by Calculated Risk on 2/05/2019 08:58:00 AM

Tuesday, February 05, 2019

CoreLogic: House Prices up 4.7% Year-over-year in December

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports December Home Prices Increased by 4.7 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4.7 percent year over year from December 2017. On a month-over-month basis, prices increased by 0.1 percent in December 2018. (November 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, the CoreLogic HPI Forecast indicates home prices will increase by 4.6 percent on a year-over-year basis from December 2018 to December 2019. Comparing the annual average HPI and HPI forecast for 2018 and 2019, average price growth is forecasted to slow from 5.8 percent to 3.4 percent. On a month-over-month basis, home prices are expected to decrease by 1 percent from December 2018 to January 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Higher mortgage rates slowed home sales and price growth during the second half of 2018,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Annual price growth peaked in March and averaged 6.4 percent during the first six months of the year. In the second half of 2018, growth moderated to 5.2 percent. For 2019, we are forecasting an average annual price growth of 3.4 percent.”

emphasis added

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.The year-over-year comparison has been positive for almost seven consecutive years since turning positive year-over-year in February 2012.

Monday, February 04, 2019

Tuesday: ISM non-Mfg Index

by Calculated Risk on 2/04/2019 05:59:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Quickly Retreating After Hitting Long-Term Lows

Mortgage rates continued moving higher today as Fridays unfortunate series of events seems to have motivated a big bounce. What events are those? Namely, we're talking about several important economic reports including the big jobs report and the most closely-watched manufacturing report from ISM. These were joined by two other supporting actors (Consumer Sentiment and Factory Orders) to round out an entire morning of data that came in much stronger than expected.Tuesday:

...

The good news is that US Treasury yields have been suffering more than mortgages. Apart from the last 3 business days, rates are still in line with their lowest levels in months. [30YR FIXED - 4.5%]

emphasis added

• At 8:00 AM ET: CoreLogic House Price Index for December.

• At 10:00 AM: the ISM non-Manufacturing Index for January.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 2/04/2019 02:41:00 PM

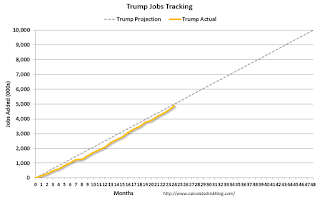

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (24 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 24 months of Mr. Trump's term, the economy has added 4,683,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the first 24 months of Mr. Trump's term, the economy has added 196,000 public sector jobs.

After 24 months of Mr. Trump's presidency, the economy has added 4,879,000 jobs, about 121,000 behind the projection.

Update: Framing Lumber Prices Down Year-over-year

by Calculated Risk on 2/04/2019 11:01:00 AM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down about 25% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through January 18, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 28% from a year ago, and CME futures are down 25% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Black Knight Mortgage Monitor for December

by Calculated Risk on 2/04/2019 08:00:00 AM

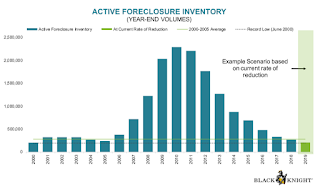

Black Knight released their Mortgage Monitor report for December today. According to Black Knight, 3.88% of mortgages were delinquent in December, down from 4.71% in December 2017. Black Knight also reported that 0.52% of mortgages were in the foreclosure process, down from 0.65% a year ago.

This gives a total of 4.40% delinquent or in foreclosure.

Press Release: BBlack Knight: Active Foreclosure Rate and Inventory End 2018 Below Pre-Recession Averages; Total Year Foreclosure Starts and Sales Hit More Than 18-Year Lows

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon its industry-leading loan-level mortgage performance database. With full-year mortgage performance data in, this month’s report looked at 2018 in review. As explained by Ben Graboske, president of Black Knight’s Data & Analytics division, more than a decade past the start of the financial crisis, most metrics reflect a recovery to their long-term, 2000-2005 pre-recession averages.

“Across the board, 2018 year-end numbers are good news from a mortgage performance perspective,” said Graboske. “All four major performance metrics – delinquencies, serious delinquencies, active foreclosures and total non-current inventory – ended the year below pre-recession averages for the first time since the financial crisis. Just 576,000 foreclosures were initiated throughout the entirety of 2018 – an 18-year low – and the vast majority of these were repeat actions. In fact, first-time foreclosures were down 18 percent from the year before, hitting the lowest point we’ve seen since Black Knight started reporting the metric in 2000. Even repeats – though making up more than 60 percent of all foreclosures – were down 6 percent from 2017.

“These year-end numbers are further proof of what we’ve been observing for some time now. The high credit quality and corresponding lower risk we’ve seen in the post-crisis origination market for the better part of a decade continues to pay dividends in terms of mortgage performance. In addition, the low interest rate environment we’ve enjoyed for so long had – until very recently – resulted in a refinance-heavy blend of originations for years. Refis, as a whole, tend to outperform their purchase mortgage counterparts, which has boosted mortgage performance as well. On top of that, we’ve had the benefit of strong employment and housing markets, which have helped the vast majority of homeowners meet their debt obligations, while those few who may have faced a possible default have gained enough equity to be able to sell rather than face foreclosure.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the year end delinquency rate over time.

From Black Knight:

• While we’ve documented the potential impact of rising interest rates, and talk of a looming recession persists in the market, mortgage performance continues to strengthenThe second graph shows active foreclosure inventory over time.

• The national delinquency rate is down 18% from last year, though that figure is overstated due to hurricane-related effects over the past 18 months

• Still, even excluding hurricane-impacted areas, December's delinquency rate was down an impressive 11% from last year

• Both the national foreclosure rate and the number of loans in active foreclosure have now fallen below long-term normsThere is much more in the mortgage monitor.

• In fact, the national foreclosure rate closed out 2018 below its pre-crisis average for the first time since 2005

• While the rate of improvement has slowed slightly in recent months, at the current rate of decline, both metrics would be near record lows by the end of 2019

Sunday, February 03, 2019

Sunday Night Futures

by Calculated Risk on 2/03/2019 10:40:00 PM

Weekend:

• Schedule for Week of February 3, 2019

• Lawler: Selected Operating Results from Large Publicly-Traded Home Builders

Monday:

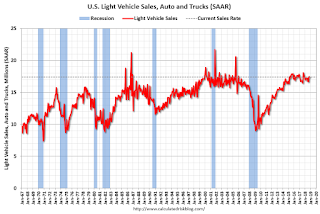

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to be 17.0 million SAAR in January, down from 17.2 million in December (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $55.29 per barrel and Brent at $62.81 per barrel. A year ago, WTI was at $65, and Brent was at $67 - so oil prices are down about 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon. A year ago prices were at $2.60 per gallon, so gasoline prices are down 34 cents per gallon year-over-year.

Lawler: Selected Operating Results from Large Publicly-Traded Home Builders

by Calculated Risk on 2/03/2019 10:51:00 AM

From housing economist Tom Lawler:

Here are a few observations based on press releases and conference calls (note that NVR provides no “color” in its press release and does not do an earnings conference.)

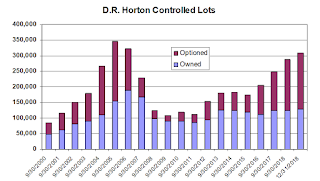

First (and trivially), D.R. Horton’s YOY increase in net orders was boosted slightly by acquisitions of a few smaller builders, and “pro forma” net orders would have been up by close to 2% YOY.

Second, all builders noted that they experienced slower demand last quarter, and most attributed the slowdown to “affordability” concerns, partly but not even mainly association with the increase in mortgage rates during the third and early fourth quarter, but also to the rapid price increases of the past few years in many markets. There appeared to be greater weakness at “higher” price points, and several markets where home prices had risen sharply over the past few years – especially much of California and Colorado – were “especially soft.

Most builders were peppered with questions about sales incentives, and while those reporting incentives on closings said that there was just a “modest” increase from a year ago, many also implied that a further increase in sales incentives in the first part of this year was a distinct possibility. Most builders also seemed to feel that in aggregate home prices, after outpacing income growth for the last seven years, would likely grow by less than income growth in 2019. That is also the consensus among competent housing economists.

| Net Orders | Average Order Price | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/31/18 | 12/31/17 | % Chg | 12/31/18 | 12/31/17 | % Chg |

| D.R. Horton | 11,042 | 10,753 | 2.7% | $292,085 | $299,693 | -2.5% |

| PulteGroup | 4,267 | 4,805 | -11.2% | $424,034 | $422,523 | 0.4% |

| NVR | 3,841 | 4,306 | -10.8% | $376,100 | $380,800 | -1.2% |

| Meritage Homes | 1,653 | 1,795 | -7.9% | $390,000 | $424,000 | -8.0% |

| MDC Holdings | 1,059 | 1,252 | -15.4% | $428,000 | $458,700 | -6.7% |

| Total | 21,862 | 22,911 | -4.6% | $346,587 | $359,125 | -3.5% |

| Closings | Average Closing Price | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/31/18 | 12/31/17 | % Chg | 12/31/18 | 12/31/17 | % Chg |

| D.R. Horton | 11,500 | 10,788 | 6.6% | $296,574 | 295,189 | 0.5% |

| PulteGroup | 6,709 | 6,632 | 1.2% | $430,000 | 410,000 | 4.9% |

| NVR | 5,186 | 4,630 | 12.0% | $376,800 | 384,700 | -2.1% |

| Meritage Homes | 2,505 | 2,253 | 11.2% | $398,000 | 410,000 | -2.9% |

| MDC Holdings | 1,827 | 1,556 | 17.4% | $469,900 | 451,600 | 4.1% |

| Total | 27,727 | 25,859 | 7.2% | $364,448 | $360,076 | 1.2% |

With the exception of D.R. Horton, which began focusing more on the entry-level market several years ago, all of the builders said they have ramped up lot acquisitions designed for the entry-level market, as well as actual building for that market (Meritage and MDC more than Pulte). This shift reflects the growing consensus view that all of the shortfall in single-family housing construction over the past few years has been in the smaller, lower-priced housing market.

All of these builders owned or controlled more lots than was the case a year ago, with D.R. Horton’s owned/controlled lot position hitting a level not seen since 2006 – though today the share of controlled lots optioned is much higher than was the case during last decades housing bubble/bust.

All of these builders owned or controlled more lots than was the case a year ago, with D.R. Horton’s owned/controlled lot position hitting a level not seen since 2006 – though today the share of controlled lots optioned is much higher than was the case during last decades housing bubble/bust.Finally, order cancellation rates (expressed as a % of gross orders), were generally up modestly last quarter from the comparable quarter of 2017.

Saturday, February 02, 2019

Schedule for Week of February 3, 2019

by Calculated Risk on 2/02/2019 08:11:00 AM

Special Note on Government Opening: Now that the Government is open, some of the data releases that were postponed are starting to be released. The BEA and Census will provide further release dates soon (like for Q4 GDP).

The key reports scheduled for this week are the trade deficit and January vehicle sales.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.0 million SAAR in January, down from 17.2 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.0 million SAAR in January, down from 17.2 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate (The BEA hasn't released December sales yet).

10:00 AM: the ISM non-Manufacturing Index for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.

7:00 PM: Fed Chair Jerome Powell, Brief Opening Remarks, At the Conversation with the Chairman: A Teacher Town Hall Meeting, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 253 thousand the previous week.

3:00 PM: Consumer Credit from the Federal Reserve.

No major economic releases scheduled.

Friday, February 01, 2019

Oil: Another large drop in rig counts

by Calculated Risk on 2/01/2019 06:36:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on February 1, 2019:

• Oil rig counts imploded, -15 to 847

• The news on the horizontal oil rig count was not as bad, -7 to 759

• The Permian lost 2, ‘Other US’ was whacked with -7, but all other named plays were flat

• We now have enough data to begin to sketch out this mini-cycle (assuming the historical relationship of rigs to oil prices holds)

• Having fallen by 27 in the last four weeks, the model suggests the horizontal oil rig count will fall by additional 65 or so rigs before bottoming in April. So pencil in 100 total horizontal oil rigs lost in Q1.

• Assuming oil prices crawl back up to $60 WTI – and both the futures curve and recent oil prices trends suggest that is possible – rig counts should stabilize or begin to recover in Q2.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q4 GDP Forecasts: Mid 2s

by Calculated Risk on 2/01/2019 02:02:00 PM

The BEA has not yet announced a new release date for the Q4 advanced GDP report.

From Merrill Lynch:

data cut 0.5pp from 4Q GDP tracking, bringing us down to 2.3% qoq saar. [Feb 1 estimate]From Goldman Sachs:

emphasis added

we left our Q4 GDP tracking estimate unchanged at +2.5% (qoq ar). [Feb 1 estimate]From the NY Fed Nowcasting Report

The GDP release scheduled for this week was postponed as a result of the partial shutdown of the federal government. The New York Fed Staff Nowcast stands at 2.6% for 2018:Q4 and 2.4% for 2019:Q1. [Feb 1 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.5 percent on February 1, down from 2.7 percent on January 31. [Feb 1 estimate]CR Note: These estimates suggest GDP in the mid 2s for Q4.