by Calculated Risk on 1/30/2017 07:54:00 PM

Monday, January 30, 2017

Tuesday: Case-Shiller House Prices, Chicago PMI

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Lower to Begin Week

Mortgage rates fell modestly today, keeping rates near the lower end of the range seen since January 18th. The catch is that rates moved sharply higher on the 18th, and from there, you'd have to go back to late December to see anything higher. Simply put, we're at the lower end of the recently higher range. ... 4.25% remains the most prevalent quote on top tier conventional 30yr fixed scenarios.Thursday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices. The consensus is for a 5.0% year-over-year increase in the Comp 20 index for November. The Zillow forecast is for the National Index to increase 5.6% year-over-year in November.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 55.2, up from 54.6 in December.

Fannie Mae: Mortgage Serious Delinquency rate decreased in December, Lowest since March 2008

by Calculated Risk on 1/30/2017 05:18:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate decreased to 1.20% in December, down from 1.23% in November. The serious delinquency rate is down from 1.55% in December 2015.

This is the lowest serious delinquency rate since March 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.35 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% for about 7 more months.

Note: Freddie Mac reported earlier.

Dallas Fed: Regional Manufacturing Activity "Continues to Expand" in January

by Calculated Risk on 1/30/2017 02:34:00 PM

From the Dallas Fed: Texas Manufacturing Activity Continues to Expand

Texas factory activity increased for the seventh consecutive month in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, edged down but remained positive at 11.9, suggesting output growth continued but at a slightly slower pace this month. ...This was the last of the regional Fed surveys for January.

...

The general business activity index posted a fourth consecutive positive reading and moved up to 22.1, its highest reading since April 2010.

...

Labor market measures indicated employment gains and longer workweeks. The employment index bounced back to 6.1 after dipping into negative territory last month. Twenty-three percent of firms noted net hiring, compared with 17 percent noting net layoffs. The hours worked index moved up to 9.1, its strongest reading since the end of 2015. ...

emphasis added

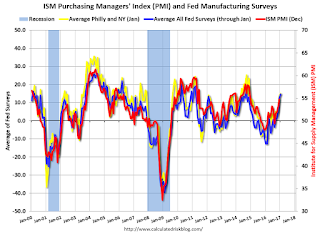

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

It seems likely the ISM manufacturing index will show stronger expansion in January, and the consensus is for a reading of 55.0.

Duy: FOMC Preview

by Calculated Risk on 1/30/2017 12:12:00 PM

From Tim Duy at Fed Watch: FOMC Preview

The Fed will take a pass at this week’s FOMC meeting. The median policy participant forecasts just three 25bp rate hikes this year and incoming data offers no surprises to force one of those this month. March, however, remains in play.

The three forecasted rate hikes is not a promise. It could be one hike or could be four or more. The actual outcome will depend on the path of actual economic outcomes and what those outcomes imply for the forecast.

...

he Fed’s crystal ball is as cloudy as everyone else’s, but that’s hard to explain. For example, the potential positive demand shock from expected deficit spending could be overwhelmed by a potential negative supply shock from an increasingly xenophobic Trump Administration.

What does this mean for March? Currently, market participants place low odds of a March rate hike. The underlying bet is that if the Fed moves three times this year, the most likely timing will be June, September, and December. I think this is reasonable; bringing March into that mix requires a change in the tone of the data.

...

At this point I still do not anticipate a March hike. And note that a March move doesn’t guarantee a faster pace of rate hikes; it could be largely pre-emptive, just displacing a subsequent rate hike. But if they could justify a March move and you were anticipating two to three rate hikes this year, you should probably be thinking of three to four. Not to mention some action on the balance sheet added to the mix.

emphasis added

NAR: Pending Home Sales Index increased 1.6% in December, up 0.3% year-over-year

by Calculated Risk on 1/30/2017 10:05:00 AM

From the NAR: Pending Home Sales Bounce Back in December

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 1.6 percent to 109.0 in December from 107.3 in November. With last month's uptick in activity, the index is now 0.3 percent above last December (108.7).This was above expectations of a 0.6% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

The PHSI in the Northeast declined 1.6 percent to 96.4 in December, and is now 1.2 percent below a year ago. In the Midwest the index decreased 0.8 percent to 102.7 in December, and is now 3.4 percent lower than December 2015.

Pending home sales in the South rose 2.4 percent to an index of 121.3 in December and are now 0.5 percent above last December. The index in the West jumped 5.0 percent in December to 106.1, and is now 5.0 percent higher than a year ago.

emphasis added

Personal Income increased 0.3% in December, Spending increased 0.5%

by Calculated Risk on 1/30/2017 09:04:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $50.2 billion (0.3 percent) in December according to estimates released today by the Bureau of Economic Analysis ... personal consumption expenditures (PCE) increased $63.1 billion (0.5 percent).On inflation: The PCE price index increased 1.6 percent year-over-year. (This was up from 1.4% year-over-year in November). The core PCE price index (excluding food and energy) increased 1.7 percent year-over-year in December (the same as in November).

...

Real PCE increased 0.3 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

Sunday, January 29, 2017

Sunday Night Futures

by Calculated Risk on 1/29/2017 07:11:00 PM

On Trump immigration executive order:

"This isn't normal. Its not humane, its not thought through, its not necessary, its not wise, its not decent and above all, its not American."

Eliot A. Cohen, Counselor in the United States Department of State under Condoleezza Rice and President George W. Bush

Weekend:

• Schedule for Week of Jan 29, 2017

• These are Not Normal Times

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 8, and DOW futures are down 60 (fair value).

Oil prices were down over the last week with WTI futures at $52.97 per barrel and Brent at $55.52 per barrel. A year ago, WTI was at $33, and Brent was at $33 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.27 per gallon - a year ago prices were at $1.82 per gallon - so gasoline prices are up 45 cents a gallon year-over-year.

January 2017: Unofficial Problem Bank list unchanged at 163 Institutions

by Calculated Risk on 1/29/2017 11:37:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 2017.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for January 2017. During the month, the list dropped from 169 to 163 institutions after six removals. Aggregate assets fell by $1.5 billion to $43.5 billion. A year ago, the list held 238 institutions with assets of $69.5 billion.

Actions were terminated against The Baraboo National Bank, Baraboo, WI ($412 million); International Finance Bank, Miami, FL ($354 million); First National Bank USA, Boutte, LA ($132 million); and First Federal of South Carolina, FSB, Walterboro, SC ($77 million Ticker: FSGB).

Removals through failure were Seaway Bank and Trust Company, Chicago, IL ($361 million) and Harvest Community Bank, Pennsville, NJ ($126 million). It has been 15 months since the last month with two or more bank failures. The failure in Chicago is the 18th bank to fail in that city since September 2009 and the 64th bank to fail in Illinois since 2008.

Saturday, January 28, 2017

These are Not Normal Times

by Calculated Risk on 1/28/2017 08:02:00 PM

These are not normal times, and I can't just post economic data and remain silent on other issues.

Mr. Trump's executive order is un-American, not Christian, and hopefully unconstitutional. This is a shameful act and no good person can remain silent.

From the NY Times: Donald Trump’s Muslim Ban Is Cowardly and Dangerous

The first casualties of this bigoted, cowardly, self-defeating policy were detained early Saturday at American airports just hours after the executive order, ludicrously titled “Protecting the Nation From Foreign Terrorist Entry Into the United States,” went into effect. It must have felt like the worst trick of fate for these refugees to hit the wall of Donald Trump’s political posturing at the very last step of a yearslong, rigorous vetting process. This ban will also disrupt the lives and careers of potentially hundreds of thousands of immigrants who have been cleared to live in America under visas or permanent residency permits.

That the order, breathtaking in scope and inflammatory in tone, was issued on Holocaust Remembrance Day spoke of the president’s callousness and indifference to history, to America’s deepest lessons about its own values.

The order lacks any logic. It invokes the attacks of Sept. 11 as a rationale, while exempting the countries of origin of all the hijackers who carried out that plot and also, perhaps not coincidentally, several countries where the Trump family does business. The document does not explicitly mention any religion, yet it sets a blatantly unconstitutional standard by excluding Muslims while giving government officials the discretion to admit people of other faiths.

...

Republicans in Congress who remain quiet or tacitly supportive of the ban should recognize that history will remember them as cowards.

Schedule for Week of Jan 29, 2017

by Calculated Risk on 1/28/2017 08:11:00 AM

The key report this week is the January employment report on Friday.

Other key indicators include the January ISM manufacturing and non-manufacturing indexes, and January auto sales.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected.

8:30 AM: Personal Income and Outlays for December. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.6% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed surveys for January.

9:00 AM ET: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the October 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.0% year-over-year increase in the Comp 20 index for November. The Zillow forecast is for the National Index to increase 5.6% year-over-year in November.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 55.2, up from 54.6 in December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in January, from 18.4 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in January, from 18.4 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 168,000 payroll jobs added in January, up from 153,000 added in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 55.0, up from 54.7 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 55.0, up from 54.7 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 54.7% in December. The employment index was at 53.1%, and the new orders index was at 60.2%.

10:00 AM: Construction Spending for December. The consensus is for a 0.2% increase in construction spending.

2:00 PM: FOMC Meeting Announcement. No change to FOMC policy is expected at this meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, down from 259 thousand the previous week.

8:30 AM: Employment Report for January. The consensus is for an increase of 175,000 non-farm payroll jobs added in January, up from the 156,000 non-farm payroll jobs added in December.

The consensus is for the unemployment rate to be unchanged at 4.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.16 million jobs.

A key will be the change in wages.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is a 0.9% increase in orders.

10:00 AM: the ISM non-Manufacturing Index for January. The consensus is for index to increase to 57.2 from 57.1 in December.