by Calculated Risk on 3/04/2016 01:00:00 PM

Friday, March 04, 2016

Comments: A Strong Employment Report

This was a strong employment report.

The unemployment rate was unchanged at 4.9% even as the participation rate increased (another strong household survey). Not only was the headline number above the consensus forecast, but revisions were up for the previous two months. This was strong job growth.

Earlier: February Employment Report: 242,000 Jobs, 4.9% Unemployment Rate

A few more numbers: Total employment is now 5.1 million above the previous peak. Total employment is up 13.8 million from the employment recession low.

Private payroll employment increased 230,000 in February, and private employment is now 5.5 million above the previous peak. Private employment is up 14.3 million from the recession low.

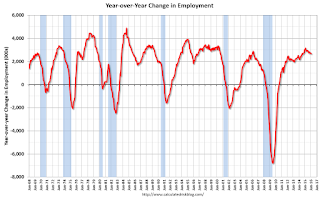

In February, the year-over-year change was 2.67 million jobs.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in February to 81.2%, and the 25 to 54 employment population ratio increased to 77.8%. The participation rate for this group might increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.2% YoY in February. This series is noisy, however overall wage growth is trending up.

Note: CPI has been running under 2%, so there has been real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (also referred to as involuntary part-time workers) was unchanged in February at 6.0 million and has shown little movement since November. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons was little changed in February. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 9.7% in February - the lowest level since May 2008.

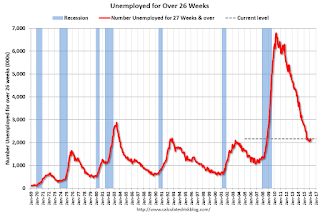

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.165 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 2.089 million in January.

This is generally trending down, but is still high.

There are still signs of slack (as example, part time workers for economic reasons and elevated U-6), but there also signs the labor market is tightening. Overall this was a strong employment report.

Trade Deficit Increased in January to $45.7 Billion

by Calculated Risk on 3/04/2016 10:06:00 AM

Earlier the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $45.7 billion in January, up $1.0 billion from $44.7 billion in December, revised. January exports were $176.5 billion, $3.8 billion less than December exports. January imports were $222.1 billion, $2.8 billion less than December imports.The trade deficit was larger than the consensus forecast of $43.9 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2016.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in December.

Exports are 6% above the pre-recession peak and down 7% compared to January 2015; imports are 4% below the pre-recession peak, and down 5% compared to January 2015.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $32.06 in January, down from $36.60 in December, and down from $58.96 in January 2015. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $28.9 billion in January, from $28.6 billion in January 2015. The deficit with China is a substantial portion of the overall deficit.

February Employment Report: 242,000 Jobs, 4.9% Unemployment Rate

by Calculated Risk on 3/04/2016 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 242,000 in February, and the unemployment rate was unchanged at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in health care and social assistance, retail trade, food services and drinking places, and private educational services. Job losses continued in mining.

...

The change in total nonfarm payroll employment for December was revised from +262,000 to +271,000, and the change for January was revised from +151,000 to +172,000. With these revisions, employment gains in December and January combined were 30,000 more than previously reported.

...

In February, average hourly earnings for all employees on private nonfarm payrolls declined by 3 cents to $25.35, following an increase of 12 cents in January. Average hourly earnings have risen by 2.2 percent over the year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 242 thousand in February (private payrolls increased 230 thousand).

Payrolls for December and January were revised down by a combined 30 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.67 million jobs. A solid gain.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in February to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate increased in February to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio increased to 59.8% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in February at 4.9%.

This was well above expectations of 190,000 jobs, and with the upward revisions to prior months, this was a strong report.

I'll have much more later ...

Thursday, March 03, 2016

Friday: Employment Report, Trade Deficit

by Calculated Risk on 3/03/2016 07:44:00 PM

Hotel occupancy is mostly tracking 2015 (the record year for hotel occupancy). And RevPar is up about 3%. From HotelNewsNow: STR: US hotel results for week ending 27 February

In year-over-year comparisons, the industry’s occupancy was nearly flat (-0.2% to 64.2%). Average daily rate for the week was up 3.3% to US$119.50, and revenue per available room increased 3.1% to US$76.76.Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for an increase of 190,000 non-farm payroll jobs added in February, up from the 151,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to be unchanged at 4.9%.

• Also at 8:30 AM, the Trade Balance report for January from the Census Bureau. The consensus is for the trade deficit to be at $43.9 billion from $43.4 billion in December.

Goldman Payroll Preview: 195K Forecast

by Calculated Risk on 3/03/2016 03:31:00 PM

Note: Earlier I wrote: Preview: Employment Report for February

A few excerpts from a research piece by Goldman Sachs economist Daan Struyven:

We expect a 195k gain in nonfarm payroll employment in February, in line with consensus expectations—and a slight downward revision from our forecast at the start of the week. Labor market indicators were mixed in February, with lower jobless claims and a rise in the ISM manufacturing employment component, but declines in the employment components of most non-manufacturing surveys, including the ISM services survey. We expect some rebound from the large declines last month in employment in the private education, temporary help services, and couriers and messengers sectors.

The unemployment rate is likely to remain unchanged at 4.9%. Average hourly earnings are likely to rise just 0.1% month-over-month, due mostly to calendar effects. ... A 0.1% increase in February would still result in a year-on-year rate flat at 2.5% (due to favorable base effects).

Preview: Employment Report for February

by Calculated Risk on 3/03/2016 12:51:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus, according to Bloomberg, is for an increase of 190,000 non-farm payroll jobs in February (with a range of estimates between 168,000 to 217,000), and for the unemployment rate to be unchanged at 4.9%.

The BLS reported 151,000 jobs added in January.

Here is a summary of recent data:

• The ADP employment report showed an increase of 214,000 private sector payroll jobs in February. This was above expectations of 185,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in February to 48.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 25,000 in February. The ADP report indicated 9,000 fewer manufacturing jobs. Note: Recently the ADP has been a better predictor for BLS reported manufacturing employment than the ISM survey.

The ISM non-manufacturing employment index decreased in February to 49.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 65,000 in February.

Combined, the ISM indexes suggests employment gains of 40,000. This suggests employment growth way below expectations.

• Initial weekly unemployment claims averaged close to 270,000 in February, down from 283,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 262,000, down from 294,000 during the reference week in January.

The decrease during the reference suggests fewer layoffs in February as compared to January.

• The final February University of Michigan consumer sentiment index decreased to 91.7 from the January reading of 92.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like lower gasoline prices.

• "TrimTabs Investment Research estimates based on real-time income tax withholdings that the U.S. economy added between 55,000 and 85,000 jobs in February, the lowest monthly job growth since July 2013."

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. The ADP report and unemployment claims suggest job growth in the 200 thousand plus range.

However the ISM surveys and tax withholdings suggest a report way below consensus.

The signals are mixed, but my guess is employment will be below consensus in February.

ISM Non-Manufacturing Index Decreased to 53.4% in February

by Calculated Risk on 3/03/2016 10:04:00 AM

The February ISM Non-manufacturing index was at 53.4%, down from 53.5% in January. The employment index decreased in February to 49.7%, down from 52.1% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 73rd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 53.4 percent in February, 0.1 percentage point lower than the January reading of 53.5 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index increased to 57.8 percent, 3.9 percentage points higher than the January reading of 53.9 percent, reflecting growth for the 79th consecutive month at a faster rate. The New Orders Index registered 55.5 percent, 1 percentage point lower than the reading of 56.5 percent in January. The Employment Index decreased 2.4 percentage points to 49.7 percent from the January reading of 52.1 percent and indicates contraction after 23 consecutive months of growth. This is the first time the employment index has contracted since February 2014. The Prices Index decreased 0.9 percentage point from the January reading of 46.4 percent to 45.5 percent, indicating prices decreased in February for the fourth time in the last six months. According to the NMI®, 14 non-manufacturing industries reported growth in February. The majority of the respondents' comments continue to be positive about business conditions. The respondents are projecting a slight optimism in regards to the overall economy. There is an increase in the number of industries reflecting growth in both New Orders and Business Activity; however, the NMI® has decreased slightly due to the contraction in the Employment index."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.1, however suggests slower expansion in February than in January.

Weekly Initial Unemployment Claims increase to 278,000

by Calculated Risk on 3/03/2016 08:34:00 AM

The DOL reported:

In the week ending February 27, the advance figure for seasonally adjusted initial claims was 278,000, an increase of 6,000 from the previous week's unrevised level of 272,000. The 4-week moving average was 270,250, a decrease of 1,750 from the previous week's unrevised average of 272,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 270,250.

This was above the consensus forecast of 270,000. The low level of the 4-week average suggests few layoffs.

Wednesday, March 02, 2016

Thursday: Unemployment Claims, ISM non-Mfg Survey

by Calculated Risk on 3/02/2016 06:44:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Pushing Important Boundary

Mortgage rates continued farther into to the highest levels since early February today. ...Thursday:

... 10yr Treasury yields ended the day at 1.84% and today's most prevalent conventional 30yr fixed rate quote is right on the edge of a move back up to 3.75% after a stable run at 3.625%.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 272 thousand the previous week.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is a 2.0% increase in orders.

• Also at 10:00 AM, the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 53.1 in February from 53.5 in January.

Fed's Beige Book: "Economic activity expanded in most Districts"

by Calculated Risk on 3/02/2016 02:36:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Kansas City and based on information collected before February 22, 2016."

Reports from the twelve Federal Reserve Districts continued to indicate that economic activity expanded in most Districts since the previous Beige Book report. Economic growth increased moderately in Richmond and San Francisco and at a modest pace in Cleveland, Atlanta, Chicago, and Minneapolis. Philadelphia reported a slight increase in economic activity, and St. Louis described conditions as mixed. Most contacts in Boston cited higher sales or revenues than a year-ago but mixed results since the previous month. New York and Dallas described economic activity as flat, and Kansas City noted a modest decline in activity. Across the nation, business contacts were generally optimistic about future economic growth.And on real estate:

Residential real estate sales were up since the last report across all Districts, with the exception of New York and Kansas City where sales were somewhat weaker in part due to normal seasonal patterns. The Boston, Cleveland, St. Louis, and San Francisco Districts reported strong growth in sales, and contacts in Boston and Cleveland cited relatively mild winter weather as a positive contribution to growth. Low- to moderately-priced homes sold better than higher-priced homes in Cleveland, Kansas City, and Dallas. ... Residential construction generally strengthened since the previous survey period, with only Philadelphia and Kansas City reporting declines.Real Estate growth in most districts was decent ...

Districts characterized nonresidential real estate sales and leasing growth as flat to strong. Contacts in Cleveland cited growth in demand from the healthcare and higher education sectors and to a lesser extent the manufacturing, commercial real estate (excluding office buildings) and multifamily housing sectors. Commercial occupancy rates rose in San Francisco, spurring higher lease rates and additional construction projects. Commercial vacancy rates were nearing or below prerecession levels in Minneapolis despite significant new commercial real estate construction, and St. Paul saw more commercial net absorption in the last year than in the previous ten years combined. Similarly, industrial vacancy rates decreased across the Cleveland, St. Louis, and Dallas Districts. Demand for commercial real estate space grew robustly in Chicago across retail, industrial and office segments, but there was concern that the lack of commercial construction and increased demand would lead to space shortages and price bubbles. Commercial leasing activity in Boston was steady, and fundamentals remained strong. Richmond commercial leasing activity increased moderately for the retail market since the previous report, while activity in the office and industrial markets was tepid. Commercial rents increased in Philadelphia, and contacts in Atlanta noted generally improving rents as well as increased absorption.

emphasis added