by Calculated Risk on 11/04/2016 08:42:00 AM

Friday, November 04, 2016

October Employment Report: 161,000 Jobs, 4.9% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 161,000 in October, and the unemployment rate was little changed at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in health care, professional and business services, and financial activities.

...

The change in total nonfarm payroll employment for August was revised up from +167,000 to +176,000, and the change for September was revised up from +156,000 to +191,000. With these revisions, employment gains in August and September combined were 44,000 more than previously reported.

...

In October, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents to $25.92, following an 8-cent increase in September. Over the year, average hourly earnings have risen by 2.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 161 thousand in October (private payrolls increased 142 thousand).

Payrolls for August and September were revised up by a combined 44 thousand.

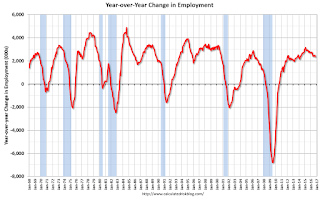

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.36 million jobs. A solid gain.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased in September to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate decreased in September to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio decreased to 59.7% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in October to 4.9%.

This was slightly below expectations of 170,000 jobs, however job growth for August and September were revised up - and there was solid wage growth. A solid report.

I'll have much more later ...

Thursday, November 03, 2016

Friday: Employment Report, Trade Deficit

by Calculated Risk on 11/03/2016 08:08:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drift Higher Ahead of Jobs Report

Mortgage Rates were slightly higher today, keeping them in line with the weakest levels in just over 5 months. "Weakness" is relative, however. Apart from the past 5 months, and a few months in 2012, today's rates would rank among all-time lows. Day-to-day movement hasn't been extreme for the past few days, with most lenders continuing to quote 3.625% on top tier conventional 30yr fixed scenarios, and merely making small adjustments to the upfront costs depending on market movement.Friday:

emphasis added

• At 8:30 AM ET, Employment Report for October. The consensus is for an increase of 178,000 non-farm payroll jobs added in October, up from the 156,000 non-farm payroll jobs added in September. The consensus is for the unemployment rate to decline to 4.9%.

• Also at 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to be at $38.9 billion in September from $40.7 billion in August.

October Employment Preview

by Calculated Risk on 11/03/2016 03:53:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus, according to Bloomberg, is for an increase of 178,000 non-farm payroll jobs in October (with a range of estimates between 155,000 to 200,000), and for the unemployment rate to decrease to 4.9%.

The BLS reported 156,000 jobs added in September.

Here are a few excerpts from Goldman Sachs' October Payroll Preview by economists Elad Pashtan and Zach Pandl:

We forecast an increase of 185k in nonfarm payroll employment for October, slightly above consensus expectations. An expected rebound in employment growth for state and local governments, as well as education- and health care-related industries, is a key reason for the acceleration from a 156k gain in payrolls in September.Here is a summary of recent data:

We look for a decline in the unemployment rate to 4.9%, which is now unusually high compared with continuing jobless claims. Favorable calendar effects as well as strengthening underlying wage tends likely boosted average hourly earnings by 0.3% month-over-month.

emphasis added

• The ADP employment report showed an increase of 147,000 private sector payroll jobs in October. This was below expectations of 170,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat below expectations.

• The ISM manufacturing employment index increased in October to 52.9%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased slightly in October. The ADP report indicated 1,000 manufacturing jobs lost in October.

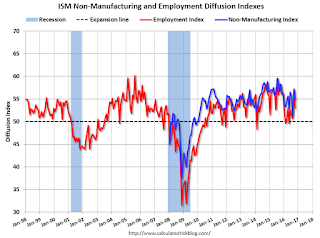

The ISM non-manufacturing employment index decreased in October to 53.1%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 156,000 in October.

Combined, the ISM indexes suggests employment gains of about 155,000. This suggests employment growth somewhat below expectations.

• Initial weekly unemployment claims averaged 258,000 in October, up from 256,000 in September. For the BLS reference week (includes the 12th of the month), initial claims were at 252,000, up from 251,000 during the reference week in August.

The slight increase during the reference suggests about the same level of labor stress in October as in September. This suggests another positive employment report.

• The final October University of Michigan consumer sentiment index decreased to 87.2 from the September reading of 91.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and possibly politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. The ADP and the ISM reports suggest weaker job growth. And it is possible Hurricane Matthew negatively impacted employment in a few states.

My guess is the October report will be below the consensus forecast.

Fannie and Freddie: REO inventory declined in Q3, Down 31% Year-over-year

by Calculated Risk on 11/03/2016 12:43:00 PM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 12,185 at the end of Q3 2106 compared to 17,780 at the end of Q3 2015.

For Freddie, this is down 84% from the 74,897 peak number of REOs in Q3 2010. For Freddie, this is the lowest since at least 2007.

Fannie Mae reported the number of REO declined to 41,973 at the end of Q3 2016 compared to 60,958 at the end of Q3 2015.

For Fannie, this is down 75% from the 166,787 peak number of REOs in Q3 2010. For Fannie, this is the lowest since Q4 2007.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q3 for both Fannie and Freddie, and combined inventory is down 31% year-over-year.

Delinquencies are falling, but there are still a number of properties in the foreclosure process with long time lines in judicial foreclosure states - but this is getting close to normal levels of REOs.

ISM Non-Manufacturing Index declined to 54.8% in October

by Calculated Risk on 11/03/2016 10:04:00 AM

The September ISM Non-manufacturing index was at 54.8%, down from 57.1% in September. The employment index decreased in October to 53.1%, from 57.2%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:October 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 81st consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 54.8 percent in October, 2.3 percentage points lower than the September reading of 57.1 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 57.7 percent, 2.6 percentage points lower than the September reading of 60.3 percent, reflecting growth for the 87th consecutive month, at a slower rate in October. The New Orders Index registered 57.7 percent, 2.3 percentage points lower than the reading of 60 percent in September. The Employment Index decreased 4.1 percentage points in October to 53.1 percent from the September reading of 57.2 percent. The Prices Index increased 2.6 percentage points from the September reading of 54 percent to 56.6 percent, indicating prices increased in October for the seventh consecutive month. According to the NMI®, 13 non-manufacturing industries reported growth in October. There has been a slight cooling-off in the non-manufacturing sector month-over-month, indicating that last month’s increases weren’t sustainable. Respondent’s comments remain mostly positive about business conditions and the overall economy. Several comments were made about the uncertainty on the impact of the upcoming U.S. presidential election."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.1, and suggests slower expansion in October than in September.

Weekly Initial Unemployment Claims increase to 265,000

by Calculated Risk on 11/03/2016 08:34:00 AM

The DOL reported:

In the week ending October 29, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 7,000 from the previous week's unrevised level of 258,000. The 4-week moving average was 257,750, an increase of 4,750 from the previous week's unrevised average of 253,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 87 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 257,750.

This was above the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, November 02, 2016

Thursday: Unemployment Claims, ISM non-Mfg Index

by Calculated Risk on 11/02/2016 07:16:00 PM

From Tim Duy at Fed Watch: Fed Remains On The Sidelines, Excerpt:

As expected, the Federal Reserve left policy unchanged this month. The statement itself was largely unchanged as well. .... Thursday:

We get two employment reports before the December meeting; for the Fed to stay on the sidelines yet again, we probably need to see both reports come in weak. The first one - for October - comes Friday morning. ADP estimates that private payrolls will be up 147k - not surging, but still easily sufficient for the Fed to justify a rate hike. If this comes to pass, we would probably need a deluge of soft numbers to keep the Fed on hold again.

Bottom Line: Fed is looking past the election to the December meeting for its second move in this rate hike cycle. Probably need some unlikely softer numbers to hold them back again

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 258 thousand the previous week.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is a 0.2% increase in orders.

• Also at 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 56.1 from 57.1 in August.

FOMC Statement: No Change to Policy

by Calculated Risk on 11/02/2016 02:02:00 PM

No strong signal about December ...

FOMC Statement:

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and growth of economic activity has picked up from the modest pace seen in the first half of this year. Although the unemployment rate is little changed in recent months, job gains have been solid. Household spending has been rising moderately but business fixed investment has remained soft. Inflation has increased somewhat since earlier this year but is still below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation have moved up but remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will strengthen somewhat further. Inflation is expected to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The Committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action were: Esther L. George and Loretta J. Mester, each of whom preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.

emphasis added

Update: The Endless Parade of Recession Calls

by Calculated Risk on 11/02/2016 10:42:00 AM

It was almost a year ago that I wrote: The Endless Parade of Recession Calls. In that post, I pointed out that I wasn't "even on recession watch". Here is a repeat of that post with a few updates in italics.

Note: I've made one recession call since starting this blog. One of my predictions for 2007 was a recession would start as a result of the housing bust (made it by one month - the recession started in December 2007). That prediction was out of the consensus for 2007 and, at the time, ECRI was saying a "recession is no longer a serious concern". Ouch.

For the last 6+ years [now 7+ years], there have been an endless parade of incorrect recession calls. The most reported was probably the multiple recession calls from ECRI in 2011 and 2012.

In May of [2015], ECRI finally acknowledged their incorrect call, and here is their admission : The Greater Moderation

In line with the old adage, “never say never,” [ECRI's] September 2011 U.S. recession forecast did turn out to be a false alarm.I disagreed with that call in 2011; I wasn't even on recession watch!

And here is another call [last December] via CNBC: US economy recession odds '65 percent': Investor

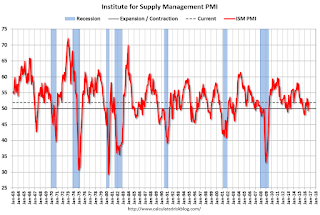

Raoul Pal, the publisher of The Global Macro Investor, reiterated his bearishness ... "The economic situation is deteriorating fast." ... [The ISM report] "is showing that the U.S. economy is almost at stall speed now," Pal said. "It gives us a 65 percent chance of a recession in the U.S.Here is the report Pal is referring to from the Institute for Supply Management: November 2015 Manufacturing ISM® Report On Business®

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index [from last November].

The manufacturing sector has been weak, and contracted in the US in November due to a combination of weakness in the oil sector, the strong dollar and some global weakness. But this doesn't mean the US will enter a recession.

The last time the index contracted was in 2012 (no recession), and has shown contraction a number of times outside of a recession.

[Here is an update through October 2016. Manufacturing was weak due to the sharp decline in oil investment, but now the ISM index is showing expansion again.]

[Here is an update through October 2016. Manufacturing was weak due to the sharp decline in oil investment, but now the ISM index is showing expansion again.]Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). [a recession in 2017 is very unlikely]. Someday I'll make another recession call, but I'm not even on recession watch now.

[Still not on recession watch!]

ADP: Private Employment increased 147,000 in October

by Calculated Risk on 11/02/2016 08:20:00 AM

Private sector employment increased by 147,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 170,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong although the pace of growth appears to be slowing. Behind the slowdown is businesses’ difficulty filling open positions. However, there is some weakness in construction, education and mining."

The BLS report for October will be released Friday, and the consensus is for 178,000 non-farm payroll jobs added in October.