by Calculated Risk on 3/09/2017 08:26:00 PM

Thursday, March 09, 2017

Friday: Jobs and Wages

Earlier:, my February Employment Preview and Goldman: February Employment Preview

Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for an increase of 195,000 non-farm payroll jobs added in February, down from the 227,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to decline to 4.7%.

Goldman: February Employment Preview

by Calculated Risk on 3/09/2017 05:17:00 PM

A few excerpts from a note by Goldman Sachs economist Spencer Hill: February Payrolls Preview

We estimate that February nonfarm payrolls increased 215k in February, following +227k in January ... Reasons to expect a strong report include favorable weather effects, the strong hiring trends indicated in the ADP employment report, and a further drop in jobless claims to their lowest levels since the 1970s.CR note: the consensus is for a 195k jobs added in February, and for the unemployment rate to decline to 4.7%.

We estimate that the unemployment rate fell one tenth to 4.7% ... We also forecast average hourly earnings increased 0.3% month over month and 2.7% year over year, reflecting tightening labor markets and the continued impact of state-level minimum wage hikes.

...

February exhibited unseasonably warm weather and relatively limited snowfall, both of which are likely to boost payrolls in weather-sensitive industries. ... such a pattern is associated with strong growth in weather-sensitive industries, including construction, retail trade, and leisure and hospitality.

Fed's Flow of Funds: Household Net Worth increased in Q4

by Calculated Risk on 3/09/2017 01:03:00 PM

The Federal Reserve released the Q4 2016 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3:

The net worth of households and nonprofits rose to $92.8 trillion during the fourth quarter of 2016. The value of directly and indirectly held corporate equities increased $728 billion and the value of real estate increased $557 billion.Household net worth was at $92.8 trillion in Q4 2016, up from $90.8 trillion in Q3 2016.

The Fed estimated that the value of household real estate increased to $23.1 trillion in Q4. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and also including new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2016, household percent equity (of household real estate) was at 57.8% - up from Q3, and the highest since Q2 2006. This was because of an increase in house prices in Q3 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 57.8% equity - and about 3 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $63 billion in Q4.

Mortgage debt has declined by $1.21 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q4, and is above the average of the last 30 years (excluding bubble).

CoreLogic: "1 million borrowers moved out of negative equity during 2016"

by Calculated Risk on 3/09/2017 10:51:00 AM

From CoreLogic: CoreLogic Reports 1 Million US Borrowers Regained Equity in 2016

CoreLogic ... today released a new analysis showing that U.S. homeowners with mortgages (roughly 63 percent of all homeowners) saw their equity increase by a total of $783 billion in 2016, an increase of 11.7 percent. Additionally, just over 1 million borrowers moved out of negative equity during 2016, increasing the percentage of homeowners with positive equity to 93.8 percent of all mortgaged properties, or approximately 48 million homes.On states:

In Q4 2016, the total number of mortgaged residential properties with negative equity stood at 3.17 million, or 6.2 percent of all homes with a mortgage. This is a decrease of 2 percent quarter over quarter from 3.23 million homes, or 6.3 percent of all mortgaged properties, in Q3 2016* and a decrease of 25 percent year over year from 4.23 million homes, or 8.4 percent of all mortgaged properties, compared with Q4 2015 ...

...

Negative equity peaked at 26 percent of mortgaged residential properties in Q4 2009 based on CoreLogic equity data analysis, which began in Q3 2009.

...

“Average home equity rose by $13,700 for U.S. homeowners during 2016,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The equity build-up has been supported by home-price growth and paydown of principal. The CoreLogic Home Price Index for the U.S. rose 6.3 percent over the year ending December 2016. Further, about one-fourth of all outstanding mortgages have a term of 20 years or less, which amortize more quickly than 30-year loans and contribute to faster equity accumulation.”

emphasis added

"Nevada had the highest percentage of homes with negative equity at 13.6 percent, followed by Florida (11.6 percent), Illinois (11.1 percent), Rhode Island (10 percent) and Arizona (9.8 percent). These top five states combined account for 29.7 percent of negative equity in the U.S., but only 16.3 percent of outstanding mortgages."Note: The share of negative equity is still high in Nevada and Florida, but down from a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q4 2016 compared to Q3 2016.

About 2% of properties have 25% or more negative equity. For reference, about four years ago, in Q3 2012, almost 10% of residential properties had 25% or more negative equity.

A year ago, in Q4 2015, there were 4.3 million properties with negative equity - now there are 3.2 million. A significant change.

Weekly Initial Unemployment Claims increase to 243,000

by Calculated Risk on 3/09/2017 08:39:00 AM

The DOL reported:

In the week ending March 4, the advance figure for seasonally adjusted initial claims was 243,000, an increase of 20,000 from the previous week's unrevised level of 223,000. The 4-week moving average was 236,500, an increase of 2,250 from the previous week's unrevised average of 234,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 236,500.

This was higher than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, March 08, 2017

Thursday: Unemployment Claims, Q4 Flow of Funds

by Calculated Risk on 3/08/2017 07:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Spike to 2017 Highs

Mortgage rates spiked, big-time, today. Underlying bond markets had already moved higher in rate overnight, but the trend was taken to a new level by an exceptionally strong employment report from ADP. Although this isn't the big jobs report (we'll get that on Friday), many market participants treat the ADP numbers as one of several advance indicators of Friday's jobs report. Sometimes it doesn't register a response, but when it beats the forecast by as much as it did today (298k vs 190k), markets can't help but adjust their trajectory ahead of Friday.Thursday:

The net effect was the sharpest move higher in rates in several months, slightly outpacing last Wednesday's rout. Moreover, with the exception of a modest improvement on Monday, rates have moved higher every single day since February 27th. In just over a week, the average conventional 30yr fixed quote is up approximately a quarter of a percent for most lenders. Stronger lenders are offering 4.25% on top tier scenarios while many moved up to 4.375% with today's weakness.

emphasis added

• At 8:30 AM ET, < The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, up from 223 thousand the previous week.

• At 10:00 AM, The Q4 Quarterly Services Report from the Census Bureau.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

Leading Index for Commercial Real Estate Increases in February

by Calculated Risk on 3/08/2017 03:31:00 PM

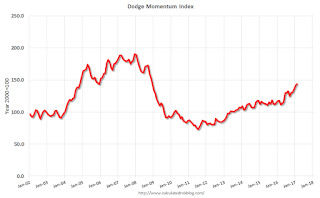

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Increases in February

The Dodge Momentum Index rose 1.6% in February to 144.0 (2000=100) from its revised January reading of 141.7. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. February’s increase was due to a 4.4% jump in institutional planning, while commercial planning slipped slightly, falling 0.3% for the month. The Momentum Index has now increased for five consecutive months; however, the underlying components continue to be volatile on a month-to-month basis as large projects continue to sway the data. The overall trend, however, is rising. On a year-over-year basis the Momentum Index is 22% higher, with commercial planning up 28% and institutional planning moving 15% ahead of last year. This suggests that construction activity will continue to see further growth as the year progresses.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 144.0 in February, up from 141.7 in January.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.

February Employment Preview

by Calculated Risk on 3/08/2017 11:42:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus, according to Bloomberg, is for an increase of 195,000 non-farm payroll jobs in February (with a range of estimates between 168,000 to 215,000), and for the unemployment rate to decline to 4.7%.

The BLS reported 227,000 jobs added in January.

Here is a summary of recent data:

• The ADP employment report showed an increase of 298,000 private sector payroll jobs in February. This was well above expectations of 183,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in February to 54.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 3,000 in February. The ADP report indicated 32,000 manufacturing jobs added in February.

The ISM non-manufacturing employment index increased in February to 55.2%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 212,000 in February.

Combined, the ISM indexes suggests employment gains of about 215,000. This suggests employment growth above expectations.

• Initial weekly unemployment claims averaged 234,000 in February, down from 248,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 244,000, up from 237,000 during the reference week in January.

The increase during the reference suggests slightly more layoffs during the reference week in February than in January. This suggests an employment report close to January - above the consensus.

• The final February University of Michigan consumer sentiment index decreased to 96.3 from the January reading of 98.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. However the ADP report and ISM surveys suggest stronger job growth. Weekly unemployment claims suggest job growth similar to January. So my guess is the February report will be above the consensus forecast.

ADP: Private Employment increased 298,000 in February

by Calculated Risk on 3/08/2017 08:26:00 AM

Private sector employment increased by 298,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 183,000 private sector jobs added in the ADP report.

...

“February proved to be an incredibly strong month for employment with increases we have not seen in years,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Gains were driven by a surge in the goods sector, while we also saw the information industry experience a notable increase.”

Mark Zandi, chief economist of Moody’s Analytics said, “February was a very good month for workers. Powering job growth were the construction, mining and manufacturing industries. Unseasonably mild winter weather undoubtedly played a role. But near record high job openings and record low layoffs underpin the entire job market.”

The BLS report for February will be released Friday, and the consensus is for 195,000 non-farm payroll jobs added in February.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/08/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 3, 2017. The previous week’s results included an adjustment for the President’s Day holiday.

... The Refinance Index increased 5 percent from the previous week to the highest level since December 2016. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.36 percent from 4.30 percent, with points increasing to 0.44 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still holding up.

However refinance activity has declined significantly since rates increased.