by Calculated Risk on 9/19/2015 08:15:00 AM

Saturday, September 19, 2015

Schedule for Week of September 20, 2015

The key reports this week are August New Home sales on Thursday, the third estimate of Q2 GDP, also on Thursday, and August existing home sales on Monday.

There will be a focus on Fed Chair Dr. Yellen's speech on Thursday.

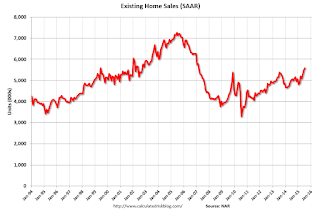

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.50 million SAAR, down from 5.59 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.50 million SAAR, down from 5.59 million in July. Sales in July were at a 5.59 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.54 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

9:00 AM: FHFA House Price Index for July 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, up from 264 thousand the previous week.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.2% decrease in durable goods orders.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 515 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 507 thousand in July.

11:00 AM: the Kansas City Fed manufacturing survey for August.

5:00 PM: Speech by Fed Chair Janet Yellen, "Inflation Dynamics and Monetary Policy", At the University of Massachusetts Amherst, Amherst, Massachusetts

8:30 AM: Gross Domestic Product, 2nd quarter 2015 (third estimate). The consensus is that real GDP increased 3.7% annualized in Q2, the same as the second estimate.

10:00 AM: University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 87.1, up from the preliminary reading of 85.7.

Friday, September 18, 2015

Mortgage Equity Withdrawal Slightly Negative in Q2 2015

by Calculated Risk on 9/18/2015 02:17:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2015, the Net Equity Extraction was minus $4 billion, or a negative 0.1% of Disposable Personal Income (DPI) - only slightly negative.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There might be a little actual MEW right now, however this data is heavily impacted by debt cancellation and foreclosures.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $38 billion in Q2.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again soon.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Flow of Funds: Household Net Worth at Record High at end of Q2

by Calculated Risk on 9/18/2015 12:28:00 PM

The Federal Reserve released the Q2 2015 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q2 compared to Q1:

The net worth of households and nonprofits rose to $85.7 trillion during the second quarter of 2015. The value of directly and indirectly held corporate equities increased $61 billion and the value of real estate rose $499 billion.Household net worth was at $85.7 trillion in Q2 2015, up from $85.0 billion in Q1. Net worth will probably decline in Q3 due to the decline in the stock market..

The Fed estimated that the value of household real estate increased to $21.5 trillion in Q2 2015. The value of household real estate is still $1.0 trillion below the peak in early 2006 (not adjusted for inflation).

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2015, household percent equity (of household real estate) was at 56.3% - up from Q1, and the highest since Q3 2006. This was because of an increase in house prices in Q2 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 56.3% equity - and several million still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $38 billion in Q2.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q2, and somewhat above the average of the last 30 years (excluding bubble).

BLS: Twenty-Nine States had Unemployment Rate Decreases in August

by Calculated Risk on 9/18/2015 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in August. Twenty-nine states had unemployment rate decreases from July, 10 states had increases, and 11 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nebraska had the lowest jobless rate in August, 2.8 percent, followed by North Dakota, 2.9 percent. West Virginia had the highest rate, 7.6 percent.

Click on graph for larger image.

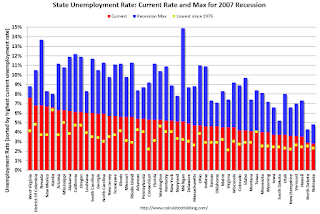

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. West Virginia, at 7.6%, had the highest state unemployment rate.

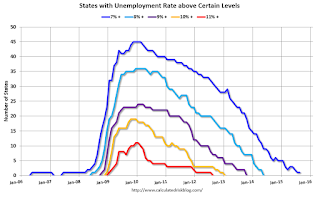

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Only one state (West Virginia) was at or above 7% (dark blue).

Thursday, September 17, 2015

Mortgage Rates Decline after FOMC Annoucement

by Calculated Risk on 9/17/2015 08:06:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drop Sharply After Fed Announcement

While the Fed Funds Rate doesn't directly dictate mortgage rates, the two tend to correlate over time. At its most basic level, the Fed rate dictates the cost of short term money, which has ripple effects that carry through to longer term financing costs, like those associated with things like 10yr Treasury notes and mortgage rates.Friday:

Not only did the Fed forego a rate hike, they were also noticeably more downbeat about inflation and global growth/stability. It's just as likely that these longer-term implications helped longer term rates (like mortgages) do as well as they did today.

All that having been said, the drop in rates merely brings them back in line with last week's best levels. Considering they only rose from there due to Anxiety over today's Fed meeting, it's not unfair to say that rates are still in the same narrow range that's been in effect for more than 2 months. ... several lenders inching back into the high 3's today for conventional 30yr fixed rate quotes ...

• At 10:00 AM ET, Regional and State Employment and Unemployment for August.

• At 12:00 PM, Q2 Flow of Funds Accounts of the United States from the Federal Reserve

Earlier: Philly Fed Manufacturing Survey decreased to -6.0 in September

by Calculated Risk on 9/17/2015 06:03:00 PM

From the Philly Fed: September Manufacturing Survey

Manufacturing conditions in the region were mixed in September, according to firms responding to this month’s Manufacturing Business Outlook Survey. The indicator for general activity fell into negative territory, but indicators for new orders, shipments, and employment remained positive.This was below the consensus forecast of a reading of 6.3 for September.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 8.3 in August to -6.0 this month. This is the first negative reading in the index since February 2014 ...

Firms’ responses suggest some improvement in employment conditions in September despite the reported lull in overall activity. The percentage of firms reporting an increase in employees in September (21 percent) was higher than the percentage reporting a decrease (11 percent). The current employment index increased 5 points, its highest reading in five months. Firms also reported, on balance, a modest increase in the workweek similar to August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys decreased in September, and this suggests a weak reading for the ISM survey.

FOMC Projections and Press Conference

by Calculated Risk on 9/17/2015 02:11:00 PM

Statement here. No rate hike.

As far as the "Appropriate timing of policy firming", participant views moved out a little on the timing of the first rate hike (13 participants expect the first rate hike in 2015, down from 15 in June, 3 in 2016, up from 2, and 1 in 2017), and the "dots" moved down (fewer rate hikes this year and next).

The FOMC projections for inflation are still on the low side through 2017.

Yellen press conference here.

On the projections, GDP for 2015 was revised up, the unemployment rate was revised down, and core PCE inflation projections were mostly unrevised.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 2.0 to 2.3 | 2.2 to 2.6 | 2.0 to 2.4 | |

| Jun 2015 | 1.8 to 2.0 | 2.4 to 2.7 | 2.1 to 2.5 | |

| Mar 2015 | 2.3 to 2.7 | 2.3 to 2.7 | 2.0 to 2.5 | |

The unemployment rate was at 5.1% in August, so the unemployment rate projection for Q4 2015 was revised lower.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | |

| Sept 2015 | 5.0 to 5.1 | 4.7 to 4.9 | 4.7 to 4.9 | |

| Jun 2015 | 5.2 to 5.3 | 4.9 to 5.1 | 4.9 to 5.1 | |

| Mar 2015 | 5.0 to 5.2 | 4.9 to 5.1 | 4.8 to 5.1 | |

As of July, PCE inflation was up only 0.3% from July 2014, so the FOMC revised down PCE inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 0.3 to 0.5 | 1.5 to 1.8 | 1.8 to 2.0 | |

| Jun 2015 | 0.6 to 0.8 | 1.6 to 1.9 | 1.9 to 2.0 | |

| Mar 2015 | 0.6 to 0.8 | 1.7 to 1.9 | 1.9 to 2.0 | |

PCE core inflation was up only 1.2% in July year-over-year. However core PCE inflation has been running at a 1.7% annualized rate over the last 6 months.

Core PCE inflation projection was unchanged for Q4 2015, but revised down slightly for 2016 and 2017.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 1.3 to 1.4 | 1.5 to 1.8 | 1.8 to 2.0 | |

| Jun 2015 | 1.3 to 1.4 | 1.6 to 1.9 | 1.9 to 2.0 | |

| Mar 2015 | 1.3 to 1.4 | 1.5 to 1.9 | 1.8 to 2.0 | |

FOMC Statement: No Rate Hike

by Calculated Risk on 9/17/2015 02:00:00 PM

Information received since the Federal Open Market Committee met in July suggests that economic activity is expanding at a moderate pace. Household spending and business fixed investment have been increasing moderately, and the housing sector has improved further; however, net exports have been soft. The labor market continued to improve, with solid job gains and declining unemployment. On balance, labor market indicators show that underutilization of labor resources has diminished since early this year. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation moved lower; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term. Nonetheless, the Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring developments abroad. Inflation is anticipated to remain near its recent low level in the near term but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams. Voting against the action was Jeffrey M. Lacker, who preferred to raise the target range for the federal funds rate by 25 basis points at this meeting.

Comments on August Housing Starts

by Calculated Risk on 9/17/2015 11:59:00 AM

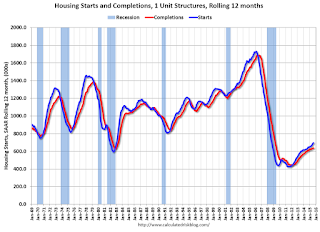

Total housing starts in August were below expectations, and, including the downward revisions to June and July, starts were a little disappointing.

However permits were up in August.

Earlier: Housing Starts decreased to 1.126 Million Annual Rate in August

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Single family starts are running 11.1% ahead of 2014 through August, and single family starts were up 14.9% year-over-year in August.

Starts for 5+ units are up 12.7% for the first eight months compared to last year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A somewhat weak report, but I expect the recovery for single family starts to continue.

Employment: Preliminary annual benchmark revision shows downward adjustment of 208,000 jobs

by Calculated Risk on 9/17/2015 10:05:00 AM

The BLS released the preliminary annual benchmark revision showing 208,000 fewer payroll jobs as of March 2015. The final revision will be published when the January 2016 employment report is released in February 2016. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued on February 5, 2016, with the publication of the January 2016 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2015 was 208,000 lower than originally estimated. In February 2016, the payroll numbers will be revised down to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2014).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus three-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2015 total nonfarm employment of -208,000 (-0.1 percent). ...

There are 33,000 more construction jobs than originally estimated.

This preliminary estimate showed 255,000 fewer private sector jobs, and 47,000 additional government jobs (as of March 2015).