by Calculated Risk on 11/27/2018 09:10:00 AM

Tuesday, November 27, 2018

Case-Shiller: National House Price Index increased 5.5% year-over-year in September

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Annual Home Price Gains Slow According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in September, down from 5.7% in the previous month. The 10City Composite annual increase came in at 4.8%, down from 5.2% in the previous month. The 20-City Composite posted a 5.1% year-over-year gain, down from 5.5% in the previous month.

Las Vegas, San Francisco and Seattle reported the highest year-over-year gains among the 20 cities. In September, Las Vegas led the way with a 13.5% year-over-year price increase, followed by San Francisco with a 9.9% increase and Seattle with an 8.4% increase. Four of the 20 cities reported greater price increases in the year ending September 2018 versus the year ending August 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.1% in September. The 10-City and 20-City Composites did not report any gains for the month. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase in September. The 10-City Composite and the 20-City Composite both posted 0.3% month-over-month increases. In September, nine of 20 cities reported increases before seasonal adjustment, while 18 of 20 cities reported increases after seasonal adjustment.

“Home prices plus data on house sales and construction confirm the slowdown in housing,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P CoreLogic Case-Shiller National Index showed a 5.5% year-over-year gain, weaker for the second month in a row as 16 of 20 cities showed smaller annual price gains. On a monthly basis, nine cities saw prices decline in September compared to August. In Seattle, where prices were rising at doubledigit annual rates a few months ago, prices dropped last month. The few places reporting larger gains including some of the cities which had the biggest gains and largest losses 10 years ago: Las Vegas, Phoenix and Tampa.

“Sales of both new and existing single family homes peaked one year ago in November 2017. Sales of existing homes are down 9.3% from that peak. Housing starts are down 8.7% from November of last year. The National Association of Home Builders sentiment index dropped seven points to 60, its lowest level in two years. One factor contributing to the weaker housing market is the recent increase in mortgage rates. Currently the national average for a 30-year fixed rate loan is 4.9%, a full percentage point higher than a year ago.”

emphasis added

Click on graph for larger image.

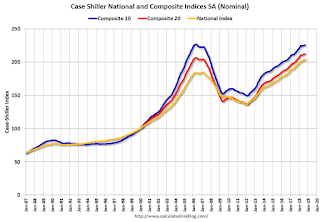

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off slightly from the bubble peak, and up 0.3% in September (SA).

The Composite 20 index is 2.8% above the bubble peak, and up 0.3% (SA) in September.

The National index is 10.8% above the bubble peak (SA), and up 0.4% (SA) in September. The National index is up 49.8% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.8% compared to September 2017. The Composite 20 SA is up 5.2% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, November 26, 2018

Tuesday: Case-Shiller House Prices

by Calculated Risk on 11/26/2018 09:14:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still On Vacation

Mortgage rates began the post-holiday week by holding the same sideways posture seen last week during the slow market days surrounding Thanksgiving. Generally speaking, slow market days make for limited mortgage rate movement. [30YR FIXED - 4.875-5.0%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for September. The consensus is for a 5.3% year-over-year increase in the Comp 20 index for September.

• At 9:00 AM, FHFA House Price Index for September 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

Q4 GDP Forecasts; Mid-2s

by Calculated Risk on 11/26/2018 05:36:00 PM

From Merrill Lynch:

We look for 3Q GDP growth to be revised slightly lower to 3.4% qoq saar in the second release next week. We continue to track 2.7% for 4Q. [Nov 21 estimate].From Goldman Sachs:

emphasis added

[W]e lowered our Q4 GDP tracking estimate by one tenth to +2.4% (qoq ar) [Nov 21 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.5 percent on November 21 [Nov 21 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.5%. [Nov 23 estimate]CR Note: These early estimates suggest GDP in the mid-2s for Q4. Based on these estimates for Q4, 2018 annual GDP would be around 2.9%, and Q4 over Q4 around 3.1%. In line with most forecasts at the beginning of the year.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 11/26/2018 01:39:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 17 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 11-17 November 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 November 2017, the industry recorded the following:

• Occupancy: +0.6% to 66.6%

• Average daily rate (ADR): +2.5 to US$127.53

• Revenue per available room (RevPAR): +3.1% to US$84.99

…

Houston, Texas, registered the steepest declines in occupancy (-17.3% to 66.5%) and RevPAR (-23.3% to US$71.92).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com

Dallas Fed: "Texas Manufacturing Expansion Continues to Moderate"

by Calculated Risk on 11/26/2018 10:39:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues to Moderate

Texas factory activity continued to expand in November, albeit at a markedly slower pace, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained positive but fell nine points to 8.4, indicating output growth continued to abate.This is a solid reading, but suggests growth is slowing in the Texas region. So far the regional surveys suggest the national ISM index will be solid in November, but probably down from the October reading of 57.7.

Other indexes of manufacturing activity also suggested notably slower expansion in November. The survey’s demand indicators—the new orders and growth rate of new orders indexes—declined to 9.7 and 4.8, respectively, representing their lowest readings in 20 months. The capacity utilization index fell six points to 9.4, and the shipments index fell nine points to 7.7, both at their lowest levels in at least 20 months.

Perceptions of broader business conditions remained positive overall but were less optimistic than in October. The general business activity and company outlook indexes posted double-digit declines, coming in at 17.6 and 13.7, respectively. These readings are lower than what has been seen over the past year but still well above long-term averages. The index measuring uncertainty regarding companies’ outlooks rose five points to 12.3, indicating uncertainty was more widespread this month.

Labor market measures suggested continued but slower employment growth and longer workweeks in November. The employment index retreated eight points to 15.9, a level well above average. Twenty-three percent of firms noted net hiring, compared with 7 percent noting net layoffs. The hours worked index edged down to 4.9.

emphasis added

Chicago Fed "Index Points to a Slight Increase in Economic Growth in October"

by Calculated Risk on 11/26/2018 08:39:00 AM

From the Chicago Fed: Index Points to a Slight Increase in Economic Growth in October

Led by improvements in employment-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.24 in October from +0.14 in September. Only one of the four broad categories of indicators that make up the index increased from September, but three of the four categories made positive contributions to the index in October. The index’s three-month moving average, CFNAI-MA3, ticked up to +0.31 in October from +0.30 in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in October (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, November 25, 2018

Sunday Night Futures

by Calculated Risk on 11/25/2018 06:59:00 PM

Weekend:

• Schedule for Week of November 25, 2018

• "Is a Recession Coming?"

• Oil Prices Down Year-over-year

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for October. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for November.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5 and DOW futures are up 47 (fair value).

Oil prices were down sharply over the last week with WTI futures at $50.46 per barrel and Brent at $59.03 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so WTI oil prices are down 15%, and Brent prices down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.50 per gallon, so gasoline prices are up 4 cents per gallon year-over-year.

Climate Change Report

by Calculated Risk on 11/25/2018 10:53:00 AM

This is a critical threat and should be a nonpartisan issue.

Here is the Fourth National Climate Assessment. An excerpt on the economic impact:

In the absence of significant global mitigation action and regional adaptation efforts, rising temperatures, sea level rise, and changes in extreme events are expected to increasingly disrupt and damage critical infrastructure and property, labor productivity, and the vitality of our communities. Regional economies and industries that depend on natural resources and favorable climate conditions, such as agriculture, tourism, and fisheries, are vulnerable to the growing impacts of climate change. Rising temperatures are projected to reduce the efficiency of power generation while increasing energy demands, resulting in higher electricity costs. The impacts of climate change beyond our borders are expected to increasingly affect our trade and economy, including import and export prices and U.S. businesses with overseas operations and supply chains. Some aspects of our economy may see slight near-term improvements in a modestly warmer world. However, the continued warming that is projected to occur without substantial and sustained reductions in global greenhouse gas emissions is expected to cause substantial net damage to the U.S. economy throughout this century, especially in the absence of increased adaptation efforts. With continued growth in emissions at historic rates, annual losses in some economic sectors are projected to reach hundreds of billions of dollars by the end of the century—more than the current gross domestic product (GDP) of many U.S. states.

Saturday, November 24, 2018

Schedule for Week of November 25, 2018

by Calculated Risk on 11/24/2018 08:11:00 AM

The key reports this week are October New Home sales, and the second estimate of Q3 GDP.

Other key indicators include Personal Income and Outlays for October and Case-Shiller house prices for September.

For manufacturing, the Dallas and Richmond Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.3% year-over-year increase in the Comp 20 index for September.

9:00 AM: FHFA House Price Index for September 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 3nd quarter 2018 (Second estimate). The consensus is that real GDP increased 3.5% annualized in Q3, unchanged from the advance estimate of GDP.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 575 thousand SAAR, up from 553 thousand in September.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

12:00 PM: Speech by Fed Chair Jerome Powell, The Federal Reserve's Framework for Monitoring Financial Stability, At The Economic Club of New York Signature Luncheon, New York, New York

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, down from 224 thousand the previous week.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 0.5% increase in the index.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of November 7-8, 2018

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 58.0, down from 58.4 in October.

Friday, November 23, 2018

"Is a Recession Coming?"

by Calculated Risk on 11/23/2018 02:46:00 PM

Derek Thompson at The Atlantic asked me about my views on an imminent recession in this excellent overview: Is a Recession Coming?

Thompson concluded:

If you’re going to worry, you should worry about three things: exports, China, and maybe the looming shadow of corporate debt. But nothing in the economy seems to predict an imminent recession.For more on the joke about Kudlow, see: Larry Kudlow is usually wrong

Or at least that was my conclusion before Bill McBride sent me a follow-up email.

“Just saw Larry Kudlow’s remarks. Maybe I’m wrong!”