by Calculated Risk on 1/27/2016 07:00:00 AM

Wednesday, January 27, 2016

MBA: Mortgage Applications Increased in Latest Weekly Survey, Purchase Applications up 22% YoY

From the MBA: Mortgage Applications Increase as Rates Continue to Drop in Latest MBA Weekly Survey

Mortgage applications increased 8.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 22, 2016. This week’s results include an adjustment to account for the Martin Luther King holiday.

...

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 0.4 percent compared with the previous week and was 22 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since October 2015, 4.02 percent, from 4.06 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 22% higher than a year ago.

Tuesday, January 26, 2016

Wednesday: FOMC Announcement, New Home Sales

by Calculated Risk on 1/26/2016 09:15:00 PM

From Tim Duy at Bloomberg: The Five Scenarios Now Facing the Federal Reserve

Bottom Line: If there was ever any doubt about the “about” of this week’s FOMC meeting, it has long since been eliminated. The Fed will hold policy steady and affirm the faith in its underlying forecast while acknowledging the global and financial risks. This will be interpreted dovishly, probably more so than the policymakers at the central bank would like. Given that I’m in the “no recession” camp, I am wary that the Fed falls into risk management mode now, but at the cost of a faster pace of hikes later. Of course, if you’re in the “recession now” camp, then the game is already over.Wednesday:

• 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 10:00 AM, New Home Sales for December from the Census Bureau. The consensus is for a increase in sales to 500 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 490 thousand in November.

• 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to make no change to policy at this meeting.

Chemical Activity Barometer "Notches Slight Gain " in January

by Calculated Risk on 1/26/2016 03:49:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Notches Slight Gain As Signs of Slowing Growth Mount

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), ticked up slightly in January, rising 0.1 percent following a downward adjustment of 0.1 percent in December. All data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.6 percent over this time last year, a marked deceleration of activity from one year ago when the barometer logged a 3.2 percent year-over-year gain from 2014. On an unadjusted basis the CAB fell 0.1 percent and 0.2 percent in December and January, respectively, raising concerns about the pace of future business activity through the second quarter of 2016. ...

...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Real Prices and Price-to-Rent Ratio in November

by Calculated Risk on 1/26/2016 12:41:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.3% year-over-year in November

The year-over-year increase in prices is mostly moving sideways now around 5%. In November 2015, the index was up 5.3% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 4.3% below the bubble peak. However, in real terms, the National index is still about 18% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to September 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to May 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

In real terms, the National index is back to November 2003 levels, the Composite 20 index is back to July 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 0.8% year-over-year, so this has been pushing up real prices recently.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

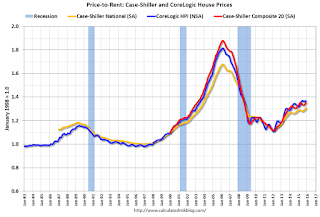

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to July 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

BLS: Unemployment Rate decreased in 25 States in December

by Calculated Risk on 1/26/2016 10:11:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in December. Twenty-five states had unemployment rate decreases from November, 14 states had increases, and 11 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

North Dakota had the lowest jobless rate in December, 2.7 percent, followed by Nebraska and South Dakota, 2.9 percent each. New Mexico had the highest rate, 6.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. New Mexico, at 6.7%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only eight states are at or above 6% (dark blue).

Case-Shiller: National House Price Index increased 5.3% year-over-year in November

by Calculated Risk on 1/26/2016 09:15:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Continued Increases in Home Prices for October According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 5.3% annual increase in November 2015 versus a 5.1% increase in October 2015. The 10-City Composite increased 5.3% in the year to November compared to 5.0% previously. The 20-City Composite’s year-over-year gain was 5.8% versus 5.5% reported in October.

...

Before seasonal adjustment, the National Index posted a gain of 0.1% month-over-month in November. The 10- City Composite was unchanged and the 20-City Composite reported gains of 0.1% month-over-month in November. After seasonal adjustment, the National Index, along with the 10-City and 20-City Composites, all increased 0.9% month-over-month in November. Fourteen of 20 cities reported increases in November before seasonal adjustment; after seasonal adjustment, all 20 cities increased for the month.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 12.9% from the peak, and up 0.9% in November (SA).

The Composite 20 index is off 11.5% from the peak, and up 0.9% (SA) in November.

The National index is off 4.3% from the peak, and up 0.9% (SA) in November. The National index is up 29.2% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.4% compared to November 2014.

The Composite 20 SA is up 5.8% year-over-year..

The National index SA is up 5.3% year-over-year.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in November seasonally adjusted. (Prices increased in 14 of the 20 cities NSA) Prices in Las Vegas are off 39.0% from the peak.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 55% above January 2000 (55% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 15% above the change in overall prices due to inflation.

Six cities - Charlotte, Boston, Dallas, Denver, Portland and San Francisco - are above the bubble highs (Seattle is close). Detroit prices are barely above the January 2000 level.

I'll have more on house prices later.

Monday, January 25, 2016

Tuesday: Case-Shiller House Prices

by Calculated Risk on 1/25/2016 06:27:00 PM

Tuesday:

• 9:00 AM: FHFA House Price Index for November 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

• 9:00 AM: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices. The consensus is for a 5.7% year-over-year increase in the Comp 20 index for November. The Zillow forecast is for the National Index to increase 5.3% year-over-year in November.

• 10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

• 10:00 AM ET: Regional and State Employment and Unemployment for December.

From Diana Olick at CNBC: Homebuilder DR Horton's Bet on Entry-Level Houses Paying Off Big

... Texas-based DR Horton's CEO David Auld said on the company's quarterly earnings call. "The Express (brand) has been the driver of market share gains."As we've discussed, future growth for new home sales is partially dependent on more affordable homes.

Express launched in early 2014, touting no-option, no-frills homes in exchange for prices between $120,000 and $150,000. Prices are now slightly higher, moving with the broader market gains, but still below the nation's median price. The brand has solid footing in Texas, the Carolinas and Florida, but it is now expanding strongly into Southern California. ...

"They are doing the best job of any of the large builders executing at entry level, and I think you have to have that as you go through '16," homebuilding analyst Stephen East of Evercore ISI said on CNBC's "Squawk on the Street."

Vehicle Sales Forecast: Sales to Reach 10-Year High for a January

by Calculated Risk on 1/25/2016 12:55:00 PM

The automakers will report January vehicle sales on Tuesday, February 2nd.

Note: There were 24 selling days in January, down from 26 in January 2015.

From WardsAuto: Forecast: January SAAR Set to Reach 10-Year High

A WardsAuto forecast calls for U.S. automakers to deliver 1.13 million light vehicles in January.Looks like another solid month for car sales.

The resulting daily sales rate (DSR) of 47,126 units, a 10-year high for the month, over 24 days represents a 6.8% improvement from like-2015 (26 days) and a 19.2% month-to-month decline from December (28 days).

The 5-year average December-to-January decline is 26%, but the traditional pull-ahead of sales in December was not as strong as expected this time. Lighter deliveries allowed dealers to remain well-stocked with vehicles highest in demand going into January.

The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, compared with a year-ago’s 16.6 million and December’s 17.2 million.

Dallas Fed: "Texas Manufacturing Activity Falls Sharply" in January

by Calculated Risk on 1/25/2016 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Activity Falls Sharply

Texas factory activity fell sharply in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index—a key measure of state manufacturing conditions—dropped 23 points, from 12.7 to -10.2, suggesting output declined this month after growing throughout fourth quarter 2015.Texas manufacturing is in a recession - no surprise with the sharp decline in oil prices.

Other indexes of current manufacturing activity also indicated contraction in January. The survey’s demand measures—the new orders index and the growth rate of orders index—led the falloff in production with negative readings last month, and these indexes pushed further negative in January. The new orders index edged down to -9.2, and the growth rate of orders index fell to -17.5, its lowest level in a year. The capacity utilization index fell 15 points from 8.1 to -7, and the shipments index also posted a double-digit decline into negative territory, coming in at -11.

Perceptions of broader business conditions weakened markedly in January. The general business activity and company outlook indexes fell to their lowest readings since April 2009, when Texas was in recession. The general business activity index fell 13 points to -34.6, and the company outlook index slipped to -19.5.

Labor market indicators reflected a decline in January after exhibiting strength in November and December 2015. The employment index dropped from 10.9 to -4.2, with 17 percent of firms noting net hiring and 21 percent noting net layoffs. The hours worked index plummeted 23 points to -9.2, suggesting a sharp pullback in employee hours.

emphasis added

Black Knight: House Price Index up 0.1% in November, Up 5.5% year-over-year

by Calculated Risk on 1/25/2016 08:11:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. home prices rose 0.1% from October, and were up 5.5% on a year-over-year basis

• U.S. home prices rose 0.1% from October, and were up 5.5% on a year-over- year basisThe Black Knight HPI increased 0.1% percent in November, and is off 5.3% from the peak in June 2006 (not adjusted for inflation).

• This puts national home prices up 27% since the bottom of the market at the start of 2012 and just 5.3% off its June 2006 peak

• For the fifth straight month, New York led gains among the states, seeing 1.2% month-over-month appreciation

• Ohio and Connecticut topped the list of 10 most negative price movements among the states, with home prices falling by 0.4% from October in each state

• California home prices declined for the second straight month, though seasonally adjusted numbers suggest continued but slowing growth for the state

The year-over-year increase in the index has been about the same for the last year.

Note: Case-Shiller for November will be released tomorrow.