by Calculated Risk on 1/23/2017 11:51:00 AM

Monday, January 23, 2017

NMHC: Apartment Market Tightness Index remained negative in January Survey

From the National Multifamily Housing Council (NMHC): Apartment Markets Soften in the January NMHC Quarterly Survey

— Apartment markets continued to retreat in the January National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. All four indexes of Market Tightness (25), Sales Volume (25), Equity Financing (33) and Debt Financing (14) remained below the breakeven level of 50 for the second quarter in a row.

“Weaker conditions are evident across all sectors as the apartment industry adjusts to changing conditions,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Rising supply—particularly during a seasonally weak quarter—is causing rent growth to moderate in many markets. At the same time, the sharp rise in interest rates in recent months was a triple whammy for the industry. First, higher rates directly worsen debt financing conditions. Second, the associated rise in cap rates also put a crimp in sales of apartment properties. Third, higher cap rates following the long run-up in apartment prices caused greater caution among equity investors.”

“The underlying demand for apartment residences remains strong, however. While new apartments continue to come online at a good clip, absorptions of those apartments remain strong. As long as the job market continues its steady expansion, any local supply overshoots should be manageable,” said Obrinsky.

The Market Tightness Index dropped three points to 25 – the fifth consecutive quarter of declining conditions and the lowest in more than seven years. Over half (58 percent) reported looser conditions from three months ago, compared to only eight percent who reported tighter conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the fifth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to slow.

Black Knight: Mortgage Delinquencies Declined in December

by Calculated Risk on 1/23/2017 10:11:00 AM

From Black Knight: Black Knight Financial Services’ First Look at December 2016 Mortgage Data

• The inventory of loans in active foreclosure nationwide declined by more than 200,000 in 2016According to Black Knight's First Look report for December, the percent of loans delinquent decreased 0.9% in December compared to November, and declined 7.5% year-over-year.

• Delinquencies were down 0.91 percent from November 2016 and 7.5 percent from December 2015

• December’s 59,700 foreclosure starts represented a 24 percent decline from the same time last year

• Pre-payment activity continues to slow, down 5.5 percent from November

The percent of loans in the foreclosure process declined 3.3% in December and were down 30.5% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.42% in December, down from 4.46% in November.

The percent of loans in the foreclosure process declined in December to 0.95%.

The number of delinquent properties, but not in foreclosure, is down 286,000 properties year-over-year, and the number of properties in the foreclosure process is down 206,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for December by February 6th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2016 | Nov 2016 | Dec 2015 | Dec 2014 | |

| Delinquent | 4.42% | 4.46% | 4.78% | 5.62% |

| In Foreclosure | 0.95% | 0.98% | 1.37% | 1.75% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,248,000 | 2,263,000 | 2,408,000 | 2,833,000 |

| Number of properties in foreclosure pre-sale inventory: | 483,000 | 498,000 | 689,000 | 881,000 |

| Total Properties | 2,731,000 | 2,761,000 | 3,097,000 | 3,715,000 |

Sunday, January 22, 2017

Sunday Night Futures

by Calculated Risk on 1/22/2017 09:01:00 PM

Menzie Chinn at Econbrowser recommends a new site: EconoFact

EconoFact is a non-partisan publication, online starting today, designed to bring key facts and incisive analysis to the national debate on economic and social policies. It is written by leading academic economists from across the country who belong to the EconoFact Network, and published by the Edward R. Murrow Center for a Digital World at The Fletcher School at Tufts University. The co-editors are Michael Klein and Edward Schumacher-Matos.Weekend:

Inaugural memos tackle Trump’s promise to bring back manufacturing jobs, the prospects for the big, beautiful wall, charter schools, the destination based border tax, whether the trade deficit is a drag on growth, and whether China is now manipulating its currency.

• Schedule for Week of Jan 22, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 5, and DOW futures are down 34 (fair value).

Oil prices were down over the last week with WTI futures at $53.28 per barrel and Brent at $55.53 per barrel. A year ago, WTI was at $28, and Brent was at $28 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.30 per gallon - a year ago prices were at $1.85 per gallon - so gasoline prices are up 45 cents a gallon year-over-year.

Hotels: Concerns about Fewer Foreign Visitors in 2017

by Calculated Risk on 1/22/2017 11:09:00 AM

From HotelNewsNow.com: US hoteliers keep eye on dip in bookings from Europe

U.S. hoteliers have reported seeing a decline in bookings from European travelers heading into 2017 and are looking to explain what has caused the drop.From HotelNewsNow.com: STR: US hotel results for week ending 14 January

Possible factors include economic uncertainty in the continent, coupled with a new U.S. president who is unpopular in several European countries. But it’s hard to say what combination of things, if any, is keeping Europeans away.

PM Hotel Group began watching reservations originating from other countries shortly after the presidential election, President Joe Bojanowski said. Company officials had serious concerns about foreign inbound travel in the New York City and San Francisco areas, he said, and the company has seen a decline in reservations in those markets.

The U.S. hotel industry reported mixed results in the three key performance metrics during the week of 8-14 January 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy decreased 0.9% to 56.6%. However, average daily rate (ADR) rose 2.8% to US$122.29, and revenue per available room (RevPAR) increased 1.9% to US$69.24.

emphasis added

The red line is for 2017, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2017 is close to 2015, and well ahead of the median rate.

For hotels, this is the slow season of the year, and occupancy will pick up into the Spring.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, January 21, 2017

Schedule for Week of Jan 22nd

by Calculated Risk on 1/21/2017 08:04:00 AM

The key economic report this week is the advance report of Q4 GDP on Friday.

Other key reports are December New and Existing Home sales.

No economic releases scheduled.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.54 million SAAR, down from 5.61 million in November.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.54 million SAAR, down from 5.61 million in November.Housing economist Tom Lawler expects the NAR to report sales of 5.55 million SAAR in December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for December 2016

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for November 2016. This was originally a GSE only repeat sales, however there is also an expanded index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 247 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM ET: New Home Sales for December from the Census Bureau.

10:00 AM ET: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the October sales rate.

The consensus is for a decrease in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 592 thousand in November.

11:00 AM: the Kansas City Fed manufacturing survey for January.

8:30 AM: Gross Domestic Product, 4th quarter 2016 (advance estimate). The consensus is that real GDP increased 2.2% annualized in Q4, down from 3.5% in Q3.

8:30 AM: Durable Goods Orders for December from the Census Bureau. The consensus is for a 3.0% increase in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 98.2, up from the preliminary reading 98.1.

Friday, January 20, 2017

Lawler: The Household Conundrum, Part I Continued: The CPS/ASEC Data for 18-29 Year Olds

by Calculated Risk on 1/20/2017 05:25:00 PM

Earlier: Lawler: The Household Conundrum, Part I: The CPS/ASEC Data

From housing economist Tom Lawler: The Household Conundrum, Part I Continued: The CPS/ASEC Data for 18-29 Year Olds

Many analysts have noted that estimates for the number of households from the CPS/ASEC appear to have overstated the “actual” number of households, with most of the overstatement being estimates of the number of “young adult” householders. If that were the case, then obviously the CPS/ASEC also understates the “other” living arrangements of young adults (e.g., young adults living with parents, other relatives, or non-relatives. Below is a table comparing the shares of 18-29 year olds by household relationship as estimated by the CPS/ASEC to those from Decennial Census 2010.

Note that the CPS/ASEC is a “household” survey, and not a survey of the entire population. Note also that the CPS/ASEC counts students living in college housing as living at home, while the Decennial Census counts students living in college housing as living in “group quarters” (and as such are not counted in the “household” population. On April 1, 2010 Decennial Census estimates show about 2.5 million people living in college housing, with the vast majority (though not quite all) of those people being between 18 and 29 years old. As such, I have added the number of 18-29 year olds living in college housing to the Decennial Census estimates of the “household” population in order to make Census data comparable in definition to the CPS/ASEC data.

| Share of 18-29 Year Olds in the "Household" Population (CPS definition) by Relationship to Householder, 2010 | |||

|---|---|---|---|

| CPS/ASEC | Census | Difference | |

| Householder | 30.5% | 27.6% | 2.9% |

| Spouse | 10.0% | 9.7% | 0.3% |

| Child | 38.4% | 39.7% | -1.4% |

| Other Relative | 7.9% | 8.2% | -0.2% |

| Non-Relative | 13.2% | 14.8% | -1.6% |

As the table indicates, CPS/ASEC estimates of the share of 18-29 year olds that were householders in 2010 is almost 3 percentage points higher than estimates from the Decennial Census. CPS/ASEC estimates of the share of 18-29 year olds living with parents, in contrast, are 1.4 percentage points below Census estimates, and the share of 18-29 year olds living with “non-relative” (roomer or boarder, housemate or roommate, unmarried partner, or “other”) is 1.6 percentage points below Census estimates.

While these differences may not seem that large, the (1) are statistically significant; and (2) imply that the CPS/ASEC estimate for the number of 18-29 year old householders is about 1.6 million “too high.”

Even more startling, though not as important, are the CPS/ASEC estimates for the number of householders 15-17 years old – about 210,000 – compared to the Decennial Census estimate of 28,297.

On the next table is a comparison of the number of households by age group from Census 2010 (“official” numbers) compared to those of the CPS/ASEC (adjusted to reflect Census 2010 population count “controls).

| Household Estimates by Age Group, 2010 (000's) | |||

|---|---|---|---|

| Decennial Census | CPS/ASEC (Adjusted) | % Difference | |

| 15-17 | 28 | 209 | 638.5% |

| 18-24 | 5,373 | 6,116 | 13.8% |

| 25-29 | 8,490 | 9,397 | 10.7% |

| 30-34 | 9,468 | 9,776 | 3.3% |

| 35-44 | 21,291 | 21,729 | 2.1% |

| 45-54 | 24,907 | 25,113 | 0.8% |

| 55-64 | 21,340 | 20,777 | -2.6% |

| 65-74 | 13,505 | 13,400 | -0.8% |

| 75+ | 12,315 | 12,243 | -0.6% |

| Total | 116,716 | 118,760 | 1.8% |

It is not readily apparent either (1) why the CPS/ASEC estimates for the number of “young” adult households are overstated by as much as they are (or why the overstatement is a function of age); or (2) why this overstatement showed up for the first time (albeit by not nearly as much) in 2000.

Some believe related to the significant increase in the non-response rate in the CPS that began around the same time (1994) that the CPS shifted computer-assisted interview data collection system (CATI), combined with higher non-response rates for younger adults relative to older adults. Others wonder whether the differences are somehow related to the “imperfect” sampling frame of the CPS/ASEC. Personally, I don’t know the answer.

If, in fact, the CPS is not getting the “living arrangements” of young adults “right” – overstating both the share of young adults that are householders and the share of young adults that are homeowners (see LEHC, 1/18/2016), then it would not be surprising that other statistics about young adults from the CPS (employment, income, etc.) may also be “off.”

Then and Now

by Calculated Risk on 1/20/2017 01:42:00 PM

A few indicators comparing eight years ago and today ...

| Jan-09 | Dec-16 | |

|---|---|---|

| Vehicle Sales1 | 9.6 | 18.3 |

| Monthly Employment change2 | -791 | 156 |

| Unemployment Rate3 | 7.8% | 4.7% |

| Housing Starts4 | 490 | 1,126 |

| New Home Sales5 | 336 | 592 |

| Mortgage Delinquency Rate6 | 13.0% | 6.1% |

| Budget Deficit7 | 9.8% | 2.8% |

| S&P 5008 | 805 | 2,269 |

| 1millions, SAAR 2Thousands 3Peaked at 10% in 2009 4Thousands, SAAR 5Thousands, SAAR 6Source: MBA, Quarterly including in-foreclosure 7Annual, fiscal 2008 vs. 2016 8Jan 20, 2009 vs Jan 20, 2017 | ||

Lawler: The Household Conundrum, Part I: The CPS/ASEC Data

by Calculated Risk on 1/20/2017 10:23:00 AM

From housing economist Tom Lawler: The Household Conundrum, Part I: The CPS/ASEC Data

A major challenge facing housing analysts is the lack of any timely and accurate time series of the characteristics of the housing market, including both the number of and the characteristics of occupied or vacant housing units. Instead, analysts are faced with numerous and often conflicting household and/or housing stock estimates based on different surveys conducted by different areas of the Census Bureau.

For analysts trying to assess which, if any, of the various surveys (which are based on samples) provides the “best” estimates of the number of and the characteristics of US households, one approach is to compare the survey estimates to counts from the decennial Census, which attempts to provide complete coverage of the population, households, and the housing stock, as well as all of their characteristics.

While some might think that such a comparison is straightforward, in fact it can be a little tricky. First, household estimates (totals and/or characteristics) are based on either population estimates or housing stock estimates available at the time the survey results are published. While initial population and housing stock estimates for any given year are almost always revised – sometimes by a sizable amount subsequent to the compilation of decennial Census counts – household estimates for those years are typically not revised. As such, the historical time series on households from most surveys are not consistent with current population/housing stock estimates.

For example, for the Current Population Survey Annual Social and Economic Supplement (CPS/ASEC), the household estimates for 1990, 2000, and 2010 (coinciding with decennial Census years) are not based on population counts from the decennial Census in those years, but instead are based on pre-Decennial Census estimates. And, in each year’s case, the population estimates used in the CPS/ASEC were significantly different from decennial Census counts. As such, CPS/ASEC household estimates for those years need to be adjusted to reflect what they would have been if updated population estimates had been available.

Further complicating these comparisons is the fact the Decennial Census counts themselves are not perfect. In fact, subsequent to each Decennial Census the Census Bureau conducts two separate studies to assess the coverage and accuracy of the Census counts: one designed to assess the coverage and accuracy of the population count, and the other to assess the coverage and accuracy of the housing stock count. As such, one should probably adjust the “official” Decennial Census household counts when comparing them to the “adjusted” CPS/ASEC estimates.

I have attempted to make all of the adjustments to the best of my ability, and the adjusted results are shown in the following table.

| Total Households by Age Group, Adjusted CPS/ASEC (000's) | ||||||

|---|---|---|---|---|---|---|

| 1990 | 2000 | 2010 | 2000-1990 | 2010-2000 | 2010-1990 | |

| Total | 93,424 | 106,434 | 118,760 | 13,010 | 12,326 | 25,336 |

| 15-24 | 5,361 | 5,844 | 6,325 | 483 | 481 | 964 |

| 25-34 | 20,811 | 18,987 | 19,173 | -1,824 | 186 | -1,638 |

| 35-44 | 20,691 | 24,025 | 21,729 | 3,334 | -2,296 | 1,038 |

| 45-54 | 14,371 | 21,212 | 25,113 | 6,841 | 3,901 | 10,742 |

| 55-64 | 12,243 | 13,888 | 20,777 | 1,645 | 6,889 | 8,534 |

| 65-74 | 11,568 | 11,641 | 13,400 | 73 | 1,759 | 1,832 |

| 75+ | 8,379 | 10,837 | 12,243 | 2,458 | 1,406 | 3,864 |

| Total Households by Age Group, Adjusted Decennial Census (000's) | ||||||

| 1990 | 2000 | 2010 | 2000-1990 | 2010-2000 | 2010-1990 | |

| Total | 92,434 | 105,809 | 116,752 | 13,375 | 10,943 | 24,318 |

| 15-24 | 5,283 | 5,551 | 5,403 | 268 | -148 | 120 |

| 25-34 | 20,407 | 18,355 | 17,963 | -2,052 | -392 | -2,444 |

| 35-44 | 20,515 | 24,043 | 21,298 | 3,528 | -2,745 | 783 |

| 45-54 | 14,392 | 21,359 | 24,915 | 6,967 | 3,556 | 10,523 |

| 55-64 | 12,253 | 14,291 | 21,347 | 2,038 | 7,056 | 9,094 |

| 65-74 | 11,250 | 11,544 | 13,509 | 294 | 1,965 | 2,259 |

| 75+ | 8,334 | 10,666 | 12,319 | 2,332 | 1,653 | 3,985 |

| Homeowners by Age Group, Adjusted CPS/ASEC (000's) | ||||||

| 1990 | 2000 | 2010 | 2000-1990 | 2010-2000 | 2010-1990 | |

| Total | 59,623 | 71,620 | 79,684 | 11,997 | 8,064 | 20,061 |

| 15-24 | 820 | 1,232 | 1,446 | 412 | 214 | 626 |

| 25-34 | 9,223 | 8,772 | 8,633 | -451 | -139 | -590 |

| 35-44 | 13,754 | 16,200 | 14,232 | 2,446 | -1,968 | 478 |

| 45-54 | 10,929 | 16,252 | 18,455 | 5,323 | 2,203 | 7,526 |

| 55-64 | 9,847 | 11,139 | 16,326 | 1,292 | 5,187 | 6,479 |

| 65-74 | 9,101 | 9,593 | 10,984 | 492 | 1,391 | 1,883 |

| 75+ | 5,949 | 8,432 | 9,608 | 2,483 | 1,176 | 3,659 |

| Homeowners by Age Group, Adjusted Decennial Census (000's) | ||||||

| 1990 | 2000 | 2010 | 2000-1990 | 2010-2000 | 2010-1990 | |

| Total | 59,246 | 69,927 | 76,140 | 10,681 | 6,213 | 16,894 |

| 15-24 | 905 | 992 | 872 | 87 | -120 | -33 |

| 25-34 | 9,281 | 8,350 | 7,562 | -931 | -788 | -1,719 |

| 35-44 | 13,625 | 15,892 | 13,283 | 2,267 | -2,609 | -342 |

| 45-54 | 10,874 | 15,982 | 17,840 | 5,108 | 1,858 | 6,966 |

| 55-64 | 9,792 | 11,385 | 16,536 | 1,593 | 5,151 | 6,744 |

| 65-74 | 8,889 | 9,369 | 10,856 | 480 | 1,487 | 1,967 |

| 75+ | 5,881 | 7,958 | 9,191 | 2,077 | 1,233 | 3,310 |

There are a few things worth noting. For 1990 the adjusted CPS/ASEC household and homeowner counts are not too far off from the adjusted Decennial Census Counts either in total or by age. By 2000, however, the CPS/ASEC homeowner counts were significantly higher than the Decennial Census Counts, and that gap widened sharply in 2010. That “gap” was especially striking for estimates of young adult homeowners, where CPS/ASEC estimates massively exceeded decennial Census estimates. CPS/ASEC estimates of total household growth from 2000 to 2010 also were significantly higher than growth shown in the Decennial Census, with most of the difference coming in growth estimates for younger adults. The rather sizable disparities between CPS/ASEC estimates of younger adult households (and even more so for homeowners) and Decennial Census estimates for 2010 is rather disturbing, and suggests that the CPS/ASEC may not provide a particular good measure of the living arrangements of “young” adults.

This comparison also suggests that housing economists looking either to analyze past household/homeowner trends by age, or to project future household growth and homeowner growth by age, should probably not use the CPS/ACS estimates to produce such analysis or forecasts. In addition, people looking for household projections should be extremely leery of projections based on CPS/ASEC data (the recently released from the Joint Center for Housing Studies comes to mind).

Thursday, January 19, 2017

Yellen: The Economic Outlook and the Conduct of Monetary Policy

by Calculated Risk on 1/19/2017 08:07:00 PM

From Fed Chair Janet Yellen: The Economic Outlook and the Conduct of Monetary Policy

In my remarks today, I will review the considerable progress the economy has made toward the attainment of the two objectives that the Congress has assigned to the Federal Reserve--maximum employment and price stability. The upshot is that labor utilization is close to its estimated longer-run normal level, and we are closing in on our 2 percent inflation objective. I will then discuss the prospects for adjusting monetary policy in the manner needed to sustain a strong job market while maintaining low and stable inflation. Determining how best to adjust the federal funds rate over time to achieve these objectives will not be easy. For that reason, in the balance of my remarks, I will discuss some considerations that will help inform our decisions, including the guidance provided by simple policy rules. I will conclude by touching on some key uncertainties affecting the outlook.

...

I think that allowing the economy to run markedly and persistently "hot" would be risky and unwise. Waiting too long to remove accommodation could cause inflation expectations to begin ratcheting up, driving actual inflation higher and making it harder to control. The combination of persistently low interest rates and strong labor market conditions could lead to undesirable increases in leverage and other financial imbalances, although such risks would likely take time to emerge. Finally, waiting too long to tighten policy could require the FOMC to eventually raise interest rates rapidly, which could risk disrupting financial markets and pushing the economy into recession. For these reasons, I consider it prudent to adjust the stance of monetary policy gradually over time--a strategy that should improve the prospects that the economy will achieve sustainable growth with the labor market operating at full employment and inflation running at about 2 percent.

...

To sum up, simple policy rules can serve as useful benchmarks to help assess how monetary policy should be adjusted over time. However, their prescriptions must be interpreted carefully, both because estimates of some of their key inputs can vary significantly and because the rules often do not take into account important considerations and information pertaining to the outlook. For these reasons, the rules should not be followed mechanically, since doing so could have adverse consequences for the economy.

...

Conclusion

My remarks have focused on the policy trajectory that the Committee now considers likely to be appropriate to sustain the economic expansion while keeping inflation close to our 2 percent goal. In concluding, it is important to emphasize the considerable uncertainty that attaches to such assessments and the need to constantly update them.

In particular, the path of the neutral federal funds rate, which plays an important role in determining the appropriate policy path, is highly uncertain. For example, productivity growth is a key determinant of the neutral rate, and while most forecasters expect productivity growth to pick up from its recent unusually slow pace, the timing of such a pickup is highly uncertain. Indeed, there is little consensus among researchers about the causes of the recent slowdown in productivity growth that has occurred both at home and abroad. The strength of global growth will also have an important bearing on the neutral rate through both trade and financial channels, and here, too, the scope for surprises is considerable. Finally, I would mention the potential for changes in fiscal policy to affect the economic outlook and the appropriate policy path. At this point, however, the size, timing, and composition of such changes remain uncertain. However, as this discussion highlights, the course of monetary policy over the next few years will depend on many different factors, of which fiscal policy is just one.

Comments on December Housing Starts

by Calculated Risk on 1/19/2017 01:25:00 PM

Earlier: Housing Starts increased to 1.226 Million Annual Rate in December

The housing starts report this morning was above consensus because of the sharp increase in multi-family starts. Multi-family is frequently volatile month-to-month, and has seen especially wild swings over the last four months.

Meanwhile single family starts were decent. Just remember that multi-family can be very volatile ...

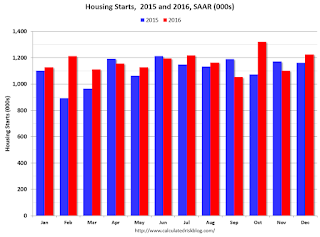

This first graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Starts were up 4.9% in 2016 compared to 2015. My guess was starts would increase 4% to 8% in 2016.

Multi-family starts are down 3.1% in 2016, and single-family starts are up 9.3% year-over-year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has started to decline. Completions (red line) have lagged behind - but completions have been generally catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.