by Calculated Risk on 6/12/2017 11:47:00 AM

Monday, June 12, 2017

Q2 GDP Forecasts

From Merrill Lynch:

We revised down our official 2Q GDP forecast to 2.5%, essentially marking-to market. 1Q is tracking a tenth higher to 1.1%.From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 3.0 percent on June 9, down from 3.4 percent on June 2. The forecast for second-quarter real GDP growth fell from 3.4 percent to 3.1 percent on June 5 after the U.S. Census Bureau's manufacturing report and the incorporation of motor vehicle sales estimates released by the U.S. Bureau of Economic Analysis on the prior business day.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.3% for 2017:Q2 and 1.8% for 2017:Q3.

Oil: "Smallest number of horizontal oil rigs added since January"

by Calculated Risk on 6/12/2017 09:47:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 9, 2017:

• smallest number of horizontal oil rigs added – one – since January

• Total US oil rigs were up 8 to 741

• This week’s horizontal rig additions are consistent with slowing activity in the sector – but one week does not a trend make

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Sunday, June 11, 2017

Sunday Night Futures

by Calculated Risk on 6/11/2017 08:01:00 PM

Weekend:

• Schedule for Week of June 11, 2017

• My FOMC preview.

• Excerpts from Goldman's FOMC preview.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 4 and DOW futures down 32 (fair value).

Oil prices were down over the last week with WTI futures at $45.94 per barrel and Brent at $48.15 per barrel. A year ago, WTI was at $49, and Brent was at $49 - so oil prices are DOWN year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.33 per gallon - a year ago prices were at $2.40 per gallon - so gasoline prices are down year-over-year.

FOMC Preview

by Calculated Risk on 6/11/2017 01:04:00 PM

The consensus is that the Fed will raise the Fed Funds Rate 25 bps following the FOMC meeting this coming week.

Since a rate hike is expected (and assuming it happens), the focus this month will be on the wording of the statement, the projections, and Fed Chair Janet Yellen's press conference.

From Goldman Sachs on the statement: "The statement will likely characterize economic activity as picking up but recognize that inflation slowed since earlier this year."

And from Goldman on the press conference: "The press conference should provide some clarity on whether the next tightening step after June will be balance sheet normalization or a third funds rate hike."

And from Merrill Lynch on the press conference: "We expect the press conference to be focused on balance sheet normalization. Chair Yellen is likely to be asked about the specifics of the balance sheet policy and to elaborate on the potential timing of implementation. ... We also expect Yellen to note that the recent weak data on inflation is likely transitory, but she may provide some hints that she has become a bit more concerned."

Here are the March FOMC projections.

The projection for GDP in 2017 will likely be either unchanged or revised down slightly. GDP in Q1 was at 1.2% annualized, and Q2 looks like around 2.3% to 3.0% based on current forecasts.

My guess is, as far as the impact of fiscal stimulus, the Fed will continue to wait and see what the actual proposals will be.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2017 | 2018 | 2019 |

| Mar 2017 | 2.0 to 2.2 | 1.8 to 2.3 | 1.8 to 2.0 |

| Dec 2016 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.0 |

The unemployment rate was at 4.3% in May. So the unemployment rate for Q4 2017 will be revised down a few tenths of a percentage point. 2018 will probably be revised down too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2017 | 2018 | 2019 |

| Mar 2017 | 4.5 to 4.6 | 4.3 to 4.6 | 4.3 to 4.7 |

| Dec 2016 | 4.5 to 4.6 | 4.3 to 4.7 | 4.3 to 4.8 |

As of April, PCE inflation was up 1.7% from April 2016. It appears inflation might be revised down for 2017.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2017 | 2018 | 2019 |

| Mar 2017 | 1.8 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

| Dec 2016 | 1.7 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.5% in April year-over-year. Core PCE inflation will probably be revised down for 2017.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2017 | 2018 | 2019 |

| Mar 2017 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 to 2.1 |

| Dec 2016 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 |

In general, it appears GDP and inflation might be revised down (GDP slightly), and the unemployment rate will be revised lower.

Saturday, June 10, 2017

Goldman: FOMC Preview

by Calculated Risk on 6/10/2017 05:41:00 PM

A few brief excerpts from a Goldman Sachs research note:

Another rate increase from the FOMC next week is now extremely likely ...CR Note: Almost all analysts expect a rate hike this week, even though inflation has fallen further below the Fed's target. A few key questions are: Does the FOMC see the dip in inflation as transitory? Will the Fed keep tightening if inflation stays below target? Will the next tightening step be another rate hike or balance sheet normalization?

The unemployment rate has fallen 0.4pp since the March meeting and our current activity indicator and real GDP estimates signal that above-trend output growth will produce further labor market improvement. But the year-over-year core PCE inflation is now 0.2pp lower than at the March meeting.

... The statement will likely characterize economic activity as picking up but recognize that inflation slowed since earlier this year. ...

The press conference should provide some clarity on whether the next tightening step after June will be balance sheet normalization or a third funds rate hike.

Schedule for Week of June 11, 2017

by Calculated Risk on 6/10/2017 08:11:00 AM

The key economic reports this week are May Housing Starts, Retail Sales and the Consumer Price Index (CPI).

For manufacturing, May industrial production, and the June New York, and Philly Fed manufacturing surveys, will be released this week.

The FOMC meets this week and is expected to announce a 25bps increase in the Fed Funds rate.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for May.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for 0.1% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for May will be released. The consensus is for a 0.2% increase in retail sales.

8:30 AM ET: Retail sales for May will be released. The consensus is for a 0.2% increase in retail sales.This graph shows retail sales since 1992 through April 2017.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.1% decrease in inventories.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 242 thousand initial claims, down from 245 thousand the previous week.

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 5.0, up from -1.0.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 27.0, down from 38.8.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

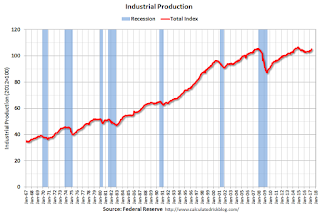

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for May. The consensus is for 1.221 million, up from the April rate of 1.172 million.

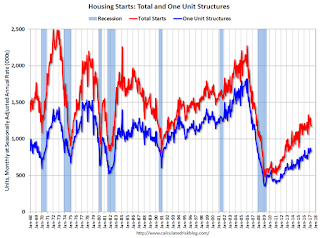

8:30 AM: Housing Starts for May. The consensus is for 1.221 million, up from the April rate of 1.172 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for May 2017

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 97.1, unchanged from 97.1 in May.

Friday, June 09, 2017

Merrill FOMC Preview

by Calculated Risk on 6/09/2017 03:41:00 PM

The FOMC is expected to raise rate at their meeting next week. Here are a few brief excerpts from a Merrill Lynch preview:

The June FOMC meeting will be full of information. Most obviously, we think the Fed will hike rates by 25bp, as widely expected. It is possible – although quite unlikely – that a very weak CPI and retail sales report the morning of the 14th would discourage the Fed from delivering a hike. More likely, however, is that weak reports would influence the language in the statement and press conference.CR Note: I'll post a preview over the weekend.

...

The FOMC is likely to note that the pace of job growth has slowed while the unemployment rate has continued to decline, pointing to solid labor market fundamentals. We also expect the Fed to maintain language that indicates that the weakness in growth at the start of the year was likely transitory and activity is expected to accelerate. On inflation, we think the language will note that inflation has moved below target, but should continue to trend toward 2%. ...

We expect a number of changes to the projections. ... There will be particular interest in the outlook for inflation – we expect the median forecast for core PCE inflation to shift down to 1.7% for this year but think that the median will stay at 2.0% for 2018.

...

We expect the press conference to be focused on balance sheet normalization. Chair Yellen is likely to be asked about the specifics of the balance sheet policy and to elaborate on the potential timing of implementation. ... We also expect Yellen to note that the recent weak data on inflation is likely transitory, but she may provide some hints that she has become a bit more concerned.

Mortgage Equity Withdrawal slightly negative in Q1

by Calculated Risk on 6/09/2017 12:25:00 PM

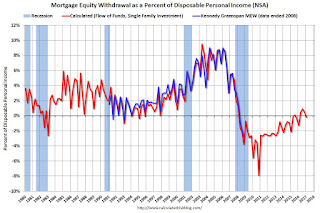

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q1 2017, the Net Equity Extraction was a negative $7 billion, or a negative 0.02% of Disposable Personal Income (DPI) . Note that seasonally, Q1 is the usually the weakest quarter of the year equity extraction.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $44 billion in Q4.

The Flow of Funds report also showed that Mortgage debt has declined by $1.22 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With a slower rate of debt cancellation, MEW will likely be positive going forward.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Goldman: "Prices and Risks in Commercial Real Estate"

by Calculated Risk on 6/09/2017 10:16:00 AM

A few excerpts from a research note by Goldman Sachs economists Spencer Hill and Daan Struyven: Seven Years of Feast: Prices and Risks in Commercial Real Estate

Commercial real estate prices have increased 76% in real terms over the last seven years and are now above pre-crisis levels. At the same time, elevated supply growth, demand risks, and rapid credit growth in some subsectors suggest additional focus on the asset class is warranted ... we believe commercial real estate valuations are becoming increasingly stretched and are now moderately overvalued – between 0.5 and 0.9 standard deviations rich – even after taking into account the lofty levels of other assets classes.CR Note: there are several warning signs for commercial real estate. As an example, even as the economy approaches full employment - and the demand for office space will likely slow - new construction is still strong and vacancy rates are already high.

...

[W]e think it’s important to note two key distinctions between the CRE market today and that of 2006. First, lending standards appear meaningfully tighter today ... Second, valuations do not look nearly as stretched today, with the extent of overvaluation 2-3x larger in 2006

[W]hile we believe commercial real estate markets were reasonably valued during most of this expansion, our models now suggest they could be moderately overvalued – even taking into account the lofty level of other assets classes. Furthermore, the combination of higher interest rates and potentially unfavorable supply & demand dynamics suggest heightened risk that the misvaluation could worsen. Indeed, these developments could ultimately become the catalysts that produce such a repricing.

Click on graph for larger image.

Click on graph for larger image.This graph, based on data from Reis, shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 15.8% in Q1. The office vacancy rate is at the lowest level since early 2009, but remains elevated.

Slowing office demand, more supply and an already high vacancy rate imply weaker fundamentals going forward.

Thursday, June 08, 2017

AAR: Rail Traffic increased in May

by Calculated Risk on 6/08/2017 05:00:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

May 2017 was a good month for U.S. rail traffic. Total originated carloads were up 8.4% (99,290) over May 2017 thanks to big increases for coal (up 19.6% in May), grain (up 24.5%), and crushed stone, gravel, and sand (up 15.3%, thanks to frac sand). ... [Intermodal]: It was the second best May in history (slightly behind 2015) in terms of average weekly intermodal volume. Year-to-date intermodal in 2017 through May was the highest in history, fractionally ahead of 2015.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. rail carloads rose 8.4% (99,290 carloads) in May 2017 over May 2016. The-glass-is-half-full types will point out that this is the seventh straight year-over-year monthly gain for total carloads, something that hasn’t happened since the seven months ending in January 2015 (see the chart below right). The glassis-half-empty types, though, will point out that average weekly total carloads in May 2017 (257,215) were the third lowest for May since 1988, when our data begin. (Only May 2009 and May 2016 were lower.)

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. rail intermodal volume in May 2017 was 1,339,417 containers and trailers, up 4.6%, or 58,665 units, over May 2016. Weekly average intermodal volume in May 2017 (267,883 units) was the second best for May in history (slightly behind 2015).