by Calculated Risk on 2/03/2019 10:51:00 AM

Sunday, February 03, 2019

Lawler: Selected Operating Results from Large Publicly-Traded Home Builders

From housing economist Tom Lawler:

Here are a few observations based on press releases and conference calls (note that NVR provides no “color” in its press release and does not do an earnings conference.)

First (and trivially), D.R. Horton’s YOY increase in net orders was boosted slightly by acquisitions of a few smaller builders, and “pro forma” net orders would have been up by close to 2% YOY.

Second, all builders noted that they experienced slower demand last quarter, and most attributed the slowdown to “affordability” concerns, partly but not even mainly association with the increase in mortgage rates during the third and early fourth quarter, but also to the rapid price increases of the past few years in many markets. There appeared to be greater weakness at “higher” price points, and several markets where home prices had risen sharply over the past few years – especially much of California and Colorado – were “especially soft.

Most builders were peppered with questions about sales incentives, and while those reporting incentives on closings said that there was just a “modest” increase from a year ago, many also implied that a further increase in sales incentives in the first part of this year was a distinct possibility. Most builders also seemed to feel that in aggregate home prices, after outpacing income growth for the last seven years, would likely grow by less than income growth in 2019. That is also the consensus among competent housing economists.

| Net Orders | Average Order Price | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/31/18 | 12/31/17 | % Chg | 12/31/18 | 12/31/17 | % Chg |

| D.R. Horton | 11,042 | 10,753 | 2.7% | $292,085 | $299,693 | -2.5% |

| PulteGroup | 4,267 | 4,805 | -11.2% | $424,034 | $422,523 | 0.4% |

| NVR | 3,841 | 4,306 | -10.8% | $376,100 | $380,800 | -1.2% |

| Meritage Homes | 1,653 | 1,795 | -7.9% | $390,000 | $424,000 | -8.0% |

| MDC Holdings | 1,059 | 1,252 | -15.4% | $428,000 | $458,700 | -6.7% |

| Total | 21,862 | 22,911 | -4.6% | $346,587 | $359,125 | -3.5% |

| Closings | Average Closing Price | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/31/18 | 12/31/17 | % Chg | 12/31/18 | 12/31/17 | % Chg |

| D.R. Horton | 11,500 | 10,788 | 6.6% | $296,574 | 295,189 | 0.5% |

| PulteGroup | 6,709 | 6,632 | 1.2% | $430,000 | 410,000 | 4.9% |

| NVR | 5,186 | 4,630 | 12.0% | $376,800 | 384,700 | -2.1% |

| Meritage Homes | 2,505 | 2,253 | 11.2% | $398,000 | 410,000 | -2.9% |

| MDC Holdings | 1,827 | 1,556 | 17.4% | $469,900 | 451,600 | 4.1% |

| Total | 27,727 | 25,859 | 7.2% | $364,448 | $360,076 | 1.2% |

With the exception of D.R. Horton, which began focusing more on the entry-level market several years ago, all of the builders said they have ramped up lot acquisitions designed for the entry-level market, as well as actual building for that market (Meritage and MDC more than Pulte). This shift reflects the growing consensus view that all of the shortfall in single-family housing construction over the past few years has been in the smaller, lower-priced housing market.

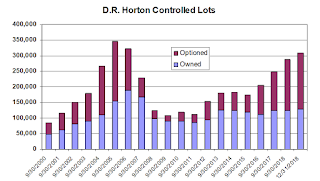

All of these builders owned or controlled more lots than was the case a year ago, with D.R. Horton’s owned/controlled lot position hitting a level not seen since 2006 – though today the share of controlled lots optioned is much higher than was the case during last decades housing bubble/bust.

All of these builders owned or controlled more lots than was the case a year ago, with D.R. Horton’s owned/controlled lot position hitting a level not seen since 2006 – though today the share of controlled lots optioned is much higher than was the case during last decades housing bubble/bust.Finally, order cancellation rates (expressed as a % of gross orders), were generally up modestly last quarter from the comparable quarter of 2017.