by Calculated Risk on 12/16/2015 02:00:00 PM

Wednesday, December 16, 2015

FOMC Statement: Fed Funds Rate target range increased to 1/4 to 1/2 percent

Information received since the Federal Open Market Committee met in October suggests that economic activity has been expanding at a moderate pace. Household spending and business fixed investment have been increasing at solid rates in recent months, and the housing sector has improved further; however, net exports have been soft. A range of recent labor market indicators, including ongoing job gains and declining unemployment, shows further improvement and confirms that underutilization of labor resources has diminished appreciably since early this year. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation remain low; some survey-based measures of longer-term inflation expectations have edged down.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen. Overall, taking into account domestic and international developments, the Committee sees the risks to the outlook for both economic activity and the labor market as balanced. Inflation is expected to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee continues to monitor inflation developments closely.

The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective. Given the economic outlook, and recognizing the time it takes for policy actions to affect future economic outcomes, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent. The stance of monetary policy remains accommodative after this increase, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

emphasis added

AIA: "Architecture Billings Index Hits another Bump " in November

by Calculated Risk on 12/16/2015 11:31:00 AM

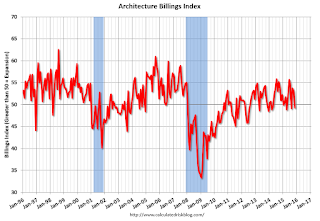

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Hits another Bump

As has been the case a few times already this year, the Architecture Billings Index (ABI) dipped in November. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the November ABI score was 49.3, down from the mark of 53.1 in the previous month. This score reflects a decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.6, up just a nudge from a reading of 58.5 the previous month.

“Since architecture firms continue to report that they are bringing in new projects, this volatility in billings doesn’t seem to reflect any underlying weakness in the construction sector,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Rather, it could reflect the uncertainty of moving ahead with projects given the continued tightness in construction financing and the growing labor shortage problem gripping the entire design and construction industries.”

...

• Regional averages: South (55.4), West (54.5), Midwest (47.8), Northeast (46.2)

• Sector index breakdown: multi-family residential (53.8), institutional (52.0), commercial / industrial (51.0), mixed practice (47.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.3 in November, down from 53.1 in October. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of the year - suggesting a slowdown or less growth for apartments - but has been positive for the last two months.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

Fed: Industrial Production decreased 0.6% in November

by Calculated Risk on 12/16/2015 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.6 percent in November after decreasing 0.4 percent in October. In November, manufacturing production was unchanged from October. The index for utilities dropped 4.3 percent, as unusually warm weather held down the demand for heating. The index for mining fell 1.1 percent in November, with much of this decrease attributable to sizable declines for coal mining and for oil and gas well drilling and servicing. At 106.5 percent of its 2012 average, total industrial production in November was 1.2 percent below its year-earlier level. Capacity utilization for the industrial sector declined 0.5 percentage point in November to 77.0 percent, a rate that is 3.1 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.0% is 3.1% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.6% in November to 106.5. This is 22.1% above the recession low, and 1.3% above the pre-recession peak.

This was below expectations of a 0.2% decrease, partially due to the warm weather.

The weather is boosting some sectors - like housing starts - and hurting other sectors like heating utilities.

Housing Starts increased to 1.173 Million Annual Rate in November

by Calculated Risk on 12/16/2015 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

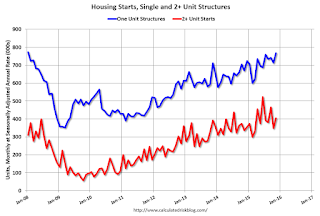

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,173,000. This is 10.5 percent above the revised October estimate of 1,062,000 and is 16.5 percent above the November 2014 rate of 1,007,000.

Single-family housing starts in November were at a rate of 768,000; this is 7.6 percent above the revised October figure of 714,000. The November rate for units in buildings with five units or more was 398,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,289,000. This is 11.0 percent above the revised October rate of 1,161,000 and is 19.5 percent above the November 2014 estimate of 1,079,000.

Single-family authorizations in November were at a rate of 723,000; this is 1.1 percent above the revised October figure of 715,000. Authorizations of units in buildings with five units or more were at a rate of 539,000 in November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in November. Multi-family starts are up 20% year-over-year.

Single-family starts (blue) increased in November and are up 15% year-over-year.

This is the highest level of single family starts since January 2008.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in November were above expectations, and starts for September and October were revised up slightly. A solid report. I'll have more later ...

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey, Purchase Applications up 34% YoY

by Calculated Risk on 12/16/2015 07:02:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

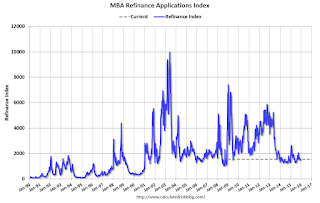

Mortgage applications decreased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 11, 2015.

...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 34 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.14 percent, with points increasing to 0.45 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 34% higher than a year ago.

Tuesday, December 15, 2015

Wednesday: FOMC Announcement, Housing Starts, Industrial Production

by Calculated Risk on 12/15/2015 07:52:00 PM

From the WSJ on the Nuts and Bolts:

The Fed has signaled that the details will be announced in an “implementation note” alongside the usual policy statement, and officials will watch closely to make sure those tools work as expected. “If adjustments to policy tools or administered rates subsequently proved necessary to implement an unchanged policy stance, the implementation note could be revised without altering the [Fed's] policy statement,” according to the central bank’s June meeting minutes.Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM ET, Housing Starts for November. Total housing starts decreased to 1.060 million (SAAR) in October. Single family starts decreased to 722 thousand SAAR in October. The consensus for 1.140 million, up from October.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.4%.

• During the day, the AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate at this meeting.

• Also at 2:00 PM, the FOMC Forecasts. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Lawler: Early Read on Existing Home Sales in November: Big Drop

by Calculated Risk on 12/15/2015 03:48:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.97 million in November, down 7.3% from October’s preliminary estimate and up just 0.4% from last November’s seasonally adjusted pace. Compared to last November unadjusted sales were either flat or down in quite a few (though by no means all) markets across the country, which seems surprising since last November’s sales face fell well below expectations. Overall I estimate that unadjusted existing home sales last month were up by about 2.4% from last November’s pace. (There was one more business day this November compared to last November, so the YOY % change in seasonally adjusted sales should be lower than that for unadjusted sales).

It was not directly clear what led to the sharp slide in seasonally adjusted national home sales last month. Some realtor groups suggested that the October implementation of the new “TRID” rule in early October may have delayed home closings last month, though others suggested that probably this factor wasn’t a “big deal.” And while in a few markets – notably Houston and a few others with exposure to the oil industry – sharp declines in home sales reflected a weakening housing market – that wasn’t apparent in most markets.

It is slightly interesting to note that the monthly % change in existing home sales for each of the last four November’s has been unusually large, as shown in the table below.

| Monthly % Change in Existing Home Sales (SAAR) | ||||

|---|---|---|---|---|

| Nov. 2012 | Nov. 2013 | Nov. 2014 | Nov. 2015** | |

| Preliminary | 5.9% | -4.3% | -6.1% | -7.3% |

| First Revision | 4.8% | -5.9% | -6.3% | |

| Latest* | 3.5% | -4.0% | -4.1% | |

| *includes seasonal factor revisions, done once a year **LEHC estimate | ||||

On the inventory front, my “best guess” is that the NAR’s estimate of the inventory of existing homes for sale at the end of November will be 1.99 million, down 7.0% from October and down 4.3% from a year earlier. In many markets inventories are down much more sharply from a year earlier, though Houston – with listings up by more than 20% from a year ago – is a big exception.

Finally, local realtor/MLS data suggests that the national US median existing SF home sales price last month was up by about 5.9% from last November.

Earlier: NY Fed: Manufacturing Contracts Again in Region, Outlook Improves

by Calculated Risk on 12/15/2015 03:08:00 PM

The NY Fed manufacturing survey indicated contraction for the fifth consecutive month in the New York region. However the outlook has improved.

From the NY Fed: Empire State Manufacturing Survey

The December 2015 Empire State Manufacturing Survey indicates that business activity declined for a fifth consecutive month for New York manufacturers. However, the pace of decline slowed somewhat: the headline general business conditions index, though still negative, moved up six points to -4.6. New orders continued to drop, but shipments increased for the first time since the summer. ...

...

Labor market conditions deteriorated noticeably: the index for number of employees, negative for a fourth consecutive month, fell nine points to -16.2, and the average workweek index plunged thirteen points to -27.3, its lowest level since early 2009.

Indexes for the six-month outlook increased markedly this month, suggesting more widespread optimism about future business conditions. The index for future business conditions jumped eighteen points to 38.5, and the indexes for future new orders and future shipments also rose sharply. Labor market conditions were expected to improve, with the index for expected number of employees little changed at 15.2 and the index for expected workweek rising to 10.1.

emphasis added

Key Measures Show Inflation close to 2% in November

by Calculated Risk on 12/15/2015 11:42:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in November. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.4% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for November here. Motor fuel was down 26% annualized in November.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was unchanged (0.3% annualized rate) in November. The CPI less food and energy rose 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy also rose 2.0%. Core PCE is for October and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.4% annualized, and core CPI was at 2.2% annualized.

On a year-over-year basis, two of these measures suggest inflation remains below the Fed's target of 2% (core CPI as at 2% and median CPI is above 2%).

Using these measures, inflation has been moving up and is closer to the Fed's target.

NAHB: Builder Confidence declines to 61 in December

by Calculated Risk on 12/15/2015 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 61 in December, down from 62 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Edges Down One Point in December

Builder confidence in the market for newly constructed single-family homes remained relatively flat in December, dropping one point to 61 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Overall, builders are optimistic about the housing market, although they are reporting concerns with the high price of lots and labor,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“For the past seven months, builder confidence levels have averaged in the low 60s, which is in line with a gradual, consistent recovery,” said NAHB Chief Economist David Crowe. “With job creation, economic growth and growing household formations, we anticipate the housing market to continue to pick up traction as we head into 2016.”

...

All three HMI components posted modest losses in December. The index measuring sales expectations in the next six months fell two points to 67, the component gauging current sales conditions decreased one point to 66, and the index charting buyer traffic dropped two points to 46.

Looking at the three-month moving averages for regional HMI scores, the West increased three points to 76 while the Northeast rose a single point to 50. Meanwhile the Midwest dropped two points to 58 and the South fell one point to 64.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 63, but still a strong reading.