by Calculated Risk on 12/28/2017 11:03:00 AM

Thursday, December 28, 2017

Reis: Apartment Vacancy Rate increased in Q4 to 4.5%

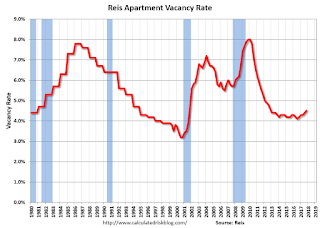

Reis reported that the apartment vacancy rate was at 4.5% in Q4 2017, up from 4.4% in Q3, and up from 4.2% in Q4 2016. This is the highest vacancy rate since Q4 2012 (although the increase has been small). The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

The apartment market continued to face pressure from added supply in the fourth quarter as the national vacancy rate increased 10 basis points to 4.5% in the quarter. Asking rents increased 0.4% in the fourth quarter, while effective rents grew 0.3%. Effective rents net out landlord concessions. Over the year, asking rents increased 3.9% while effective rents grew by 3.3%. These growth rates reflect a deceleration in apartment market fundamentals compared to recent years, due in part to the large amount of new supply coming online. New construction totaled 43,769 units in the fourth quarter, raising the year-end total to 213,802 units. The national apartment market has not seen new completions in excess of 200,000 since 1986.

At 4.5%, the national vacancy rate increased 10 basis points from 4.4% in the third quarter. This represents a 30 basis point increase in year-over-year vacancy (the year-end vacancy rate in 2016 was 4.2%); vacancies have more or less been on an upward march since the middle of 2016. The net change in occupied stock, or net absorption, was 31,554 units, lower than new supply. With supply growth outstripping demand, vacancies were pushed upwards this quarter.

At $1,364, the average asking rent grew 0.4% in the quarter. This is well below the 0.9% average quarterly growth rate for the prior six quarters. Effective rent growth was 0.3% in the quarter, also below the 0.8% average quarterly effective rent growth for the prior six quarters. Overall, these statistics reflect a distinct pullback in the national apartment market, especially when compared to 2015. However, the gap between asking rent growth and effective rent growth remained within a 10 basis point range. This suggests that landlords’ offers of free rent were less aggressive – implying that demand remains relatively robust.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. However it appears the vacancy rate has bottomed and is starting to increase. With more supply coming on line next year - and less favorable demographics - the vacancy rate will probably continue to increase in 2018.

Apartment vacancy data courtesy of Reis.

Weekly Initial Unemployment Claims unchanged at 245,000

by Calculated Risk on 12/28/2017 08:34:00 AM

The DOL reported:

In the week ending December 23, the advance figure for seasonally adjusted initial claims was 245,000, unchanged from the previous week's unrevised level of 245,000. The 4-week moving average was 237,750, an increase of 1,750 from the previous week's unrevised average of 236,000.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 237,750.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, December 27, 2017

Thursday: Unemployment Claims, Apartment Survey

by Calculated Risk on 12/27/2017 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 245 thousand the previous week.

• Early: Reis Q4 2017 Apartment Survey of rents and vacancy rates.

Ten Economic Questions for 2018

by Calculated Risk on 12/27/2017 05:21:00 PM

Here is a review of the Ten Economic Questions for 2017.

Here are my ten questions for 2018. I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2018, and - when there are surprises - to adjust my thinking.

1) Economic growth: Heading into 2018, most analysts are pretty sanguine and expecting some pickup in growth due to the recent tax cuts. From Goldman Sachs:

"We are adjusting our forecasts to reflect the final details of the tax bill, as well as the incremental easing in financial conditions and continued strong economic momentum to end the year. We are increasing our GDP forecasts for 2018 and 2019 by 0.3pp and 0.2pp, respectively, on a Q4/Q4 basis (to 2.6% and 1.7%)."How much will the economy grow in 2018?

2) Employment: Through November, the economy has added just over 1,900,000 jobs this year, or 174,000 per month. As expected, this was down from the 187 thousand per month in 2016. Will job creation in 2018 be as strong as in 2017? Or will job creation be even stronger, like in 2014 or 2015? Or will job creation slow further in 2018?

3) Unemployment Rate: The unemployment rate was at 4.1% in November, down 0.5 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.7% to 4.0% range in Q4 2018. What will the unemployment rate be in December 2018?

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

5) Monetary Policy: The Fed raised rates three times in 2017 and started to reduce their balance sheet. The Fed is forecasting three more rate hikes in 2018. Some analysts think there will be more, from Goldman Sachs:

"We expect the next rate hike to come in March with subjective odds of 75%, and we continue to expect a total of four hikes in 2018."Will the Fed raise rates in 2018, and if so, by how much?

6) Real Wage Growth: Wage growth picked up in 2016 (up 2.9%), but slowed in 2017 (up 2.5% year-over-year in November). How much will wages increase in 2018?

7) Residential Investment: Residential investment (RI) was sluggish in 2017, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2018? How about housing starts and new home sales in 2018?

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up over 6% in 2017. What will happen with house prices in 2018?

9) Housing Inventory: Housing inventory declined in 2015, 2016 and 2017. Will inventory increase or decrease in 2018?

10) Housing and Taxes A key change in the new tax law is limiting the deductibility of State and Local Taxes (SALT) and property taxes to $10,000. Many analysts think this will hit certain segments of the housing market in states like New York, New Jersey and California. The NAR noted their forecast today:

"Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas."Relative to the overall market, will sales slow, inventory increase, and price growth slow in these states?

There are other important questions, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

Here is some discussion and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Philly Fed: State Coincident Indexes increased in 35 states in November

by Calculated Risk on 12/27/2017 03:00:00 PM

From the Philly Fed:

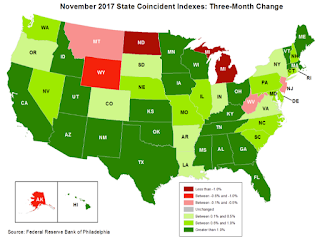

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2017. Over the past three months, the indexes increased in 43 states and decreased in seven, for a three-month diffusion index of 72. In the past month, the indexes increased in 35 states, decreased in 11, and remained stable in four, for a one-month diffusion index of 48.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Recently several states have turned red.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In November, 37 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

The reason for the mid-to-late 2017 sharp decrease in the number of states with increasing activity is unclear.

Q4 Review: Ten Economic Questions for 2017

by Calculated Risk on 12/27/2017 11:59:00 AM

At the end of last year, I posted Ten Economic Questions for 2017. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2017 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a Q4 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2017: Will housing inventory increase or decrease in 2017?

right now my guess is active inventory will increase in 2017 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2017). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent increase in interest rates.According to the November NAR report on existing home sales, inventory was down 9.7% year-over-year in November, and the months-of-supply was at 3.4 months. I was definitely wrong. Inventory will be a key metric to watch in 2018.

9) Question #9 for 2017: What will happen with house prices in 2017?

Inventories will probably remain low in 2017, although I expect inventories to increase on a year-over-year basis by December of 2017. Low inventories, and a decent economy suggests further price increases in 2017.The Case-Shiller data released yesterday showed prices up 6.2% year-over-year in November. With falling inventory, house prices increased faster in 2017 than in 2016.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2017, it seems likely that price appreciation will slow to the low-to-mid single digits.

8) Question #8 for 2017: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 million in 2017, and for new home sales of around 600 to 650 thousand. This would be an increase of around 7% for starts and maybe 10% for new home sales.Through November, starts were up 3.1% year-over-year compared to the same period in 2016. And new home sales were up 9.1% year-over-year. About as expected.

I think there will be further growth in 2017, but I think a combination of higher mortgage rates, less multi-family starts, and not enough lots for low-to-mid range new homes will mean sluggish growth in 2017.

My guess is starts will increase to just over 1.2 million in 2017 and new home sales will be in the low 600 thousand range.

7) Question #7 for 2017: How much will wages increase in 2017?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase more than 3% in 2017 according to the CES.Through November 2017, nominal hourly wages were up 2.5% year-over-year. This is a decrease from last year, and it appears wages will increase at a slower rate in 2017. Wages were disappointing in 2017.

6) Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

Analysts are being cautious on forecasting rate hikes, probably because they forecasted too many hikes over the last few years. However, as the economy approaches full employment, and with the possibility of fiscal stimulus in 2017, it is possible that inflation will pick up a little - and, if so, the Fed could hike more than expected.The Fed hiked three times in 2017, and started to reduce their balance sheet.

My current guess is the Fed will hike twice in 2017.

5) Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

The Fed is projecting core PCE inflation will increase to 1.8% to 1.9% by Q4 2017. However there are risks for higher inflation. The labor market is approaching full employment, and the new administration is proposing some fiscal stimulus (tax cuts, possible infrastructure spending), so it is possible - as a result - that inflation will increase more than expected in 2017 and 2018.Inflation has eased, and is below the Fed's target by most measures.

Currently I think PCE core inflation (year-over-year) will increase further and be close to 2% in 2017, but too much inflation will still not be a serious concern in 2017.

4) Question #4 for 2017: What will the unemployment rate be in December 2017?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will declining slightly by December 2017 from the current 4.7%.The unemployment rate was at 4.1% in November, below the level I expected for the end of 2017.

3) Question #3 for 2017: Will job creation slow further in 2017?

So my forecast is for gains of 125,000 to 150,000 payroll jobs per month in 2017. Lower than in 2016, but another solid year for employment gains given current demographics.Through November 2017, the economy has added 1,916,000 jobs, or 174,000 per month, down from 187,000 per month in 2016. This was slightly above my expectations.

2) Question #2 for 2017: How much will the economy grow in 2017?

There will probably be some economic boost from oil sector investment in 2017 since oil prices have increased (this was a drag last year).GDP was a 1.2% in Q1, 3.2% in Q2, and 3.1% in Q3. It appears GDP will be around 3% (annualized) in Q4, putting GDP growth around 2.6% for the year. About as expected.

The housing recovery is ongoing, however auto sales might have peaked.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2017, but this will depend somewhat on which policies are enacted.

1) Question #1 for 2017: What about fiscal and regulatory policy in 2017?

We are still waiting for the details. As far as the impact on 2017, my expectation is there will be both individual and corporate tax cuts - and some sort of infrastructure program. I expect that something will happen with the ACA (those that have insurance for 2017 will keep their insurance, but they might not have insurance in 2018 - and that impact would be in 2018). I think the negative proposals (immigration, trade) will impact the economy in 2018 or later - overall there will be a small boost to GDP in 2017.The key policy change was the recently passed tax cuts. Policy had little impact on 2017, but will have an impact going forward.

A final comment: The words of a President matter. Mr Trump has been impulsive, reckless and irresponsible with his comments, and that has continued since the election. One absurd comment could send the markets into a tailspin and negatively impact the economy (and that could happen at any time).

Currently it looks like 2017 unfolded mostly as expected. GDP was at expectations, employment gains were slightly better, but down from 2016 (as expected), housing starts and new home sales were also at expectations. The key surprises were wage growth disappointed and housing inventory declined further.

NAR: Pending Home Sales Index Increased Slightly in November, Up 0.8% Year-over-year

by Calculated Risk on 12/27/2017 10:10:00 AM

From the NAR: Pending Home Sales Inch Up 0.2 Percent in November

ending home sales were mostly unmoved in November, but did squeak out a minor gain both on a monthly and annualized basis, according to the National Association of Realtors®. Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas.This was above expectations of a 0.8% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 0.2 percent to 109.5 in November from 109.3 in October. With last month’s modest increase, the index remains at its highest reading since June (110.0), and is now 0.8 percent above a year ago.

...

The PHSI in the Northeast jumped 4.1 percent to 98.9 in November, and is now 1.1 percent above a year ago. In the Midwest the index rose 0.4 percent to 105.8 in November, and is now 0.8 percent higher than November 2016.

Pending home sales in the South decreased 0.4 percent to an index of 123.1 in November but are still 2.5 percent higher than last November. The index in the West declined 1.8 percent in November to 100.4, and is now 2.3 percent below a year ago.

emphasis added

Tuesday, December 26, 2017

Wednesday: Pending Home Sales

by Calculated Risk on 12/26/2017 08:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Seasonally Sideways

Mortgage rates were lifeless today as financial markets drifted sideways. [30YR FIXED - 4.125%] Although rates CAN move during the last week of December when there's an imbalance between buyers and sellers in bond markets, that's the exception to the rule. We tend to see days exactly like today with effectively zero change in lender rates sheets compared to the previous business day (in this case, last Friday).Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. (might not be released this week due to holidays)

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 0.8% decrease in the index.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/26/2017 04:20:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

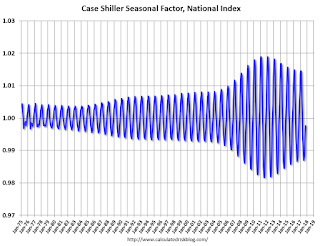

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/26/2017 01:18:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in October

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 5.7% above the previous bubble peak. However, in real terms, the National index (SA) is still about 12.2% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In October, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,400 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to January 2006 levels.

Real House Prices

In real terms, the National index is back to September 2004 levels, and the Composite 20 index is back to April 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to December 2003 levels, and the Composite 20 index is back to September 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.