by Calculated Risk on 2/06/2018 09:15:00 AM

Tuesday, February 06, 2018

CoreLogic: House Prices up 6.6% Year-over-year in December

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports December Home Prices Up More Than 6 Percent Year-Over-Year for Fifth Consecutive Month

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2017, which shows home prices are up both year over year and month over month. Home prices nationally increased year over year by 6.6 percent from December 2016 to December 2017, and on a month-over-month basis home prices increased by 0.5 percent in December 2017 compared with November 2017, according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is towards the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that home prices will increase by 4.3 percent on a year-over-year basis from December 2017 to December 2018, and on a month-over-month basis home prices are expected to decrease by 0.4 percent from December 2017 to January 2018. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The number of homes for sale has remained very low,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Job growth lowered the unemployment rate to 4.1 percent by year’s end, the lowest level in 17 years. Rising income and consumer confidence has increased the number of prospective homebuyers. The net result of rising demand and limited for-sale inventory is a continued appreciation in home prices.”

emphasis added

The year-over-year comparison has been positive for almost six consecutive years since turning positive year-over-year in February 2012.

Trade Deficit at $53.1 Billion in December

by Calculated Risk on 2/06/2018 08:43:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $53.1 billion in December, up $2.7 billion from $50.4 billion in November, revised. December exports were $203.4 billion, $3.5 billion more than November exports. December imports were $256.5 billion, $6.2 billion more than November imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in December.

Exports are 23% above the pre-recession peak and up 7% compared to December 2016; imports are 10% above the pre-recession peak, and up 10% compared to December 2016.

Trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $52.10 in December, up from $50.10 in November, and up from $41.40 in December 2016. The petroleum deficit had been declining for years (although the petroleum deficit has been fairly steady for the last few years) this is the major reason the overall deficit has mostly moved sideways since early 2012 - although the overall deficit is increasing again.

The trade deficit with China increased to $30.8 billion in December, from $27.7 billion in December 2016.

Monday, February 05, 2018

Tuesday: Trade Deficit, Job Openings

by Calculated Risk on 2/05/2018 07:14:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Catch a Break After Stock Market Rout

Mortgage rates caught a break today, moving back near last Thursday's levels as bonds (which underlie rates) benefited from today's extreme market volatility. ...Tuesday:

Unfortunately, the scope of the improvement in rates was nowhere near that of the stock market rout. The average lender is back in line with last Thursday afternoon in terms of today's mortgage rate quotes. Last Thursday afternoon--at the time--was still the worst day in several years. [30YR FIXED - 4.375-4.5%]

emphasis added

• At 8:30 AM ET, Trade Balance report for December from the Census Bureau. The consensus is for the U.S. trade deficit to be at $51.9 billion in December from $50.5 billion in November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for December from the BLS. Jobs openings decreased in November to 5.879 million from 5.925 in October. The number of job openings were up 4.4% year-over-year, and Quits were up 3.1% year-over-year.

Market Update

by Calculated Risk on 2/05/2018 04:29:00 PM

Update: Framing Lumber Prices Up Sharply Year-over-year, At Record Prices

by Calculated Risk on 2/05/2018 12:56:00 PM

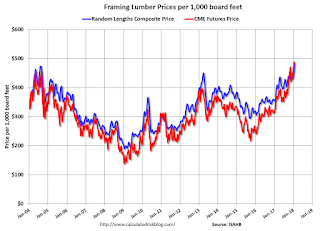

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and now prices are above the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early February 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 31% from a year ago, and CME futures are up about 39% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Rising costs - both material and labor - will be headwinds for the building industry this year.

ISM Non-Manufacturing Index increased to 59.9% in January

by Calculated Risk on 2/05/2018 10:07:00 AM

The January ISM Non-manufacturing index was at 59.9%, up from 56.0% in December. The employment index increased in January to 61.6%, from 56.3%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2018 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 96th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 59.9 percent, which is 3.9 percentage points higher than the seasonally adjusted December reading of 56 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 59.8 percent, 2 percentage points higher than the seasonally adjusted December reading of 57.8 percent, reflecting growth for the 102nd consecutive month, at a faster rate in January. The New Orders Index registered 62.7 percent, 8.2 percentage points higher than the seasonally adjusted reading of 54.5 percent in December. The Employment Index increased 5.3 percentage points in January to 61.6 percent from the seasonally adjusted December reading of 56.3 percent. The Prices Index increased by 2 percentage points from the seasonally adjusted December reading of 59.9 percent to 61.9 percent, indicating that prices increased in January for the 23rd consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in January than in December.

Black Knight Mortgage Monitor: '“Hurricane Effect” Aside, Mortgage Performance Continued to Improve in 2017'

by Calculated Risk on 2/05/2018 09:03:00 AM

Black Knight released their Mortgage Monitor report for December today. According to Black Knight, 4.71% of mortgages were delinquent in December, up from 4.42% in December 2016. The increase was primarily due to the hurricanes. Black Knight also reported that 0.65% of mortgages were in the foreclosure process, down from 0.95% a year ago.

This gives a total of 5.36% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: “Hurricane Effect” Aside, Mortgage Performance Continued to Improve in 2017; Foreclosure Starts, Completions at 17-Year Lows

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of December 2017. This month, Black Knight’s examination of year-end trends in mortgage performance found that – as expected – the year’s multiple major hurricanes have left lasting effects. However, as Black Knight Data & Analytics Executive Vice President Ben Graboske explained, when taking the storms’ impacts into consideration, 2017 continued a long-term trend of improvement for the market.

“Hurricanes Harvey and Irma significantly impacted 2017 mortgage performance metrics,” said Graboske. “Overall, there were approximately 164,000 more past-due loans at the end of 2017 than the year before, pushing the national delinquency rate to a 23-month high. When Black Knight isolated non-hurricane-impacted areas – which represent 90 percent of the entire active U.S. mortgage universe – we see the national delinquency rate actually fell to 11 percent below long-term norms. Likewise, the 90-day delinquency rate was also up six percent from last year, with roughly a third more seriously delinquent loans than we'd expect in a healthy market. Excluding the hurricane impact, though, we see that there were 84,000 fewer loans 90 or more days past due than last year; a 14 percent reduction. The national non-current rate – which tracks all loans 30 or more days past due or in active foreclosure – edged down slightly from 2016, even including the effects of the storms. Isolating those non-hurricane areas, though, we see that the total number of past-due mortgages fell by more than 140,000 – which brought the non-current rate in these areas down 10 percent below long-term norms.

“Due to the various foreclosure moratoria put into place after the storms, there was no hurricane impact to speak of in that regard. In fact, the improvement in foreclosure inventory – which continued unabated in 2017 – may have actually received a short-term boost from the moratoria. In any case, it was a record-setting year in terms of foreclosure activity. Just 649,000 foreclosure starts were initiated in 2017, which was the fewest of any year since 2000, with the lowest number of first-time starts on record. In fact, first-time foreclosure starts were 15 percent below 2016 levels and roughly half the annual average seen from 2000-2005. Likewise, the year saw the lowest single-year total for foreclosure completions since the turn of the century. All in all, the inventory of loans in active foreclosure is on track to normalize in 2018. That said, there are still issues with aged inventory; more than 125,000 active foreclosures have had no payments made in more than two years. Of those, some 63,000 have gone unpaid for five years or more.”

Black Knight also observed evidence of the “hurricane effect” at work in the home equity market. Similar to the first lien market, nearly 10 percent of active home equity loans and lines of credit – over 1 million in total – are located in areas impacted by the year's major hurricanes, primarily in Florida. Noticeable jumps were seen in the number of past-due loans and lines, although the overall impact has been muted as compared to the first lien market. In Irma-impacted areas, the share of past-due second lien lines of credit increased from July to November by 117 basis points (from 3.2 to 4.4 percent) and second lien loans by 349 basis points (7.2 to 10.7 percent). Increases were also seen in Harvey-affected areas of Texas, with the non-current rate on lines increasing by 79 basis points to 1.9 percent, and by 378 basis points on loans to 11.8 percent. An estimated 17,200 second liens became delinquent as a result of the storm, with 5,000 resulting serious delinquencies. In a market where delinquency rates are relatively low, the rise has been noticeable.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the foreclosure inventory by delinquency bucket. Notice short term is at record lows, but lenders are still working through older loans.

From Black Knight:

• There are 331K loans in active foreclosure nationwide, down by more than 150K from last yearThere is much more in the mortgage monitor.

• Total foreclosure inventory is just 2.0 percent above pre-crisis averages, an excess of approximately 5,600 over what would be expected in a normal market

• Just over 200K are early-stage foreclosures (delinquent for less than two years), almost 100K fewer than “normal”

• In a typical market, this subset of foreclosures would make up the vast majority (93 percent) of active foreclosures

• During the financial crisis, the share of early-stage foreclosures got as low as 45 percent (2014); it currently stands at 65 percent

• More than 125K active foreclosures have had no payments made in more than two years

• Of these, nearly 64K have gone unpaid for five years or more, a number which would typically be fewer than 1,500 nationally

Sunday, February 04, 2018

U.S. Courts: Bankruptcy Filings Decline Slightly in 2017, Lowest since 2006

by Calculated Risk on 2/04/2018 08:09:00 AM

From the U.S. Courts: Bankruptcy Filings Fall 0.7% – Smallest 12-Month Decline Since 2010

Bankruptcy filings in the 12-month period ending December 31, 2017, fell just 0.7 percent, compared with bankruptcy cases filed in calendar year 2016. According to newly released data, 789,020 cases were filed in 2017, compared with 794,960 in the previous year.

The percentage decline is the smallest for a 12-month period since bankruptcy filings reached a peak in 2010. The number of bankruptcy filings is the lowest for any calendar year since 2006, and the seventh consecutive calendar year that filings have fallen.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 2001.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

Other than 2006, this was the lowest level for filings since 1995. This is another indicator of an economy that has mostly recovered from the housing bust and financial crisis.

Saturday, February 03, 2018

Schedule for Week of Feb 4, 2018

by Calculated Risk on 2/03/2018 08:11:00 AM

This will be a light week for economic data.

The key reports this week are the trade deficit and job openings.

10:00 AM: the ISM non-Manufacturing Index for January. The consensus is for index to increase to 56.2 from 55.9 in December.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $51.9 billion in December from $50.5 billion in November.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in November to 5.879 million from 5.925 in October.

The number of job openings (yellow) were up 4.4% year-over-year, and Quits were up 3.1% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $20.0 billion in December.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 230 thousand the previous week.

No major economic releases scheduled.

Friday, February 02, 2018

Oil Rigs "Some signs of life outside the Permian"

by Calculated Risk on 2/02/2018 04:26:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Feb 2, 2018:

• Total US oil rigs were up, +6 to 765

• Horizontal oil rigs were similarly up, +6 to 668

...

• The Permian took a breather this week, with no horizontal gains after last week’s large 12 rig addition

...

• The oil price softened this week, with the Brent spread falling under $4. The price outlook is accordingly bearish as we head into turnaround season for the refineries.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.