by Calculated Risk on 6/22/2017 02:29:00 PM

Thursday, June 22, 2017

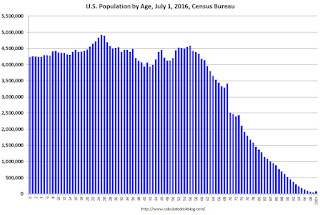

U.S. Demographics: The Millennials Take Over

From the Census Bureau The Nation’s Older Population Is Still Growing, Census Bureau Reports

New detailed estimates show the nation’s median age — the age where half of the population is younger and the other half older — rose from 35.3 years on April 1, 2000, to 37.9 years on July 1, 2016.

“The baby-boom generation is largely responsible for this trend,” said Peter Borsella, a demographer in the Population Division. “Baby boomers began turning 65 in 2011 and will continue to do so for many years to come.”

Residents age 65 and over grew from 35.0 million in 2000, to 49.2 million in 2016, accounting for 12.4 percent and 15.2 percent of the total population, respectively.

Click on graph for larger image.

Click on graph for larger image.This graph uses the data in the July 1, 2016 estimate released today.

Using the Census data, here is a table showing the ten most common ages in 2010 and 2016.

Note the younger baby boom generation dominated in 2010. By 2016 the millennials have taken over. The six largest groups, by age, are in their 20s - and eight of the top ten are in their 20s.

My view is this is positive for both housing and the economy.

| Population: Most Common Ages by Year | ||

|---|---|---|

| 2010 | 2016 | |

| 1 | 50 | 25 |

| 2 | 49 | 26 |

| 3 | 20 | 24 |

| 4 | 19 | 23 |

| 5 | 47 | 27 |

| 6 | 46 | 22 |

| 7 | 48 | 55 |

| 8 | 51 | 28 |

| 9 | 18 | 21 |

| 10 | 52 | 55 |

Kansas City Fed: Regional Manufacturing Activity "Expanded Further" in June

by Calculated Risk on 6/22/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded further with strong expectations for future activity.The Kansas City region was hit hard by the sharp decline in oil prices, but activity has been expanding as oil prices increased. It is too early to tell if the recent decline in oil prices will impact the Kansas City region again.

“Firms reported faster growth in June than earlier in the second quarter,” said Wilkerson. “The share of factories planning to add workers over the next six months also rose solidly.”

...

The month-over-month composite index was 11 in June, up from 8 in May and 7 in April. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ...

emphasis added

Black Knight: Mortgage Delinquencies Decreased in May, Foreclosures at 10-Year Lows

by Calculated Risk on 6/22/2017 09:30:00 AM

From Black Knight: Prepayments (historically a good indicator of refinance activity) jumped 23 percent month-over-month, reaching their highest point so far in 2017

• Prepayments (historically a good indicator of refinance activity) jumped 23 percent month-over-month, reaching their highest point so far in 2017According to Black Knight's First Look report for May, the percent of loans delinquent decreased 7.1% in May compared to April, and declined 10.8% year-over-year.

• Delinquencies reversed course after calendar driven increase in April, falling 7.13 percent month-over-month

• April’s delinquency rate increase was primarily calendar-driven (due to both the month ending on a Sunday and March being the typical calendar-year low) and largely isolated to early-stage delinquencies

• Inventory of loans either seriously delinquent (90 or more days past due) or in active foreclosure continues to improve, with both hitting 10-year lows in May

The percent of loans in the foreclosure process declined 3.0% in May and were down 26.9% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.79% in May, down from 4.08% in April.

The percent of loans in the foreclosure process declined in May to 0.83%.

The number of delinquent properties, but not in foreclosure, is down 226,000 properties year-over-year, and the number of properties in the foreclosure process is down 153,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2017 | Apr 2017 | May 2016 | May 2015 | |

| Delinquent | 3.79% | 4.08% | 4.25% | 4.91% |

| In Foreclosure | 0.83% | 0.85% | 1.13% | 1.59% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,927,000 | 2,072,000 | 2,153,000 | 2,478,000 |

| Number of properties in foreclosure pre-sale inventory: | 421,000 | 433,000 | 574,000 | 803,000 |

| Total Properties | 2,348,000 | 2,505,000 | 2,727,000 | 3,280,000 |

Weekly Initial Unemployment Claims increase to 241,000

by Calculated Risk on 6/22/2017 08:34:00 AM

The DOL reported:

In the week ending June 17, the advance figure for seasonally adjusted initial claims was 241,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 237,000 to 238,000. The 4-week moving average was 244,750, an increase of 1,500 from the previous week's revised average. The previous week's average was revised up by 250 from 243,000 to 243,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 244,750.

This was close to the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, June 21, 2017

Thursday: Unemployment Claims

by Calculated Risk on 6/21/2017 08:58:00 PM

Thursday:

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 237 thousand the previous week.

• At 9:00 AM, FHFA House Price Index for April 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for June.

Philly Fed: State Coincident Indexes increased in 36 states in May

by Calculated Risk on 6/21/2017 03:55:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2017. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78. In the past month, the indexes increased in 36 states, decreased in seven, and remained stable in seven, for a one-month diffusion index of 58.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In May, 43 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices. The reason for the recent decrease in the number of states with increasing activity is unclear - and might be revised away.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

A Few Comments on May Existing Home Sales

by Calculated Risk on 6/21/2017 12:42:00 PM

Earlier: NAR: "Existing-Home Sales Rise 1.1 Percent in May"

Two key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. The NAR reported sales of 5.62 million SAAR, Lawler projected 5.65 million SAAR, and the consensus was 5.55 million SAAR. See: Lawler: Early Read on Existing Home Sales in May

"I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.65 million in May, up 1.4% from April’s preliminary pace and up 3.3% from last May’s seasonally adjusted pace."2) Inventory is still very low and falling year-over-year (down 8.4% year-over-year in May).

I started the year expecting inventory would be increasing year-over-year by the end of 2017. That now seems unlikely, but still possible.

More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in May (red column) were above May2016. (NSA) - and the highest for May since 2006.

Note that sales NSA are now in the seasonally strong period (March through September).

NAR: "Existing-Home Sales Rise 1.1 Percent in May"

by Calculated Risk on 6/21/2017 10:11:00 AM

From the NAR: Existing-Home Sales Rise 1.1 Percent in May; Median Sales Price Ascends to New High

Existing-home sales rebounded in May following a notable decline in April, and low inventory levels helped propel the median sales price to a new high while pushing down the median days a home is on the market to a new low, according to the National Association of Realtors®. All major regions except for the Midwest saw an increase in sales last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, climbed 1.1 percent to a seasonally adjusted annual rate of 5.62 million in May from a downwardly revised 5.56 million in April. Last month's sales pace is 2.7 percent above a year ago and is the third highest over the past year.

...

Total housing inventory at the end of May rose 2.1 percent to 1.96 million existing homes available for sale, but is still 8.4 percent lower than a year ago (2.14 million) and has fallen year-over-year for 24 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, which is down from 4.7 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May (5.63 million SAAR) were 1.1% higher than last month, and were 2.7% above the May 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.96 million in May from 1.92 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.96 million in May from 1.92 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 8.4% year-over-year in May compared to May 2016.

Inventory decreased 8.4% year-over-year in May compared to May 2016. Months of supply was at 4.2 months in May.

This was above the consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

AIA: Architecture Billings Index positive in May

by Calculated Risk on 6/21/2017 09:15:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Design billings maintain solid footing, with strong momentum reflected in both project inquiries and design contracts

Design services at architecture firms continue to project a healthy disposition on the construction industry as the Architecture Billings Index (ABI) recorded the fourth consecutive month of growth. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 53.0, up from a score of 50.9 in the previous month. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.4, up from a reading of 60.2 the previous month, while the new design contracts index increased from 53.2 to 54.8.

“The fact that the data surrounding both new project inquiries and design contracts have remained positive every month this year, while reaching their highest scores for the year, is a good indication that both the architecture and construction sectors will remain healthy for the foreseeable future,” AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “This growth hasn’t been an overnight escalation, but rather a steady, stable increase.”

...

• Regional averages: South (56.1), West (52.3), Midwest (50.4), Northeast (46.5)

• Sector index breakdown: mixed practice (55.8), multi-family residential (51.3), commercial / industrial (51.2), institutional (51.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.0 in May, up from 50.9 the previous month. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017 and early 2018.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 6/21/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 16, 2017.

... The Refinance Index increased 2 percent from the previous week to its highest level since November 2016. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.13 percent from 4.14 percent, with points increasing to 0.35 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity increased recently as rates declined, but will not increase significantly unless rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.