by Calculated Risk on 10/24/2015 08:11:00 AM

Saturday, October 24, 2015

Schedule for Week of October 25th

The key reports this week are September New Home sales on Monday, the advance estimate of Q3 GDP on Thursday, and August Case-Shiller house prices on Tuesday.

The FOMC meets on Tuesday and Wednesday, but no change in policy is expected.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for a decrease in sales to 549 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 552 thousand in August.

10:30 AM: Dallas Fed Manufacturing Survey for October.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the July 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for August. The Zillow forecast is for the National Index to increase 4.7% year-over-year in August.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

10:00 AM: the Q3 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Meeting Announcement. No change in policy is expected at this meeting.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2015 (Advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 1.0% increase in the index.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

8:30 AM ET: Employment Cost Index for Q3. The consensus is for a 0.6% increase in Q3.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 49.2, up from 48.7 in September.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 92.5, up from the preliminary reading of 92.1.

Friday, October 23, 2015

Merrill on Q3 GDP and Headwinds

by Calculated Risk on 10/23/2015 08:00:00 PM

The advance estimate for Q3 GDP will be released Thursday October 29th. Here is Merrill Lynch's forecast:

The economy has faced some strong headwinds this year, including a sharp rise in the dollar, weaker-than-expected global growth and sharp cuts in oil sector investment. Further, the economy is in the middle of an inventory correction. Weaker data, particularly for inventories, has contributed to lower GDP tracking, and we are now incorporating that weakness into our official forecast, cutting 3Q real GDP growth by 0.8pp to 1.2%. This lowers 2014 annual GDP growth to 2.4% from 2.5%. Looking past trade and inventories, domestic demand is expected to remain strong, rising by 3.5% in 3Q 2015, and by 3.0% in 2015 as a whole.And on headwinds for the U.S. economy:

First, while the economy faces new global headwinds, the fundamental backdrop for the domestic economy has improved significantly. Post-crisis deleveraging has largely run its course. The housing and banking sectors are back on their feet. And Washington is no longer a major source of austerity and confidence shocks: Federal and state and local fiscal policy has shifted from a 1% or higher GDP headwind to a small tailwind and Americans have learned to largely ignore the budget battles in Washington. In our view, the new global headwinds—a strong dollar, weak growth in emerging markets and weak commodity prices—have less impact on US growth than the fading domestic headwinds –deleveraging, crippled banking and housing sectors and fiscal shocks.The future is bright!

Second, it is important to get the timing of the various shocks right. In our view, most of the hit to growth from global developments has already happened. The strong dollar is an ongoing drag on growth, but model simulations suggest a hump-shape pattern, with small effects last year, a peak drag on growth this summer and diminishing drag in the quarters ahead. On a similar vein, the biggest hit from the collapse in oil prices is behind us, with the collapse in mining investment in the first half of the year. Going forward, we expect a small net effect from low prices as a slow decline in mining related activity is offset or more than offset by consumers spending more of their savings from lower gas prices. The same applies to the inventory adjustment: almost all of the correction came in 3Q. The only shock that builds, rather than diminishes, going forward is the trade and confidence shocks from weakness in China and the rest of emerging markets. Our hope and expectation is that these effects will be small.

Off topic: Hurricane Patricia

by Calculated Risk on 10/23/2015 04:51:00 PM

Hurricane Patricia is about to make landfall in Mexico as a category 5 storm. According to the National Hurricane Center:

There has been little change in the satellite appearance of Patricia since the earlier Hurricane Hunter aircraft left the hurricane. Based on this, the initial intensity remains 175 kt. Some fluctuations in strength are possible before landfall, but it is expected that Patricia will make landfall as a Category 5 hurricane in southwestern Mexico in less than 12 hours. After landfall, a combination of the mountainous terrain of Mexico and increasing shear should cause the cyclone to rapidly weaken, with the system likely to dissipate completely after 36 hours.Below is a satellite image of Patricia. The storm east of Hawaii is Olaf (that is expected to dissipate). For a larger image, click here.

...

The global models continue to depict the development of a cyclone near the Texas coast over the weekend. This system should be non-tropical in nature. However, this cyclone is expected to draw significant amounts of moisture from Patricia's remnants, and could result in locally heavy rainfall over portions of the northwestern Gulf of Mexico coastal area within the next few days.

A Few Random Comments on September Existing Home Sales

by Calculated Risk on 10/23/2015 02:43:00 PM

Once again, housing economist Tom Lawler's projection of the NAR reported sales rate was much closer than the consensus. For September, the NAR reported sales of 5.55 million on a seasonally adjusted annual rate (SAAR) basis, the consensus was 5.35 million, and Lawler's projection was 5.56 million (almost exact). Thanks to Tom for sharing his research with all of us!

Yesterday: Existing Home Sales in September: 5.55 million SAAR

Even though sales were up in September, I expect that the seasonally adjusted pace for existing home sales will slow in coming months due to limited inventory and higher prices.

However, if sales do slow, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. So some slowing for existing home sales (if it happens) will not be a big deal for the economy.

Also, I've been expecting some increase in inventory this year, but it hasn't happened yet. Inventory is still very low (down 3.1% year-over-year in September). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Also, the NAR reported distressed sales declined a little further year-over-year:

Distressed sales — foreclosures and short sales — remained at 7 percent in September for the third consecutive month; they were 10 percent a year ago. Six percent of September sales were foreclosures and 1 percent (lowest since NAR began tracking in October 2008) were short sales.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in September (red column) were the highest for September since 2006 (NSA).

Philly Fed: State Coincident Indexes increased in 41 states in September

by Calculated Risk on 10/23/2015 11:41:00 AM

From the Philly Fed:

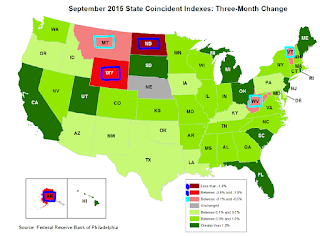

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2015. In the past month, the indexes increased in 41 states, decreased in six, and remained stable in three, for a one-month diffusion index of 70. Over the past three months, the indexes increased in 43 states, decreased in six, and remained stable in one, for a three-month diffusion index of 74.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 42 states had increasing activity (including minor increases).

The worst performing states over the last 6 months are West Virginia (coal), North Dakota (oil), Alaska (oil), Wyoming, and Oklahoma (oil).

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now. Note: Blue added for Red/Green issues.

Black Knight's First Look at September Mortgage Data

by Calculated Risk on 10/23/2015 10:05:00 AM

From Black Knight: Black Knight Financial Services' First Look at September Mortgage Data: Delinquency Rate Rises for Second Consecutive Month, Now 4.9 Percent

According to Black Knight's First Look report for September, the percent of loans delinquent increased 1.7% in September compared to August, and declined 13.9% year-over-year.

The percent of loans in the foreclosure process declined 1.5% in September and were down 23% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.87% in September.

The percent of loans in the foreclosure process declined in September to 1.46%.

The number of delinquent properties, but not in foreclosure, is down 392,000 properties year-over-year, and the number of properties in the foreclosure process is down 214,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for September in early November.

Thursday, October 22, 2015

Apartments: Q&A with NMHC Chief Economist Mark Obrinsky

by Calculated Risk on 10/22/2015 06:11:00 PM

Following the release today of the National Multifamily Housing Council (NMHC) quarterly apartment survey, I had an email exchange with NMHC chief economist Dr. Mark Obrinsky. I've known Mark for several years, and he has helped me understand the apartment market (and other economic topics). His bio is here.

McBride: I’ve found the NMHC quarterly apartment survey very useful in analyzing the apartment market. I understand the indexes are standard diffusion indexes. Could you share with us the coverage of the survey?

Obrinsky: We survey NMHC members who are apartment owners, property managers, developers, brokers, investors, and lenders.

McBride: In the October 2015 survey released today, the tightness index was at 53 (Any reading above 50 indicates tighter conditions from the previous quarter). This would seem to suggest upward pressure on rents, and downward pressure on the vacancy rate. Is that a reasonable interpretation?

Obrinsky: Indeed, a market tightness index reading above 50 indicates higher rents, lower vacancies, or both.

Note that in the most recent survey, 60% of respondents indicated conditions are unchanged from 3 months earlier; 23% indicated tighter conditions, 16% indicated looser conditions. A reasonable interpretation would be that most markets saw little change – and that the number of markets where conditions tightened was a little higher than the number of markets where conditions loosened.

McBride: Other sources, such as the Reis apartment survey (large cities only) seem to suggest the vacancy rate has bottomed. Reis Senior Economist and Director of Research Ryan Severino recently wrote:

“It appears as if the market has finally reached its inflection point during the third quarter. Although the national vacancy increase of 10 basis points was slight, it was actually a slight acceleration of a trend that began during the second quarter of 2014. ... Importantly, this rise in vacancy has occurred without the deluge of new supply that is in the pipeline but has not yet hit the market. When that occurs, likely in the next few quarters, vacancy increases are sure to accelerate because the market will not be able to digest that much new product.”Do you think the vacancy rate has bottomed or is near a bottom?

Obrinsky: By most measures, the national vacancy rate for apartments is quite low. For example, the Census Bureau’s estimate for rental units in buildings with at least 5 units is at its lowest point since 1984. Some private data providers estimate the vacancy rate for investment grade apartments at 4% or less. Thus, there isn’t much room for the vacancy rate to decline from here, especially with new construction finally getting close to the level needed to meet the increase in demand for apartments.

That said, the vacancy rate is only one indicator, and no single indicator is likely to capture the dynamics of the industry. Higher demand can show up as either a lower vacancy rate or higher rent growth or both. In today’s market, the impact of strong demand is evidenced not only in the low vacancy rate, but even more so in rent growth. Several data sources show rent growth at or above 5% annually, and by one measure rent growth is the strongest since days of the tech bubble (when national averages were skewed by the outsized rent growth on the West Coast, particularly in northern California). This is especially interesting considering that rent growth slowed in 2012-2013, but has picked up strongly since then.

McBride: An indicator I follow for new multifamily construction is the AIA Architecture Billings Index. The sector index for the multi-family residential market was negative for the eighth consecutive month in September - and this might be indicating a slowdown for new apartment construction. Multifamily has been a significant driver of the rebound in total housing starts over the last several years, so a slowdown would be important. Do you expect multifamily housing starts to level out, or do you expect further growth?

Obrinsky: I have long said we need 300-400 thousand new apartments annually for an extended period of time to meet the ongoing demand increase plus pentup demand from the recession and its aftermath. (This range also includes the estimated 100-125 thousand units lost each year due to destruction, deterioration, or conversion to other use.) I would expect to see starts in this range for some time.

McBride: Back in April 2010 the tightness index increased significantly, and this was one of the first signs of the coming rental boom. Back then you and I discussed the favorable demographics for apartments, and also the impact of the housing bust and foreclosure crisis on the rental market. The foreclosure crisis is mostly behind us. What is your current view on demographics and the apartment market?

Obrinsky: I continue to think demographic trends are bullish for apartments. In particular:

• overall population growth (good for rental and for-sale housing). The UN projections show that only 7 countries will add more people over the next 10 years (and only 6 countries will add more people in the next 20 years).

• continuing trend in household composition: more single-person households (now the most common household type, surpassing married couples without children), single parents, and roommates. All these household types have a higher propensity to rent than the national average.

• immigration has bounced back from its recession-induced lows, and immigrants are more likely to rent than native born. And: newly arrived immigrants (less than 10 years in the US) are more likely to rent than immigrants who arrived earlier (in the US 10 years or more), but even immigrants who arrived earlier are more likely to rent than native born householders.

• young people are entering the housing market in large numbers (and will continue to do so for years), and young people are the most likely group to rent.

• baby boomer downsizing, giving up the large suburban single-family home to move to multifamily housing (condos and apartments) in close-in suburbs or cities. There is mixed evidence on this, but even if the share of older households who do this is unchanged from previous generations, the fact that there are so many more boomers than previous generations mean this could be an important source of demand.

And just to clarify: renting vs. owning doesn’t have to be – and through most of our postwar history wasn’t – a zero-sum game. We can have more of both. In saying that demographic trends are favorable for apartments, I am not saying that the homeownership rate will continue to fall indefinitely.

McBride: Thanks Mark!

NMHC: Apartment Market Conditions Slightly Tighter in October Survey

by Calculated Risk on 10/22/2015 02:30:00 PM

From the National Multifamily Housing Council (NMHC): NMHC Quarterly Survey of Apartment Conditions October 2015

The Market Tightness Index decreased by 8 points from last quarter (and increased by 1 point from a year earlier) to 53. Thirty-one percent of respondents reported tighter conditions than three months ago.

This is the seventh consecutive quarter where the index indicates tighter conditions. And the index indicated tighter conditions in 21 of the 23 quarters.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates market conditions were tighter over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

Kansas City Fed: Regional Manufacturing Activity "Steadied" in October

by Calculated Risk on 10/22/2015 12:17:00 PM

From the Kansas City Fed: Tenth District Manufacturing Activity Steadied

The Federal Reserve Bank of Kansas City released the October Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity steadied somewhat and was expected to remain largely unchanged heading forward.The earlier decline in the Kansas City region manufacturing was probably mostly due to lower oil prices, although respondents are also blame weaker exports on the strong dollar.

“Following six months of composite index readings of worse than -6, this month’s reading of -1 was somewhat encouraging,” said Wilkerson. “Modest increases in new orders and production nearly offset declines in employment, supplier delivery time, and inventory indexes.”

...

Tenth District manufacturing activity steadied somewhat, and expectations for future activity were largely flat following last month’s more negative reading. Most price indexes edged higher for the first time in several months.

The month-over-month composite index was -1 in October, up from -8 in September and -9 in August ...

emphasis added

Existing Home Sales in September: 5.55 million SAAR

by Calculated Risk on 10/22/2015 10:11:00 AM

From the NAR: Existing-Home Sales Regain Momentum in September

Total existing–home sales, which are completed transactions that include single–family homes, townhomes, condominiums and co–ops, increased 4.7 percent to a seasonally adjusted annual rate of 5.55 million in September from a slightly downwardly revised 5.30 million in August, and are now 8.8 percent above a year ago (5.10 million). ...

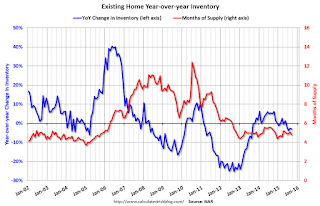

Total housing inventory at the end of September decreased 2.6 percent to 2.21 million existing homes available for sale, and is now 3.1 percent lower than a year ago (2.28 million). Unsold inventory is at a 4.8–month supply at the current sales pace, down from 5.1 months in August.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (5.55 million SAAR) were 4.7% higher than last month, and were 8.8% above the September 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.21 million in September from 2.27 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.21 million in September from 2.27 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 3.1% year-over-year in September compared to September 2014.

Inventory decreased 3.1% year-over-year in September compared to September 2014. Months of supply was at 4.8 months in September.

This was above expectations of sales of 5.35 million. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...