by Calculated Risk on 3/04/2018 08:09:00 PM

Sunday, March 04, 2018

Sunday Night Futures

Weekend:

• Schedule for Week of Mar 4, 2018

• Housing Industry Concerned about Tariffs

Monday:

• 10:00 AM, the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 58.8 from 59.9 in January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down6, and DOW futures are down 20 (fair value).

Oil prices were down over the last week with WTI futures at $61.62 per barrel and Brent at $64.75 per barrel. A year ago, WTI was at $53, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.52 per gallon. A year ago prices were at $2.31 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

Housing Industry Concerned about Tariffs

by Calculated Risk on 3/04/2018 10:28:00 AM

On Thursday, NAR chief economist was quoted in Inman News: Trump tariffs on steel and aluminum will be a blow to the construction industry

“Tariffs could measurably raise the cost of building materials and hinder home construction of affordable homes,” said Yu. “But more importantly, tariffs and restrictions to international trade will hold back economic growth and job creations. A better way to raise GDP growth is to produce more homes. Job growth and additional housing inventory will greatly help American workers and American consumers.”And from the NAHB: Statement from NAHB Chairman Randy Noel on New Steel and Aluminum Tariffs

“Given that home builders are already grappling with 20 percent tariffs on Canadian softwood lumber and that the price of lumber and other key building materials are near record highs, this announcement by the president could not have come at a worse time.As a noted in When the Story Changes, Be Alert, housing is facing several headwinds in 2018: higher mortgage rates, a negative impact from tax changes, higher labor costs, and higher material costs (especially lumber), and now tariffs on steel and aluminum.

“Tariffs hurt consumers and harm housing affordability."

Saturday, March 03, 2018

Schedule for Week of Mar 4, 2018

by Calculated Risk on 3/03/2018 08:11:00 AM

The key report this week is the February employment report on Friday.

Other key indicators include the January Trade deficit, and the February ISM non-manufacturing index and the February ADP employment report.

10:00 AM: the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 58.8 from 59.9 in January.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 203,000 payroll jobs added in February, down from 234,000 added in January.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through December. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $55.1 billion in January from $53.1 billion in December.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.8 billion in January.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 210 thousand the previous week.

8:30 AM: Employment Report for February. The consensus is for an increase of 205,000 non-farm payroll jobs added in February, up from the 200,000 non-farm payroll jobs added in January.

The consensus is for the unemployment rate to decrease to 4.0%.

The consensus is for the unemployment rate to decrease to 4.0%.This graph shows the year-over-year change in total non-farm employment since 1968.

In January the year-over-year change was 2.114 million jobs.

A key will be the change in wages.

Friday, March 02, 2018

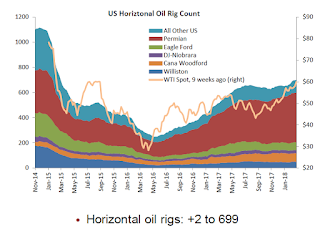

Oil Rigs "A Small Rise in Rig Counts"

by Calculated Risk on 3/02/2018 03:45:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 2, 2018:

• Total US oil rigs came in soft this week, +1 to 800

• Horizontal oil rigs were up, +2 to 699

...

• Rig additions should be accelerating through the coming weeks. If we do not see a substantial rise in the horizontal oil rig count in the next two weeks, we will once again be looking at an inflection point

• For the week as a whole, oil prices were not much changed over the previous week, holding around $61 / barrel WTI.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Merrill on Housing

by Calculated Risk on 3/02/2018 01:58:00 PM

A few brief excerpts on taxes from a note by Merrill Lynch economist Michelle Meyer: Housing: the top five questions (Overall Merrill is positive on housing).

How does the tax legislation impact the housing market?CR Note: There are several headwinds for housing this year including: higher mortgage rates, impact of tax legislation, higher labor costs, higher material costs (Lumber prices are up sharply), and overall affordability. I think housing will be OK this year, but I'm watching for any slowing.

On the one hand, tax reform is supportive of the housing market as it increases disposable income for households. The average household will see tax-home pay increase by $1,610 this year according to the Joint Committee of Taxation, which helps affordability and increases confidence.

On the other hand, it reduces the incentive for homeownership by doubling the standard deduction, reducing the cap for the mortgage interest deduction (MID) to 750k and limiting property tax deductions along with state and local income taxes to $10k. This results in fewer households who will itemize deductions, thereby making homeownership less attractive from a tax perspective. The biggest challenge is for markets where there is a double whammy of high home prices and property/income taxes....

In our view, the winners from tax reform are conventional buyers who are below the MID cap and likely to see a net windfall of cash from lower taxes. However, the high priced markets on the coast could struggle. The consequence: we expect to see strong new home sales growth, particularly for lower priced properties, but slower growth in high priced existing home sales.

When the Story Changes, Be Alert

by Calculated Risk on 3/02/2018 11:48:00 AM

There is an axiom in investing that when the story changes, pay attention. As an example, if a company changes their focus, reconsider your investment.

Over the last several years, the economic story has been consistent: Strong employment growth, steady economic growth (solid given demographics), low inflation, and an accommodative monetary policy - with no fiscal stimulus. I noted several times that the future was bright, and in late 2016, I pointed out that the cupboard is full.

With minimal policy changes in 2017, and a stronger global economy, the US economic expansion continued, pretty much as expected.

But in 2018, the story is changing. We are seeing some economic tailwinds and some headwinds. Although the tax changes are poorly conceived, and mostly benefit high income earners, there should be some short term boost to economic growth. That might lead the Federal Reserve to raise rates a little quicker than anticipated.

And, for housing, the tax changes could negatively impact a segment of the housing market, and rising mortgage rates are another headwind. Note: I'm tracking housing inventory this year to see if there is an impact.

And now the Trump administration is proposing tariffs and talking openly talking of a trade war. That is a downside risk to the economy.

As economists at Nomura noted this morning: "A sharp deterioration in financial conditions and aggressive trade policies by the Trump administration present notable risks."

I still think the economy will be fine in 2018, but the story is changing.

Zillow Case-Shiller Forecast: More Solid House Price Gains in January

by Calculated Risk on 3/02/2018 08:58:00 AM

The Case-Shiller house price indexes for December were released on Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: December Case-Shiller Results and January Forecast: Why 2018 Looks A Lot Like 2017

The familiar patterns in the housing market that emerged in the second half of 2017 – lots of demand from home buyers, limited supply of homes available to buy, quickly rising prices and slow but steadily deteriorating affordability – are continuing to shape the start to 2018 as well.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be slightly larger in January than in December. Zillow is forecasting a smaller year-over-year increase for both the 10-city index, and the 20-city index in January.

Zillow predicts the S&P/Case-Shiller national index will show a 6.4 percent gain in national home prices in January, a slight increase from the 6.3 percent annual gain home prices posted for December. The December increase was greater than November’s 6.1 percent annual gain. Case-Shiller will release January data on Tuesday, March 27.

Case-Shiller’s 20-city composite index rose 6.3 percent year-over-year in December, a slight slowdown from November’s 6.4 percent annual growth. The 10-city composite index climbed 6 percent, the same rate as the prior month.

Among cities included in the 20-city index, Seattle, Las Vegas and San Francisco reported the highest year-over-year gains in December, at 12.7 percent, 11.1 percent and 9.2 percent, respectively.

Thursday, March 01, 2018

Market Update

by Calculated Risk on 3/01/2018 06:37:00 PM

Friday:

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 99.5, down from 99.9 in January.

Click on graph for larger image.

By request - following the market sell off today - here is a stock market graph. This graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today.

The market is close to unchanged year-to-date, and off 6.8% from the all time high.

Not very scary - at least not yet.

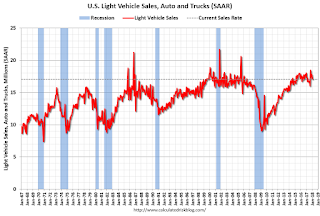

U.S. Light Vehicle Sales mostly unchanged at 17.1 million annual rate in February

by Calculated Risk on 3/01/2018 03:40:00 PM

Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.08 million SAAR in February.

That is down 1.4% year-over-year from February 2017, and down slightly from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for February (red, light vehicle sales of 17.08 million SAAR from AutoData).

This was at the consensus forecast for February.

Note that the increase in sales at the end of 2017 was due to buying following the hurricanes.

Sales will probably decline again in 2018 after setting a new sales records in both 2015 and 2016.

Note: dashed line is current estimated sales rate.

Construction Spending mostly unchanged in January

by Calculated Risk on 3/01/2018 11:52:00 AM

Earlier today, the Census Bureau reported that overall construction spending was mostly unchanged in January:

Construction spending during January 2018 was estimated at a seasonally adjusted annual rate of $1,262.8 billion, nearly the same as the revised December estimate of $1,262.7 billion. The January figure is 3.2 percent above the January 2017 estimate of $1,223.5 billion.Private spending decreased and public spending increased in January:

Spending on private construction was at a seasonally adjusted annual rate of $962.7 billion, 0.5 percent below the revised December estimate of $967.9 billion. ...

n January, the estimated seasonally adjusted annual rate of public construction spending was $300.1 billion, 1.8 percent above the revised December estimate of $294.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 23% below the bubble peak.

Non-residential spending is 6% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 8% below the peak in March 2009, and 14% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 4%. Non-residential spending is down 1% year-over-year. Public spending is up 8% year-over-year.

This was below the consensus forecast of a 0.3% increase for January, however spending for the previous two months was revised up slightly.