by Calculated Risk on 2/11/2018 09:13:00 PM

Sunday, February 11, 2018

Sunday Night Futures

Weekend:

• Schedule for Week of Feb 11, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 14, and DOW futures are up 129 (fair value).

Oil prices were down over the last week with WTI futures at $59.73 per barrel and Brent at $63.25 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.57 per gallon. A year ago prices were at $2.28 per gallon - so gasoline prices are up 29 cents per gallon year-over-year.

Hotels: Solid Start for Occupancy Rate in 2018

by Calculated Risk on 2/11/2018 11:06:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 3 February

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 28 January through 3 February 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 29 January through 4 February 2017, the industry recorded the following:

• Occupancy: +1.4% to 56.4%

• Average daily rate (ADR): +2.2% to US$122.35

• Revenue per available room (RevPAR): +3.6% to US$69.05

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is ahead of the record year in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, February 10, 2018

Schedule for Week of Feb 11, 2018

by Calculated Risk on 2/10/2018 08:11:00 AM

The key economic reports this week are January Housing Starts, Retail Sales and the Consumer Price Index (CPI).

For manufacturing, January industrial production, and the February New York, and Philly Fed manufacturing surveys, will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for January will be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM ET: Retail sales for January will be released. The consensus is for a 0.3% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis in December.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.2% increase in inventories.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 229 thousand initial claims, up from 221 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 21.5, down from 22.2.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is a 0.4% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM ET: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 17.5, down from 17.7.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.0%.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 72, unchanged from 72 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for January.

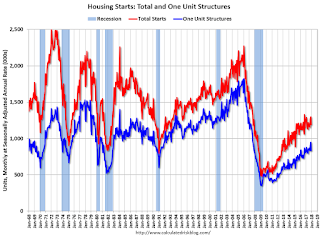

8:30 AM: Housing Starts for January. This graph shows single and total housing starts since 1968.

The consensus is for 1.230 million SAAR, up from 1.192 million SAAR.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 95.5, down from 95.7.

Friday, February 09, 2018

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

by Calculated Risk on 2/09/2018 05:57:00 PM

Below is a table showing selected operating statistics for eight large, publicly-traded builders for the quarter ended December 31, 2017.

From housing economist Tom Lawler:

| Net Orders | Settlements | Average Closing Price $ (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/17 | 12/16 | % Chg | 12/17 | 12/16 | % Chg | 12/17 | 12/16 | % Chg |

| D.R. Horton | 10,753 | 9,241 | 16.4% | 10,788 | 9,404 | 14.7% | 295 | 297 | -0.8% |

| Pulte Group | 4,805 | 4,202 | 14.4% | 6,632 | 6,197 | 7.0% | 410 | 391 | 4.9% |

| NVR | 4,306 | 3,645 | 18.1% | 4,630 | 4,419 | 4.8% | 387 | 381 | 1.5% |

| Cal Atlantic | 3,407 | 2,848 | 19.6% | 4,557 | 4,338 | 5.0% | 460 | 447 | 2.9% |

| Beazer Homes | 1,110 | 1,005 | 10.4% | 1,066 | 995 | 7.1% | 345 | 338 | 2.1% |

| Meritage Homes | 1,795 | 1,492 | 20.3% | 2,253 | 2,117 | 6.4% | 410 | 414 | -1.0% |

| MDC Holdings | 1,252 | 1,018 | 23.0% | 1,556 | 1,582 | -1.6% | 452 | 453 | -0.2% |

| M/I Homes | 1,220 | 999 | 22.1% | 1,584 | 1,416 | 11.9% | 372 | 356 | 4.5% |

| Total | 28,648 | 24,450 | 17.2% | 33,066 | 30,468 | 8.5% | 374 | 370 | 1.1% |

Oil Rigs "Rig Counts Soar as Oil Prices Collapse"

by Calculated Risk on 2/09/2018 03:59:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Feb 9, 2018:

• Total US oil rigs were up an astounding +26 to 791

• Horizontal oil rigs were similarly up, +18 to 686

...

• The Permian added 9 horizontal oil rigs, the major plays added 5, ‘Other’ added 4.

• The oil price collapsed this week, falling almost $7 / barrel in the last five days.

• Very bearish.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler on Prime Working Age Population

by Calculated Risk on 2/09/2018 01:47:00 PM

CR note: Earlier this week, I wrote Prime Working-Age Population At New Peak, First Time Since 2007. As I noted, my graph was based on data from the BLS.

Housing economist Tom Lawler pointed out that the BLS data doesn't match the Census data. He wrote: "The reason the BLS population data don't jive with the latest Census population estimates is that there have been numerous and in some cases sizable revisions in population estimates from those first reported, and the BLS does NOT go back and adjust historical data for revisions. In re last decade, there were a string of downward population revisions."

Here is a table of the recent Census estimates for the prime working age population (Vintage 2016). Note: The Vintage 2017 has been released, but not by age.

In general, the data shows the same pattern as the data from the BLS (although the details are different) - the prime working age population was mostly flat in the 2010 to 2014 period (due to demographics, not the great recession), and the prime working age population is now growing again (although this may be impacted by immigration policies going forward). This is important because slower working age population growth impacts GDP. See Demographics and GDP: 2% is the new 4%

| Prime Working Age Population, Census Vintage 2016 | ||

|---|---|---|

| As of July 1 | 25 to 54 | Annual Change |

| 2000 | 122,972,314 | |

| 2001 | 123,909,542 | 0.8% |

| 2002 | 123,982,489 | 0.1% |

| 2003 | 124,217,955 | 0.2% |

| 2004 | 124,696,761 | 0.4% |

| 2005 | 125,260,089 | 0.5% |

| 2006 | 125,925,139 | 0.5% |

| 2007 | 126,449,632 | 0.4% |

| 2008 | 126,860,406 | 0.3% |

| 2009 | 127,078,241 | 0.2% |

| 2010 | 127,191,778 | 0.1% |

| 2011 | 127,209,296 | 0.0% |

| 2012 | 127,144,275 | -0.1% |

| 2013 | 127,134,500 | 0.0% |

| 2014 | 127,302,008 | 0.1% |

| 2015 | 127,578,973 | 0.2% |

| 2016 | 127,934,078 | 0.3% |

Housing: Inventory is Key

by Calculated Risk on 2/09/2018 10:41:00 AM

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas through January 2018, Phoenix and Sacramento (January 2018 not available yet for Phoenix and Sacramento), and also total existing home inventory as reported by the NAR (through December 2017).

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Inventory has increased recently in Sacramento (still very low), but is down Nationally, and in Phoenix and Las Vegas.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.

Merrill: "The $1 trillion dollar budget deficit"

by Calculated Risk on 2/09/2018 09:20:00 AM

A few brief excerpts from a note by Merrill Lynch economists: The $1 trillion dollar budget deficit

The latest developments in Washington imply that the budget deficit will continue to swell in the coming years. The bipartisan Senate agreement would boost spending cap levels for defense and non-defense programs over the next two years by roughly $300bn. As a first pass at estimating the impact on the deficit forecast, we think it would [bring] deficits to $825bn and $1,070bn. This will translate to one of the largest budget deficits during an expansion and, by far, the largest when the economy is at full employment.The US had trillion dollar deficits in the fiscal years during and just following the great recession. Those deficits peaked at close to 10% of GDP; this deficit will be around 5% of GDP, but still very high during the later stages of an expansion.

...

The Senate agreement also suspends the debt limit and staves off a potential Treasury default, which we projected would occur in early March without an increase. The “suspension” of the debt limit does not set a new level for the amount of debt outstanding, but instead sets a date on which the debt limit will be reinitiated. Press reports indicate that the debt limit will be suspended until March 2019, which removes this issue until Congress gets beyond the mid-term elections in November. ...

What do higher deficits mean for the economy and markets? The first order impact is greater Treasury supply ... [Merrill] expect the Treasury will look to boost its bill financing and see risks to more near-term supply due to a higher cash balance. These developments further the view of our rates strategy team for higher Treasury rates and a steeper curve. For the economy, a higher deficit will boost near term growth, though it will also threaten to “crowd out” private investment.

Thursday, February 08, 2018

Another Government Shutdown?

by Calculated Risk on 2/08/2018 07:55:00 PM

From CNBC: White House instructs government agencies to prepare for shutdown

The Trump administration instructed federal agencies to get ready for a possible government shutdown as Congress moved closer to the midnight Thursday deadline without passing a funding bill, CNBC confirmed.If the shutdown happens - and doesn't end quickly - several agencies will probably not release regular government reports. There are no major economic releases scheduled for tomorrow (Friday), so there will probably be no impact on data if the shutdown ends before Monday morning.

An Office of Management and Budget official said the office is preparing for funding to lapse as a Senate stalemate drags on with only hours until current funding expires. The Trump administration supports the massive bipartisan budget deal working its way through Congress and wants lawmakers to pass it, the official said.

Some government agencies will run out of money and have to furlough workers if Congress lets funding lapse. A shutdown would be the second in less than a month.

Hundreds of thousands of workers would not go into work Friday if a shutdown takes place through the start of the day. Others would have to work without getting paid at first.

If the shutdown continues, the following week Housing Starts, CPI and Retail Sales will all probably be delayed. Also, next week is the reference week for the February employment report, and that report will probably be delayed if the data isn't gathered on a timely basis.

Private data will still be released. All Federal Reserve data will continue to be released (separate funding).

Also, the DOL will continue to process unemployment claims and release the weekly initial unemployment claims report.

AAR: Rail Carloads Declined YoY, "Best January Ever" for Intermodal

by Calculated Risk on 2/08/2018 04:37:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

January wasn’t the best start of the year in terms of volume that railroads could hope for, but there’s certainly no reason to panic yet either. Total U.S. carloads were down 3.4%, or 42,431 carloads, in January 2018 from January 2017. The overall decrease was due largely to declines for coal (down 5.8%, or 25,083 carloads), motor vehicles and parts (down 10.1%, or 8,372 carloads), and grain (down 5.8%, or 6,917 carloads). ... Intermodal picked up where it left off last year (when it set a new annual record) with volume in January 2018 up 3.5%, or 44,183 containers and trailers, over January 2017 and marking the best January for intermodal in history. Winter weather negatively impacted rail traffic in January in many areas, but it’s impossible to precisely calculate how much, if any, of January’s decline is weather related.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,217,405 carloads in January 2018, down 3.4% (42,431 carloads) from January 2017. It’s the sixth year-over-year monthly decline in the past seven months and the largest percentage decline. Total carloads averaged 243,481 per week in January 2018; since 1988, when our U.S. data begin, only 2016 had a lower weekly average in January. This year, extreme cold and blizzards negatively impacted carloads in January in many parts of the country, though to be fair winter weather is a problem most years. It’s not possible to precisely determine how much of January’s decline might be attributable to the weather.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):Following up on a record-setting 2017, 2018 started well for intermodal. Volume in January 2018 was 1.31 million containers and trailers, up 3.5%, or 44,183 units, over January 2017. Average weekly volume in January 2018 was 262,028 units, the most for a January in history.