by Calculated Risk on 11/02/2016 10:42:00 AM

Wednesday, November 02, 2016

Update: The Endless Parade of Recession Calls

It was almost a year ago that I wrote: The Endless Parade of Recession Calls. In that post, I pointed out that I wasn't "even on recession watch". Here is a repeat of that post with a few updates in italics.

Note: I've made one recession call since starting this blog. One of my predictions for 2007 was a recession would start as a result of the housing bust (made it by one month - the recession started in December 2007). That prediction was out of the consensus for 2007 and, at the time, ECRI was saying a "recession is no longer a serious concern". Ouch.

For the last 6+ years [now 7+ years], there have been an endless parade of incorrect recession calls. The most reported was probably the multiple recession calls from ECRI in 2011 and 2012.

In May of [2015], ECRI finally acknowledged their incorrect call, and here is their admission : The Greater Moderation

In line with the old adage, “never say never,” [ECRI's] September 2011 U.S. recession forecast did turn out to be a false alarm.I disagreed with that call in 2011; I wasn't even on recession watch!

And here is another call [last December] via CNBC: US economy recession odds '65 percent': Investor

Raoul Pal, the publisher of The Global Macro Investor, reiterated his bearishness ... "The economic situation is deteriorating fast." ... [The ISM report] "is showing that the U.S. economy is almost at stall speed now," Pal said. "It gives us a 65 percent chance of a recession in the U.S.Here is the report Pal is referring to from the Institute for Supply Management: November 2015 Manufacturing ISM® Report On Business®

Click on graph for larger image.

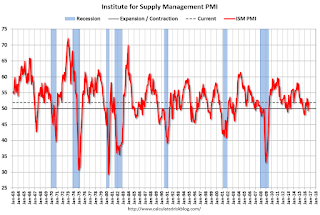

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index [from last November].

The manufacturing sector has been weak, and contracted in the US in November due to a combination of weakness in the oil sector, the strong dollar and some global weakness. But this doesn't mean the US will enter a recession.

The last time the index contracted was in 2012 (no recession), and has shown contraction a number of times outside of a recession.

[Here is an update through October 2016. Manufacturing was weak due to the sharp decline in oil investment, but now the ISM index is showing expansion again.]

[Here is an update through October 2016. Manufacturing was weak due to the sharp decline in oil investment, but now the ISM index is showing expansion again.]Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). [a recession in 2017 is very unlikely]. Someday I'll make another recession call, but I'm not even on recession watch now.

[Still not on recession watch!]