by Calculated Risk on 8/07/2017 01:59:00 PM

Monday, August 07, 2017

Prime Working-Age Population near 2007 Peak

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of July 2017, according to the BLS, there were still fewer people in the 25 to 54 age group than in 2007.

At the beginning of this year - based on demographics - it looked like the prime working age (25 to 54) would probably hit a new peak in 2017.

However, since the end of last year, the prime working age population has declined slightly.

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (25 to 54 years old) from 1948 through May 2017.

Note: This is population, not work force.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group should start growing at 0.5% per year - and this should boost economic activity.

Q2 2017 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 8/07/2017 11:15:00 AM

The BEA has released the underlying details for the Q2 advance GDP report.

The BEA reported that investment in non-residential structures increased at a 5.2% annual pace in Q2. This is a turnaround from early last year when non-residential investment declined due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration increased substantially in Q2, from a $59 billion annual rate in Q4 2016 to a $97 billion annual rate in Q2 2017 - but is still down from a recent peak of $165 billion in Q4 2014.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q2, and is up 13% year-over-year - and is now almost as high as the housing bubble years as a percent of GDP.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was up slightly year-over-year in Q2. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q2, however lodging investment is up 8% year-over-year.

My guess is office and hotel investment growth will slow (office vacancies are still high, although hotel occupancy is near record levels). But investment growth is still very strong this year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for three and a half years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $261 billion (SAAR) (about 1.4% of GDP), and was up in Q2 compared to Q1.

Investment in home improvement was at a $230 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.2% of GDP). Home improvement spending has been solid.

Black Knight Mortgage Monitor: "Low-Down-Payment Purchase Lending at Seven-Year High"

by Calculated Risk on 8/07/2017 08:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for June today. According to BKFS, 3.80% of mortgages were delinquent in June, down from 4.31% in June 2016. BKFS also reported that 0.81% of mortgages were in the foreclosure process, down from 1.10% a year ago.

This gives a total of 4.61% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Low-Down-Payment Purchase Lending at Seven-Year High, Largely a Product of Overall Purchase Market Growth

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of June 2017. This month, in light of much commentary and speculation on the re-emergence of purchase loans with loan-to-value (LTV) ratios of 97 percent or higher, Black Knight looked at low-down-payment purchase lending trends, gaining some early insight into the performance of these products. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, in general, low-down-payment purchases are on the rise, but this does not necessarily mean a return to the practices – and risks – of the past.

“Over the past 12 months, approximately 1.5 million borrowers have purchased homes using less-than-10-percent down payments,” said Graboske. “That is close to a seven-year high in low-down-payment purchase volumes. The increase is primarily a function of the overall growth in purchase lending, but, after nearly four consecutive years of declines, low-down-payment loans have ticked upwards in market share over the past 18 months as well. In fact, they now account for nearly 40 percent of all purchase lending. The bulk of the growth has not been among the various three-percent-or-less down payment programs that have been reintroduced in the last few years, but rather in five-to-nine- percent down payment mortgages. This segment grew at twice the rate of the overall purchase market in late 2016, whereas lending with down payments of less than five percent grew at about the market average.

“However, low-down-payment purchase lending today has a much different risk profile than it did back in 2005-2006 during the run-up to the financial crisis. At that time, half of all low-down-payment purchase originations involved ‘piggyback’ second liens, as opposed to a single high-LTV first lien mortgage. It’s also worth noting that while the total share of purchase lending going to borrowers putting less than 10 percent down was relatively similar then to what we see today, today’s low-down-payment mortgage products and secondary risk characteristics are markedly different. In the pre-crisis years, a large proportion of low-down-payment loans were more risky adjustable rate mortgages (ARMs). In contrast, ARMs are virtually nonexistent today among high-LTV loans. Perhaps the most telling difference is that borrowers using these programs today have average credit scores roughly 50 points higher than those approved for high-LTV purchase loans in 2004-2007. Among GSE loans with down payments under five percent, average credit scores are 60 points higher today.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the foreclosure rate over time.

From Black Knight:

• At the current rate of improvement, the foreclosure rate will fall to pre-crisis (2000-2006) levels in the summer of 2018 – hitting the lowest level since the turn of the century by mid-2019There is much more in the mortgage monitor.

• However, based on current improvement rates, even when foreclosure volumes normalize there will still be over 70K excess aged foreclosures

• Though the pristine nature of recent originations will have reduced both inflow and overall volumes, it will be this excess backlog keeping foreclosure volumes near historic norms

• It will take an additional three years (mid-2021) for that backlog to normalize at the national level, though some states will still be dealing with residual foreclosures from the crisis years

• Returning to New York, at the current rate of recovery the foreclosure rate won’t normalize until 2021, and it will be 2025 before the backlog of aged foreclosures works its way through the pipeline

Sunday, August 06, 2017

Sunday Night Futures

by Calculated Risk on 8/06/2017 07:30:00 PM

Weekend:

• Schedule for Week of Aug 6, 2017

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $16.0 billion increase in credit.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are down slightly (fair value).

Oil prices were down slightly over the last week with WTI futures at $49.57 per barrel and Brent at $52.39 per barrel. A year ago, WTI was at $43, and Brent was at $43 - so oil prices are up 15% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.34 per gallon - a year ago prices were at $2.13 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

Hotels: Occupancy Rate Up Slightly Year-over-Year

by Calculated Risk on 8/06/2017 11:16:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 29 July

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 23-29 July 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 24-30 July 2016, the industry recorded the following:

• Occupancy: +0.3% to 77.4%

• Average daily rate (ADR): +1.2% to US$132.21

• Revenue per available room (RevPAR): +1.5% to US$102.39

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and slightly behind the record year in 2015.

Seasonally, the occupancy rate will remain strong over the next month and then decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, August 05, 2017

Schedule for Week of Aug 6, 2017

by Calculated Risk on 8/05/2017 08:09:00 AM

The key economic report this week is the Consumer Price Index (CPI).

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $16.0 billion increase in credit.

6:00 AM ET: NFIB Small Business Optimism Index for July.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in May to 5.666 million from 5.967 in April.

The number of job openings (yellow) were up 2% year-over-year, and Quits were up 7% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 241 thousand initial claims, up from 240 thousand the previous week.

8:30 AM: The Producer Price Index for July from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

Friday, August 04, 2017

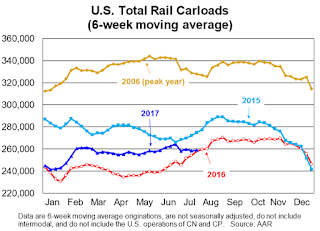

AAR: Rail Traffic decreased slightly in July

by Calculated Risk on 8/04/2017 07:27:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total U.S. rail carloads were 0.6% lower in July 2017 than in July 2016. That’s not much, but it’s the first decline since October 2016. The end of easy comps for coal and grain gets much of the blame. For coal, carloads rose 4.0% in July, down from double-digit gains the previous six months. ... The biggest bright spots for rail traffic in July were carloads of crushed stone, gravel, and sand (up 15.0%, their sixth straight double-digit increase — thank frac sand) and intermodal (up 5.6%, keeping it on pace to set a new annual record this year). Carloads of petroleum products kept falling in July, as did carloads of motor vehicles and parts (consistent with declines in sales and production of cars and light trucks). Year-todate total carloads were up 5.4% through July; year-to-date intermodal was up 3.1%.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

Last month we said that U.S. rail carloads were doing relatively well. Well, that was last month. Thanks in large part to much tougher comparisons, July’s carloads don’t look nearly as good. In July 2017, U.S. carload originations were 1,019,239, down 0.6% (6,079 carloads) from July 2016. It’s the first yearover-year monthly decrease for total carloads since October 2016, a span of eight months (see the chart below right). Average total weekly carloads in July 2017 of 254,810 were the lowest for July since sometime prior to 1988, when our records begin.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):Unlike some rail carload categories, intermodal remains on track. U.S. intermodal originations were up 5.6% (55,997 containers and trailers) in July 2017 over July 2016. Weekly average originations of 264,589 in July 2017 were the second highest for July on record, behind July 2015.

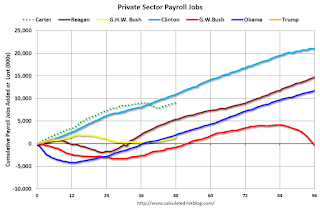

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 8/04/2017 03:01:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just six months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,937,000 more private sector jobs at the end of Mr. Obama's first term. At the end of his second term, there were 11,756,000 more private sector jobs than when Mr. Obama initially took office.

During the first six months of Mr. Trump's term, the economy has added 1,027,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first six months of Mr. Trump's term, the economy has gained 47,000 public sector jobs.

After six months of Mr. Trump's presidency, the economy has added 1,074,000 jobs, about 176,000 behind the projection.

Trade Deficit at $43.6 Billion in June

by Calculated Risk on 8/04/2017 11:59:00 AM

Earlier from the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.6 billion in June, down $2.7 billion from $46.4 billion in May, revised. June exports were $194.4 billion, $2.4 billion more than May exports. June imports were $238.0 billion, $0.4 billion less than May imports.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in June.

Exports are 18% above the pre-recession peak and up 6% compared to June 2016; imports are 3% above the pre-recession peak, and up 5% compared to June 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $44.68 in June, down from $45.03 in May, and up from $39.38 in June 2016. The petroleum deficit had been declining for years - and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $32.6 billion in June, from $29.7 billion in June 2016.

Comment: A Solid Employment Report

by Calculated Risk on 8/04/2017 10:00:00 AM

The headline jobs number was above expectations, and there were slight combined upward revisions to the previous two months. And the unemployment decreased slightly.

Earlier: July Employment Report: 209,000 Jobs, 4.3% Unemployment Rate

In July, the year-over-year change was 2.16 million jobs. This is decent year-over-year job growth.

Note that July has been the second strongest month for job growth over the three previous years, exceeded only by June, and just ahead of November. This is the 4th consecutive solid job gain in July: 202 thousand in July 2014, 254 in July 2015, 291 thousand in July 2016, and now 209 thousand in July 2017.

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in July.

Wage growth has generally been trending up.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 5.3 million, was essentially unchanged in July. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased slightly in July. The number working part time for economic reasons suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 8.6% in July.

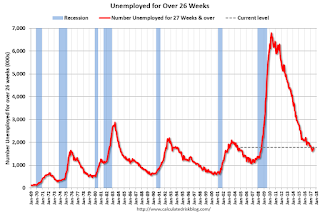

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.79 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 1.66 million in June.

This is generally trending down, but still a little elevated.

Although U-6, the number of persons employed part time for economic reasons, and the number of long term unemployed are still a little elevated, it appears the economy is nearing full employment.

Overall this was another solid report.