by Calculated Risk on 11/11/2018 07:48:00 PM

Sunday, November 11, 2018

Sunday Night Futures

Thank you to all the veterans! Especially to my 96 years young father who flew a Corsair off the USS Bennington in the Pacific during WWII, and also served in Korea and Vietnam.

Weekend:

• Schedule for Week of November 11, 2018

Monday:

• Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $60.81 per barrel and Brent at $71.10 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.68 per gallon. A year ago prices were at $2.55 per gallon, so gasoline prices are up 13 cents per gallon year-over-year.

U.S. Heavy Truck Sales up 18% Year-over-year in October

by Calculated Risk on 11/11/2018 11:47:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2018 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 366 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 515 thousand SAAR in October, down from the recent peak of 539 thousand SAAR in September, and up from 436 thousand SAAR in October 2017.

With the recent decline oil prices, and softness in housing, heavy truck sales will probably decline over the next few months.

Saturday, November 10, 2018

Schedule for Week of November 11, 2018

by Calculated Risk on 11/10/2018 08:11:00 AM

The key economic reports this week are October CPI and Retail Sales.

For manufacturing, October industrial production, and the November New York, Philly and Kansas City Fed surveys, will be released this week.

Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

6:00 AM: NFIB Small Business Optimism Index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for October from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 214 thousand the previous week.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.5% increase in retail sales.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.5% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 20.0, down from 21.1.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 20.0, down from 22.2.

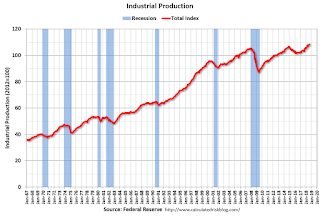

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

10:00 AM: State Employment and Unemployment (Monthly) for October 2018

11:00 AM: NY Fed: Q3 Quarterly Report on Household Debt and Credit

11:00 AM: the Kansas City Fed manufacturing survey for November.

Friday, November 09, 2018

Oil Rigs Increased, Oil Prices Fall

by Calculated Risk on 11/09/2018 04:06:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on November 9, 2018:

• Oil rigs in total were up sharply, +12 to 886CR Note: Meanwhile oil prices have been falling, from MarketWatch: U.S. oil extends slide into bear market, down 10 sessions in a row

• Horizontal oil rigs gained more modestly, +3 at 778

U.S. crude-oil futures on Friday posted a 10th straight session decline, extending their drop into a bear market, as output increases fueled concerns of surging supplies.

…

On Friday, West Texas Intermediate crude for December delivery CLZ8, -1.29% lost 48 cents, or 0.8%, to settle at $60.19 a barrel on the New York Mercantile Exchange, for the lowest front-month contract settlement since March 8, according to FactSet data. Prices lost 4.7% for the week, tallying their fifth straight weekly drop.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q4 GDP Forecasts

by Calculated Risk on 11/09/2018 01:25:00 PM

From Merrill Lynch:

We continue to track 3.7% for 3Q GDP and 2.8% for 4Q. [Nov 9 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.9 percent on November 9, unchanged from November 2. The nowcast of the contribution of inventory investment to fourth-quarter real GDP growth inched down from -0.05 percentage points to -0.08 percentage points after this morning's Producer Price Index release from the U.S. Bureau of Labor Statistics and this morning's wholesale trade report from the U.S. Census Bureau. [Nov 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.7%. News from this week's data releases increased the nowcast for 2018:Q4 by 0.1 percentage point. A positive surprise from producer prices data accounted for most of the increase.[Nov 9 estimate]CR Note: These early estimates suggest GDP in the high 2s for Q4.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 11/09/2018 10:55:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 3 November

The U.S. hotel industry reported mostly flat year-over-year results in the three key performance metrics during the week of 28 October through 3 November 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 29 October through 4 November 2017, the industry recorded the following:

• Occupancy: -0.7% to 62.9%

• Average daily rate (ADR): +0.7% to US$124.81

• Revenue per available room (RevPAR): -0.1% to US$78.54

…

Houston, Texas, registered the steepest declines in occupancy (-23.5% to 60.6%) and RevPAR (-30.8% to US$61.90). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com

Merrill on Trade and Tariffs

by Calculated Risk on 11/09/2018 08:38:00 AM

A few excerpts from a note by economists Anna Zhou and Ethan Harris at Merrill Lynch: "Here for a long time, not a good time"

In their October 2018 paper, Furceri, Hannan, Ostry and Rose looked into the macroeconomic consequences of tariffs. They analysed data spanning 151 counties (including both EM and DM economies) over the period 1963-2014 to quantify the impact of tariffs on output, productivity, unemployment, real exchange rates and trade balances. The authors find that tariffs have adverse macroeconomic consequences in the short and medium term.

These results are also consistent with economic theory. …

What about the trade balance? According to Furceri, Hannan, Ostry and Rose, the impact is minimal: they find that an increase in tariffs has a small and statistically-insignificant impact on the trade balance-to-GDP ratio. ... developed economies tend to respond more negatively to tariffs than emerging economies.

None of this bodes well for the US. Since the US is an advanced economy that is at or close to the peak of the business cycle, the results of the paper point to the risk of a substantial negative impact from the tariffs.

There is also bad news for the global outlook. As we have argued many times previously, the administration’s primary goal on trade is a significant reduction in the trade balance. We have also contended that this goal will probably not be achieved—and the trade deficit will instead probably widen—because fiscal stimulus will boost consumption and import demand. The paper shows that historical data also do not support an improvement in the trade balance.

Thursday, November 08, 2018

Homebuilder D.R. Horton: Housing Market "Choppy", "momentum is slipping"

by Calculated Risk on 11/08/2018 08:14:00 PM

Friday:

• At 8:30 AM ET, The Producer Price Index for October from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for November).

A few comments via Bloomberg from homebuilder D.R.Horton: (HT Brian)

Rising home prices, combined with the jump in interest rates over the past year, are weighing on demand in the U.S., especially for more expensive properties. On a call with analysts, Chief Executive Officer David Auld side the market has been "choppy" in the past four or five weeks. A "little momentum is slipping from the market," he said.

AAR: October Rail Carloads Up 1.0% YoY, Intermodal Up 4.2% YoY

by Calculated Risk on 11/08/2018 04:19:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail traffic in October 2018 was mixed. Total carloads rose 1.0%, or 12,598. On the positive side, carloads of petroleum and petroleum products surged 28.4% (13,746) in October thanks to higher crude oil shipments; carloads of coal rose 1.6% (6,828 carloads, their first increase in five months); and carloads of steel and other primary metal products rose 9.8% (4,188 carloads, their 21st increase in the past 23 months). … Meanwhile, uncertainties in export markets is hurting grain, carloads of which were down 4.8% (5,620) in October. ... Intermodal did very well in October: volumes were up 4.2%, or 58,546 containers and trailers.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,338,037 carloads in October 2018, up 1.0%, or 12,598 carloads, over October 2017. It’s the eighth straight monthly increase for total carloads, but it’s also the smallest percentage increase in those eight months. In October 2018, 13 of the 20 commodity categories the AAR tracks had carload increases, the fewest since March 2018.

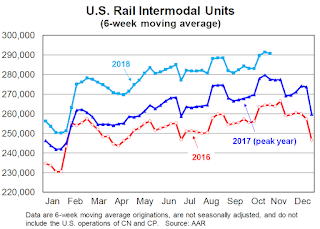

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,443,914 containers and trailers in October 2018, up 4.2% (58,546 units) over October 2017. The weekly average in October 2018 was 288,783, the second most (behind June 2018) for any month in history.2018 will be another record year for intermodal traffic.

FOMC Statement: No Change to Policy

by Calculated Risk on 11/08/2018 03:12:00 PM

Merrill on FOMC statement:

"In terms of today's statement, there were only two small changes: 1) "household spending has continued to grow strongly" which shows that the Fed has taken notice of the strength in the consumer spending data; 2) "business fixed investment has moderated from its rapid pace earlier in the year" which is a mark-to-market given the weaker investment data in 3Q. We shouldn't be surprised by either comment as they are simply a summary of the recent data. Interestingly, there was no mention of the softer housing data."FOMC Statement:

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 2 to 2-1/4 percent.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Richard H. Clarida; Mary C. Daly; Loretta J. Mester; and Randal K. Quarles.

emphasis added