by Calculated Risk on 9/04/2015 08:42:00 AM

Friday, September 04, 2015

August Employment Report: 173,000 Jobs, 5.1% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 173,000 in August, and the unemployment rate edged down to 5.1 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and social assistance and in financial activities. Manufacturing and mining lost jobs.

...

The change in total nonfarm payroll employment for June was revised from +231,000 to +245,000, and the change for July was revised from +215,000 to +245,000. With these revisions, employment gains in June and July combined were 44,000 more than previously reported.

...

In August, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $25.09, following a 6-cent gain in July. Hourly earnings have risen by 2.2 percent over the year.

emphasis added

Click on graph for larger image.

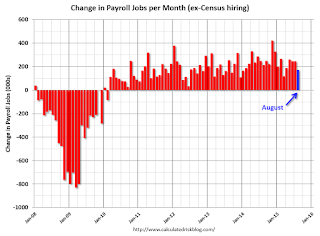

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 173 thousand in August (private payrolls increased 140 thousand).

Payrolls for June and July were revised up by a combined 44 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was over 2.9 million jobs.

That is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was unchanged in August at 62.6%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased to 59.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decline in August to 5.1%.

This was well below expectations of 223,000 jobs, however revisions were up, the unemployment rate declined significantly, and there was some wage growth ... overall a decent report.

I'll have much more later ...

Thursday, September 03, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/03/2015 08:03:00 PM

From Justin Lahart at the WSJ: Jobs Report Could Seal the Deal on Rates

J.P. Morgan economist Michael Feroli thinks the Fed will stand pat, leaving its target range on overnight rates at zero-to-0.25%. But an increase of 250,000 jobs coupled with a drop in the unemployment rate to 5.1% or 5% would represent a “pretty strong case” for a rate increase, he says. Bank of America Merrill Lynch economist Ethan Harris thinks the Fed will raise its rate range by a quarter point, but that a job gain of less than 150,000 would call that into question.As I noted in the earlier employment preview, most of the data was a little weaker in August than in July, and August tends to be revised up significantly - so I'm taking the "under" on the consensus forecast.

Friday:

• At 8:30 AM ET, the Employment Report for August. The consensus is for an increase of 223,000 non-farm payroll jobs added in August, up from the 215,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decrease to 5.2%.

Goldman Employment Forecast: 190K Jobs

by Calculated Risk on 9/03/2015 04:34:00 PM

A brief excerpt from a research note by Goldman Sachs economist Chris Mischaikow August Payrolls Preview

We forecast nonfarm payroll growth of 190k in August, below the consensus forecast of 218k and down from July’s 215k gain. Labor market indicators were mixed last month. However, reported August payroll growth has tended to be relatively soft in the first release, with more frequent downside surprises and larger upward revisions compared to other months.

We expect the unemployment rate to decline to 5.2%, in line with consensus. Average hourly earnings for all employees are likely to increase 0.3% month-over-month in August.

Preview: Employment Report for August

by Calculated Risk on 9/03/2015 12:59:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus, according to Bloomberg, is for an increase of 223,000 non-farm payroll jobs in August (with a range of estimates between 173,000 to 257,000), and for the unemployment rate to decline to 5.2%.

The BLS reported 215,000 jobs added in July.

Here is a summary of recent data:

• The ADP employment report showed an increase of 190,000 private sector payroll jobs in August. This was below expectations of 210,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in August to 51.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 13,000 in August. The ADP report indicated a 7,000 increase for manufacturing jobs.

The ISM non-manufacturing employment index decreased in August to 56.0%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 234,000 in August.

Combined, the ISM indexes suggests employment gains of 221,000. This suggests employment at expectations.

• Initial weekly unemployment claims averaged close to 275,000 in August, about the same as in July. For the BLS reference week (includes the 12th of the month), initial claims were at 277,000; up from 255,000 during the reference week in July.

The increase during the reference suggests a slightly higher level of layoffs in August.

• The final July University of Michigan consumer sentiment index decreased to 91.9 from the July reading of 93.1. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a small decrease in small business employment in August. From Intuit: Small Business: Hours Worked, Compensation Rose in August; Jobs Declined

Small business employment fell by 5,000 jobs in August, an annual rate of 0.30 percent. However, Susan Woodward, the economist who works with Intuit to produce the indexes, said this change is very small.• Trim Tabs reported that the U.S. economy added 241,000 jobs in August. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

“July’s figure was revised up by 2,000 jobs. The level of small business employment is 20.7 million jobs, so the August decline doesn’t indicate a clear or major sign of softness in the labor force,” Woodward said.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report.

There were several weaker indicators such the ADP report, ISM manufacturing, and small business hiring.

Historically the initial report for August tends to be revised up, so I'll take the under on the consensus this month.

ISM Non-Manufacturing Index decreased to 59.0% in August

by Calculated Risk on 9/03/2015 10:05:00 AM

The August ISM Non-manufacturing index was at 59.0%, down from 60.3% in July. The employment index decreased in August to 56.0%, down from 59.6% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 67th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59 percent in August, 1.3 percentage points lower than the July reading of 60.3 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 63.9 percent, which is 1 percentage point lower than the July reading of 64.9 percent, reflecting growth for the 73rd consecutive month at a slower rate. The New Orders Index registered 63.4 percent, 0.4 percentage point lower than the reading of 63.8 percent in July. The Employment Index decreased 3.6 percentage points to 56 percent from the July reading of 59.6 percent and indicates growth for the 18th consecutive month. The Prices Index decreased 2.9 percentage points from the July reading of 53.7 percent to 50.8 percent, indicating prices increased in August for the sixth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in August. Overall, respondents continue to be optimistic about business conditions and the economy. This is reflected by indexes that are again strong; however, lower than what was seen in July."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 58.5% and suggests slightly slower expansion in August than in July. Another strong report.

Trade Deficit decreased in July to $41.8 Billion

by Calculated Risk on 9/03/2015 08:49:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.9 billion in July, down $3.3 billion from $45.2 billion in June, revised. July exports were $188.5 billion, $0.8 billion more than June exports. July imports were $230.4 billion, $2.5 billion less than June imports.The trade deficit was smaller than the consensus forecast of $42.9 billion.

The first graph shows the monthly U.S. exports and imports in dollars through June 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports decreased in July.

Exports are 14% above the pre-recession peak and down 4% compared to July 2014; imports are close to the pre-recession peak, and down 3% compared to July 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $54.20 in July, up from $53.76 in June, and down from $97.81 in July 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $31.6 billion in July, from $30.9 billion in July 2014. The deficit with China is a large portion of the overall deficit.

Weekly Initial Unemployment Claims increased to 282,000

by Calculated Risk on 9/03/2015 08:33:00 AM

The DOL reported:

In the week ending August 29, the advance figure for seasonally adjusted initial claims was 282,000, an increase of 12,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 271,000 to 270,000. The 4-week moving average was 275,500, an increase of 3,250 from the previous week's revised average. The previous week's average was revised down by 250 from 272,500 to 272,250.The previous week was revised down to 270,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 275,500.

This was higher than the consensus forecast of 273,000, however the low level of the 4-week average suggests few layoffs.

Wednesday, September 02, 2015

Thursday: Trade Deficit, Unemployment Claims, ISM non-mfg

by Calculated Risk on 9/02/2015 07:07:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still Waiting for Bigger News

Mortgage rates were almost flat again today. Most lenders were just a hair higher in costs vs yesterday. The most prevalent conventional 30yr fixed quote remains 4.0% for top tier scenarios, but 3.875% is still available.Mortgage rates are mostly moving sideways.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 273 thousand initial claims, up from 271 thousand the previous week.

• Also at 8:30 AM, Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be at $42.9 billion in July from $42.8 billion in June.

• At 10:00 AM, the ISM non-Manufacturing Index for August. The consensus is for index to decrease to 58.5 from 60.3 in July.

Fed's Beige Book: Economic Activity Expanded

by Calculated Risk on 9/02/2015 02:04:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Boston based on information collected on or before August 24, 2015."

Reports from the twelve Federal Reserve Districts indicate economic activity continued expanding across most regions and sectors during the reporting period from July to mid-August. Six Districts cited moderate growth while New York, Philadelphia, Atlanta, Kansas City, and Dallas reported modest increases in activity. The Cleveland District noted only slight growth since the last report. In most cases, these recent results represented a continuation of the overall pace reported in the July Beige Book. Respondents in most sectors across Districts expected growth to continue at its recent pace, but the Kansas City report cited more mixed expectations.And on real estate:

District reports on manufacturing activity were mostly positive, although among these, the Cleveland, St. Louis, Minneapolis, and Dallas Districts painted a somewhat mixed picture across manufacturing sectors. Only the New York and Kansas City Districts cited declines in manufacturing.

Residential real estate activity improved across the 12 Districts, with home sales and home prices increasing in every District, while construction activity was more mixed. ...Mostly positive.

District reports on commercial real estate were positive on balance. Commercial leasing activity increased in the Richmond, Atlanta, Chicago, St. Louis, Minneapolis, and Kansas City Districts. Leasing activity was steady in the Philadelphia District, steady or increasing in the New York District, and mixed in the Boston District. Leasing demand was described as very strong in large cities, including Boston, New York, Philadelphia, Chicago, and Dallas, but Houston saw weak leasing demand.

emphasis added

FDIC: Fewer Problem banks, Residential REO Declines in Q2

by Calculated Risk on 9/02/2015 11:15:00 AM

The FDIC released the Quarterly Banking Profile for Q2 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $43.0 billion in the second quarter of 2015, up $2.9 billion (7.3 percent) from a year earlier and the highest quarterly income on record. The increase in earnings was mainly attributable to a $3.6 billion rise in net operating revenue (net interest income plus total noninterest income). Financial results for the second quarter of 2015 are included in the FDIC's latest Quarterly Banking Profile released today.

...

"Bankers generally reported another quarter of higher earnings, improved asset quality, and increased lending," [FDIC Chairman Martin] Gruenberg said. "There were fewer problem banks, and only one bank failed during the second quarter.

"However," he continued, "the low interest-rate environment remains a challenge. Many institutions have responded by acquiring higher-yielding, longer-term assets, but this has left banks more vulnerable to rising interest rates and that is a matter of ongoing supervisory attention."

...

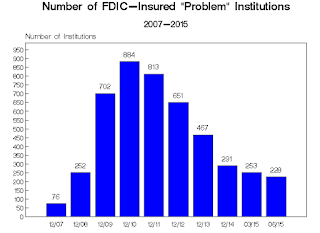

"Problem List" Continues to Shrink: The number of banks on the FDIC's Problem List fell from 253 to 228 during the second quarter. This is the smallest number of problem banks in nearly seven years and is down dramatically from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $60.3 billion to $56.5 billion during the second quarter.

Deposit Insurance Fund (DIF) Rises $2.3 Billion to $67.6 Billion: The DIF increased from $65.3 billion in the first quarter to $67.6 billion in the second quarter, largely driven by $2.3 billion in assessment income. The DIF reserve ratio rose from 1.03 percent to 1.06 percent during the quarter.

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1 and Q2 2015, and year end prior to 2015):

The number of insured commercial banks and savings institutions reporting quarterly financial results in the second quarter fell to 6,348 from 6,419 reporters in the first quarter. During the quarter, 66 institutions were merged into other banks, while one insured institution failed. This is the first time since fourth quarter 2007 that there has been only one failure in a quarter. For a sixth consecutive quarter, no new charters were added. Banks reported 2,042,386 full-time equivalent employees in the second quarter, down from 2,042,688 in the first quarter and 2,059,827 in second quarter 2014. The number of insured institutions on the FDIC’s “Problem List” declined for a 17th consecutive quarter, from 253 to 228. Total assets of problem institutions fell from $60.3 billion to $56.5 billion.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.72 billion in Q1 2015 to $5.23 billion in Q2. This is the lowest level of REOs since Q2 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.72 billion in Q1 2015 to $5.23 billion in Q2. This is the lowest level of REOs since Q2 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.