by Calculated Risk on 8/30/2018 12:03:00 PM

Thursday, August 30, 2018

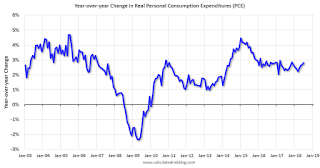

Year-over-year Change in Real Personal Consumption Expenditures (PCE)

Earlier I posted a graph showing real monthly personal consumption expenditures (PCE) based on the monthly BEA report.

Here is a graph showing the year-over-year change in real PCE since 2003.

In July, the YoY change was 2.8%, about the same level as for the last few years.

There was a significant decline in real PCE during the great recession, and real PCE was fairly weak during the first few years of the recovery - partially due to the ongoing weakness in housing following the housing bubble and bust.

More recently real PCE has been increasing at a fairly steady rate between 2.0% and 3.0% per year.

Personal Income increased 0.3% in July, Spending increased 0.4%

by Calculated Risk on 8/30/2018 08:50:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $54.8 billion (0.3 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $52.5 billion (0.3 percent) and personal consumption expenditures (PCE) increased $49.3 billion (0.4 percent).The July PCE price index increased 2.3 percent year-over-year and the July PCE price index, excluding food and energy, increased 2.0 percent year-over-year.

Real DPI increased 0.2 percent in July and Real PCE increased 0.2 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through July 2018 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was at expectations.

Weekly Initial Unemployment Claims increased to 213,000

by Calculated Risk on 8/30/2018 08:33:00 AM

The DOL reported:

In the week ending August 25, the advance figure for seasonally adjusted initial claims was 213,000, an increase of 3,000 from the previous week's unrevised level of 210,000. The 4-week moving average was 212,250, a decrease of 1,500 from the previous week's unrevised average of 213,750. This is the lowest level for this average since December 13, 1969 when it was 210,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,250.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, August 29, 2018

Thursday: Personal Income and Outlays, Unemployment Claims

by Calculated Risk on 8/29/2018 06:21:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand the previous week.

• Also at 8:30 AM, Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

Chemical Activity Barometer "Softens" in August

by Calculated Risk on 8/29/2018 01:42:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Softens as Pace of Growth Slows

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), was flat in August remaining at 122.14 on a three-month moving average (3MMA) basis. This continued a general softening trend since the first quarter. The barometer is up 3.8 percent year-over-year (Y/Y/), a slower pace than of that earlier in the year and similar to that seen in the second half of 2017. The unadjusted CAB also was flat, and follows a 0.3 percent decline in July. August readings indicate gains in U.S. commercial and industrial activity well into the first quarter 2019, but at a slower pace as growth has turned over.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production in 2018 and early 2019, but at a slower pace.

NAR: Pending Home Sales Index Decreased 0.7% in July

by Calculated Risk on 8/29/2018 10:03:00 AM

From the NAR: Pending Home Sales Trail Off 0.7 Percent in July

Pending home sales stepped back in July and have now fallen on an annual basis for seven straight months, according to the National Association of Realtors®.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.7 percent to 106.2 in July from 107.0 in June. With last month’s decline, contract signings are now down 2.3 percent year-over-year.

...

The PHSI in the Northeast climbed 1.0 percent to 94.6 in July, but is still 2.3 percent below a year ago. In the Midwest the index inched up 0.3 percent to 102.2 in July, but is still 1.5 percent lower than July 2017.

Pending home sales in the South declined 1.7 percent to an index of 122.1 in July, and are 0.9 percent below a year ago. The index in the West decreased 0.9 percent in July to 94.7, and is 5.8 percent below a year ago.

emphasis added

Q2 GDP Revised up to 4.2% Annual Rate

by Calculated Risk on 8/29/2018 08:36:00 AM

From the BEA: National Income and Product Accounts Gross Domestic Product: Second Quarter 2018 (Second Estimate)

Real gross domestic product (GDP) increased 4.2 percent in the second quarter of 2018, according to the “second” estimate released by the Bureau of Economic Analysis. The growth rate was 0.1 percentage point more than the “advance” estimate released in July. In the first quarter, real GDP increased 2.2 percent.PCE growth was revised down from 4.0% to 3.8%. Residential investment was revised down from -1.1% to -1.6%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 4.1 percent. With this second estimate for the second quarter, the general picture of economic growth remains the same; the revision primarily reflected upward revisions to nonresidential fixed investment and private inventory investment that were partly offset by a downward revision to personal consumption expenditures (PCE). Imports which are a subtraction in the calculation of GDP, were revised down.

emphasis added

Here is a Comparison of Second and Advance Estimates.

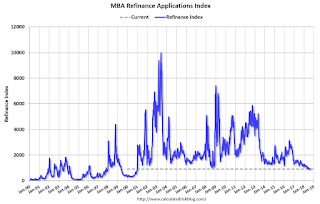

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 8/29/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 24, 2018.

... The Refinance Index decreased three percent from the previous week. The seasonally adjusted Purchase Index decreased one percent from one week earlier. The unadjusted Purchase Index decreased three percent compared with the previous week and was three percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.78 percent from 4.81 percent, its lowest rate since the week ending July 20, 2018, with points increasing to 0.46 from 0.42 (including the origination fee) for 80 percent loanto-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, August 28, 2018

Wednesday: GDP, Pending Home Sales

by Calculated Risk on 8/28/2018 07:51:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2018 (Second estimate). The consensus is that real GDP increased 4.0% annualized in Q2, down from the advance estimate of 4.1%.

• At 10:00 AM, Pending Home Sales Index for July. The consensus is for no change in the index.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in July

by Calculated Risk on 8/28/2018 04:37:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 0.78%, down from 0.82% in June. Freddie's rate is down from 0.85% in July 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since March 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate late last year was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.75% range - but this is close to a bottom.

Note: Fannie Mae will report for July soon.