by Calculated Risk on 7/29/2016 11:52:00 AM

Friday, July 29, 2016

Q2 GDP: Investment Slump

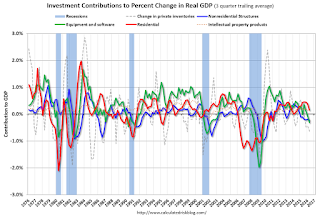

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

There was an investment slump in Q2, even though consumer spending was strong (PCE increased at 4.2% annual rate in Q2).

Residential investment (RI) decreased at a 6.1% annual rate in Q2. Equipment investment decreased at a 3.5% annual rate, and investment in non-residential structures decreased at a 7.9% annual rate.

On a 3 quarter trailing average basis, RI (red) is positive, equipment (green) and nonresidential structures (blue) are negative.

Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to pick up going forward (except for maybe energy and power), and for the economy to grow at a steady pace.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has generally been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Although there was an investment slump in Q2 - no worries - residential investment will pickup (still very low), and non-residential (except energy) will also pickup. Investment in inventory has been negative for five consecutive quarters, and that should make a positive contribution soon.

Chicago PMI declines in July, Final July Consumer Sentiment at 90.0

by Calculated Risk on 7/29/2016 10:15:00 AM

Chicago PMI: July Chicago Business Barometer Down 1 Point to 55.8

The MNI Chicago Business Barometer fell 1 point to 55.8 in July from the 1½-year high of 56.8 in June, led by a fall in New Orders. Smaller declines were seen in Production and Order Backlogs, which offset a strong increase in the Employment component.This was above the consensus forecast of 54.0.

The Barometer’s three-month average, though, which provides a better picture of the underlying trend in economic activity, rose to 54.0 from 52.2 in Q2, the highest since February 2015.

...

“Demand and output softened somewhat in July following a solid showing in June but still outperformed the very weak results seen earlier in the year. On the upside, it was the first time since January 2015 that all five Barometer components were above 50. Looking at the three-month average, the Chicago Business Barometer so far suggests economic activity running at a healthier pace in Q3,” said Lorena Castellanos, senior economist at MNI Indicators.

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for July was at 90.0, up from the preliminary reading 89.5, and down from 93.5 in June.

"Although confidence strengthened in late July, for the month as a whole the Sentiment Index was still below last month's level mainly due to increased concerns about economic prospects among upper income households. The Brexit vote was spontaneously mentioned by record numbers of households with incomes in the top third (23%), more than twice as frequently as among households with incomes in the bottom two-thirds (11%). Given the prompt rebound in stock prices as well as the tiny direct impact on U.S. trade, it is surprising that concerns about Brexit remained nearly as high in late July as immediately following the Brexit vote. While concerns about Brexit are likely to quickly recede, weaker prospects for the economy are likely to remain. Uncertainties surrounding global economic prospects and the presidential election will keep consumers more cautious in their expectations for future economic growth. "

emphasis added

BEA: Real GDP increased at 1.2% Annualized Rate in Q2

by Calculated Risk on 7/29/2016 08:37:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2016 (Advance Estimate)

Real gross domestic product increased at an annual rate of 1.2 percent in the second quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent (revised).The advance Q1 GDP report, with 1.2% annualized growth, was below expectations of a 2.6% increase.

...

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE) and exports that were partly offset by negative contributions from private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The acceleration in real GDP growth in the second quarter reflected an acceleration in PCE, an upturn in exports, and smaller decreases in nonresidential fixed investment and in federal government spending. These were partly offset by a larger decrease in private inventory investment, and downturns in residential fixed investment and in state and local government spending.

emphasis added

Personal consumption expenditures (PCE) increased at a 4.2% annualized rate in Q2, up from 1.6% in Q1. Residential investment (RI) decreased at a 6.1% pace. Equipment investment decreased at a 3.5% annualized rate, and investment in non-residential structures decreased at a 7.9% pace (due to the recent decline in oil prices).

The key negatives were investment in inventories (subtracted 1.16 percentage points), fixed investment (subtracted 0.52 percentage point), and government spending (subtracted 0.16 percentage points).

I'll have more later ...

Thursday, July 28, 2016

Friday: Q2 GDP, Chicago PMI, Consumer Sentiment

by Calculated Risk on 7/28/2016 08:14:00 PM

Note: As part of the GDP release tomorrow, the BEA will also release the annual revision. From the BEA:

The annual revision of the national income and product accounts, covering the first quarter of 2013 through the first quarter of 2016, will be released along with the "advance" estimate of GDP for the second quarter of 2016 on July 29. For more information, see “Preview of the Upcoming Annual NIPA Revision” included in the May Survey of Current Business article on “GDP and the Economy”.Friday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2016 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q2. The annual revision will also be released.

• At 9:45 AM, Chicago Purchasing Managers Index for July. The consensus is for a reading of 54.0, down from 56.8 in June.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 90.6, up from the preliminary reading 89.5, and down from 93.5 in June.

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since May 2008

by Calculated Risk on 7/28/2016 05:04:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in June to 1.32%, down from 1.38% in May. The serious delinquency rate is down from 1.66% in June 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is the lowest rate since May 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.34 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2017.

Note: Freddie Mac reported yesterday.

Zillow Forecast: Expect slightly slower YoY Growth in June for the Case-Shiller Indexes

by Calculated Risk on 7/28/2016 03:51:00 PM

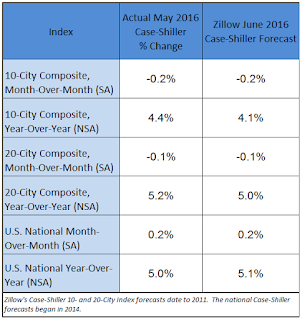

The Case-Shiller house price indexes for May were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: June Case-Shiller Forecast: Expect a Third Straight Monthly Decline in 10- and 20-City Indices

May Case-Shiller data showed modestly slower growth largely in line with expectations, with seasonally adjusted home prices falling for two months in a row on the 10- and 20-city indices – a rare occurrence since the recovery began in earnest. Looking ahead, Zillow’s June Case-Shiller forecast calls for more of the same, with seasonally adjusted prices in the 10- and 20-city indices set to fall for a third straight month, while annual growth stays largely flat.The year-over-year change for the 20-city index will probably be slightly lower in the June report than in the May report. The change for the National index will probably be about the same.

The June Case-Shiller National Index is expected to grow 5.1 percent year-over-year and 0.2 percent month-to-month (seasonally adjusted). We expect the 10-City Index to grow 4.1 percent year-over-year and to fall 0.2 percent (SA) from May. The 20-City Index is expected to grow 5 percent between June 2015 and June 2016, and fall 0.1 percent (SA) from May.

Zillow’s June Case-Shiller forecast is shown in the table below. These forecasts are based on today’s May Case-Shiller data release and the June 2016 Zillow Home Value Index (ZHVI). The June Case-Shiller Composite Home Price Indices will not be officially released until Tuesday, August 30.

Kansas City Fed: Regional Manufacturing Activity "Declined Modestly" in July

by Calculated Risk on 7/28/2016 11:21:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Modestly

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined modestly.This was the last of the regional Fed surveys for July.

“Factories in our region reported a slight pullback in July following modest expansion in June,” said Wilkerson. “However, their expectations for future activity continued to increase.”

...

The month-over-month composite index was -6 in July, down from 2 in June and -5 in May ... The employment index inched down to -5 ...

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

It seems likely the ISM manufacturing index will show expansion again in July.

HVS: Q2 2016 Homeownership and Vacancy Rates

by Calculated Risk on 7/28/2016 10:10:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2016.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.1% in Q2, from 63.5% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and the Reis survey is showing rental vacancy rates have started to increase.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate is probably close to the bottom.

Weekly Initial Unemployment Claims increased to 264,000

by Calculated Risk on 7/28/2016 08:35:00 AM

The DOL reported:

In the week ending July 23, the advance figure for seasonally adjusted initial claims was 266,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 253,000 to 252,000. The 4-week moving average was 256,500, a decrease of 1,000 from the previous week's revised average. The previous week's average was revised down by 250 from 257,750 to 257,500.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 73 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 256,500.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, July 27, 2016

Thursday: Unemployment Claims

by Calculated Risk on 7/27/2016 07:13:00 PM

Based on the FOMC statement, the likelihood of a rate hike in September (or November or December) has increased. Most analysts talk about possible rate hikes in September or December (ignoring November) because of the scheduled press conferences. However Fed Chair Janet Yellen has made it clear that all meetings are "live", so November is possible too. Some people think the Fed will wait until after the election, but I doubt that is a factor being considered.

Back to the FOMC statement: The first paragraph was about as upbeat as back in April when many analysts thought a rate hike in June was possible. So now the key is the data (the minutes will also be interesting). There are two employment reports (the July and August reports) between now and the meeting on September 20th and 21st. Also the advance and second estimate of Q2 GDP will be released, and PCE for June and July, and CPI for July and August will be released before the September meeting. If the data is solid, the FOMC might raise rates in September.

If the data is disappointing - as has happened so many times before - the FOMC will wait.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 264 thousand initial claims, up from 253 thousand the previous week.

• At 10:00 AM, the Q2 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for July. This is the last of the regional Fed surveys for July.