by Calculated Risk on 9/02/2015 11:15:00 AM

Wednesday, September 02, 2015

FDIC: Fewer Problem banks, Residential REO Declines in Q2

The FDIC released the Quarterly Banking Profile for Q2 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $43.0 billion in the second quarter of 2015, up $2.9 billion (7.3 percent) from a year earlier and the highest quarterly income on record. The increase in earnings was mainly attributable to a $3.6 billion rise in net operating revenue (net interest income plus total noninterest income). Financial results for the second quarter of 2015 are included in the FDIC's latest Quarterly Banking Profile released today.

...

"Bankers generally reported another quarter of higher earnings, improved asset quality, and increased lending," [FDIC Chairman Martin] Gruenberg said. "There were fewer problem banks, and only one bank failed during the second quarter.

"However," he continued, "the low interest-rate environment remains a challenge. Many institutions have responded by acquiring higher-yielding, longer-term assets, but this has left banks more vulnerable to rising interest rates and that is a matter of ongoing supervisory attention."

...

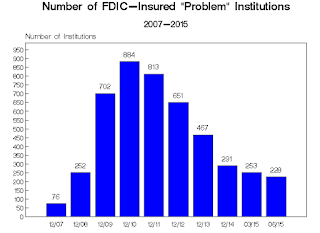

"Problem List" Continues to Shrink: The number of banks on the FDIC's Problem List fell from 253 to 228 during the second quarter. This is the smallest number of problem banks in nearly seven years and is down dramatically from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $60.3 billion to $56.5 billion during the second quarter.

Deposit Insurance Fund (DIF) Rises $2.3 Billion to $67.6 Billion: The DIF increased from $65.3 billion in the first quarter to $67.6 billion in the second quarter, largely driven by $2.3 billion in assessment income. The DIF reserve ratio rose from 1.03 percent to 1.06 percent during the quarter.

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1 and Q2 2015, and year end prior to 2015):

The number of insured commercial banks and savings institutions reporting quarterly financial results in the second quarter fell to 6,348 from 6,419 reporters in the first quarter. During the quarter, 66 institutions were merged into other banks, while one insured institution failed. This is the first time since fourth quarter 2007 that there has been only one failure in a quarter. For a sixth consecutive quarter, no new charters were added. Banks reported 2,042,386 full-time equivalent employees in the second quarter, down from 2,042,688 in the first quarter and 2,059,827 in second quarter 2014. The number of insured institutions on the FDIC’s “Problem List” declined for a 17th consecutive quarter, from 253 to 228. Total assets of problem institutions fell from $60.3 billion to $56.5 billion.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.72 billion in Q1 2015 to $5.23 billion in Q2. This is the lowest level of REOs since Q2 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.72 billion in Q1 2015 to $5.23 billion in Q2. This is the lowest level of REOs since Q2 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.