by Calculated Risk on 2/26/2019 04:41:00 PM

Tuesday, February 26, 2019

Real House Prices and Price-to-Rent Ratio in December

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 4.7% year-over-year in December

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 11.9% above the previous bubble peak. However, in real terms, the National index (SA) is still about 8.2% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.8% below the bubble peak.

The year-over-year increase in prices has slowed to 4.7% nationally, and will probably slow more as inventory picks up.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $286,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

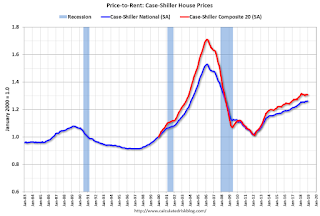

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to March 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 2/26/2019 02:33:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through December 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Comments on December Housing Starts

by Calculated Risk on 2/26/2019 11:32:00 AM

Earlier: Housing Starts Decreased to 1.078 Million Annual Rate in December

Total housing starts in December were well below expectations, and starts for October and November were revised down.

The housing starts report released this morning showed starts were down 11.2% in December compared to November (November starts were revised down), and starts were down 10.9% year-over-year compared to December 2017.

Single family starts were down 10.5% year-over-year. This was the weakest month for single family starts since August 2016.

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were down 10.9% in December compared to December 2017.

Even with the year end weakness, total starts were up 3.6% in 2018 compared to 2017. The weakness at the end of 2018 has been blamed on higher mortgage rates (that have since come down to around 4.5%), the stock market volatility (since stabilized), trade and immigration policies (impacting foreign buyers), and the partial government shutdown (started in December, but mostly in January).

My sense is starts will pick up in Q1 compared to Q4 2018.

Single family starts were up 2.8% in 2018 compared to 2017.

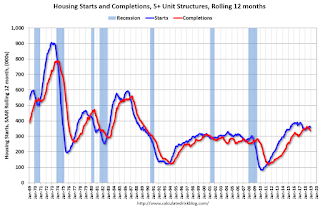

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now (more deliveries).

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR) - however multi-family has picked up a little recently.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Fed Chair Powell: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/26/2019 10:02:00 AM

From Fed Chair Jerome Powell: Semiannual Monetary Policy Report to the Congress. Excerpts:

While we view current economic conditions as healthy and the economic outlook as favorable, over the past few months we have seen some crosscurrents and conflicting signals. Financial markets became more volatile toward year-end, and financial conditions are now less supportive of growth than they were earlier last year. Growth has slowed in some major foreign economies, particularly China and Europe. And uncertainty is elevated around several unresolved government policy issues, including Brexit and ongoing trade negotiations. We will carefully monitor these issues as they evolve.And on the balance sheet:

emphasis added

In light of the substantial progress we have made in reducing reserves, and after extensive deliberations, the Committee decided at our January meeting to continue over the longer run to implement policy with our current operating procedure. That is, we will continue to use our administered rates to control the policy rate, with an ample supply of reserves so that active management of reserves is not required. Having made this decision, the Committee can now evaluate the appropriate timing and approach for the end of balance sheet runoff. I would note that we are prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments. In the longer run, the size of the balance sheet will be determined by the demand for Federal Reserve liabilities such as currency and bank reserves.

Case-Shiller: National House Price Index increased 4.7% year-over-year in December

by Calculated Risk on 2/26/2019 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Annual Gains Fall to 4.7% to End 2018 According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.7% annual gain in December, down from 5.1% in the previous month. The 10City Composite annual increase came in at 3.8%, down from 4.2% in the previous month. The 20-City Composite posted a 4.2% year-over-year gain, down from 4.6% in the previous month.

Las Vegas, Phoenix and Atlanta reported the highest year-over-year gains among the 20 cities. In December, Las Vegas led the way with an 11.4% year-over-year price increase, followed by Phoenix with an 8.0% increase and Atlanta with a 5.9% increase. Three of the 20 cities reported greater price increases in the year ending December 2018 versus the year ending November 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month decrease of 0.1% in December. The 10-City and 20-City Composites both reported 0.2% decreases for the month. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase in December. The 10-City Composite and the 20-City Composite both posted 0.2% month-over-month increases. In December, five of 20 cities reported increases before seasonal adjustment, while 14 of 20 cities reported increases after seasonal adjustment.

“The annual rate of price increases continues to fall,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Even at the reduced pace of 4.7% per year, home prices continue to outpace wage gains of 3.5% to 4% and inflation of about 2%. A decline in interest rates in the fourth quarter was not enough to offset the impact of rising prices on home sales. The monthly number of existing single family homes sold dropped throughout 2018, reaching an annual rate of 4.45 million in December. The 2018 full year sales pace was 4.74 million.

“Regional patterns continue to shift. Seattle and Portland, OR experienced the fastest price increases of any city from late 2016 to the spring of 2018; in December, they ranked 11th and 16th. Currently, the cities with the fastest price increases are Las Vegas and Phoenix. These are a reminder of how prices rose and collapsed in the financial crisis 12 years ago. Despite their recent gains, Las Vegas and Phoenix are the furthest below their 2006 peaks of any city followed in the S&P CoreLogic Case-Shiller Indices.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up slightly from the bubble peak, and up 0.2% in December (SA).

The Composite 20 index is 3.8% above the bubble peak, and up 0.2% (SA) in December.

The National index is 11.9% above the bubble peak (SA), and up 0.3% (SA) in December. The National index is up 51.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 3.7% compared to December 2017. The Composite 20 SA is up 4.2% year-over-year.

The National index SA is up 4.7% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Housing Starts Decreased to 1.078 Million Annual Rate in December

by Calculated Risk on 2/26/2019 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,078,000. This is 11.2 percent below the revised November estimate of 1,214,000 and is 10.9 percent below the December 2017 rate of 1,210,000. Single‐family housing starts in December were at a rate of 758,000; this is 6.7 percent below the revised November figure of 812,000. The December rate for units in buildings with five units or more was 302,000.

An estimated 1,246,600 housing units were started in 2018. This is 3.6 percent (±2.1%) above the 2017 figure of 1,203,000.

Building Permits:

Privately‐owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,326,000. This is 0.3 percent above the revised November rate of 1,322,000 and is 0.5 percent above the December 2017 rate of 1,320,000. Single‐family authorizations in December were at a rate of 829,000; this is 2.2 percent below the revised November figure of 848,000. Authorizations of units in buildings with five units or more were at a rate of 460,000 in December.

An estimated 1,310,700 housing units were authorized by building permits in 2018. This is 2.2 percent above the 2017 figure of 1,282,000.

emphasis added

Click on graph for larger image.

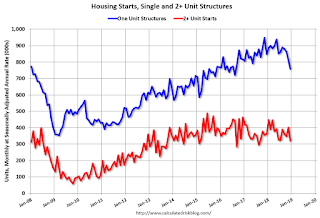

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in December compared to November. Multi-family starts were down 12% year-over-year in December.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) decreased in December, and were down 11% year-over-year.

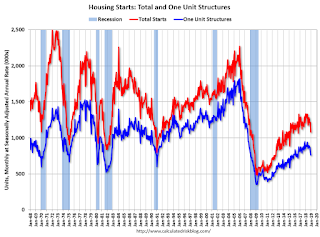

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in December were below expectations, and starts for October and November were revised down.

I'll have more later ...

Monday, February 25, 2019

Tuesday: Housing Starts, Case-Shiller House Prices, Fed Chair Powell Testimony, Richmond Fed Mfg

by Calculated Risk on 2/25/2019 08:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Only Modestly Higher After Tariff News

Mortgage rates were very nearly unchanged today, although the average lender was just slightly higher.Tuesday:

...

Potentially more important will be congressional testimony tomorrow with Federal Reserve Chair Jerome Powell. [30YR FIXED 4.375 - 4.5%]

emphasis added

• At 8:30 AM ET, Housing Starts for December. The consensus is for 1.256 million SAAR, unchanged from 1.256 million SAAR.

• At 9:00 AM, FHFA House Price Index for December 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 4.5% year-over-year increase in the Comp 20 index for December.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

• Also at 10:00 AM: Testimony by Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

Freddie Mac: Mortgage Serious Delinquency Rate Increased Slightly in January

by Calculated Risk on 2/25/2019 06:12:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in January was 0.70%, up slightly from 0.69% in December. Freddie's rate is down from 1.07% in January 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since December 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate in late 2017 and early 2018 was due to the hurricanes (These are serious delinquencies, so it took three months late to be counted).

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.7% range - but this is close to a bottom.

Note: Fannie Mae will report for January soon.

February Vehicle Sales Forecast: 16.6 Million SAAR

by Calculated Risk on 2/25/2019 02:21:00 PM

From JD Power: J.D. Power and LMC Automotive Forecast February 2019

"The year is off to its slowest start since 2014 with the industry set to post sales declines again in February. While retail sales through the first two months will be down more than 4%, it's important to note that January and February are among the lowest volume sales months of the year." (Last year the two months combined to account for only 13.5% of the annual total.)This forecast is for sales to be about the same level as in January, and down from 16.9 million SAAR in February 2018.

Looking ahead to the coming months, the industry should expect to receive a slight boost with the recovery of any lost sales due to inclement weather. [Forecast: total sales 16.6 million SAAR]

Dallas Fed: "Texas Manufacturing Expansion Continues"

by Calculated Risk on 2/25/2019 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to expand in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, slipped four points to 10.1, indicating a slight deceleration in output growth.So far the regional surveys have been mixed for February.

Most other measures of manufacturing activity also suggested continued but slower expansion in February. The new orders index fell five points to 6.9, its lowest reading in more than two years. Similarly, the capacity utilization index fell eight points to 7.1 and reached a two-year low. Meanwhile, the shipments index was largely unchanged at 10.7.

Perceptions of broader business conditions improved notably in February. The general business activity index rose 12 points to 13.1 after posting weak readings the prior two months. The company outlook index rose seven points to 14.2, a four-month high. The index measuring uncertainty regarding companies’ outlooks retreated 12 points to 4.1, its lowest reading in nine months.

Labor market measures suggested stronger employment growth and little change in workweek length in February. The employment index rebounded from 6.6 to 12.6.

emphasis added