by Calculated Risk on 3/05/2019 10:15:00 AM

Tuesday, March 05, 2019

New Home Sales increased to 621,000 Annual Rate in December

Note: This release is for December (this was delayed due to the government shutdown). The January report is scheduled for March 14th.

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 621 thousand.

The previous three months were revised down significantly.

"Sales of new single‐family houses in December 2018 were at a seasonally adjusted annual rate of 621,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.7 percent above the revised November rate of 599,000, but is 2.4 percent below the December 2017 estimate of 636,000.

An estimated 622,000 new homes were sold in 2018. This is 1.5 percent above the 2017 figure of 613,000."

emphasis added

Click on graph for larger image.

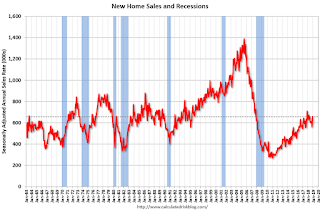

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in December to 6.6 months from 6.7 months in November.

The months of supply decreased in December to 6.6 months from 6.7 months in November. The all time record was 12.1 months of supply in January 2009.

This is above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of December was 344,000. This represents a supply of 6.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is a little low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2018 (red column), 44 thousand new homes were sold (NSA). Last year, 45 thousand homes were sold in December.

The all time high for December was 87 thousand in 2005, and the all time low for December was 23 thousand in 1966 and 2010.

This was above expectations of 591,000 sales SAAR, however the previous months were revised down. I'll have more later today.

CoreLogic: House Prices up 4.4% Year-over-year in January

by Calculated Risk on 3/05/2019 08:33:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports January Home Prices Increased by 4.4 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4.4 percent year over year from January 2018. On a month-over-month basis, prices increased by 0.1 percent in January 2019. (December 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, the CoreLogic HPI Forecast indicates that the 2019 annual average home price will increase 3.4 percent above the 2018 annual average. On a month-over-month basis, home prices are expected to decrease by 0.9 percent from January 2019 to February 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The spike in mortgage interest rates last fall chilled buyer activity and led to a slowdown in home sales and price growth,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Fixed-rate mortgage rates have dropped 0.6 percentage points since November 2018 and today are lower than they were a year ago. With interest rates at this level, we expect a solid home-buying season this spring.”

emphasis added

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.The year-over-year comparison has been positive for almost seven consecutive years since turning positive year-over-year in February 2012.

Monday, March 04, 2019

Tuesday: New Home Sales, ISM Non-Mfg Index

by Calculated Risk on 3/04/2019 09:25:00 PM

Note: This is New Home sales for December - they are still catching up after the government shutdown.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Remain Steady, But That's a Victory Today

[30YR FIXED 4.375 - 4.5%]Tuesday:

emphasis added

• At 8:00 AM ET: Corelogic House Price index for January.

• At 10:00 AM: New Home Sales for December from the Census Bureau. The consensus is for 591 thousand SAAR, down from 657 thousand in November.

• At 10:00 AM: the ISM non-Manufacturing Index for February.

Update: Framing Lumber Prices Down 25% Year-over-year

by Calculated Risk on 3/04/2019 05:31:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down about 25% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through February 22, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 26% from a year ago, and CME futures are down 25% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Q4 2018 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 3/04/2019 01:22:00 PM

The BEA has released the underlying details for the Q4 initial GDP report.

The BEA reported that investment in non-residential structures decreased at a 4.2% annual pace in Q4. Investment in petroleum and natural gas exploration increased in Q4 compared to Q3, and has increased substantially recently (although this may change with the recent decline in oil prices).

Without the increase in petroleum and natural gas exploration, non-residential investment would only be up about 5% year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices increased in Q4, and is up 12% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 15% year-over-year in Q4. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased in Q4, and lodging investment is up 16% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for the last six years - although single family investment has been down a little recently.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increase.

Investment in single family structures was $278 billion (SAAR) (about 1.3% of GDP), and was down in Q4 compared to Q3.

Investment in multi-family structures increased in Q4.

Investment in home improvement was at a $270 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (about 1.3% of GDP). Home improvement spending has been solid.

Construction Spending decreased in December

by Calculated Risk on 3/04/2019 10:10:00 AM

From the Census Bureau reported that overall construction spending decreased in December:

Construction spending during December 2018 was estimated at a seasonally adjusted annual rate of $1,292.7 billion, 0.6 percent below the revised November estimate of $1,300.6 billion. The December figure is 1.6 percent above the December 2017 estimate of $1,272.6 billion.Both private and public spending decreased:

The value of construction in 2018 was $1,297.7 billion, 4.1 percent above the $1,246.0 billion spent in 2017.

Spending on private construction was at a seasonally adjusted annual rate of $991.2 billion, 0.6 percent below the revised November estimate of $997.1 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $301.5 billion, 0.6 percent below the revised November estimate of $303.5 billion.

emphasis added

Click on graph for larger image.

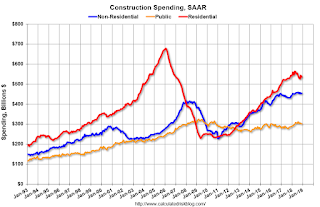

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined recently - and is still 21% below the bubble peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 7% below the peak in March 2009, and 15% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 1%. Non-residential spending is up 3% year-over-year. Public spending is up 4% year-over-year.

This was below consensus expectations, however spending for October and November were revised up.

Sunday, March 03, 2019

Sunday Night Futures

by Calculated Risk on 3/03/2019 07:34:00 PM

Weekend:

• Schedule for Week of March 3, 2019

Monday:

• All day, Light vehicle sales for February. The consensus is for light vehicle sales to be 17.0 million SAAR in February, down from 16.6 million in January (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET,: Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 11 and DOW futures are up 105 (fair value).

Oil prices were down over the last week with WTI futures at $56.01 per barrel and Brent at $65.22 per barrel. A year ago, WTI was at $62, and Brent was at $66 - so WTI oil prices are down about 10% year-over-year, and Brent is down slightly.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.43 per gallon. A year ago prices were at $2.52 per gallon, so gasoline prices are down 9 cents per gallon year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 3/03/2019 12:21:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 23 February

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 17-23 February 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 18-24 February 2018, the industry recorded the following:

• Occupancy: -1.7% to 64.7%

• Average daily rate (ADR): +1.7% to US$129.05

• Revenue per available room (RevPAR): flat at US$83.43

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019 - about the same as the previous 4 years..

Seasonally, the occupancy rate will increase over the next month or so into the Spring travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, March 02, 2019

Schedule for Week of March 3, 2019

by Calculated Risk on 3/02/2019 08:11:00 AM

The key reports scheduled for this week are the February employment report, December New Home Sales, and January Housing Starts (Some more catching up).

Other key reports scheduled for this week are the trade deficit and February vehicle sales.

Fed Chair Jerome Powell will speak on Friday about Monetary Policy Normalization.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 17.0 million SAAR in February, down from 16.6 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 17.0 million SAAR in February, down from 16.6 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

10:00 AM: Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 591 thousand SAAR, down from 657 thousand in November.

10:00 AM: Corelogic House Price index for January.

10:00 AM: the ISM non-Manufacturing Index for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in February, down from 213,000 added in January.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $57.6 billion. The U.S. trade deficit was at $49.3 billion in November.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, unchanged from 225 thousand the previous week.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

3:00 PM: Consumer Credit from the Federal Reserve.

8:30 AM: Employment Report for February. The consensus is for 178,000 jobs added, and for the unemployment rate to decline to 3.9%.

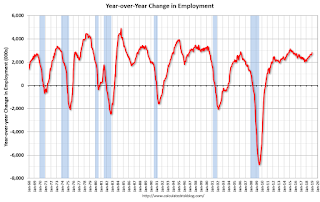

8:30 AM: Employment Report for February. The consensus is for 178,000 jobs added, and for the unemployment rate to decline to 3.9%.There were 304,000 jobs added in January, and the unemployment rate was at 4.0%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In January the year-over-year change was 2.807 million jobs.

8:30 AM ET: Housing Starts for January.

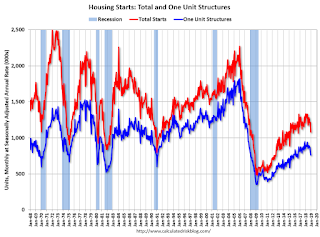

8:30 AM ET: Housing Starts for January. This graph shows single and total housing starts since 1968.

The consensus is for 1.170 million SAAR, up from 1.078 million SAAR.

10:00 PM: Speech by Fed Chair Jerome Powell, Monetary Policy Normalization and Review, At the 2019 Stanford Institute for Economic Policy Research (SIEPR) Economic Summit, Stanford, California

Friday, March 01, 2019

Demographics: Renting vs. Owning

by Calculated Risk on 3/01/2019 03:52:00 PM

Note; This is an update to a post I wrote in 2015.

It was almost 9 years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers in 2011 were 1) very low new supply for apartments, and 2) strong demand (both favorable demographics, and people moving from owning to renting).

The move "from owning to renting" is over, and demographics for apartments are much less favorable than 8 years ago. Also much more supply has come online. Slowing demand and more supply for apartments is why multi-family starts have slowed recently (multi-family starts probably peaked in 2015).

| Multi-family Starts by Year | |

|---|---|

| Year | 5+ Units (000s) |

| 2005 | 311.4 |

| 2006 | 292.8 |

| 2007 | 277.3 |

| 2008 | 266.0 |

| 2009 | 97.3 |

| 2010 | 104.3 |

| 2011 | 167.3 |

| 2012 | 233.9 |

| 2013 | 293.7 |

| 2014 | 341.7 |

| 2015 | 385.8 |

| 2016 | 380.8 |

| 2017 | 342.7 |

| 2018 | 359.7 |

On demographics, a large cohort had been moving into the 20 to 29 year old age group (a key age group for renters). Going forward, a large cohort is moving into the 30 to 39 age group (a key for ownership).

Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

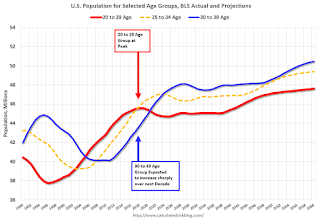

NOTE: This graph is updated using the Vintage 2017 estimates.

Click on graph for larger image.

Click on graph for larger image.This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023. This suggests demand for apartments will soften somewhat.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

This demographics is now positive for home buying, and this is a key reason I expect single family housing starts to continue to increase.