph for different time periods.

Update: Framing Lumber Prices Down 35% Year-over-year

by Calculated Risk on 7/01/2019 02:11:00 PM

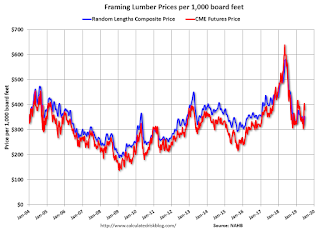

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down 35% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through May 31, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 35% from a year ago, and CME futures are down 33% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Construction Spending Declined in May

by Calculated Risk on 7/01/2019 11:23:00 AM

From the Census Bureau reported that overall construction spending declined in May:

Construction spending during May 2019 was estimated at a seasonally adjusted annual rate of $1,293.9 billion, 0.8 percent below the revised April estimate of $1,304.0 billion. The May figure is 2.3 percent below the May 2018 estimate of $1,324.3 billion.Both private and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $953.2 billion, 0.7 percent below the revised April estimate of $960.3 billion. ...

In May, the estimated seasonally adjusted annual rate of public construction spending was $340.6 billion, 0.9 percent below the revised April estimate of $343.7 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 26% below the bubble peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 5% above the previous peak in March 2009, and 30% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 11%. Non-residential spending is down slightly year-over-year. Public spending is up 11% year-over-year.

This was below consensus expectations, however spending for April was revised up slightly. Another weak construction spending report.

ISM Manufacturing index Decreased to 51.7 in June

by Calculated Risk on 7/01/2019 10:04:00 AM

The ISM manufacturing index indicated expansion in June. The PMI was at 51.7% in June, down from 52.1% in May. The employment index was at 54.5%, up from 53.7% last month, and the new orders index was at 50.0%, down from 52.7%.

From the Institute for Supply Management: June 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in June, and the overall economy grew for the 122nd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The June PMI® registered 51.7 percent, a decrease of 0.4 percentage point from the May reading of 52.1 percent. The New Orders Index registered 50 percent, a decrease of 2.7 percentage points from the May reading of 52.7 percent. The Production Index registered 54.1 percent, a 2.8-percentage point increase compared to the May reading of 51.3 percent. The Employment Index registered 54.5 percent, an increase of 0.8 percentage point from the May reading of 53.7 percent. The Supplier Deliveries Index registered 50.7 percent, a 1.3-percentage point decrease from the May reading of 52 percent. The Inventories Index registered 49.1 percent, a decrease of 1.8 percentage points from the May reading of 50.9 percent. The Prices Index registered 47.9 percent, a 5.3-percentage point decrease from the May reading of 53.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 51.2%, and suggests manufacturing expanded at a slower pace in June than in May.

Black Knight Mortgage Monitor for May: Record Low National Delinquency Rate, Early Delinquency Rate Increasing

by Calculated Risk on 7/01/2019 08:27:00 AM

Black Knight released their Mortgage Monitor report for May today. According to Black Knight, 3.36% of mortgages were delinquent in May, down from 3.64% in May 2018. Black Knight also reported that 0.49% of mortgages were in the foreclosure process, down from 0.59% a year ago.

This gives a total of 3.85% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: In May, Adjustable-Rate Mortgage Prepayments Highest Since 2007; Prepays on 2018 Vintage Loans Up Three Times Over Past Four Months

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, the company took an in-depth look at the resurgence in mortgage prepayments spurred by lower interest rates and seasonal increases in home sale activity. As Black Knight Data & Analytics President Ben Graboske explained, prepayments are up across the board, but some cohorts are seeing greater levels of activity than others.

“Overall, prepayment activity – largely driven by home sales and mortgage refinances – has more than doubled over the past four months,” said Graboske. “It’s now at the highest levels we’ve seen since the fall of 2016, when rates began their steep upward climb. While we’ve observed increases across nearly every investor type, product type, credit score bucket and vintage, some changes stand out. For instance, prepayments among fixed-rate loans have hewed close to the overall market average, rising by more than two times over the past four months. However, ARM prepayment rates have now jumped to their highest level since 2007 as borrowers have sought to shed the uncertainty of their adjustable-rate products for the security of a low, fixed interest rate over the long haul.”

“Likewise, while all loan vintages have seen prepayment activity increase, they are all dwarfed by 2018. Prepays among the 2018 vintages have jumped by more than 300% over the past four months and are now nearly 50% higher than 2014, the next highest vintage. As of June 27, there were 1.5 million refinance candidates from the 2018 vintage alone, accounting for one of every six such candidates in the market, matching the total from the 2013-2017 vintages combined. All in all, some 8.2 million homeowners with mortgages could now both benefit from and likely qualify for a refinance, including more than 35% of those who took out their mortgages just last year. Early estimates suggest closed refinances rose by more than 30% from April 2019, with May’s volumes estimated to be three times higher than the 10-year low seen in November 2018. Given that interest rates have fallen further from May to June – and that we’ve yet to see the calendar year peak in terms of housing turnover related-prepayments – we may very well continue to see rising prepayment activity again in June’s mortgage data.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National delinquency rate over time.

From Black Knight:

• After a slow start to the year, the national delinquency rate has now set record lows in each of the past two monthsThe second graph shows the early delinquency rates:

• As we've previously reported, delinquencies fell by less than 6% over the span of Q1 2019, the lowest first quarter improvement on record

• At 3.36%, delinquencies are more than 20% (-0.88%) below their pre-recession (20002005) average

• Early-stage delinquency rates have been on the rise since mid-2017, with a sharp increase in such delinquencies on purchase loans beginning in early 2018There is much more in the mortgage monitor.

• The 6-month delinquency rate of recent originations is the highest it’s been since 2010, while the same metric shows the 6-month delinquency rate among purchase loans it at its highest level since mid-2012

• Examining more recent originations (those from June to November 2018, specifically) we see that 6-month delinquency rates among purchase loans are, on average, 50% above the year prior, suggesting this trend may strengthen

• That said, early-stage delinquencies are still well below pre-recession averages, but the sharp rise is worth keeping an eye on

Sunday, June 30, 2019

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 6/30/2019 08:30:00 PM

Weekend:

• Schedule for Week of June 30, 2019

Monday:

• At 10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 51.2, down from 52.1 in May.

• At 10:00 AM: Construction Spending for May. The consensus is for a 0.1% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 23 and DOW futures are up 206 (fair value).

Oil prices were up over the last week with WTI futures at $59.74 per barrel and Brent at $66.01 barrel. A year ago, WTI was at $74, and Brent was at $77 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.70 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are down about 6% year-over-year.

June 2019: Unofficial Problem Bank list increased to 76 Institutions, Q2 2019 Transition Matrix

by Calculated Risk on 6/30/2019 08:11:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources. DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for June 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for June 2019. During the month, the list increased by three to 76 institutions after a removal and three additions. Assets changed by a nominal $322 million to $55 billion. A year ago, the list held 92 institutions with assets of $60 billion.

This month, the action against First Southern Bank (f/k/a The Patterson Bank), Patterson, GA ($123 million) was terminated. Additions this month included The Farmers Bank, Carnegie, OK ($121 million); Home Bank of Arkansas, Portland, AR ($76 million); and State Bank, Green River, WY ($29 million). Also, thanks to a reader that identified an institution not included within the list – CornerstoneBank, Atlanta, GA ($219 million), that has been operating under a Consent Order since 2012.

With the conclusion of the second quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, 1,747 institutions have appeared on a weekly or monthly list since the start of publication. Only 4.2 percent of the banks that have appeared on a list remain today as 1,671 institutions have transitioned through the list. Departure methods include 984 action terminations, 406 failures, 262 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 6 or 1.5 percent, are still designated as being in a troubled status more than nine years later. The 406 failures represent 23.3 percent of the 1,747 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 179 | (68,279,301) | |

| Unassisted Merger | 41 | (10,072,112) | |

| Voluntary Liquidation | 5 | (10,672,586) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | 345,554 | ||

| Still on List at 6/30/2019 | 6 | 1,237,647 | |

| Additions after 8/7/2009 | 70 | 53,790,865 | |

| End (6/30/2019) | 76 | 55,028,512 | |

| Intraperiod Removals1 | |||

| Action Terminated | 805 | 325,312,142 | |

| Unassisted Merger | 221 | 82,691,403 | |

| Voluntary Liquidation | 14 | 2,558,186 | |

| Failures | 248 | 125,152,210 | |

| Total | 1,288 | 535,731,941 | |

| 1Institution not on 8/7/2009 or 6/30/2019 list but appeared on a weekly list. | |||