by Calculated Risk on 11/02/2016 10:42:00 AM

Wednesday, November 02, 2016

Update: The Endless Parade of Recession Calls

It was almost a year ago that I wrote: The Endless Parade of Recession Calls. In that post, I pointed out that I wasn't "even on recession watch". Here is a repeat of that post with a few updates in italics.

Note: I've made one recession call since starting this blog. One of my predictions for 2007 was a recession would start as a result of the housing bust (made it by one month - the recession started in December 2007). That prediction was out of the consensus for 2007 and, at the time, ECRI was saying a "recession is no longer a serious concern". Ouch.

For the last 6+ years [now 7+ years], there have been an endless parade of incorrect recession calls. The most reported was probably the multiple recession calls from ECRI in 2011 and 2012.

In May of [2015], ECRI finally acknowledged their incorrect call, and here is their admission : The Greater Moderation

In line with the old adage, “never say never,” [ECRI's] September 2011 U.S. recession forecast did turn out to be a false alarm.I disagreed with that call in 2011; I wasn't even on recession watch!

And here is another call [last December] via CNBC: US economy recession odds '65 percent': Investor

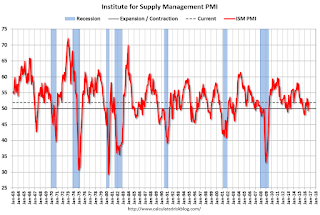

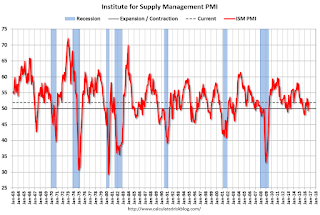

Raoul Pal, the publisher of The Global Macro Investor, reiterated his bearishness ... "The economic situation is deteriorating fast." ... [The ISM report] "is showing that the U.S. economy is almost at stall speed now," Pal said. "It gives us a 65 percent chance of a recession in the U.S.Here is the report Pal is referring to from the Institute for Supply Management: November 2015 Manufacturing ISM® Report On Business®

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index [from last November].

The manufacturing sector has been weak, and contracted in the US in November due to a combination of weakness in the oil sector, the strong dollar and some global weakness. But this doesn't mean the US will enter a recession.

The last time the index contracted was in 2012 (no recession), and has shown contraction a number of times outside of a recession.

[Here is an update through October 2016. Manufacturing was weak due to the sharp decline in oil investment, but now the ISM index is showing expansion again.]

[Here is an update through October 2016. Manufacturing was weak due to the sharp decline in oil investment, but now the ISM index is showing expansion again.]Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). [a recession in 2017 is very unlikely]. Someday I'll make another recession call, but I'm not even on recession watch now.

[Still not on recession watch!]

ADP: Private Employment increased 147,000 in October

by Calculated Risk on 11/02/2016 08:20:00 AM

Private sector employment increased by 147,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 170,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong although the pace of growth appears to be slowing. Behind the slowdown is businesses’ difficulty filling open positions. However, there is some weakness in construction, education and mining."

The BLS report for October will be released Friday, and the consensus is for 178,000 non-farm payroll jobs added in October.

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 11/02/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 28, 2016.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.4 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since June 2016, 3.75 percent, from 3.71 percent, with points decreasing to 0.36 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity increased this year since rates declined, however, since rates are up a little recently, refinance activity has declined a little.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "9 percent higher than the same week one year ago".

Tuesday, November 01, 2016

Wednesday: FOMC Announcement, ADP Employment

by Calculated Risk on 11/01/2016 08:47:00 PM

A few excerpts from a piece by Goldman Sachs economists Zach Pandl and Jan Hatzius

• We expect the statement [the] FOMC meeting to remain relatively upbeat about US growth prospects ... However, the committee is very unlikely to raise the funds rate. ...Wednesday:

• To keep markets on notice for a possible rate hike in December, we expect the statement to indicate that the committee is considering action “at its next meeting”—although this is a close call. The statement will likely again say that risks to the economic outlook are “roughly balanced”.

• A statement along these lines should keep the committee on track to raise the funds rate at the December meeting. We see a 75% chance of an increase, roughly in line with market expectations. The remaining uncertainty relates to incoming economic data and financial conditions ... conditional on decent data and stable markets, a December rate hike looks very likely.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in October, up from 154,000 added in September.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

U.S. Light Vehicle Sales increase to 17.9 million annual rate in October

by Calculated Risk on 11/01/2016 02:30:00 PM

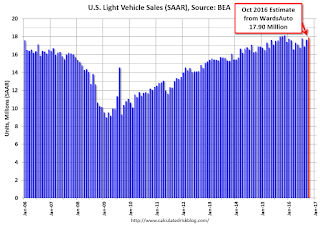

Based on a preliminary estimate from WardsAuto (estimate for Ford), light vehicle sales were at a 17.9 million SAAR in October.

That is down about slightly from October 2015, and up 1.3% from the 17.65 million annual sales rate last month.

From Erin Sunde at WardsAuto October 2016 U.S. LV Sales Thread: Automakers Hit 17.9 Million SAAR

U.S. automakers delivered 1.36 million light vehicles last month, resulting in 17.90 million SAAR, the highest SAAR of any month this year. The daily sales rate of 52,458 over 26 selling days was 15-year high for the month, beating prior-year by 1.5% (28 days).

...

Ford postponed reporting due to a fire at its headquarters.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 17.90 million SAAR from WardsAuto).

This was above the consensus forecast of 17.7 million SAAR (seasonally adjusted annual rate) and the best sales month for 2016.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Sales for 2016 - through the first ten months - are up slightly from the comparable period last year.

After increasing significantly for several years following the financial crisis, auto sales are now moving mostly sideways ...

Construction Spending declined in September

by Calculated Risk on 11/01/2016 11:30:00 AM

Earlier today, the Census Bureau reported that overall construction spending declined in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2016 was estimated at a seasonally adjusted annual rate of $1,150.0 billion, 0.4 percent below the revised August estimate of $1,154.4 billion. The September figure is 0.2 percent below the September 2015 estimate of $1,152.1 billion.Both private spending and public spending decreased in September:

During the first 9 months of this year, construction spending amounted to $863.2 billion, 4.4 percent above the $826.8 billion for the same period in 2015.

Spending on private construction was at a seasonally adjusted annual rate of $879.7 billion, 0.2 percent below the revised August estimate of $881.6 billion. ...August was revised up to -0.5% from -0.7%, and July revised up sharply to 0.5% from -0.3%.

In September, the estimated seasonally adjusted annual rate of public construction spending was $270.3 billion, 0.9 percent below the revised August estimate of $272.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, but is 33% below the bubble peak.

Non-residential spending is now 3% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 17% below the peak in March 2009, and only 3% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 1%. Non-residential spending is up 4% year-over-year. Public spending is down 8% year-over-year.

Looking forward, all categories of construction spending should increase in the coming year. Residential spending is still fairly low, non-residential is increasing - although there has been a recent decline in public spending.

This was well below the consensus forecast of a 0.6% increase for September.

ISM Manufacturing index increased to 51.9 in October

by Calculated Risk on 11/01/2016 10:04:00 AM

The ISM manufacturing index indicated expansion in October. The PMI was at 51.9% in October, up from 51.5% in September. The employment index was at 52.9%, up from 49.7% last month, and the new orders index was at 52.1%, down from 55.1%.

From the Institute for Supply Management: October 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October, and the overall economy grew for the 89th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The October PMI® registered 51.9 percent, an increase of 0.4 percentage point from the September reading of 51.5 percent. The New Orders Index registered 52.1 percent, a decrease of 3 percentage points from the September reading of 55.1 percent. The Production Index registered 54.6 percent, 1.8 percentage points higher than the September reading of 52.8 percent. The Employment Index registered 52.9 percent, an increase of 3.2 percentage points from the September reading of 49.7 percent. Inventories of raw materials registered 47.5 percent, a decrease of 2 percentage points from the September reading of 49.5 percent. The Prices Index registered 54.5 percent in October, an increase of 1.5 percentage points from the September reading of 53 percent, indicating higher raw materials prices for the eighth consecutive month. Comments from the panel are largely positive citing a favorable economy and steady sales, with some exceptions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 51.6%, and suggests manufacturing expanded in October.

CoreLogic: House Prices up 6.3% Year-over-year in September

by Calculated Risk on 11/01/2016 08:55:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6.3 Percent in September 2016

Home prices nationwide, including distressed sales, increased year over year by 6.3 percent in September 2016 compared with September 2015 and increased month over month by 1.1 percent in September 2016 compared with August 2016, according to the CoreLogic HPI.

...

“Home-equity wealth has doubled during the last five years to $13 trillion, largely because of the recovery in home prices,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Nationwide during the past year, the average gain in housing wealth was about $11,000 per homeowner, but with wide geographic variation.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in September (NSA), and is up 6.3% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 5.2% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty six consecutive months since turning positive year-over-year in February 2012.

Monday, October 31, 2016

Tuesday: ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 10/31/2016 06:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates End October Just Off 5-Month Highs

Mortgage Rates moved sideways to slightly lower for the 2nd day in a row, after hitting the highest levels in 5 months on Thursday. While the positive progress is better than a sharp stick in the eye, it nonetheless leaves us right in line with highs for all practical purposes. In fact, virtually all lenders are putting out quotes today that are indistinguishable from Thursday's for most prospective borrowers. The most prevalently-quoted conventional 30yr fixed rate remains 3.625% on top tier scenarios, with a handful of the most aggressive lenders at 3.5%.Tuesday:

emphasis added

• At 10:00 AM ET, ISM Manufacturing Index for October. The consensus is for the ISM to be at 51.6, up from 51.5 in September. The ISM manufacturing index indicated expansion at 51.5% in September. The employment index was at 49.7%, and the new orders index was at 55.1%.

• At 10:00 AM, Construction Spending for September. The consensus is for a 0.6% increase in construction spending.

• All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.6 million SAAR in October, from 17.7 million in September (Seasonally Adjusted Annual Rate).

Q3 2016 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/31/2016 01:41:00 PM

The BEA has released the underlying details for the Q3 advance GDP report this morning.

The BEA reported that investment in non-residential structures increased at a 5.4% annual pace in Q3. This is a turnaround from recent quarters when non-residential investment declined due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration still declined in Q3, from a $47.1 billion annual rate in Q2 to a $42.2 billion annual rate in Q3 - and is down from $149 billion in Q3 2014 (down by more than two-thirds).

Excluding petroleum, non-residential investment in structures increased at a 10% annual rate in Q3.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q3, and is up 28% year-over-year -increasing from a very low level - and is now above the lows for previous recessions (as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was up year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q3, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 23% year-over-year.

My guess is office and hotel investment growth will start to slow (office vacancies are still high, although hotel occupancy is near record levels). But investment growth has been very strong this year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $237 billion (SAAR) (about 1.3% of GDP), and was down in Q3 compared to Q2, but is down slightly year-over-year.

Investment in home improvement was at a $223 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.1% of GDP), and is up 9% year-over-year.