by Calculated Risk on 7/30/2018 12:50:00 PM

Monday, July 30, 2018

Oil Rigs: " A local peak in rig counts"

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 27, 2018:

• A clear local peak in oil rig counts

• Total oil rigs rose, +3 to 861

• Horizontal oil rigs were flat at 762

...

• Horizontal oil rigs are showing a clear local peak, similar to last July. By the time the count bottomed in November, horizontal oil rigs had fallen by 32. The difference is that oil prices were $20 / barrel lower then.

• Our model sees falling horizontal oil rig counts through Labor Day.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Dallas Fed: "Robust Expansion in Texas Manufacturing Continues; Uncertainty Picks Up"

by Calculated Risk on 7/30/2018 10:38:00 AM

From the Dallas Fed: Robust Expansion in Texas Manufacturing Continues; Uncertainty Picks Up

The robust expansion in Texas factory activity continued in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose six points to 29.4, signaling an acceleration in output growth.This was the last of the regional Fed surveys for July.

Other indexes of manufacturing activity also indicated continued solid expansion in July. The survey’s demand measures—the new orders and growth rate of orders indexes—moved down but remained well above average at 23.3 and 17.0, respectively. The shipments index climbed five points to 30.8, and the capacity utilization index edged up to 25.0.

Perceptions of broader business conditions were a bit less positive this month versus June, and uncertainty increased. The general business activity index slipped four points to 32.3. The company outlook index dropped 13 points to 20.4, which is the second-lowest reading this year but still elevated relative to the average. A new question introduced to the survey in January 2018 asks, “How has uncertainty regarding your company’s outlook changed in the current month vs. prior month?” In July, a quarter of firms said uncertainty increased, while only 8 percent said it decreased—bringing the outlook uncertainty index* to 17.0, well above its June reading and the highest level to date.

Labor market measures suggested a pickup in net hiring and longer work hours in July. The employment index pushed up five points to 28.9, a 13-year high. Thirty-six percent of firms noted net hiring, compared with 7 percent noting net layoffs. The hours worked index ticked up to 22.2.

Price and wage pressures remained highly elevated this month. While still well above average, the raw materials prices index moved down five points to 48.6, and the finished goods prices index ticked down to 22.9. Compensation costs continued to rise at a faster clip than normal, with the wages and benefits index holding fairly steady at 32.4.

emphasis added

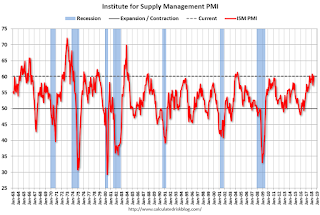

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

Based on these regional surveys, it is possible the ISM manufacturing index will be close to 60 in July (to be released on Wednesday, August 1st). The consensus is for the ISM to be at 59.4, down from 60.2 in June.

NAR: Pending Home Sales Index Increased 0.9% in June

by Calculated Risk on 7/30/2018 10:04:00 AM

From the NAR: Pending Home Sales Reverse Course, Rise 0.9 Percent in June

Pending home sales increased in all four major regions in June, but overall activity lagged year ago levels for the sixth straight month, according to the National Association of Realtors®.This was close to expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 0.9 percent to 106.9 in June from 105.9 in May. Despite last month’s increase, contract signings are still down 2.5 percent on an annual basis.

...

The PHSI in the Northeast increased 1.4 percent to 93.7 in June, but is still 4.1 percent below a year ago. In the Midwest the index rose 0.5 percent to 101.9 in June, but is still 2.1 percent lower than June 2017.

Pending home sales in the South climbed 1.1 percent to an index of 124.2 in June, but are 0.3 percent below a year ago. The index in the West inched forward 0.7 percent in June to 95.4, but is 5.6 percent below a year ago.

emphasis added

Sunday, July 29, 2018

Sunday Night Futures

by Calculated Risk on 7/29/2018 06:44:00 PM

Weekend:

• Schedule for Week of July 29, 2018

Monday:

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 0.8% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July. This is the last of the regional surveys for July.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 19 and DOW futures are down 90 (fair value).

Oil prices were up over the last week with WTI futures at $69.01 per barrel and Brent at $74.31 per barrel. A year ago, WTI was at $50, and Brent was at $52 - so oil prices are up 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.85 per gallon. A year ago prices were at $2.31 per gallon - so gasoline prices are up 54 cents per gallon year-over-year.

July 2018: Unofficial Problem Bank list declines to 89 Institutions

by Calculated Risk on 7/29/2018 11:11:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for July 2018. The list had a decline of three insured institutions to 89 banks. Aggregate assets declined during the month by $2.7 billion to $57.3 billion. A year ago, the list held 134 institutions with assets of $32.8 billion.

Actions were terminated against Amboy Bank, Old Bridge, NJ ($2.3 billion); McHenry Savings Bank, McHenry, IL ($225 million); and EH National Bank, Beverly Hills, CA ($182 million).

Saturday, July 28, 2018

Schedule for Week of July 29, 2018

by Calculated Risk on 7/28/2018 08:11:00 AM

The key report this week is the July employment report on Friday.

Other key indicators include Personal Income and Outlays for June, Case-Shiller house prices for May, the July ISM manufacturing and non-manufacturing indexes, July auto sales, and the June trade deficit.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected at this meeting.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 0.8% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for July. This is the last of the regional surveys for July.

8:30 AM: Personal Income and Outlays for June. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:00 AM ET: S&P/Case-Shiller House Price Index for May.

9:00 AM ET: S&P/Case-Shiller House Price Index for May.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.6% year-over-year increase in the Comp 20 index for May.

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a reading of 62.0, down from 64.1 in June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 172,000 payroll jobs added in July, up from 177,000 added in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 59.4, down from 60.2 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 59.4, down from 60.2 in June.Here is a long term graph of the ISM manufacturing index.

The PMI was at 60.2% in June, the employment index was at 56.0%, and the new orders index was at 63.5%.

10:00 AM: Construction Spending for June. The consensus is for a 0.3% increase in construction spending.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to be 17.1 million SAAR in July, down from 17.5 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to be 17.1 million SAAR in July, down from 17.5 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce no change to policy at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 217 thousand the previous week.

8:30 AM: Employment Report for July. The consensus is for an increase of 188,000 non-farm payroll jobs added in July, down from the 213,000 non-farm payroll jobs added in June.

8:30 AM: Employment Report for July. The consensus is for an increase of 188,000 non-farm payroll jobs added in July, down from the 213,000 non-farm payroll jobs added in June. The consensus is for the unemployment rate to decline to 3.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In June the year-over-year change was 2.374 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $45.6 billion in June from $43.1 billion in May.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 58.8 from 59.1 in June.

Friday, July 27, 2018

Housing comments from Soylent Green

by Calculated Risk on 7/27/2018 04:23:00 PM

Long term readers will remember mortgage broker "Soylent Green is People". He sent me these comments on housing that I'll pass along:

"A bit of a panic is breaking out amongst my Realtor friends. Sales are down. There are more cancellations right before closings than usual. Builders are getting a few drop outs as well on some of their units, but that could be tied to overseas buyers with other concerns. If this sales "air pocket" continues, we might see some Agents have to actually marketing, rather than just shilling their homes at the first buyer through the door. A few Agents have seen their listings grow long in the tooth, even some traditionally priced towards first time home buyers. That's a deja vu event today for 2013 vintage agents, but not so for old dogs like me.CR Note: Higher mortgage rates and the new tax policy appear to be impacting home sales in some areas. But this is a slowdown from a hot market, and I expect the key sectors - single family starts and new home sales - will see further growth.

On the mortgage side of things, more and more loans have begun funding in the upper 4's to low 5's. Customers are really chafing at anything priced above 4.75%. In order to expand volume, some lenders are duking it out on price while others are expanding their debt to income ratios, lowering the buying threshold, just as we saw back in 2006."

Top Twenty Five GDP Quarters since 2000

by Calculated Risk on 7/27/2018 01:24:00 PM

With the release of Q2 GDP data, and the 2018 Comprehensive Update to GDP (including revisions), here is an update to the table showing the top 25 quarters since Q1 2000.

Q2 2018 is the eleventh best quarter for real annualized GDP since Q1 2000. Note: unrounded, Q2 2018 was at 4.06%, just behind Q4 2004 at 4.07%.

Q2 GDP was solid..

As I've noted before, based on demographics, 2% is the new 4% (that is just simple arithmetic). I've also noted that a large government program (such as a war, or a tax cut) can give a short term boost to GDP.

| Top 25 GDP Quarters since 2000 Real GDP, Annualized Rate | ||||

|---|---|---|---|---|

| GDP | Year | Quarter | President | |

| 1 | 7.5% | 2000 | Q2 | Clinton |

| 2 | 7.0% | 2003 | Q3 | G.W.Bush |

| 3 | 5.4% | 2006 | Q1 | G.W.Bush |

| 4 | 5.1% | 2014 | Q2 | Obama |

| 5 | 4.9% | 2014 | Q3 | Obama |

| 6 | 4.7% | 2011 | Q4 | Obama |

| 7 | 4.7% | 2003 | Q4 | G.W.Bush |

| 8 | 4.5% | 2005 | Q1 | G.W.Bush |

| 9 | 4.5% | 2009 | Q4 | Obama |

| 10 | 4.1% | 2004 | Q4 | G.W.Bush |

| 11 | 4.1% | 2018 | Q2 | Trump |

| 12 | 3.8% | 2004 | Q3 | G.W.Bush |

| 13 | 3.7% | 2010 | Q2 | Obama |

| 14 | 3.6% | 2005 | Q3 | G.W.Bush |

| 15 | 3.6% | 2013 | Q1 | Obama |

| 16 | 3.5% | 2002 | Q1 | G.W.Bush |

| 17 | 3.5% | 2003 | Q2 | G.W.Bush |

| 18 | 3.4% | 2006 | Q4 | G.W.Bush |

| 19 | 3.3% | 2015 | Q2 | Obama |

| 20 | 3.3% | 2015 | Q1 | Obama |

| 21 | 3.2% | 2013 | Q4 | Obama |

| 22 | 3.2% | 2013 | Q3 | Obama |

| 23 | 3.2% | 2012 | Q1 | Obama |

| 24 | 3.1% | 2004 | Q2 | G.W.Bush |

| 25 | 3.0% | 2017 | Q2 | Trump |

Q2 GDP: Investment

by Calculated Risk on 7/27/2018 10:17:00 AM

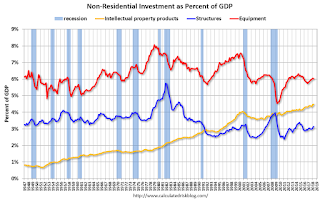

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) was decreased in Q2 (-1.1% annual rate in Q2). Equipment investment increased at a 3.9% annual rate, and investment in non-residential structures increased at a 13.3% annual rate.

On a 3 quarter trailing average basis, RI (red) is up slightly, equipment (green) is solidly positive, and nonresidential structures (blue) is also up.

Recently real RI has been soft.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP decreased in Q2, however RI has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next couple of years.

The increase is now primarily coming from single family investment and home remodeling.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

BEA: Real GDP increased at 4.1% Annualized Rate in Q2

by Calculated Risk on 7/27/2018 08:34:00 AM

Note: This release includes the 2018 Comprehensive Update to GDP, and includes revisions to previous GDP releases.

From the BEA: Gross Domestic Product: Second Quarter 2018 (Advance Estimate)

Real gross domestic product increased at an annual rate of 4.1 percent in the second quarter of 2018, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.2 percent (revised).The advance Q2 GDP report, with 4.1% annualized growth, was close to expectations.

...

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The estimates released today also reflect the results of the 15th comprehensive update of the National Income and Product Accounts (NIPAs). The updated estimates reflect previously announced improvements, and include the introduction of new not seasonally adjusted estimates for GDP, GDI, and their major components. For more information, see the Technical Note.

emphasis added

Personal consumption expenditures (PCE) increased at 4.0% annualized rate in Q2, up from 0.5% in Q1. Residential investment (RI) decreased 1.1% in Q2. Equipment investment increased at a 3.9% annualized rate, and investment in non-residential structures increased at a 13.3% pace.

I'll have more later ...