by Calculated Risk on 11/12/2015 02:27:00 PM

Thursday, November 12, 2015

Rosenberg on Labor Force Participation Rate

David Rosenberg, chief economist at Gluskin Sheff wrote about the Labor Force Participation Rate (LFPR) in his daily "Breakfast with Dave" newsletter: THEY AIN’T COMING BACK.

The title says it all. Here is the introduction and his conclusion (a long piece):

There has been a surprisingly large amount of commentary writing off the improvement in the U.S. unemployment rate — which dipped below the Congressional Budget Office’s estimate of the non-accelerating inflation rate of unemployment (NAIRU) for the first time since February 2008 in October — given that we have not seen an attendant uptick in the labour force participation rate.This is similar to my post earlier this year: Why the Prime Labor Force Participation Rate has Declined. Rosenberg focused on the Boomers retiring, however I've argued there are other factors too (People staying in school longer and a slow, but steady decline in prime men participation). But our conclusions are the same: the participation rate has mostly declined due to structural factors, not cyclical. And the participation rate will continue to decline for the next decade or more.

...

So, once again, any mention of the participation rate — or alternatively, mentions of a participation rate-adjusted unemployment rate or anything else of along those lines — as an indicator of labour market slack or as an argument for why the unemployment rate is obsolete and should be ignored, especially in the context of the policy discussion.

emphasis added

Fed's Dudley and Evans

by Calculated Risk on 11/12/2015 12:29:00 PM

First, from the WSJ Economists Overwhelmingly Expect Fed to Raise Interest Rates in December

About 92% of the business and academic economists polled by The Wall Street Journal in recent days said they expected the Fed to raise its benchmark federal-funds rate at its Dec. 15-16 policy meeting. Some 5% said the Fed would stay on hold until March and 3% predicted the Fed would keep rates at near-zero even longer.From NY Fed President William Dudley sees the risks in liftoff as "balanced": The U.S. Economic Outlook and Monetary Policy

I see the risks right now of moving too quickly versus moving too slowly as nearly balanced. The weight that one puts on each undoubtedly influences one’s views on when the time will be right to begin to normalize monetary policy and the appropriate short-term rate trajectory thereafter.Chicago Fed President Charles Evans argues for a later liftoff: A Cautious Approach to Monetary Policy Normalization

There is no doubt that labor markets have improved significantly over the past seven years. Job growth has been quite solid for some time now. That includes last month’s number, which was quite good. And today, at 5 percent, the unemployment rate is one half its peak in 2009. This is just a tenth of a percentage point above the median long-run projection. However, a number of other labor market indicators lead me to believe that there still remains some additional resource slack beyond what is indicated by the unemployment rate alone: Notably, 1) a large number of people who are employed part time would prefer a full-time job; 2) the labor force participation rate is quite low, even after accounting for demographic and other long-running trends; and 3) wage growth has been quite subdued. In sum, I don’t think we’re quite there yet, but we have made good progress toward meeting our employment mandate.

...

However, I am far less confident about reaching our inflation goal within a reasonable time frame. Inflation has been too low for too long. Core PCE inflation — which strips out the volatile energy and food components and is a good indicator of underlying inflation trends — has averaged just 1.4 percent over the past seven years. Core PCE inflation over the past 12 months was just 1.3 percent. And inflation according to the total PCE Price Index — which does include food and energy prices — was just 0.2 percent over the past year.

Most FOMC participants expect inflation to rise steadily from these low levels, coming in just a shade under the Committee’s 2 percent target by the end of 2017. My own forecast is less sanguine. I expect core PCE inflation to undershoot 2 percent by a greater margin over the next two years than do my colleagues. I expect core PCE inflation to be just below 2 percent at the end of 2018.

...

How does this asymmetric assessment of risks to achieving the dual mandate goals influence my view of the most appropriate path for monetary policy over the next three years? It leads me to conclude that 1) a later liftoff and 2) a more gradual normalization of our monetary policy setting will best position the economy for the potential challenges ahead.

More specifically, before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment. I believe that it could be well into next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation. After liftoff, I think it would be appropriate to raise the target interest rate very gradually. This would give us sufficient time to assess how the economy is adjusting to higher rates and the progress we are making toward our policy goals.

Overall, my view of appropriate policy is somewhat more accommodative than those held by the majority of my colleagues.

BLS: Jobs Openings increased to 5.5 million in September

by Calculated Risk on 11/12/2015 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.5 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.0 million and 4.8 million, respectively. Within separations, the quits rate was 1.9 percent for the sixth consecutive month, and the layoffs and discharges rate remained unchanged at 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in September, little changed from August. The number of quits has held between 2.7 million and 2.8 million for the past 13 months after increasing steadily since the end of the recession.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in September to 5.526 million from 5.377 million in August.

The number of job openings (yellow) are up 18% year-over-year compared to September 2014.

Quits are unchanged year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is a solid report. Job openings are just below the record high set in July, although Quits have leveled off.

Weekly Initial Unemployment Claims unchanged at 276,000

by Calculated Risk on 11/12/2015 08:33:00 AM

The DOL reported:

In the week ending November 7, the advance figure for seasonally adjusted initial claims was 276,000, unchanged from the previous week's unrevised level. The 4-week moving average was 267,750, an increase of 5,000 from the previous week's unrevised average of 262,750.The previous week was unrevised at 276,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 267,750.

This was above the consensus forecast of 266,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, November 11, 2015

Lawler: Post Mortem on Existing Home Sales in September

by Calculated Risk on 11/11/2015 08:32:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 266 thousand initial claims, down from 276 thousand the previous week.

• At 10:00 AM, Job Openings and Labor Turnover Survey for September from the BLS. Jobs openings decreased in August to 5.370 million from 5.668 million in July. The number of job openings were up 9% year-over-year, and Quits were up 9% year-over-year.

• At 2:00 PM, the Monthly Treasury Budget Statement for October.

• At 6:00 PM, Speech by Fed Vice Chairman Stanley Fischer, The Transmission of Exchange Rate Changes to Output and Inflation, At the Conference on Monetary Policy Implementation and Transmission in the Post-Crisis Period, Washington, D.C.

From housing economist Tom Lawler:

In its latest Existing Home Sales Report released last month, the National Association of Realtors estimated that existing home sales ran at a seasonally adjusted annual rate of 5.55 million in September, way above consensus but very close to my estimate based on regional tracking of local realtor/MLS reports available prior to the NAR’s release. Since then several additional local realtor/MLS reports have been released, and based on all local realtor/MLS reports released for September it appears that if anything the NAR’s estimate of the YOY % increase in home sales for September was a bit low. The NAR’s estimate showed a YOY % increase in unadjusted sales of 8.0% for September, with YOY increases of 10.2% in the Northeast, 10.9% in the Midwest, 8.5% in the West, but only 5.5% in the South. Local realtor reports from the South, however, strongly suggest that home sales in that region grow by significantly more than 5.5% YOY. For the other regions, in contrast, the NAR estimates seem in line with local realtor reports.

Of course, this does not necessarily mean that the NAR will revise its September sales estimate higher in this month’s report. The NAR’s sample is based almost entirely from MLS reports from metropolitan areas, while where available I use state-wide realtor reports, and it is possible that the NAR’s sample was not representative of overall sales in the region. But there is a slightly better than even chance that the NAR will revise upward its estimate for home sales in the South for September.

In re October, I don’t yet have a large enough sample of reports to generate a national estimate, but incoming reports strongly suggest that the pace of existing home sales in October (seasonally adjusted) will be down significantly from September’s pace.

emphasis added

Lawler: Large Home Builder Results, Q3/2015

by Calculated Risk on 11/11/2015 04:16:00 PM

From housing economist Tom Lawler:

Below is a table showing selected operating statistics for publicly-traded home builders reporting results for the quarter ending September 30, 2015. I’ve included results for LGH Homes, a fast-growing home builder that focuses heavily – though not solely – on “entry-level” home buyers.

Note that Standard Pacific and The Ryland Group merged effective October 1, 2015, but the new company (CalAtlantic Group) provided operating statistics for the separate entities.

For all of these builders combined, net orders per active community were up 9% from the comparable quarter of 2015.

While several builders last quarter said that “resource constraints,” especially with respect to labor (labors, land development, and trades), had caused delays in home closings and may have adversely impacted sales, a few said that “labor” wasn’t much of an issue last quarter. D.R. Horton and LGI Homes were both in the latter camp, and both said or implied that their business strategies of building relatively more “spec” homes than the rest of the industry helped them by providing more steady work to contractors

| Net Orders | Settlements | Average Closing Price ($000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg |

| D.R. Horton | 8,477 | 7,135 | 18.8% | 10,576 | 8,612 | 22.8% | $289 | 279 | 3.4% |

| Pulte Group | 4,092 | 3,779 | 8.3% | 4,356 | 4,646 | -6.2% | $336 | 334 | 0.6% |

| NVR | 3,258 | 2,936 | 11.0% | 3,607 | 3,236 | 11.5% | $380 | 366 | 3.9% |

| The Ryland Group | 1,912 | 1,707 | 12.0% | 2,046 | 2,018 | 1.4% | $339 | 331 | 2.4% |

| Beazer Homes | 1,170 | 1,173 | -0.3% | 1,896 | 1,695 | 11.9% | $322 | 295 | 9.2% |

| Standard Pacific | 1,326 | 1,154 | 14.9% | 1,165 | 1,250 | -6.8% | $537 | 483 | 11.2% |

| Meritage Homes | 1,567 | 1,500 | 4.5% | 1,712 | 1,522 | 12.5% | $387 | 358 | 8.1% |

| MDC Holdings | 1,109 | 1,081 | 2.6% | 1,080 | 1,093 | -1.2% | $421 | 370 | 13.6% |

| M/I Homes | 988 | 892 | 10.8% | 994 | 985 | 0.9% | $349 | 320 | 9.1% |

| SubTotal | 23,899 | 21,357 | 11.9% | 27,432 | 25,057 | 9.5% | $338 | $326 | 3.7% |

| LGI Homes | 908 | 553 | 64.2% | 934 | 557 | 67.7% | $186 | $166 | 12.1% |

| Total | 24,807 | 21,910 | 13.2% | 28,366 | 25,614 | 10.7% | $333 | $322 | 3.3% |

D.R. Horton provided information on the share of net orders and closings for each of its three “brands:” “Horton” (its “traditional” brand); Emerald (its high-end/”luxury” brand); and Express (its “entry-level” brand). Using these shares, here is a table showing selected operating stats from D.R. Horton by “brand.”

| D.R. Horton Operating Stats by "Brand" | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Net Orders | Settlements | Average Closing Price ($000s) | |||||||

| Qtr. Ended: | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg |

| Horton | 6,358 | 6,279 | 1.3% | 8,038 | 7,923 | 1.4% | $305 | $281 | 8.5% |

| Express | 1,865 | 714 | 161.4% | 2,221 | 517 | 329.8% | $191 | $169 | 13.1% |

| Emerald | 254 | 143 | 78.2% | 317 | 172 | 84.2% | $554 | $544 | 1.9% |

The extraordinary growth in Horton’s “Express” brand in part reflects strong response from consumers to these lower-priced/smaller/fewer amenity homes, though it also reflects the sharp increase in the number of markets where Express homes are available (48 markets/15 states last quarter vs. 24 markets/8 states a year ago.) The sizable YOY increase in the average selling prices of Express homes partly reflects “true” price increase, partly reflects on average larger homes, and partly reflects the higher “price points” (on average) of the newer markets relative to the “older” markets.

LGI Homes also experienced extraordinary growth in net orders and home closings. Part of this jump reflected its expansion into more markets, but LGI Homes also showed a YOY increase in ne orders per community of 11.7%. As with Horton’s “Express,” the sizable YOY increase in the average sales price partly reflects “true” price increase, partly reflects on average larger homes, and partly reflects the higher “price points” (on average) of the newer markets relative to the “older” markets.

I’ll have more to say about LGI Homes in a later report.

FNC: Residential Property Values increased 6.1% year-over-year in September

by Calculated Risk on 11/11/2015 01:52:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their September 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.2% from August to September (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.5% (NSA), the 20-MSA RPI increased 0.2%, and the 30-MSA RPI increased 0.2% in September. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was larger in September than in August, with the 100-MSA composite up 6.1% compared to September 2014.

The index is still down 14.4% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through September 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the 5% range. For example, Case-Shiller was up 4.7% in August, CoreLogic was up 6.4% in September.

Note: The September Case-Shiller index will be released on Tuesday, November 24th.

Goldman: "Health Inflation Should Soon Begin to Rise"

by Calculated Risk on 11/11/2015 10:58:00 AM

From Bloomberg: Goldman Sachs: Health-Care Costs Are About to Start Pushing Core Inflation Higher

"Assuming that the policy-related influences roll off as we expect and that the underlying rate of health inflation rises by the same rate as our predicted path (i.e., it starts from the lower than predicted level but rises by the same amount), we expect that the PCE price index for health services should return to around 1.5 percent year-on-year growth by [the second quarter of] 2016 under the base case, raising core PCE inflation by about 0.15 percentage points," [Goldman Sachs economist Alec Phillips] wrote. "If our estimated equation is accurate and prices begin to catch up with rising wages in the sector, health inflation could potentially rise by a bit more."PCE measured inflation is typically lower than the Consumer Price index (CPI). There are several reasons for the difference in measurement, but a key reason recently is CPI puts more emphasis on rents and housing, and PCE puts more on health care. Since rents and housing have been increasing quicker than healthcare, this has increased the gap between core CPI and core PCE.

As of September, the core PCE index has risen 1.3 percent year-over-year, well shy of the Fed's 2-percent target. A major challenge for the U.S. central bank, which has strongly hinted at liftoff for interest rates in December, will be proving that core PCE inflation can rise along with policy rate.

According to Goldman's analysis, this key segment looks likely to cooperate in this regard, helping the central bank move closer to meeting its dual mandate.

Core PCE was at 1.3% year-over-year in August, and core CPI was at 1.9% in September - and the Goldman analysis suggests core PCE should move up in coming months.

MBA: Mortgage Refinance Applications Decrease in Latest Weekly Survey, Purchase Applications up 18% YoY

by Calculated Risk on 11/11/2015 09:02:00 AM

From the MBA: Refinance Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 6, 2015.

...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 18 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.12 percent, its highest level since August 2015, from 4.01 percent, with points decreasing to 0.45 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

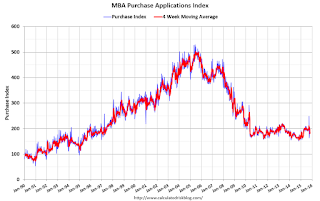

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 18% higher than a year ago.

Tuesday, November 10, 2015

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 11/10/2015 06:20:00 PM

Wednesday:

The Federal Government and Banks will be closed in observance of Veterans Day. The market will be open.

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The prime working age population peaked in 2007, and bottomed at the end of 2012. There are still fewer people in the 25 to 54 age group than in 2007.

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity.

Demographics are now improving in the U.S.!