by Calculated Risk on 11/27/2017 02:09:00 PM

Monday, November 27, 2017

Dallas Fed: "Manufacturing Expansion Slows but Remains Solid" in November

Earlier from the Dallas Fed: Manufacturing Expansion Slows but Remains Solid

Texas factory activity continued to expand in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell 10 points from its October reading but remained elevated at 15.1.

Other measures of manufacturing activity also pointed to November growth that was slightly slower than in October but still well above average. The new orders index moved down five points to 20.0, and the capacity utilization and shipments indexes similarly fell to 17.3 and 16.7, respectively. Meanwhile, the growth rate of orders index signaled a stronger pickup in demand, climbing six points to 18.1. This represents the index’s highest reading since 2010.

Perceptions of broader business conditions remained highly positive in November. The general business activity index came in at 19.4, down eight points from October. The company outlook index posted its 15th consecutive positive reading but dipped to 18.5.

Labor market measures suggested slower employment growth and longer workweeks this month. The employment index fell 10 points from October to 6.3, reflecting a more normal index level after several months of elevated readings. Nineteen percent of firms noted net hiring, compared with 13 percent noting net layoffs. The hours worked index edged down but remained positive at 11.5, indicating a continued lengthening of workweeks.

emphasis added

Black Knight: House Price Index up 0.2% in September, Up 6.4% year-over-year

by Calculated Risk on 11/27/2017 01:08:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index: Monthly Appreciation Continues to Slow as U.S. Home Prices Gain 0.16 Percent in September; Year-Over-Year Growth Accelerates Slightly at 6.36 Percent

• The rate of monthly appreciation declined again in September, falling by one-third from August and marking the sixth consecutive month of slowing growthOnce again, this index is Not seasonally adjusted, and seasonally slow appreciation is expected (so don't read too much into slowing growth). The year-over-year increase in this index has been about the same for the last year (close to 6% range).

• New York home prices led all states for the third month in a row, seeing a 1.08 percent rise in home prices from August

• Half of the nation’s 20 largest states and 17 of the largest metros saw prices fall from last month

...

• The number of states and metros setting new home price peaks continued to fall, with just six of the 20 largest states and 11 of the 40 largest metros hitting new highs in September

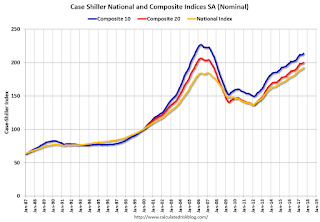

Note also that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for September will be released tomorrow.

A few Comments on October New Home Sales

by Calculated Risk on 11/27/2017 11:10:00 AM

New home sales for October were reported at 685,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the highest sales rate since October 2007. However the three previous months were revised down (combined).

There was clearly some rebound following hurricane Harvey. Sales in the South were up sharply in both September and October, from August, and at the highest level since October 2007. Some contracts in the South, that would have been signed in August, were probably delayed until September and October. Also some people who lost homes, might have signed contracts for new homes in September and October (New home sales are counted when contracts are signed).

Sales were up 18.7% year-over-year in September.

Earlier: New Home Sales increase to 685,000 Annual Rate in October.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate).

For the first ten months of 2017, new home sales are up 8.9% compared to the same period in 2016.

This was a solid year-over-year increase through October.

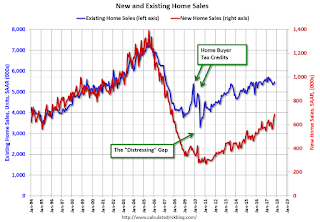

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 685,000 Annual Rate in October

by Calculated Risk on 11/27/2017 10:12:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 685 thousand.

The previous three months combined were revised down.

"Sales of new single-family houses in October 2017 were at a seasonally adjusted annual rate of 685,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.2 percent above the revised September rate of 645,000 and is 18.7 percent above the October 2016 estimate of 577,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in October to 4.9 months from 5.2 month in September.

The months of supply decreased in October to 4.9 months from 5.2 month in September. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of October was 282,000. This represents a supply of 4.9 months at the current sales rate."

On inventory, according to the Census Bureau:

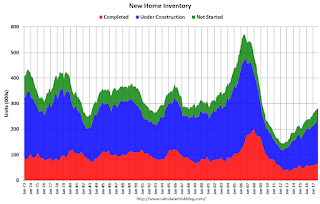

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2017 (red column), 55 thousand new homes were sold (NSA). Last year, 46 thousand homes were sold in October.

The all time high for October was 105 thousand in 2005, and the all time low for October was 23 thousand in 2010.

This was well above expectations of 620,000 sales SAAR, however the previous months were revised down, combined. Some of the recent pickup might be hurricane related (delayed signings). I'll have more later today.

Sunday, November 26, 2017

Monday: New Home Sales

by Calculated Risk on 11/26/2017 06:34:00 PM

Weekend:

• Schedule for Week of Nov 26, 2017

Monday:

• At 10:00 AM ET, New Home Sales for October from the Census Bureau. The consensus is for 620 thousand SAAR, down from 667 thousand in September.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for November.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up slightly, and DOW futures are up 10 (fair value).

Oil prices were up over the last week with WTI futures at $58.87 per barrel and Brent at $63.79 per barrel. A year ago, WTI was at $47, and Brent was at $46 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.50 per gallon. A year ago prices were at $2.13 per gallon - so gasoline prices are up 37 cents per gallon year-over-year.

Q4 GDP Forecasts

by Calculated Risk on 11/26/2017 08:38:00 AM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 3.4 percent on November 22, unchanged from November 17.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast for 2017:Q4 stands at 3.7%.From Merrill Lynch:

We continue to track 2.3% for 4Q.From Goldman Sachs:

We revised up our Q4 GDP tracking estimate by a total of three tenths to 2.6% (qoq ar) over the last weekCR Note: These forecasts are for Q4. The second estimate of Q3 GDP will be released this week, and the consensus is that real GDP increased 3.3% annualized in Q3, up from 3.0% in the advance report.

Saturday, November 25, 2017

Schedule for Week of Nov 26, 2017

by Calculated Risk on 11/25/2017 08:11:00 AM

The key economic reports this week are the second estimate of Q3 GDP, and New Home sales for October.

Other key indicators include Case-Shiller house prices for September, the November ISM manufacturing index, and November auto sales.

10:00 AM ET: New Home Sales for October from the Census Bureau.

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for 620 thousand SAAR, down from 667 thousand in September.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November.

9:00 AM ET: FHFA House Price Index for September 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for September.

9:45 AM: Testimony, Fed Governor Jerome Powell, Nomination Hearing, Committee on Banking, Housing, and Urban Affairs, U.S. Senate

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional surveys for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 3rd quarter 2017 (Second estimate). The consensus is that real GDP increased 3.3% annualized in Q3, up from 3.0% in the advance report.

10:00 AM: Testimony, Fed Chair Janet Yellen, Economic Outlook, Joint Economic Committee, U.S. Congress

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand the previous week.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 64.0, down from 66.2 in October.

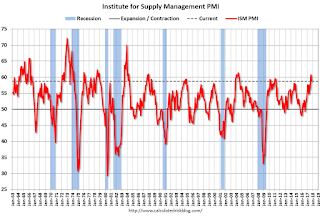

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 58.4, down from 58.7 in September.

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 58.4, down from 58.7 in September.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in October. The PMI was at 58.4% in October, the employment index was at 59.8%, and the new orders index was at 63.4%.

10:00 AM: Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to be 17.6 million SAAR in November, down from 18.0 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to be 17.6 million SAAR in November, down from 18.0 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

Friday, November 24, 2017

November 2017: Unofficial Problem Bank list declines to 108 Institutions

by Calculated Risk on 11/24/2017 03:53:00 PM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 2017.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2017. The list declined by three to 108 banks after four removals and one addition. Aggregate assets dropped by $1.1 billion to $25.5 billion, with the drop including $105 million from asset shrinkage using updated third quarter figures. A year ago, the list held 173 institutions with assets of $59.9 billion.

Actions were terminated against Pacific Valley Bank, Salinas, CA ($256 million Ticker: PVBK); Grand Bank, National Association, Hamilton, NJ ($210 million); and First Trust & Savings Bank of Albany, Illinois , Albany, IL ($193 million). First National Bank, Waupaca, WI ($429 million) found its way off the list through a merger partner.

Joining the list this month is Citizens Savings Bank and Trust Company, Nashville, TN ($108 million).

This week the FDIC released their official Problem Bank figures for the end of the third quarter of 2017. The FDIC official list holds 104 institutions with assets of $16.0 billion, which equates to an average asset size of about $154 million. Last quarter, the FDIC said the official list had 105 institutions with assets of $17.2 billion, which equated to an average asset size of $164 million. Thus, during the third quarter of 2017, the FDIC had a net change of one institution and removed $1.2 billion of assets from their official list.

Las Vegas: On Pace for Record Convention Attendance in 2017

by Calculated Risk on 11/24/2017 11:15:00 AM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered to new record highs.

As of September, visitor traffic is running slightly behind the record set in 2016 and on pace to be 8% above the pre-recession peak.

And convention attendance is now at record levels too. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

At this pace, convention attendance will set a new record in 2017, and be 2% above the pre-recession peak set in 2006.

There were many housing related conventions during the housing bubble, so it took some time for convention attendance to recover. But attendance has really picked up over the last three years.

Hotel Occupancy Rate Increased Year-over-Year, On Pace for Record Year

by Calculated Risk on 11/24/2017 08:09:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 18 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 12-18 November 2017, according to data from STR.Note: The hurricanes continues to drive demand in Texas and Florida, especially in Houston.

In comparison with the week of 13-19 November 2016, the industry recorded the following:

• Occupancy: +0.8% to 66.1%

• Average daily rate (ADR): +1.9% to US$124.65

• Revenue per available room (RevPAR): +2.6% to US$82.42

Among the Top 25 Markets, Houston, Texas, reported the largest increase in all three key performance metrics: occupancy (+27.0% to 80.3%), ADR (+11.0% to US$117.82) and RevPAR (+40.9% to US$94.60).

Miami/Hialeah, Florida, posted the second-highest increase in RevPAR (+22.5% to US$155.08), due primarily to the second-largest increase in occupancy (+11.9% to 83.4%)

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will probably push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com