by Calculated Risk on 1/16/2019 02:43:00 PM

Wednesday, January 16, 2019

Lawler; Early Read on Existing Home Sales in December: Big Drop

From housing economist Tom Lawler: Early Read on Existing Home Sales in December: Big Drop

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.97 million in December, down 6.6% from November’s preliminary estimate and down 10.6% from last December’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale in December was up by about 5.5% from last December.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 2.7% from last December.

CR Note: Existing home sales for December are scheduled to be released on Tuesday, Jan 22nd. Based on this estimate, December sales, on a seasonally adjusted annual rate basis, will be at the lowest level of sales since November 2015 (and that month was impacted by a regulation change).

Fed's Beige Book: Economic Growth "modest to moderate", Labor Market "Tight"

by Calculated Risk on 1/16/2019 02:03:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Chicago based on information collected on or before January 7, 2019. "

Economic activity increased in most of the U.S., with eight of twelve Federal Reserve Districts reporting modest to moderate growth. Nonauto retail sales grew modestly, as several Districts reported more holiday traffic compared with last year. Auto sales were flat on balance. The majority of Districts indicated that manufacturing expanded, but that growth had slowed, particularly in the auto and energy sectors. New home construction and existing home sales were little changed, with several Districts reporting that sales were limited by rising prices and low inventory. Commercial real estate activity was also little changed on balance. Most Districts reported modest to moderate growth in activity in the nonfinancial services sector, though a few Districts noted that growth there had slowed. The energy sector expanded at a slower pace, and lower energy prices contributed to a pullback in the industry's capital spending expectations. The agriculture sector struggled as prices generally remained low despite recent increases. Overall, lending volumes grew modestly, though a few Districts noted that growth had slowed. Outlooks generally remained positive, but many Districts reported that contacts had become less optimistic in response to increased financial market volatility, rising short-term interest rates, falling energy prices, and elevated trade and political uncertainty.

...

Employment increased in most of the country, with a plurality of Districts reporting modest growth. All Districts noted that labor markets were tight and that firms were struggling to find workers at any skill level.

emphasis added

Sacramento Housing in December: Sales Down 22% YoY, Active Inventory up 36% YoY

by Calculated Risk on 1/16/2019 12:39:00 PM

From SacRealtor.org: December 2018 Statistics – Sacramento Housing Market – Single Family Homes; Real estate market slows for holiday season

December closed with 1,104 total sales, a 15.3% decrease from the 1,304 sales of November. Compared to the same month last year (1,408), the current figure is down 21.6%.CR Note: Inventory is still low - months of inventory is at 1.9 months, probably closer to 4 months would be normal - however inventory is up significantly year-over-year in Sacramento.

...

The Active Listing Inventory decreased, falling 20.8% from 2,714 to 2,149 units. [Note: Compared to December 2017, inventory is up 36.4%] The Months of Inventory dropped slightly to 1.9 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Average DOM (days on market) continued its increase, rising from 36 to 38 from November to December. The Median DOM also increased, rising from 24 to 25. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,104 sales this month, 56.3% (621) were on the market for 30 days or less and 78.8% (869) were on the market for 60 days or less.

emphasis added

NAHB: Builder Confidence Increases in January

by Calculated Risk on 1/16/2019 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 58 in January, up from 56 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Lower Interest Rates Stabilize Builder Confidence

Buoyed by falling mortgage rates, builder confidence in the market for newly-built single-family homes rose two points to 58 in January on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). “The gradual decline in mortgage rates in recent weeks helped to sustain builder sentiment,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “Low unemployment, solid job growth and favorable demographics should support housing demand in the coming months.”

“Builders need to continue to manage rising construction costs to keep home prices affordable, particularly for young buyers at the entry-level of the market,” said NAHB Chief Economist Robert Dietz. “Lower interest rates that peaked around 5 percent in mid-November and have since fallen to just below 4.5 percent will help the housing market continue to grow at a modest clip as we enter the new year.”

Due to the partial government shutdown, there will be no new Census figures released tomorrow on housing starts and permits. NAHB estimates that the December Census data would show that single-family starts ended the year totaling 876,000 units, which would mark a 3 percent gain over the 2017 total of 848,900. However, the slowdown in sales during the fourth quarter of 2018 has left new home inventories elevated in some markets.

...

All the HMI indices posted gains in January. The index measuring current sales conditions rose two points to 63, the component gauging expectations in the next six months increased three points to 64 and the metric charting buyer traffic edged up one point to 44.

Looking at the three-month moving averages for regional HMI scores, the Northeast dropped five points to 45; the Midwest and South both fell three points to 52 and 62, respectively; and the West registered a one-point drop to 67.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was close to the consensus forecast.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Activity Index Highest Since 2010

by Calculated Risk on 1/16/2019 07:00:00 AM

From the MBA: Mortgage Applications Rebound in Latest MBA Weekly Survey

Mortgage applications increased 13.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 11, 2019.

... The Refinance Index increased 19 percent from the previous week to its highest level since March 2018. The seasonally adjusted Purchase Index increased 9 percent from one week earlier to its highest level since April 2010. The unadjusted Purchase Index increased 43 percent compared with the previous week and was 11 percent higher than the same week one year ago.

...

“Mortgage applications rose to their strongest level in years last week, with purchase applications rising to the highest since 2010, and refinance applications up to their highest level since last spring,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Uncertainty regarding the government shutdown, slowing global growth, Brexit, a more patient Fed, and a volatile stock market continued to keep rates from increasing. The spring homebuying season is almost upon us, and if rates stay lower, inventory continues to grow, and the job market maintains its strength, we do expect to see a solid spring market. The 11 percent gain in purchase volume compared to last year is a promising sign.”

Added Fratantoni, “Borrowers with larger loans tend to be more responsive to a given drop in mortgage rates, and we are seeing that so far in 2019. Furthermore, borrowers with jumbo loans are also more apt to take adjustable-rate mortgages as opposed to fixed-rate loans. Thus, it is not surprising to see the ARM share at its highest level since 2014. These borrowers may also feel more confident taking an adjustable-rate mortgage given the expectation of a more patient Fed.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remain unchanged at 4.74 percent, with points decreasing to 0.45 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is at the highest level since last Spring.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexThe one week seasonally adjusted purchase index is at the highest level since 2010 (that spike in 2010 was related to homebuyer tax credit). It is just one week, and the seasonal adjustment in January is very strong (since activity is always soft in January).

According to the MBA, purchase activity is up 11% year-over-year.

Tuesday, January 15, 2019

Wednesday: Retail Sales (Postponed), Homebuilder Survey, Beige Book

by Calculated Risk on 1/15/2019 06:50:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, POSTPONED Retail sales for December is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 57, up from 54. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

NAHB: Builder Confidence decreases for the 55+ Housing Market in Q3

by Calculated Risk on 1/15/2019 04:06:00 PM

I haven't posted this in some time. This is a quarterly index that was released last year by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: Builder Confidence in the 55+ Housing Market Drops in the Third Quarter

Builder confidence in the single-family 55+ housing market dropped seven points to 60 in the third quarter, according to the National Association of Home Builders' (NAHB) 55+ Housing Market Index (HMI) ... Although the index declined, it is still in positive territory as a reading above 50 means that more builders view conditions as good than poor.

“Although various headwinds are starting to have an impact on the 55+ housing market, there are many parts of the country where the market is still doing well,” said Chuck Ellison, chairman of NAHB's 55+ Housing Industry Council and Vice President-Land of Miller & Smith in McLean, Va. “In some places it is becoming a challenge for builders to provide housing at prices their customers can afford.”

...

“The decline in the single-family 55+ HMI is consistent with the recent weakness in new and existing home sales,” said NAHB Chief Economist Robert Dietz. “The high readings seen in the previous three quarters are not sustainable with high construction costs and rising interest rates.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q3 2018. Any reading above 50 indicates that more builders view conditions as good than as poor. The index decreased to 60 in Q3 down from 67 in Q2.

There are two key drivers in addition to the improved economy: 1) there is a large cohort that recently moved into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 1/15/2019 11:56:00 AM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is expanding solidly now.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

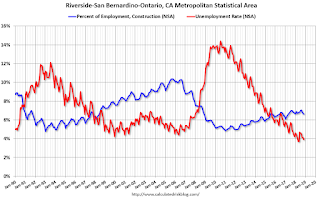

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, and is down to 3.9% (down from 14.4% in 2010). And construction employment is up from the lows (as a percent of total employment), but still well below the bubble years.

So the unemployment rate has fallen to a record low, and the economy isn't as heavily depending on construction. Overall the Inland Empire economy is in much better shape today.

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..Clearly the Inland Empire is more dependent on construction than most areas. Construction has picked up as a percent of total employment, but the economy in California and the U.S. is not as dependent on construction as during the bubble years.

NY Fed: Manufacturing "Business activity grew slightly in New York State"

by Calculated Risk on 1/15/2019 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew slightly in New York State, according to firms responding to the January 2019 Empire State Manufacturing Survey. The headline general business conditions index fell eight points to 3.9, its lowest level in well over a year. New orders increased at a slower pace than in recent months, while shipments continued to climb significantly.This was well below the consensus forecast, and the weakest reading since May 2017.

…

The index for number of employees fell ten points but remained positive at 7.4, indicating a modest increase in employment levels, while the average workweek index held steady at 6.8.

…

Firms were less optimistic about the six-month outlook than in recent months. The index for future business conditions fell thirteen points to 17.8, and the indexes for future new orders and shipments also declined.

emphasis added

Monday, January 14, 2019

Mortgages Rates: 30 Year Fixed at 4.5%

by Calculated Risk on 1/14/2019 06:26:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged to Start the Week

Mortgage rates held their ground today, keeping them in line with long-term lows achieved over the past 2 weeks. To be fair, it was the previous week that offered the biggest benefits, but last week was no slouch. Factoring out the first few days of January, it would have been the best week for mortgage rates since April 2018. [30YR FIXED - 4.5%]Tuesday:

emphasis added

• At 8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.2% increase in core PPI.

• At 8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 12.0, up from 10.9.