by Calculated Risk on 12/19/2018 03:47:00 PM

Wednesday, December 19, 2018

FOMC Projections

Statement here.

Powell press conference video here.

On the projections, growth was revised down slightly, and inflation was softer.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.0 to 3.1 | 2.3 to 2.5 | 1.8 to 2.0 |

| Sep 2018 | 3.0 to 3.2 | 2.4 to 2.7 | 1.8 to 2.1 |

| Jun 2018 | 2.7 to 3.0 | 2.2 to 2.6 | 1.8 to 2.0 |

The unemployment rate was at 3.7% in November. So the unemployment rate projection for 2018 was unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.7 | 3.5 to 3.7 | 3.5 to 3.8 |

| Sep 2018 | 3.7 | 3.4 to 3.6 | 3.4 to 3.8 |

| Jun 2018 | 3.6 to 3.7 | 3.4 to 3.5 | 3.4 to 3.7 |

As of October, PCE inflation was up 2.0% from October 2017. PCE inflation projections were revised down for 2018, 2019, and 2020.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 1.8 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 2.0 to 2.1 | 2.0 to 2.1 | 2.1 to 2.2 |

| Jun 2018 | 2.0 to 2.1 | 2.0 to 2.2 | 2.1 to 2.2 |

PCE core inflation was up 1.8% in October year-over-year. Core PCE inflation was revised down slightly for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 1.9 to 2.0 | 2.0 to 2.1 | 2.1 to 2.2 |

| Jun 2018 | 1.9 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 12/19/2018 03:40:00 PM

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. The Committee judges that risks to the economic outlook are roughly balanced, but will continue to monitor global economic and financial developments and assess their implications for the economic outlook.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2‑1/2 percent.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Loretta J. Mester; and Randal K. Quarles

emphasis added

AIA: "Run of positive billings continues at architecture firms"

by Calculated Risk on 12/19/2018 12:15:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Run of positive billings continues at architecture firms

Architecture firm billings growth expanded in November by a healthy margin, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for November was 54.7 compared to 50.4 in October. With the strongest billings growth figure since January and continued strength in new project inquiries and design contracts, billings are closing the year on a strong note.

“Despite some concerns about a potential economic downturn, architecture firms continue to report strong billings, inquiries, and new design contracts,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “For the coming year, concerns about the economy among architecture firm leaders tend to be balanced by their concerns about a lack of qualified employee prospects.”

...

• Regional averages: Northeast (56.8), Midwest (53.1), South (50.5), West (49.0)

• Sector index breakdown: commercial/industrial (53.8), mixed practice (53.8), multi-family residential (51.2), institutional (50.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.7 in November, up from 50.4 in October. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 14 consecutive months, suggesting a further increase in CRE investment in 2019.

Comments on November Existing Home Sales

by Calculated Risk on 12/19/2018 11:19:00 AM

Earlier: NAR: Existing-Home Sales Increased to 5.32 million in November

Two key points:

1) The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Overall this is a reasonable level for existing home sales, and the recent weakness is no surprise given the increase in mortgage rates.

2) Inventory is still low, but was up 4.2% year-over-year (YoY) in November. This was the fourth consecutive month with a year-over-year increase in inventory, and the largest YoY increase since late 2014.

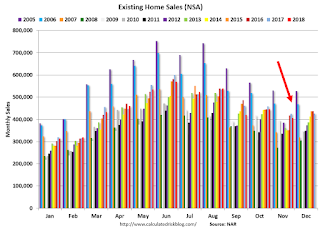

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expected inventory to increase YoY in 2018, I also expected inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase much more and still be at normal levels. No worries.

Sales NSA in November (406,000, red column) were below sales in November 2017 (425,000, NSA), but were the third highest since the housing bubble (behind 2016 and 2017).

Sales NSA through November (first eleven months) are down about 2.3% from the same period in 2017.

This is a small YoY decline in sales to-date - it is likely that higher mortgage rates are impacting sales, and it is possible there has been an impact from the changes to the tax law (decreasing property taxes write-off, etc).

NAR: Existing-Home Sales Increased to 5.32 million in November

by Calculated Risk on 12/19/2018 10:08:00 AM

From the NAR: Existing-Home Sales Increase for Second Consecutive Month

Existing-home sales increased in November, according to the National Association of Realtors®, marking two consecutive months of increases. Three of four major U.S. regions saw gains in sales activity last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 1.9 percent from October to a seasonally adjusted rate of 5.32 million in November. Sales are now down 7.0 percent from a year ago (5.72 million in November 2017).

...

Total housing inventory at the end of November decreased to 1.74 million, down from 1.85 million existing homes available for sale in October. This represents an increase from 1.67 million a year ago, however. Unsold inventory is at a 3.9-month supply at the current sales pace, down from 4.3 last month and up from 3.5 months a year ago.

emphasis added

Click on graph for larger image.

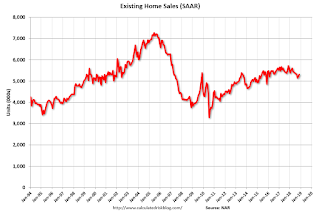

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (5.32 million SAAR) were up 1.9% from last month, but were 7.0% below the November 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.74 million in November from 1.85 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.74 million in November from 1.85 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 4.2% year-over-year in November compared to November 2017.

Inventory was up 4.2% year-over-year in November compared to November 2017. Months of supply was at 3.9 months in October.

For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 12/19/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 14, 2018.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier. The unadjusted Purchase Index decreased 10 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

“Despite mortgage rates falling across the board last week to their lowest levels in three months, mortgage applications also declined, as more potential borrowers likely stayed away because of ongoing financial market volatility and economic uncertainty,” Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications decreased almost seven percent over the week and refinances decreased around two percent, led by a larger decline in government refinances compared to conventional refinances.”

Added Kan, “With rates continuing to slide lower, refinance borrowers with larger loan balances seemed more apt to take action. The average loan balance for refinance loans increased to its highest level since September 2017.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to its lowest level since September 2018, 4.94 percent, from 4.96 percent, with points decreasing to 0.43 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, December 18, 2018

Wednesday: Existing Home Sales, FOMC Announcement

by Calculated Risk on 12/18/2018 05:02:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.19 million SAAR, down from 5.22 million.

• During the day, The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Housing Inventory Tracking

by Calculated Risk on 12/18/2018 05:01:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 2.8% year-over-year (YoY) in October, this was the third consecutive YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, and Sacramento (through November), and Phoenix (through October) and total existing home inventory as reported by the NAR (through October, November will be released tomorrow). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 63% YoY in Las Vegas in November (red), the fifth consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 9% year-over-year in Houston in November. With falling oil prices - along with higher mortgage rates - inventory will probably increase in Houston.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. At the beginning of 2018, I expected national inventory will be up YoY at the end of 2018 (but still to be somewhat low).

Also note that inventory in Seattle was up 211% year-over-year in November, and Denver up 47% YoY (not graphed)!

Lawler: Early Read on Existing Home Sales in November

by Calculated Risk on 12/18/2018 02:18:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in November

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.23 million in November, virtually unchanged from October’s preliminary pace (which based on local realtor/MLS data seemed low) and down 8.7% from last November’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale in November was up by about 4.8% from last November.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up about 4.1% from last November.

CR Note: The NAR is scheduled to release November existing home sales tomorrow, Wednesday, Dec 19th. The consensus is that the NAR will report sales of 5.19 million SAAR.

Duy: Fed Stuck In An Uncomfortable Situation

by Calculated Risk on 12/18/2018 12:08:00 PM

From Professor Tim Duy at Fed Watch: Fed Stuck In An Uncomfortable Situation

The Federal Reserve faces a most uncomfortable confluence of events as central bankers begin their two-day meeting to ponder the path of rate policy. In a nutshell, equities continued to struggle in the midst of fairly solid data as President Trump complains yet again about rate hikes while stoking the uncertainty that appears at least partly if not mostly to blame for the volatile equity markets. Yes, I know, it’s a lot to follow. Hopefully I can break it down into more manageable pieces.CR Note: Duy thinks it is likely the FOMC will "Hike rates 25 basis points to push rates at the edge of the lower range of neutral estimates" and 'Drop “further gradual increases” for language that imparts much more uncertainty about the future path of rate hikes.' This would be a "dovish hike".

…

Bottom Line: The baseline case is for a dovish hike that basically sends the message that the data is consistent with another rate hike but IF the economy turns slower more quickly than anticipated, this will be the last hike for some time if not the last hike of the cycle. The risk is that the Fed skips this meeting and leaves January open IF the data continues to support a hike. It is worth thinking about what the Fed would need to do to offset the impacts Trumpian uncertainty should that bleed over from Wall Street to Main Street.