by Calculated Risk on 11/11/2015 09:02:00 AM

Wednesday, November 11, 2015

MBA: Mortgage Refinance Applications Decrease in Latest Weekly Survey, Purchase Applications up 18% YoY

From the MBA: Refinance Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 6, 2015.

...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 18 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.12 percent, its highest level since August 2015, from 4.01 percent, with points decreasing to 0.45 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

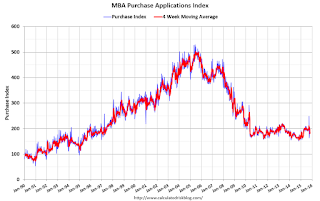

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 18% higher than a year ago.

Tuesday, November 10, 2015

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 11/10/2015 06:20:00 PM

Wednesday:

The Federal Government and Banks will be closed in observance of Veterans Day. The market will be open.

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The prime working age population peaked in 2007, and bottomed at the end of 2012. There are still fewer people in the 25 to 54 age group than in 2007.

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity.

Demographics are now improving in the U.S.!

Las Vegas: On Pace for Record Visitor Traffic in 2015, Conventions Returning

by Calculated Risk on 11/10/2015 02:32:00 PM

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2014.

We only have data through September 2015, but visitor traffic is 2.4% above the record 2014 pace so far.

And convention attendance is returning. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Through September, visitor traffic in 2015 is running 2.4% above 2014.

Convention traffic is up 5.3% from last year, but is still below the pre-recession peak. In general, the gamblers are back - and the conventions are returning.

It seemed like there were many housing related conventions during the housing bubble, so it may be some time before convention attendance hits a new high.

Duy's Fed Watch: "Onto The Next Question"

by Calculated Risk on 11/10/2015 11:43:00 AM

Some excerpts from a piece by Tim Duy: Onto The Next Question

It would seem that a December rate hike is all but certain barring some dramatic deterioration in financial conditions. The October employment report should remove any residual concerns among FOMC members over the underlaying pace of activity, clearing the way for the Fed to make good on the strongly worded October FOMC statement. Given the resilience of recent trends, it is tough to see that even a weak-ish November employment report would dissuade the Fed from hiking rates. Quite frankly, regardless of whether you think they should hike rates, if they don't hike rates, the divergence between what they say and what they do would become truly untenable from a communications perspective.

...

The question now arises, however, of what is "gradual"? The general consensus is the "gradual" means 25bp every other meeting. ...

...

Has the Fed already waited too long to sustain a path of 25bp every other meeting? That is what we should be asking. Indeed, I believe the next labor report will have more implications for the January meeting than the December meeting. ...

Bottom Line: The debate is shifting. It is soon to be no longer about the first rate hike. Fed officials, the question is shifting from whether they should go at all to whether they waited too long.

NFIB: Small Business Optimism Index unchanged in October

by Calculated Risk on 11/10/2015 09:30:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Flat Lined in October

The Index of Small Business Optimism was unchanged in October, posting no change after a rise of only 0.2 points in September and a gain of only 0.5 points in August. ...

Although the labor market components posted minor declines, they held at historically strong levels ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index was unchanged at 96.1 in October.

Monday, November 09, 2015

Employment: October Diffusion Indexes

by Calculated Risk on 11/09/2015 04:41:00 PM

Some more positive news in the employment report.

The BLS diffusion index for total private employment was at 61.8 in October, up from 53.4 in September.

For manufacturing, the diffusion index was at 51.9, up from 37.5 in September.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall private job growth was widespread in October.

Overall private job growth was widespread in October.

Update: Framing Lumber Prices down Sharply Year-over-year

by Calculated Risk on 11/09/2015 01:58:00 PM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices are down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts.

Overall the decline in prices is probably due to more supply, and less demand from China.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through October 2015 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 12% from a year ago, and CME futures are down around 21% year-over-year.

Housing: Inventory Build is Over in some Former Distressed Markets

by Calculated Risk on 11/09/2015 10:49:00 AM

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

I don't have a crystal ball, but watching inventory helps understand the housing market. If inventory kept increasing rapidly in certain markets, then we would eventually see price declines. However it now appears the inventory build is over in some former distressed markets.

The table below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento (October 2015 not available yet for Phoenix and Sacramento). Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year.

This makes sense. Prices increased rapidly in these markets in 2012 and 2013 (bouncing off the bottom with low inventory). Higher prices attracted more people to list their homes. Once prices flattened out, potential sellers weren't as motivated to list their homes. Unlike following the housing bubble, most of these potential sellers probably don't need to sell, so listings didn't grow to the moon!

Now listing are starting to decline, so prices might increase a little quicker. As an example, according to Case-Shiller, prices in Phoenix only increased 2.4% in 2014, but have increased 3.5% already this year through August. For Phoenix, the inventory build ended near the end of 2014.

For Las Vegas, the inventory might have just ended a couple of months ago. If inventory continues to decline, it seems likely price increases will pick up in Las Vegas.

I still expect overall inventory to continue to increase nationally, but this is something to watch.

| Year-over-year Change in Active Inventory | |||

|---|---|---|---|

| Month | Las Vegas | Phoenix | Sacramento |

| Jan-13 | -58.3% | -11.7% | -61.1% |

| Feb-13 | -53.4% | -8.5% | -51.1% |

| Mar-13 | -42.1% | -5.2% | -37.8% |

| Apr-13 | -24.1% | -4.9% | -10.3% |

| May-13 | -13.2% | -2.1% | 5.3% |

| Jun-13 | 3.7% | -1.6% | 18.3% |

| Jul-13 | 9.0% | -1.6% | 54.3% |

| Aug-13 | 41.1% | 2.4% | 46.8% |

| Sep-13 | 60.5% | 7.8% | 77.3% |

| Oct-13 | 73.4% | 15.7% | 93.2% |

| Nov-13 | 77.4% | 15.2% | 56.8% |

| Dec-13 | 78.6% | 20.9% | 44.2% |

| Jan-14 | 96.2% | 29.6% | 96.3% |

| Feb-14 | 107.3% | 37.7% | 87.8% |

| Mar-14 | 127.9% | 45.5% | 71.2% |

| Apr-14 | 103.1% | 48.8% | 46.3% |

| May-14 | 100.6% | 47.4% | 83.7% |

| Jun-14 | 86.2% | 43.1% | 91.0% |

| Jul-14 | 55.2% | 35.1% | 68.0% |

| Aug-14 | 38.8% | 21.9% | 60.6% |

| Sep-14 | 29.5% | 13.2% | 50.9% |

| Oct-14 | 25.6% | 5.7% | 29.1% |

| Nov-14 | 20.0% | 2.5% | 36.6% |

| Dec-14 | 18.0% | -1.8% | 32.2% |

| Jan-15 | 12.9% | -4.9% | 24.8% |

| Feb-15 | 15.8% | -8.4% | 13.9% |

| Mar-15 | 12.2% | -11.7% | 25.1% |

| Apr-15 | 7.6% | -13.2% | 26.0% |

| May-15 | 7.8% | -15.4% | -0.1% |

| Jun-15 | 4.3% | -16.4% | -10.0% |

| Jul-15 | 5.1% | -15.3% | -10.8% |

| Aug-15 | 3.5% | -13.7% | -14.9% |

| Sep-15 | -0.8% | -11.7% | -18.5% |

| Oct-15 | -7.1% | NA | NA |

Las Vegas Real Estate in October: Sales Increased 6% YoY, Inventory Down YoY

by Calculated Risk on 11/09/2015 08:01:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR Report on Local Housing Market Shows Stable is the New Normal

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in October was 3,020, up from 2,861 one year ago. Compared to October 2014, 4.7 percent more homes and 9.2 percent more condos and townhomes sold this October. Lynam said local home sales in 2015 remain ahead of last year’s sales pace.There are several key trends that we've been following:

For more than two years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In October, 6.7 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10.6 percent one year ago. Another 7.5 percent of October sales were bank-owned, down from 8.9 percent one year ago.

...

By the end of October, GLVAR reported 8,252 single-family homes listed without any sort of offer. That’s down 7.1 percent from one year ago. For condos and townhomes, the 2,314 properties listed without offers in October represented a 9.2 percent decrease from one year ago.

emphasis added

1) Overall sales were up 5.6% year-over-year.

2) Conventional (equity, not distressed) sales were up 13% year-over-year. In Oct 2014, 80.5% of all sales were conventional equity. In Oct 2015, 85.8% were standard equity sales.

3) The percent of cash sales has declined year-over-year from 35.1% in Oct 2014 to 30.9% in Oct 2015. (investor buying appears to be declining).

4) Non-contingent inventory is down 7.1% year-over-year. This was the second YoY decline in inventory since 2013. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is over.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

| Jun-15 | 4.3% |

| Jul-15 | 5.1% |

| Aug-15 | 3.5% |

| Sep-15 | -0.8% |

| Oct-15 | -7.1% |

Sunday, November 08, 2015

Sunday Night Futures

by Calculated Risk on 11/08/2015 07:54:00 PM

Goldman Sachs chief economist Jan Hatzius as quoted in Business Insider:

"The October employment report was solidly better-than-expected, and we now see a rate increase from the FOMC at the December meeting as very likely."More from Hatzius as quoted by Bloomberg's Matthew Boesler:

[Hatzius wrote] "our baseline view of the economy now implies a clear need for higher rates before long"Weekend:

• Schedule for Week of November 8, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $44.37 per barrel and Brent at $47.48 per barrel. A year ago, WTI was at $78, and Brent was at $83 - so prices are down about 40% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon (down over $0.70 per gallon from a year ago).