by Calculated Risk on 11/27/2018 03:33:00 PM

Tuesday, November 27, 2018

Real House Prices and Price-to-Rent Ratio in September

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in September

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 10.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 8.5% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 12.4% below the bubble peak.

The year-over-year increase in prices has slowed to 5.5% nationally, and will probably slow more as inventory picks up.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $286,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/27/2018 01:30:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

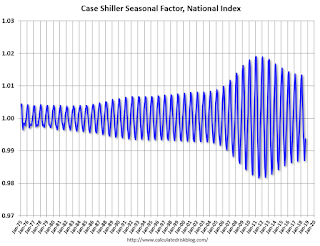

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through September 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Black Knight: National Mortgage Delinquency Rate Decreased in October

by Calculated Risk on 11/27/2018 11:18:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Rebound Strongly in October; Number of Seriously Past-Due Loans Falls Below 500,000 for First Time Since 2006

• After rising sharply in September, mortgage delinquencies fell by 8.2 percent in October and are now down by nearly 18 percent from the same time last yearAccording to Black Knight's First Look report for October, the percent of loans delinquent decreased 8.2% in October compared to September, and decreased 17.9% year-over-year.

• Serious delinquencies – loans 90 or more days past due – fell by 14,000 from last month and 90,000 from last October to hit a more than 12-year low

• Improvements in hurricane-related delinquencies associated with Harvey and Irma – which spiked in late 2017 – are contributing to the strong year-over-year improvements

• Despite foreclosure starts seeing a monthly increase from September’s nearly 18-year low, the number of loans in active foreclosure fell slightly from September and has decreased by 24 percent from last year

• Prepayment activity – now driven primarily by housing turnover – climbed 14 percent, but remains 29 percent below last year’s level

The percent of loans in the foreclosure process decreased 0.5% in October and were down 24.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.64% in October, down from 3.97% in September.

The percent of loans in the foreclosure process decreased slightly in October to 0.52% from 0.52% in September.

The number of delinquent properties, but not in foreclosure, is down 378,000 properties year-over-year, and the number of properties in the foreclosure process is down 81,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2018 | Sept 2018 | Oct 2017 | Oct 2016 | |

| Delinquent | 3.64% | 3.97% | 4.44% | 4.35% |

| In Foreclosure | 0.52% | 0.52% | 0.68% | 0.99% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,884,000 | 2,049,000 | 2,262,000 | 2,202,000 |

| Number of properties in foreclosure pre-sale inventory: | 267,000 | 268,000 | 348,000 | 504,000 |

| Total Properties | 2,152,000 | 2,317,000 | 2,610,000 | 2,706,000 |

Case-Shiller: National House Price Index increased 5.5% year-over-year in September

by Calculated Risk on 11/27/2018 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Annual Home Price Gains Slow According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in September, down from 5.7% in the previous month. The 10City Composite annual increase came in at 4.8%, down from 5.2% in the previous month. The 20-City Composite posted a 5.1% year-over-year gain, down from 5.5% in the previous month.

Las Vegas, San Francisco and Seattle reported the highest year-over-year gains among the 20 cities. In September, Las Vegas led the way with a 13.5% year-over-year price increase, followed by San Francisco with a 9.9% increase and Seattle with an 8.4% increase. Four of the 20 cities reported greater price increases in the year ending September 2018 versus the year ending August 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.1% in September. The 10-City and 20-City Composites did not report any gains for the month. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase in September. The 10-City Composite and the 20-City Composite both posted 0.3% month-over-month increases. In September, nine of 20 cities reported increases before seasonal adjustment, while 18 of 20 cities reported increases after seasonal adjustment.

“Home prices plus data on house sales and construction confirm the slowdown in housing,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P CoreLogic Case-Shiller National Index showed a 5.5% year-over-year gain, weaker for the second month in a row as 16 of 20 cities showed smaller annual price gains. On a monthly basis, nine cities saw prices decline in September compared to August. In Seattle, where prices were rising at doubledigit annual rates a few months ago, prices dropped last month. The few places reporting larger gains including some of the cities which had the biggest gains and largest losses 10 years ago: Las Vegas, Phoenix and Tampa.

“Sales of both new and existing single family homes peaked one year ago in November 2017. Sales of existing homes are down 9.3% from that peak. Housing starts are down 8.7% from November of last year. The National Association of Home Builders sentiment index dropped seven points to 60, its lowest level in two years. One factor contributing to the weaker housing market is the recent increase in mortgage rates. Currently the national average for a 30-year fixed rate loan is 4.9%, a full percentage point higher than a year ago.”

emphasis added

Click on graph for larger image.

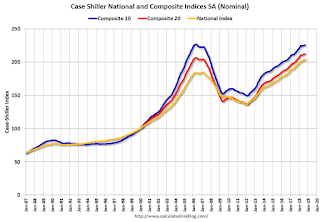

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off slightly from the bubble peak, and up 0.3% in September (SA).

The Composite 20 index is 2.8% above the bubble peak, and up 0.3% (SA) in September.

The National index is 10.8% above the bubble peak (SA), and up 0.4% (SA) in September. The National index is up 49.8% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.8% compared to September 2017. The Composite 20 SA is up 5.2% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, November 26, 2018

Tuesday: Case-Shiller House Prices

by Calculated Risk on 11/26/2018 09:14:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still On Vacation

Mortgage rates began the post-holiday week by holding the same sideways posture seen last week during the slow market days surrounding Thanksgiving. Generally speaking, slow market days make for limited mortgage rate movement. [30YR FIXED - 4.875-5.0%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for September. The consensus is for a 5.3% year-over-year increase in the Comp 20 index for September.

• At 9:00 AM, FHFA House Price Index for September 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

Q4 GDP Forecasts; Mid-2s

by Calculated Risk on 11/26/2018 05:36:00 PM

From Merrill Lynch:

We look for 3Q GDP growth to be revised slightly lower to 3.4% qoq saar in the second release next week. We continue to track 2.7% for 4Q. [Nov 21 estimate].From Goldman Sachs:

emphasis added

[W]e lowered our Q4 GDP tracking estimate by one tenth to +2.4% (qoq ar) [Nov 21 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.5 percent on November 21 [Nov 21 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.5%. [Nov 23 estimate]CR Note: These early estimates suggest GDP in the mid-2s for Q4. Based on these estimates for Q4, 2018 annual GDP would be around 2.9%, and Q4 over Q4 around 3.1%. In line with most forecasts at the beginning of the year.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 11/26/2018 01:39:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 17 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 11-17 November 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 November 2017, the industry recorded the following:

• Occupancy: +0.6% to 66.6%

• Average daily rate (ADR): +2.5 to US$127.53

• Revenue per available room (RevPAR): +3.1% to US$84.99

…

Houston, Texas, registered the steepest declines in occupancy (-17.3% to 66.5%) and RevPAR (-23.3% to US$71.92).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com

Dallas Fed: "Texas Manufacturing Expansion Continues to Moderate"

by Calculated Risk on 11/26/2018 10:39:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues to Moderate

Texas factory activity continued to expand in November, albeit at a markedly slower pace, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained positive but fell nine points to 8.4, indicating output growth continued to abate.This is a solid reading, but suggests growth is slowing in the Texas region. So far the regional surveys suggest the national ISM index will be solid in November, but probably down from the October reading of 57.7.

Other indexes of manufacturing activity also suggested notably slower expansion in November. The survey’s demand indicators—the new orders and growth rate of new orders indexes—declined to 9.7 and 4.8, respectively, representing their lowest readings in 20 months. The capacity utilization index fell six points to 9.4, and the shipments index fell nine points to 7.7, both at their lowest levels in at least 20 months.

Perceptions of broader business conditions remained positive overall but were less optimistic than in October. The general business activity and company outlook indexes posted double-digit declines, coming in at 17.6 and 13.7, respectively. These readings are lower than what has been seen over the past year but still well above long-term averages. The index measuring uncertainty regarding companies’ outlooks rose five points to 12.3, indicating uncertainty was more widespread this month.

Labor market measures suggested continued but slower employment growth and longer workweeks in November. The employment index retreated eight points to 15.9, a level well above average. Twenty-three percent of firms noted net hiring, compared with 7 percent noting net layoffs. The hours worked index edged down to 4.9.

emphasis added

Chicago Fed "Index Points to a Slight Increase in Economic Growth in October"

by Calculated Risk on 11/26/2018 08:39:00 AM

From the Chicago Fed: Index Points to a Slight Increase in Economic Growth in October

Led by improvements in employment-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.24 in October from +0.14 in September. Only one of the four broad categories of indicators that make up the index increased from September, but three of the four categories made positive contributions to the index in October. The index’s three-month moving average, CFNAI-MA3, ticked up to +0.31 in October from +0.30 in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in October (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, November 25, 2018

Sunday Night Futures

by Calculated Risk on 11/25/2018 06:59:00 PM

Weekend:

• Schedule for Week of November 25, 2018

• "Is a Recession Coming?"

• Oil Prices Down Year-over-year

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for October. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for November.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5 and DOW futures are up 47 (fair value).

Oil prices were down sharply over the last week with WTI futures at $50.46 per barrel and Brent at $59.03 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so WTI oil prices are down 15%, and Brent prices down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.50 per gallon, so gasoline prices are up 4 cents per gallon year-over-year.