by Calculated Risk on 1/06/2016 10:05:00 AM

Wednesday, January 06, 2016

ISM Non-Manufacturing Index Decreased to 55.3% in December

The December ISM Non-manufacturing index was at 55.3%, down from 55.9% in November. The employment index increased in December to 55.7%, up from 55.0% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 71st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.3 percent in December, 0.6 percentage point lower than the November reading of 55.9 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index increased to 58.7 percent, which is 0.5 percentage point higher than the November reading of 58.2 percent, reflecting growth for the 77th consecutive month at a slightly faster rate. The New Orders Index registered 58.2 percent, 0.7 percentage point higher than the reading of 57.5 percent in November. The Employment Index increased 0.7 percentage point to 55.7 percent from the November reading of 55 percent and indicates growth for the 22nd consecutive month. The Prices Index decreased 0.6 percentage point from the November reading of 50.3 percent to 49.7 percent, indicating prices decreased in December for the third time in the last four months. According to the NMI®, 11 non-manufacturing industries reported growth in December. Faster deliveries in December contributed to the overall slight slowing in the rate of growth according to the NMI® composite index. All of the other component indexes increased in the month of December. The majority of respondents’ comments remain positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.5 and suggests slightly slower expansion in December than in November. Still a solid report.

Trade Deficit Decreased in November to $42.4 Billion

by Calculated Risk on 1/06/2016 08:40:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $42.4 billion in November, down $2.2 billion from $44.6 billion in October, revised. November exports were $182.2 billion, $1.6 billion less than October exports. November imports were $224.6 billion, $3.8 billion less than October imports.The trade deficit was smaller than the consensus forecast of $44.4 billion.

The first graph shows the monthly U.S. exports and imports in dollars through November 2015.

Click on graph for larger image.

Click on graph for larger image.Imports and exports decreased in November.

Exports are 10% above the pre-recession peak and down 7% compared to November 2014; imports are 3% below the pre-recession peak, and down 5% compared to November 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier last year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier last year were due to West Coast port slowdown).Oil imports averaged $39.24 in November, down from $40.12 in October, and down from $82.92 in November 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $31.3 billion in November, from $30.2 billion in November 2014. The deficit with China is a substantial portion of the overall deficit.

ADP: Private Employment increased 257,000 in December

by Calculated Risk on 1/06/2016 08:19:00 AM

Private sector employment increased by 257,000 jobs from November to December according to the December ADP National Employment Report® ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 190,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 23,000 jobs in December, well up from a downwardly revised -2,000 the previous month. The construction industry added 24,000 jobs, which was roughly in line with the 21,000 average monthly jobs gained for the year. Meanwhile, manufacturing stayed in positive territory for the second straight month adding 2,000 jobs.

Service-providing employment rose by 234,000 jobs in December, up from an upwardly revised 213,000 in November. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Strong job growth shows no signs of abating. The only industry shedding jobs is energy. If this pace of job growth is sustained, which seems likely, the economy will be back to full employment by mid-year. This is a significant achievement, given that the last time the economy was at full employment was nearly a decade ago.”

The BLS report for December will be released Friday, and the consensus is for 200,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey, Purchase Applications up 22% YoY

by Calculated Risk on 1/06/2016 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 27 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 1, 2016. The most recent week’s results include an adjustment to account for the New Year’s Day holiday, while the previous week’s results were adjusted for the Christmas holiday.

...

The Refinance Index decreased 37 percent from two weeks ago. The seasonally adjusted Purchase Index decreased 15 percent from two weeks earlier. The unadjusted Purchase Index decreased 40 percent compared with two weeks ago and was 22 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.20 percent, its highest level since July 2015, from 4.19 percent, with points decreasing to 0.42 from 0.49 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 22% higher than a year ago.

Tuesday, January 05, 2016

Wednesday: Trade Deficit, ADP Employment, FOMC Minutes, ISM Non-Mfg Index

by Calculated Risk on 1/05/2016 08:32:00 PM

It never rains in California, oh wait ... from the LA Times: El Niño storms slam Southern California

The first major El Niño storm of the season brought heavy rainfall that closed roads, caused flooding and gave Southern California a good drenching.This is just the beginning - it looks like this will be a wet year for the West.

And that's not all -- the storms are expected to continue throughout the week, forecasters say.

...

The wet walloping delivered to Southern California on Tuesday, courtesy of El Niño, made for the wettest day Los Angeles has seen in almost four months.

There was more rain in Los Angeles on Tuesday than every day in 2015 except for one, Sept. 15, when the remnants of Hurricane Linda washed ashore, said Bill Patzert, a climatologist with the NASA Jet Propulsion Laboratory in La Cañada Flintridge.

...

“This is not a bashful El Niño. This is a brash El Niño,” Patzert said. “Definitely, it’s impressive.”

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in December, down from 217,000 in November.

• At 8:30 AM, Trade Balance report for November from the Census Bureau. The consensus is for the U.S. trade deficit to be at $44.4 billion in November from $43.9 billion in October.

• At 10:00 AM, the ISM non-Manufacturing Index for December. The consensus is for index to increase to 56.5 from 55.9 in November.

• Also at 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is a 0.2% decrease in orders.

• At 2:00 PM, the Fed will release the FOMC Minutes for the Meeting of December 15-16, 2015

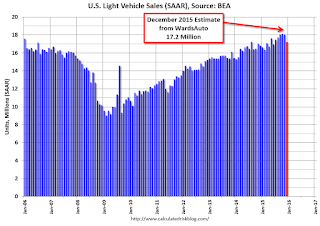

U.S. Light Vehicle Sales at 17.2 million annual rate in December

by Calculated Risk on 1/05/2016 03:33:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 17.2 million SAAR in December.

That is up about 2% from December 2014, and down about 5% from the 18.06 million annual sales rate last month.

This is probably a record year for light vehicle sales (more on that when the official data is released).

It looks like the best years were:

1) 2015 with 17.39 million sold

2) 2000 with 17.35 million

3) 2001 with 17.12 million

4) 2005 with 16.95 million

5) 1999 with 16.89 million

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 17.2 million SAAR from WardsAuto).

This was below the consensus forecast of 18.1 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was a below expectations, however 2015 was the best year ever for light vehicle sales.

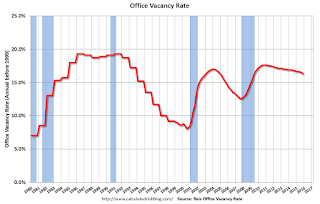

Reis: Office Vacancy Rate declined in Q4 to 16.3%

by Calculated Risk on 1/05/2016 11:48:00 AM

Reis released their Q4 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.3% in Q4, from 16.5% in Q3. This is down from 16.7% in Q4 2014, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

The ongoing decline in the national vacancy rate finally gained momentum this quarter, falling by 20 basis points to 16.3%. This marks the first time since the market began to recover in early 2011 that the quarterly vacancy rate fell by more than 10 basis points. The vacancy rate has now declined in five of the last six quarters and is at its lowest level since the second quarter of 2009. The quiet acceleration in the office market recovery is now beginning to make more noise. Both net absorption and new construction are increasing, but absorption is beginning to pull ahead of construction by a wider margin. By many measures, including absorption, construction, and vacancy compression, 2015 was the best year in the office market in recent history. The acceleration in improvement will persist in 2016 as the labor market remains near full employment, the economy expands, and office jobs are created.

...

Occupied stock increased by 15.322 million square feet during the fourth quarter. This was an increase versus last quarter and was the highest level for quarterly net absorption since the third quarter of 2007. The calendar-year total for 2015 of 42.436 million square feet was the highest annual total since 2007. In short, 2015 was the best year for demand in the office market since before the recession. Moreover, the improvement is accelerating - roughly 11 million more square feet were absorbed in 2015 versus 2014. That is the largest increase between calendar years since 2005. This should accelerate in 2016 as the continued gains in the labor market translate into greater demand for office space.

New construction of 9.597 million SF is a bit of a decline from last quarter. However, the trend over time is still upward. Construction has exceeded 9 million square feet in each of the last three quarters. That has not happened since the third quarter of 2009 when construction was slowing due to the recession. Slowly, but surely, investors and developers are feeling more confident about their prospects, spurred on by the recovery in fundamentals. Over time, speculative projects are making a return to the market, evidence of this turnabout in sentiment. Confidence will continue to grow over time, resulting in a greater number of office space being constructed going forward.

...

4Q2015 asking rent growth: +0.8% / 12-month change: +3.1%

4Q2015 effective rent growth: +0.8% / 12-month change: +3.2%

Asking and effective rents both grew by 0.8% during the fourth quarter, marking the twenty-first consecutive quarter of asking and effective rent growth. These growth rates were slightly ahead of the growth rates from last quarter. On a year-over-year basis, both asking and effective rent growth slowed versus third quarter figures. However, this is more due to the weak rent growth that was observed during the third quarter of 2014 than any slowdown in rent. In eight of the last nine quarters, both asking and effective rent growth have been at least 0.7%. Annual growth rates in excess of 3% is still strong for a market with a vacancy rate greater than 16%. Nonetheless, these growth rates should accelerate as the market continues to tighten in the coming years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.3% in Q4.

Office vacancy data courtesy of Reis.

CoreLogic: House Prices up 6.3% Year-over-year in November

by Calculated Risk on 1/05/2016 09:43:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Home Prices Up 6.3 Percent Year Over Year in November 2015

Home prices nationwide, including distressed sales, increased by 6.3 percent in November 2015 compared with November 2014 and increased by 0.5 percent in November 2015 compared with October 2015, according to the CoreLogic HPI.

“Heading into 2016, home price growth remains in its sweet spot as prices have increased between 5 and 6 percent on a year-over-year basis for 16 consecutive months,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Regionally we are beginning to see fissures, with slowdowns in some Texas and California markets, but the northwest and southeast remain on solid footing.”

“Many factors, including strong demand and tight supply in many markets, are contributing to the long-sustained boom in prices and home equity which is a very good thing for those owning homes,” said Anand Nallathambi, president and CEO of CoreLogic. “On the flip side, prices have outstripped incomes for several years in a number of regions so, as we enter 2016, affordability is becoming more of a constraint on sales in some markets.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.5% in October (NSA), and is up 6.3% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The YoY increase had been moving sideways over most of the last year, but has picked up a recently.

The YoY increase had been moving sideways over most of the last year, but has picked up a recently.The year-over-year comparison has been positive for forty five consecutive months.

Monday, January 04, 2016

Tuesday: Auto Sales

by Calculated Risk on 1/04/2016 08:44:00 PM

Tuesday:

• All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 18.1 million SAAR in December from 18.2 million in November (Seasonally Adjusted Annual Rate).

A few excerpts from Tim Duy's article at Fed Watch: A Look Ahead Into 2016

What do I expect to see in 2016? Briefly, here are my baseline expectations for the year:There is much more in the article (and I generally agree with Dr. Duy).

1.) No recession. I think that fears of recession in 2016 are overblown. Softness in the manufacturing sector is the primary motivation for such fears, but this ignores the declining economic importance of manufacturing in the US economy. Manufacturing now accounts for just 8.6% of jobs. I think people are falling into a trap of overemphasizing the importance of manufacturing as a cyclical indicator. A broader perspective indicates little reason to be worried of recession in 2016

...

5.) Inflation will accelerate. I think 2016 will be the year that economic resources become sufficiently scarce to push inflation back to the Fed's target. I know this may seem like a wildly optimistic call given the persistence of low inflation during this cycle

...

9.) The Federal Reserve will continue to hike rates, slowly. I expect that economic conditions will be sufficient for the Federal Reserve to justify 100bp of rate hikes in 2016. Although the Fed will not want to appear mechanical in its normalization process, they will likely find themselves hiking every other meeting beginning in January. They will be slow to begin the process of "normalizing" the balance sheet, although I expect that they will be fully engaged in that conversation by the middle of the year. That conversation will take on more urgency if they have difficulty controlling short rates with their new tools.

Fed: Q3 Household Debt Service Ratio Very Low

by Calculated Risk on 1/04/2016 03:32:00 PM

The Fed's Household Debt Service ratio through Q3 2015 was released Dec 28th: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio was unchanged in Q3, and has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) declined in Q3 and is also near a record low (not shown)

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last three years.

This data suggests aggregate household cash flow has improved.