by Calculated Risk on 3/30/2019 08:11:00 AM

Saturday, March 30, 2019

Schedule for Week of March 31, 2019

The key reports scheduled for this week are the March employment report, February Retail Sales, March Auto Sales, and the ISM Manufacturing survey.

Also, the Q1 quarterly Reis surveys for office and malls will be released this week.

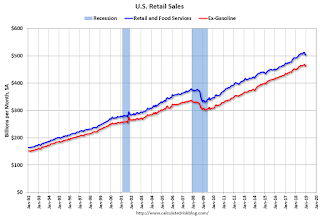

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.3% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 2.9% on a YoY basis in December.

Early: Reis Q1 2019 Office Survey of rents and vacancy rates.

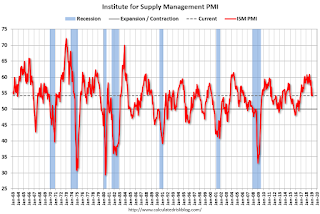

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 54.0, down from 54.2 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 54.0, down from 54.2 in February.Here is a long term graph of the ISM manufacturing index.

The PMI was at 54.2% in February, the employment index was at 53.2%, and the new orders index was at 55.5%

10:00 AM: Construction Spending for February. The consensus is for a 0.1% decrease in construction spending.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.8 million SAAR in March, up from 16.5 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.8 million SAAR in March, up from 16.5 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

Early: Reis Q1 2019 Mall Survey of rents and vacancy rates.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.9% decrease in durable goods orders.

10:00 AM: Corelogic House Price index for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 160,000 payroll jobs added in March, down from 183,000 added in February.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for a reading of 58.0, down from 59.7.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 216 thousand initial claims, up from 211 thousand the previous week.

8:30 AM: Employment Report for March. The consensus is for 169,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

8:30 AM: Employment Report for March. The consensus is for 169,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.There were 20,000 jobs added in February, and the unemployment rate was at 3.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In February the year-over-year change was 2.509 million jobs.

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, March 29, 2019

Reis: Apartment Vacancy Rate unchanged in Q1 at 4.8%

by Calculated Risk on 3/29/2019 04:27:00 PM

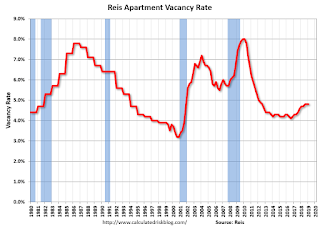

Reis reported that the apartment vacancy rate was at 4.8% in Q1 2019, unchanged from 4.8% in Q4, and up from 4.7% in Q1 2018. This ties the last two quarters as the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From economist Barbara Denham at Reis:

The apartment vacancy rate was flat in the quarter at 4.8%. In the first quarter of 2018 it was 4.7%, while at the start of 2017 it was 4.3%.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.5% in the first quarter. At $1,451 per unit (asking) and $1,380 per unit (effective), the average rents have increased 4.4% and 4.2%, respectively, from the first quarter of 2018.

...

Apartment occupancy growth had accelerated in 2018 after slowing a bit in 2017. At the same time, the housing market slumped in 2018 after gaining momentum in 2017. Recently, existing home sales jumped yet apartment occupancy growth was subdued. We had attributed the acceleration in the apartment market in 2018 to the tax cut at the end of 2017 that reduced the incentive to buy a home. Many have cited the drop in mortgage rates to the housing market jump in February.

A closer look at the numbers shows that the condo and coop sales were flat in the first two months of 2019 after falling in 2018. This is consistent with our apartment occupancy numbers and suggests that the housing market uptick was concentrated in less urban areas that do not compete as much with strong apartment construction. There are a number of factors impacting housing, but it is too early to say if the apartment market will suffer if the housing market has strengthened. The preliminary housing numbers from the National Association of Realtors are subject to change.

We still expect construction to remain robust in 2019 before completions decelerate in 2020. Occupancy should stay consistent with both supply growth and job growth, but the pent-up demand for buying a home could impact some markets more than others.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had mostly moved sideways for the last several years and moved up a little more recently.

With more supply coming on line - and somewhat less favorable demographics - the vacancy rate will probably increase over the next year or so.

Apartment vacancy data courtesy of Reis.

Q1 GDP Forecasts: Mid 1% Range

by Calculated Risk on 3/29/2019 02:25:00 PM

From Merrill Lynch:

Consumer spending inched up only 0.1% mom in Jan, and a downwardly revised Dec provided a weaker handoff into the quarter. The data sliced 0.3pp from 1Q GDP tracking, bringing our estimate down to 1.7% qoq saar [March 29 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.3% for 2019:Q1 and 1.6% for 2019:Q2 [Mar 29 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2019 is 1.7 percent on March 29, up from 1.5 percent on March 27. A decrease in the nowcast of first-quarter real personal consumption expenditures growth from 0.9 percent to 0.5 percent after this morning’s personal income and outlays release from the U.S. Bureau of Economic Analysis was more than offset by increases in the nowcasts of real nonresidential equipment investment growth, real residential investment growth, and the contribution of inventory investment to first-quarter real GDP growth. [Mar 13 estimate]CR Note: These estimates suggest real GDP growth will be in the 1% to 2% range annualized in Q1.

A few Comments on February New Home Sales

by Calculated Risk on 3/29/2019 12:10:00 PM

New home sales for February were reported at 667,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and sales for January were revised up. However sales for November and December were revised down.

With these revisions, sales increased 1% in 2018 compared to 2017. I expect sales to be around the same level in 2019 as in 2018, and my guess is we haven't seen the peak of this cycle yet.

On Inventory: Months of inventory is now just above the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch very closely.

Earlier: New Home Sales increased to 667,000 Annual Rate in February.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Year-to-date (just through February), sales are up 2.8% compared to the same period in 2018. The comparison will be most difficult in Q1, so this is a solid start for 2019.

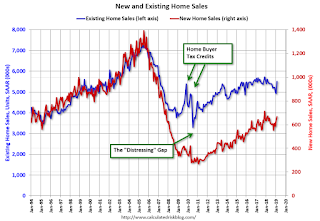

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through February 2019. This graph starts in 1994, but the relationship had been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through February 2019. This graph starts in 1994, but the relationship had been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders have focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 667,000 Annual Rate in February

by Calculated Risk on 3/29/2019 10:14:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 667 thousand.

The previous month was revised up.

"Sales of new single‐family houses in February 2019 were at a seasonally adjusted annual rate of 667,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.9 percent above the revised January rate of 636,000 and is 0.6 percent above the February 2018 estimate of 663,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in February to 6.1 months from 6.5 months in January.

The months of supply decreased in February to 6.1 months from 6.5 months in January. The all time record was 12.1 months of supply in January 2009.

This is above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of February was 340,000. This represents a supply of 6.1 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

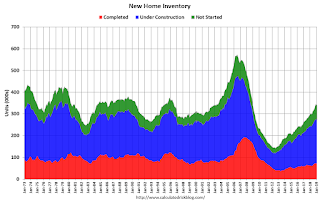

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is a little low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2019 (red column), 56 thousand new homes were sold (NSA). Last year, 54 thousand homes were sold in February.

The all time high for February was 109 thousand in 2005, and the all time low for February was 20 thousand in 2010.

This was well above expectations of 616 thousand sales SAAR, however, although sales in January were revised up, the two previous months (November and December) were revised down significantly. I'll have more later today.

Personal Income Increased 0.2% in February

by Calculated Risk on 3/29/2019 09:38:00 AM

The BEA released the Personal Income, February 2019; Personal Outlays, January 2019:

Due to the recent partial government shutdown, this report combines estimates for January and February 2019. January estimates include both personal income and outlays measures, while February estimates are limited to personal income. Estimates of outlays for February will be available with the next release on April 29, 2019.The increase in personal income for February was below expectations.

Personal income decreased $22.9 billion (-0.1 percent) in January according to estimates released today by the Bureau of Economic Analysis. Disposable personal income decreased $34.9 billion (-0.2 percent), and personal consumption expenditures increased $8.6 billion (0.1 percent).

Real DPI decreased 0.2 percent in January, and real PCE increased 0.1 percent. The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

...

Personal income increased $42.0 billion (0.2 percent) in February. Disposable personal income (DPI) increased $31.3 billion (0.2 percent)

Thursday, March 28, 2019

Friday: New Home Sales, Personal Income and Outlays

by Calculated Risk on 3/28/2019 05:38:00 PM

Friday:

• At 8:30 AM ET, Personal Income, February 2019; Personal Outlays, January 2019. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 60.3, down from 64.7 in February.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for 616 thousand SAAR, up from 607 thousand in January.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 97.8.

Chemical Activity Barometer "Up Slightly" in March

by Calculated Risk on 3/28/2019 02:51:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Up Slightly in March

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), rose 0.1 percent in March on a three-month moving average (3MMA) basis, the first gain in five months. On a year-over-year (Y/Y) basis, the barometer is down 0.3 percent (3MMA).

...

“The CAB continues to indicate gains in U.S. commercial and industrial activity through mid-2019, but at a markedly slower rate of growth, as measured by year-earlier comparisons,” said Kevin Swift, chief economist at ACC.

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production into 2019, but at a slower pace.

Kansas City Fed: "Tenth District Manufacturing Activity Accelerated Moderately"

by Calculated Risk on 3/28/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Accelerated Moderately

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity accelerated moderately, and expectations for future activity also increased.This was the last of the regional Fed surveys for March.

“Factories in the region reported an uptick in growth in March, following three straight months in which the pace of growth slowed,” said Wilkerson. “Plans for both hiring and capital spending picked up.”

...

The month-over-month composite index was 10 in March, up from 1 in February and 5 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factories expanded production of both durable and nondurable goods, particularly food and beverage products, as well as wood, paper, and printing manufacturing. Most month-over-month indexes increased in March, with production, shipments, new orders, order backlog, new orders for exports, and materials inventories rebounding back into positive territory. Most year-over-year factory indexes grew in March, and the composite index rose from 23 to 27. The future composite index also climbed up from 13 to 22, as future factory activity expectations increased across the board.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be at about the same level in March as in February, maybe slightly higher. The early consensus forecast is for a reading of 54.5, up slightly from 54.2 in February (to be released on Monday, April 1st).

NAR: Pending Home Sales Index Decreased 1.0% in February

by Calculated Risk on 3/28/2019 10:04:00 AM

From the NAR: Pending Home Sales Dip 1.0 Percent in February

Pending home sales endured a minor drop in February, according to the National Association of Realtors®. The four major regions were split last month, as the South and West saw a bump in contract activity and the Northeast and Midwest reported slight declines.This was at expectations of a 1% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 1.0 percent to 101.9 in February, down from 102.9 in January. Year-over-year contract signings declined 4.9 percent, making this the fourteenth straight month of annual decreases.

...

The PHSI in the Northeast declined 0.8 percent to 92.1 in February, and is now 2.6 percent below a year ago. In the Midwest, the index fell 7.2 percent to 93.2 in February, 6.1 percent lower than February 2018.

Pending home sales in the South inched up 1.7 percent to an index of 121.8 in February, which is 2.9 percent lower than this time last year. The index in the West increased 0.5 percent in February to 87.5 and fell 9.6 percent below a year ago.

emphasis added