by Calculated Risk on 6/13/2018 09:49:00 AM

Wednesday, June 13, 2018

Housing Inventory Tracking: The Bottom Turn

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year (YoY) change for non-contingent inventory in Houston, Las Vegas and Sacramento (all through May 2018), and also Phoenix (through April) and total existing home inventory as reported by the NAR (through April 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 30% year-over-year in May (inventory was still very low), and has increased YoY for eight consecutive months.

Also note that inventory is still down 12% YoY in Las Vegas (red), but the YoY decline has been getting smaller - and inventory in Vegas will probably be up YoY very soon.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory to be up YoY by the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally (and has already bottomed in some areas like California).

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 6/13/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 8, 2018. Last week’s results included an adjustment for the Memorial Day holiday.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 0.2 percent lower than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.83 percent from 4.75 percent, with points increasing to 0.53 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is down 0.2% year-over-year.

Tuesday, June 12, 2018

Sacramento Housing in May: Sales Unchanged YoY, Active Inventory up 30% YoY

by Calculated Risk on 6/12/2018 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for May from the BLS. The consensus is a 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

From SacRealtor.org: May 2018 Statistics – Sacramento Housing Market – Single Family Homes

May closed with 1,730 sales, a 9% increase from April’s 1,587. Compared to May 2017 (1,731), the figure is nearly unchanged. Of the 1,730 sales this month, 242 (14%) used cash financing, 1,056 (59.3%) used conventional, 290 (16.8%) used FHA, 96 (5.5%) used VA and 76 (4.4%) used Other† types of financing.CR Note: Inventory is still low, but now increasing significantly year-over-year in Sacramento.

...

Active Listing Inventory increased 20.5% from 2,082 to 2,509 units and the Months of Inventory increased from 1.3 to 1.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [CR Note: Active inventory is up 29.7% year-over-year]

The Average DOM (days on market) dropped from 23 to 20 month to month and the Median DOM dropped from 10 to 9. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,730 sales this month, 80.9% (1,400) were on the market for 30 days or less and 93.1% (1,611) were on the market for 60 days or less.

emphasis added

Did the Rebound in Oil Prices Rescue the Houston Housing Market?

by Calculated Risk on 6/12/2018 04:26:00 PM

Two years ago I asked: Will the Rebound in Oil Prices Rescue the Houston Housing Market?

When inventory was declining just about everywhere, inventory was rising in Houston as oil prices declined a few years ago. More recently, as oil prices rebounded, inventory has been declining year over year.

The Houston Association of Realtors (HAR) just released data for May.

In May, active listing were down 1.4% year-over-year compared to May2017. The current level isn't unusually high for the Houston market (inventory was over 50,000 in 2010), but inventory increased significantly when oil prices were falling.

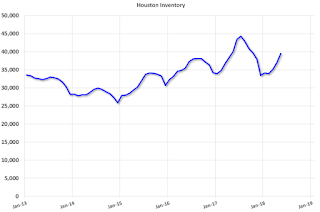

This graph shows the number of active listings in Houston since January 2013.

With higher oil prices, inventory has stopped increasing - after increasing for the previous three years.

It does seem the rebound in oil prices has helped the Houston market.

Key Measures Show Inflation increased YoY in May

by Calculated Risk on 6/12/2018 11:07:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.8% annualized rate) in May. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for May here. Motor fuel was up 23% annualized in May.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.5% annualized rate) in May. The CPI less food and energy rose 0.2% (2.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.7%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 2.2%. Core PCE is for April and increased 1.8% year-over-year.

On a monthly basis, median CPI was at 2.8% annualized, trimmed-mean CPI was at 2.1% annualized, and core CPI was at 2.1% annualized.

Using these measures, inflation increased year-over-year in May. Overall, these measures are close to the Fed's 2% target.

BLS: CPI increased 0.2% in May, Core CPI increased 0.2%

by Calculated Risk on 6/12/2018 08:33:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in May on a seasonally adjusted basis after rising 0.2 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.8 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast.

The indexes for gasoline and shelter were the largest factors in the seasonally adjusted increase in the all items index, as they were in April. The gasoline index increased 1.7 percent, more than offsetting declines in some of the other energy component indexes and led to a 0.9-percent rise in the energy index. The medical care index rose 0.2 percent. The food index was unchanged over the month.

The index for all items less food and energy rose 0.2 percent in May. … The all items index rose 2.8 percent for the 12 months ending May, continuing its upward trend since the beginning of the year. The index for all items less food and energy rose 2.2 percent for the 12 months ending May.

emphasis added

Small Business Optimism Index increased in May

by Calculated Risk on 6/12/2018 06:00:00 AM

From the National Federation of Independent Business (NFIB): May 2018 Report: Small Business Optimism Index

The Small Business Optimism Index increased in May to the second highest level in the NFIB survey's 45-year history. The index rose to 107.8, a three-point gain, with small businesses reporting high numbers in several key areas including compensation, profits, and sales trends.

..

As reported in NFIB’s May jobs report, 23 percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, followed by taxes at 17 percent and regulations at 13 percent. Fifty-eight percent reported hiring or trying to hire, up one point from last month but 83 percent of those reported few or no qualified workers.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 107.8 in May.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, June 11, 2018

Tuesday: CPI

by Calculated Risk on 6/11/2018 07:12:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Near Recent Highs

Mortgage rates edged up to the highest levels in several weeks today. Only a handful of days from mid-May stand between current levels and the highest rates in 7 years. That sounds a bit more dramatic than it is. Rates have been pretty close to these highs during the 2nd half of last week and just happened to move in an unfriendly direction by a medium-small amount today.Tuesday:

The middle of the week is more worthy of anxiety and anticipation. Between the important economic reports and the announcements from major central banks (the Fed and the European Central Bank) rates could easily be shooting to new long-term highs or surging triumphantly lower--at least in the context of the recent range. We're not talking about 30yr fixed rates rising above 5% or below 4%, but it's not uncommon to see a move of .125%-.25% when the stars align on these sorts of weeks. [30YR FIXED - 4.625%-4.75%]

emphasis added

• At 6:00 AM, NFIB Small Business Optimism Index for May.

• At 8:30 AM, The Consumer Price Index for May from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 6/11/2018 02:53:00 PM

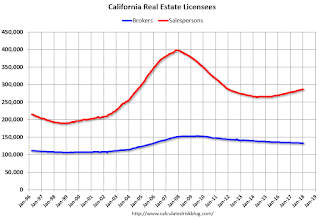

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 28% from the peak, and is increasing again (up 8.3% from low). The number of salesperson's licenses has increased to September 2004 levels.

Brokers' licenses are off 13.3% from the peak and have fallen to January 2006 levels, but are still slowly declining (down 1% year-over-year).

We are seeing a pickup in Real Estate licensees in California, although the number of Brokers is still declining.

Mortgage Equity Withdrawal slightly negative in Q1

by Calculated Risk on 6/11/2018 12:21:00 PM

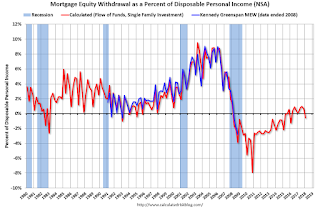

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q1 2018, the Net Equity Extraction was a negative $22 billion, or a minus 0.6% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 9 of the last 11 quarters (seasonally Q1 is usually weak). With a slower rate of debt cancellation, MEW will likely be mostly positive going forward.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $34 billion in Q1.

The Flow of Funds report also showed that Mortgage debt has declined by $0.6 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.