by Calculated Risk on 12/17/2018 08:35:00 AM

Monday, December 17, 2018

From the NY Fed: Manufacturing "Business activity grew at a slower pace than in recent months in New York State"

From the NY Fed: Empire State Manufacturing Survey

Business activity grew at a slower pace than in recent months in New York State, according to firms responding to the December 2018 Empire State Manufacturing Survey. The headline general business conditions index fell twelve points to 10.9.This was well below the consensus forecast, and the weakest reading since May 2017.

…

The index for number of employees jumped twelve points to 26.1, indicating very strong growth in employment levels, while the average workweek index was little changed at 8.0.

emphasis added

Sunday, December 16, 2018

Monday: NY Fed Mfg Survey, Homebuilder Survey

by Calculated Risk on 12/16/2018 08:38:00 PM

Weekend:

• Schedule for Week of December 16, 2018

Monday:

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 21.0, down from 23.3.

• At 10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 61, up from 60. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 6 and DOW futures are up 58 (fair value).

Oil prices were down over the last week with WTI futures at $51.46 per barrel and Brent at $60.46 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so WTI oil prices are down about 10%, and Brent prices down about 6% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.35 per gallon. A year ago prices were at $2.41 per gallon, so gasoline prices are down 6 cents per gallon year-over-year.

Sacramento Housing in November: Sales Down 7% YoY, Active Inventory up 23% YoY

by Calculated Risk on 12/16/2018 08:12:00 AM

From SacRealtor.org: November 2018 Statistics – Sacramento Housing Market – Single Family Homes, Median sales price increases, sales volume drops

November closed with 1,304 sales, a 9.3% decrease from the 1,413 sales of September. Compared to the same month last year (1,396), the current figure is down 6.6%. Of the 1,304 sales this month, 180 (13.8%) used cash financing, 791 (60.7%) used conventional, 225 (17.3%) used FHA, 76 (5.8%) used VA and 32 (2.5%) used Other types of financing.CR Note: Inventory is still low - months of inventory is at 2.1 months, probably closer to 4 months would be normal - however inventory is up significantly year-over-year in Sacramento.

...

The Active Listing Inventory decreased, dropping 11.3% from 3,060 to 2,714 units. [Note: Compared to November 2017, inventory is up 22.5%] The Months of Inventory remained at 2.1 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. The chart to the right reflects the Months of Inventory in each price range.

...

The Average DOM (days on market) continued its increase, rising from 30 to 36 from October to November. The Median DOM also increased, rising from 19 to 24. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,304 sales this month, 59% (770) were on the market for 30 days or less and 81.2% (1,060) were on the market for 60 days or less.

emphasis added

Saturday, December 15, 2018

Schedule for Week of December 16, 2018

by Calculated Risk on 12/15/2018 08:11:00 AM

The key economic reports this week are November Housing Starts, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

For manufacturing, the December New York, Philly and Kansas City Fed surveys, will be released this week.

Also, the FOMC meets this week and is expected to raise the Fed Funds rate 25bps.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 21.0, down from 23.3.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 61, up from 60. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for November.

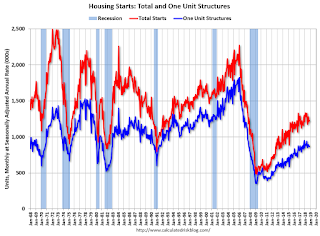

8:30 AM: Housing Starts for November. This graph shows single and total housing starts since 1968.

The consensus is for 1.222 million SAAR, down from 1.228 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.19 million SAAR, down from 5.22 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.19 million SAAR, down from 5.22 million.The graph shows existing home sales from 1994 through the report last month.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 221 thousand initial claims, up from 206 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 17.5, up from 12.9.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 3nd quarter 2018 (Third estimate). The consensus is that real GDP increased 3.5% annualized in Q3, unchanged from the second estimate of GDP.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December). The consensus is for a reading of 97.5.

10:00 AM: State Employment and Unemployment (Monthly) for November 2018

11:00 AM: the Kansas City Fed manufacturing survey for December.

Friday, December 14, 2018

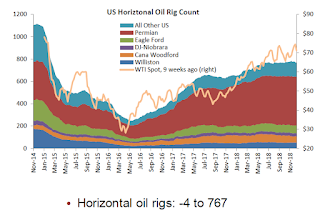

Oil Rigs Declined Slightly, More Expected

by Calculated Risk on 12/14/2018 07:46:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on December 14, 2018:

• Oil rigs fell, -4 to 873

• Horizontal oil rigs also declined, -4 to 767

• Breakeven to add rigs fell to around $75 WTI compared to $51.20 WTI on the screen as of the writing of this report.

• The model predicts we could see some big rig roll-offs in the next several weeks. An overall decline around 100 horizontal oil rigs by the end of February is not out of the question.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 12/14/2018 05:44:00 PM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 14% under Mr. Trump - compared to up 54% under Mr. Obama for the same number of market days.

Q4 GDP Forecasts: High 2s

by Calculated Risk on 12/14/2018 12:13:00 PM

From Merrill Lynch:

Core retail sales popped 0.9% mom in Nov with net upward revisions. Industrial production climbed 0.6% driven by utilities. These data boosted 4Q GDP tracking by 0.4pp to 2.9% qoq saar. [Dec 14 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 3.0 percent on December 14, up from 2.4 percent on December 7. The nowcast of fourth-quarter real personal consumption expenditures growth increased from 3.3 percent to 4.1 percent after this morning's retail sales report from the U.S. Census Bureau and this morning's industrial production release from the Federal Reserve Board of Governors. [Dec 14 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.4% for both 2018:Q4 and 2019:Q1. [Dec 14 estimate]CR Note: These early estimates suggest GDP in the high 2s for Q4.

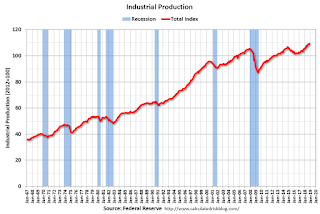

Industrial Production Increased 0.6% in November

by Calculated Risk on 12/14/2018 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.6 percent in November after moving down 0.2 percent in October; the index for October was previously reported to have edged up 0.1 percent. In November, manufacturing production was unchanged, the output of mining increased 1.7 percent, and the index for utilities gained 3.3 percent. At 109.4 percent of its 2012 average, total industrial production was 3.9 percent higher in November than it was a year earlier. Capacity utilization for the industrial sector rose 0.4 percentage point in November to 78.5 percent, a rate that is 1.3 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is 1.3% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 109.4. This is 26% above the recession low, and 4% above the pre-recession peak.

The increase in industrial production was above the consensus forecast, however the previous months were revised down. Capacity utilization was at consensus.

Retail Sales increased 0.2% in November

by Calculated Risk on 12/14/2018 08:37:00 AM

On a monthly basis, retail sales increased 0.2 percent from October to November (seasonally adjusted), and sales were up 4.2 percent from November 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $513.5 billion, an increase of 0.2 percent from the previous month, and 4.2 percent above November 2017.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.The increase in November was slightly above expectations; sales in September were revised down, revised up in October.

Thursday, December 13, 2018

Friday: Retail Sales, Industrial Production

by Calculated Risk on 12/13/2018 08:20:00 PM

Friday:

• At 8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% increase in retail sales.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.