by Calculated Risk on 2/26/2018 07:23:00 PM

Monday, February 26, 2018

Tuesday: Case-Shiller, Fed Chair Powell

From Matthew Graham at Mortgage News Daily: Another 2018 First For Mortgage Rates

Mortgage rates fell for the third day in a row--the first time that's happened so far in 2018! Much like last week was slightly less spectacular than its "best in 2018" designation, today also comes with caveats. Even though rates technically did fall for the third straight day, most of the day was spent with underlying bond markets moving into weaker territory. This resulted in several lenders raising rates in the middle of the day, leaving them roughly in line with Friday's latest offerings. [30YR FIXED - 4.625%]Tuesday:

emphasis added

• At 8:30 AM ET, Durable Goods Orders for January from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 6.3% year-over-year increase in the Comp 20 index for December.

• At 9:00 AM, FHFA House Price Index for December 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Fed Chair Jerome Powell Testimony, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February. This is the last of the regional surveys for February.

Housing Inventory Tracking

by Calculated Risk on 2/26/2018 04:05:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas through January 2018, Phoenix and Sacramento, and also total existing home inventory as reported by the NAR (through January 2018).

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory is Sacramento was up 15% year-over-year in January (still very low), and has increased year-over-year for four consecutive months. However inventory is down Nationally, and down in Phoenix and Las Vegas.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.

A few Comments on January New Home Sales

by Calculated Risk on 2/26/2018 01:25:00 PM

New home sales for January were reported at 593,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, however the three previous months were revised up.

I wouldn't read too much into one month of sales, especially in January. January is usually one of the weakest months of the year for new home sales, on a not seasonally adjusted (NSA) basis - and poor weather this year might have impacted sales a little more than usual. I'd like to see data for February and March before blaming higher interest rates, or a negative impact from the new tax law, as the cause of slower sales.

Earlier: New Home Sales decrease to 593,000 Annual Rate in January.

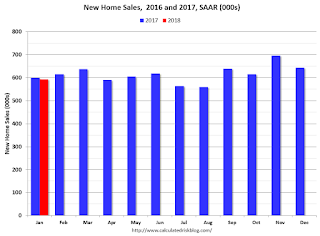

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales were down 1% year-over-year in January. No worries - yet!

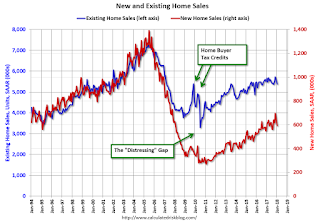

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Black Knight: House Price Index up 0.1% in December, Up 6.6% year-over-year

by Calculated Risk on 2/26/2018 11:46:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight HPI: U.S. Home Prices Ended 2017 Up 6.62 Percent from Start of Year, Gaining 0.1 Percent in December

• U.S. home prices edged up slightly in December, closing the year 6.6 percent above end of 2016Once again, this index is Not seasonally adjusted, and seasonally declines in some states is expected (so don't read too much into any regional declines). The year-over-year increase in this index has been about the same for the last year (close to 6% range).

• December marked 68 consecutive months of annual home price appreciation

• New York once again led all states in monthly gains, with home prices up 1.71 percent over last month

...

• Home prices fell in nine of the nation’s 20 largest states, while six others hit new peaks

• Likewise, while 11 of the 40 largest metros hit new home price peaks in December, prices fell in another 20

Note also that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for December will be released tomorrow.

New Home Sales decrease to 593,000 Annual Rate in January

by Calculated Risk on 2/26/2018 10:12:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 593 thousand.

The previous three months were revised up.

"Sales of new single-family houses in January 2018 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent below the revised December rate of 643,000 and is 1.0 percent below the January 2017 estimate of 599,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in January to 6.1 months from 5.5 months in December.

The months of supply increased in January to 6.1 months from 5.5 months in December. The all time record was 12.1 months of supply in January 2009.

This is at the top end of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of January was 301,000. This represents a supply of 6.1 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2018 (red column), 43 thousand new homes were sold (NSA). Last year, 45 thousand homes were sold in January.

The all time high for December was 92 thousand in 2005, and the all time low for December was 21 thousand in 2011.

This was below expectations of 600,000 sales SAAR, however the previous months combined were revised up. I'll have more later today.

Chicago Fed "Index Points to Little Change in Economic Growth in January"

by Calculated Risk on 2/26/2018 08:38:00 AM

From the Chicago Fed: Index Points to Little Change in Economic Growth in January

The Chicago Fed National Activity Index (CFNAI) ticked down to +0.12 in January from +0.14 in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in January (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, February 25, 2018

Monday: New Home Sales

by Calculated Risk on 2/25/2018 06:23:00 PM

Weekend:

• Schedule for Week of Feb 25, 2018

Monday:

• 8:30 AM ET, Chicago Fed National Activity Index for January. This is a composite index of other data.

• 10:00 AM, New Home Sales for January from the Census Bureau. The consensus is for 600 thousand SAAR, down from 625 thousand in December.

• 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5, and DOW futures are up 74 (fair value).

Oil prices were up over the last week with WTI futures at $63.57 per barrel and Brent at $67.27 per barrel. A year ago, WTI was at $54, and Brent was at $55 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.51 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 22 cents per gallon year-over-year.

February 2018: Unofficial Problem Bank list unchanged at 101 Institutions

by Calculated Risk on 2/25/2018 10:40:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for February 2018. The list had no removals or additions during the month, so the number of insured institutions on it remains at 101. However, aggregate assets had a small decline of $224 million to $20.5 billion as assets were updated with year-end figures. A year ago, the list held 155 institutions with assets of $41.8 billion. The FDIC will release industry results for the fourth quarter and provide an update on the Official Problem Bank list on February 27th.

Saturday, February 24, 2018

Schedule for Week of Feb 25, 2018

by Calculated Risk on 2/24/2018 08:11:00 AM

The key economic reports this week are the second estimate of Q4 GDP, January new home sales, February auto sales, and the December Case-Shiller house price index.

For manufacturing, the February ISM manufacturing index, and the February Richmond Fed and Dallas Fed manufacturing surveys will be released this week.

Also, the new Fed Chair, Jerome Powell, will deliver the Semiannual Monetary Policy Report to the Congress.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for 600 thousand SAAR, down from 625 thousand in December.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

8:30 ET AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the October 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.3% year-over-year increase in the Comp 20 index for December.

9:00 AM: FHFA House Price Index for December 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Fed Chair Jerome Powell Testimony, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for February. This is the last of the regional surveys for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 4th quarter 2017 (Second estimate). The consensus is that real GDP increased 2.5% annualized in Q4, down from the advance estimate of 2.6%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 65.0, down from 65.7 in January.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 0.5% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 222 thousand the previous week.

8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.3%.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 58.6, down from 59.1 in January.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 58.6, down from 59.1 in January.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in December. The PMI was at 59.1% in January, the employment index was at 54.2%, and the new orders index was at 65.4%.

10:00 AM: Construction Spending for January. The consensus is for a 0.3% increase in construction spending.

10:00 AM: Fed Chair Jerome Powell Testimony, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking Committee, Washington, D.C

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 17.2 million SAAR in February, up from 17.1 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 17.2 million SAAR in February, up from 17.1 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 99.5, down from 99.9 in January.

Friday, February 23, 2018

Oil Rigs "Oil rig counts take a breather"

by Calculated Risk on 2/23/2018 07:05:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Feb 23, 2018:

• Total US oil rigs took an anticipated breather this week, +1 to 799

• Horizontal oil rigs were up, +1 to 697

...

• The oil price continues to recover

• If rig count additions continue on our forecast trajectory, expect this to weigh on sentiment during March, particularly if supply gains surprise to the upside

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.