by Calculated Risk on 9/14/2017 01:18:00 PM

Thursday, September 14, 2017

Key Measures Show Inflation mostly below 2% in August

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (3.0% annualized rate) in August. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for August here. Motor fuel increased 107% in August, annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.9% annualized rate) in August. The CPI less food and energy rose 0.2% (3.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for July and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 3.0% annualized, trimmed-mean CPI was at 2.3% annualized, and core CPI was at 3.0% annualized.

Using these measures, inflation was soft year-over-year again in August (although inflation picked up month-to-month). Overall these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

Early Look at 2018 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/14/2017 11:01:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.9 percent over the last 12 months to an index level of 239.448 (1982-84=100). For the month, the index increased 0.3 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2016, the Q3 average of CPI-W was 235.057.

The 2016 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year. (Sometimes we have to look back two years).

For July and August 2017, the average is 239.0325 - or a 1.7% increase over the Q3 average last year. Inflation probably picked up a little in September due to the increase in gasoline prices following Hurricane Harvey, so COLA will probably be close to 2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.9% year-over-year in August, and although this is early - we still need the data for September - it appears COLA will be positive this year, and inflation probably picked up in September due to Hurricane Harvey and gasoline prices - so COLA will probably be close to 2% this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA (seems likely this year), the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2016 yet, but wages probably increased again in 2016. If wages increased the same as last year, then the contribution base next year will increase to around $131,500 from the current $127,200.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. We still need the data for September, but it appears COLA will be close to 2%, and the contribution base will increase next year.

Weekly Initial Unemployment Claims decrease to 284,000

by Calculated Risk on 9/14/2017 08:37:00 AM

The DOL reported:

In the week ending September 9, the advance figure for seasonally adjusted initial claims was 284,000, a decrease of 14,000 from the previous week's unrevised level of 298,000. The 4-week moving average was 263,250, an increase of 13,000 from the previous week's unrevised average of 250,250. This is the highest level for this average since August 13, 2016 when it was 263,250.The previous week was unrevised.

Hurricanes Harvey and Irma impacted this week's initial claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 263,250.

This was below the consensus forecast.

The report next week will include the reference period (includes the 12th of the month) for the September employment report - and will provide a hint on the impact of the hurricanes on employment in September.

Wednesday, September 13, 2017

Thursday: Unemployment Claims, CPI

by Calculated Risk on 9/13/2017 06:26:00 PM

Goldman economists on inflation:

The next piece of inflation news is the August CPI report, to be released on Thursday. We expect a 0.20% increase on the core and a 0.36% increase on the headline. Two special factors—a rebound in hotel prices and a price increase by Verizon—account for about 0.05pp of our core forecast.Thursday:

Looking further ahead with our bottom-up forecasting model, we expect core PCE to round to 1.5% by October, the last core PCE report before the December FOMC meeting, and to reach 1.6% by end-2017 and 1.9% by end-2018. The acceleration in our forecast is driven by (1) pass-through from energy prices and the dollar; (2) declining slack; and (3) the dropping out of earlier idiosyncratic declines that appear unlikely to be repeated next year.

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 300 thousand initial claims, up from 298 thousand the previous week.

• Also at 8:30 AM, The Consumer Price Index for August from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.2% increase in core CPI.

LA area Port Traffic: Imports increased, Exports decreased in August

by Calculated Risk on 9/13/2017 03:21:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.7% compared to the rolling 12 months ending in July. Outbound traffic was down 1.0% compared to the rolling 12 months ending in July.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports are mostly moving sideways to down recently.

Lawler: CPS-Based Household Growth Slowed Significantly in 2017, though Not as Much as Raw Numbers Suggest

by Calculated Risk on 9/13/2017 12:17:00 PM

From housing economist Tom Lawler: CPS-Based Household Growth Slowed Significantly in 2017, though Not as Much as Raw Numbers Suggest

The Census Bureau yesterday released its “Income and Poverty in the United States” report for 2016, which is based on the results from the 2017 Current Population Survey (CPS) Annual Social and Economic (ASEC). While the report focuses mainly on household and individual incomes and poverty rates, it also shows estimates of the number of US households based on the CPS/ASEC results.

According to the report, the CPS/ASEC-based estimates of the number of US households in March 2017 was 126.224 million, just 405,000 above the 125.819 million estimate from the previous year’s report. This meager gain, if “accurate,” would reflect a sharp slowdown in household growth.

As folks who regularly read my report know, however, part of this sharp slowdown in growth reflects the substantial downward revisions in US population estimates that were released at the end of last year. The 2017 CPS/ASEC estimates reflect these downward revisions, but the 2016 estimates do not.

To remind folks, late last year Census released its ‘2016 vintage” population estimates, which incorporated an improved methodology for estimating net international migration that resulted in material downward revisions of the US resident population, as shown in the table below.

| U.S. Resident Population, Vintage 2015 vs. Vintage 2016 | |||

|---|---|---|---|

| Vintage 2015 | Vintage 2016 | Change | |

| 7/1/2010 | 309,346,863 | 309,348,193 | 1,330 |

| 7/1/2011 | 311,718,857 | 311,663,358 | -55,499 |

| 7/1/2012 | 314,102,623 | 313,998,379 | -104,244 |

| 7/1/2013 | 316,427,395 | 316,204,908 | -222,487 |

| 7/1/2014 | 318,907,401 | 318,563,456 | -343,945 |

| 7/1/2015 | 321,418,820 | 320,896,618 | -522,202 |

| 7/1/2016 | 323,889,854 | 323,127,513 | -762,341 |

Historical estimates of households from the CPS/ASEC do NOT reflect these downward revisions in population estimates. Indeed, the “time series” of CPS/ASEC household estimates available from various Census websites does not reflect the most up-to-date estimates of historical US population estimates, and as such is not a good time series. (There are other issues with CPS/ASEC household estimates, which I have discussed before).

With respect to a comparison of the 2017 CPS/ASEC household estimate to the 2016 estimate, the US population estimate assumed in the March 2016 CPS/ASEC was about 700,000 high than the latest population estimate for that date. While it is a little tricky to “guesstimate” what the CPS/ASEC household estimate for March 2016 would have been if the latest population estimates for that date had been available (there were significant revisions in the characteristics of the population as well), my “best guess” is that the CPS/ASEC household estimate for March 2016 would have been about 300,000 lower. If that were the case, then an “adjusted” CPS/ASEC-based household increase from March 2016 to March 2017 would be about 705,000 – above that shown in the latest report, but well below what most analysts were expecting, and well below the average annual increase so far this decade.

Another CPS-based household estimate, one derived on the Housing Vacancy Survey supplement, also showed a recent sharp slowdown in estimated household growth, though that slowdown showed up in the second quarter. According to the latest HVS-based results (which are “controlled” to housing unit estimates and assume that estimate vacancy rates are accurate), the number of US households in the second quarter of 2017 averaged 118.899 million, up just 558,000 from the comparable quarter of 2016. (In contrast to the HVS, the ASEC household estimate is “controlled” to population estimates, and assumes that the characteristics of households derived from the survey are correct.)

While there is a lot of “noise” in CPS-based household estimates – reflecting in part though not solely the relatively small sample size – the latest estimates are a bit disheartening to those who have projected a strong housing recovery based on “demographics” and “pent-up demand.

Tomorrow Census is set to release the results of the 2016 American Community Survey, which will include (among a lot of other things) estimates of the average number of US households during 2016. These estimates are controlled “jointly” to population and housing unit estimates, though effectively they are “controlled” to housing unit estimates. As with the CPS/ASEC, historical ACS estimates are not revised to reflect revisions either in population estimates of housing unit estimates, which limits the usefulness of some of its “time series.”

I will have much more on this topic later this month.

Merrill: The Impact of Harvey on August Retail Sales

by Calculated Risk on 9/13/2017 09:52:00 AM

A few excerpts from a note by Merrill Lynch economists:

A net drag from Harvey in August Retail sales ex-autos, as measured by BAC aggregated credit and debit card data, declined 0.1% mom seasonally adjusted in August. After controlling for the increase in gasoline spending, retail sales ex-autos and gasoline declined 0.4%. ... Bottom line: the weakness in retail sales in August is likely exaggerated by the hurricane and July prime-day. While Hurricane Irma may depress spending in September, we typically see retail sales bounce back after a natural disaster, suggesting upside into 4Q.CR Note: We will see weakness in several indicators over the next couple of months due to the hurricanes, and then a bounce back later in the year. Retail sales for August will be released on Friday. The consensus is for a 0.1% increase in retail sales.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 9/13/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 8, 2017. This week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index increased 9 percent from the previous week. The seasonally adjusted Purchase Index increased 11 percent from one week earlier. The unadjusted Purchase Index decreased 13 percent compared with the previous week and was 7 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.03 percent from 4.06 percent, with points increasing to 0.40 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 7% year-over-year.

Tuesday, September 12, 2017

Wednesday: PPI

by Calculated Risk on 9/12/2017 07:08:00 PM

From Matthew Graham at Mortgage News Daily: Worst 2 Days For Rates Since June

Mortgage rates continued higher at a reasonably abrupt pace today as last week's themes have been completely reversed. What themes are those? Generally speaking, markets were undergoing a risk-aversion trade given the rising geopolitical tension surrounding North Korea and the economic uncertainty associated with back-to-back hurricanes. ...Wednesday:

In the bigger picture, the damage is still far from severe. The best 30yr fixed scenarios are still under 4% for many lenders. But the past 2 days have constituted the most abrupt move higher in rates since at least late June, 2017. [3.875% fixed on top tier scenarios].

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for August from the BLS. The consensus is a 0.3% increase in PPI, and a 0.2% increase in core PPI.

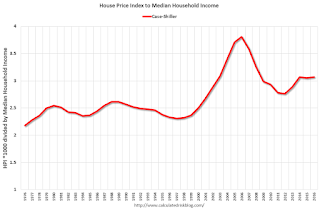

House Prices to Median Household Income

by Calculated Risk on 9/12/2017 01:31:00 PM

The Census Bureau released the Income, Poverty and Health Insurance Coverage in the United States: 2016 this morning. The report showed a significant increase in the real median household income and a decline in poverty:

The U.S. Census Bureau announced today that real median household income increased by 3.2 percent between 2015 and 2016, while the official poverty rate decreased 0.8 percentage points. At the same time, the percentage of people without health insurance coverage decreased.One of the metrics to follow is a ratio of house prices to incomes. The following graphs use annual averages of the Case-Shiller house price index - and the nominal median household income (and the mean for the fourth fifth income) through 2016.

Median household income in the United States in 2016 was $59,039, an increase in real terms of 3.2 percent from the 2015 median income of $57,230. This is the second consecutive annual increase in median household income.

The nation’s official poverty rate in 2016 was 12.7 percent, with 40.6 million people in poverty, 2.5 million fewer than in 2015. The 0.8 percentage point decrease from 2015 to 2016 represents the second consecutive annual decline in poverty.

Click on graph for larger image.

Click on graph for larger image.This graph shows the ratio of house price indexes divided by the Median Household Income through 2016 (the HPI is first multiplied by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2016, house prices were above the median historical ratio - but far below the bubble peak.

The second graph is similar but uses the mean of the fourth fifth household income (if we separate households into fifths, this is the second highest income group).

These are key households since they are more likely to be homeowners (and home buyers).

These are key households since they are more likely to be homeowners (and home buyers).Using this group, prices are well below the bubble peak.

Going forward, I think it would be a positive if incomes outpaced house prices, or at least kept pace with house prices increases for a few years.