by Calculated Risk on 7/19/2015 09:11:00 PM

Sunday, July 19, 2015

Sunday Night Futures

First, a reminder of what Professor Tim Duy wrote earlier this year:

I tend agree that the net impact [from the decline in oil prices] will be positive, but note that the negative impacts will be fairly concentrated and easy for the media to sensationalize, while the positive impacts will be fairly dispersed. We all know what is going to happen to rig counts, high-yield energy debt, and the economies of North Dakota and at least parts of Texas. "Kablooey," I think, is the technical term. Easy media fodder. Much more difficult to see the positive impact spread across the real incomes of millions of households, with particularly solid gains at the lower ends of the income distribution. This will be most likely revealed in the aggregate data and be much less newsworthy.I added to Duy's observation by noting that the negative impacts would happen quicker than the positive impacts, but lower oil prices would still be an overall positive for 2015.

emphasis added

Now from Justin Lahart at the WSJ: Cheap Oil Should Fuel Economy at Last

It looks like better days [in oil producing states] are in the offing. Federal Reserve data released last week showed that the sharp downdraft in drilling activity eased in June. And after falling by more half in the first six months of the year, Baker Hughes ’s weekly count of U.S. oil rigs has just leveled out.Weekend:

Layoff announcements in the energy sector have also fallen back lately. And Goldman’s Mr. Pandl calculates that, adjusting for seasonal swings, initial claims for unemployment insurance in the five states above have also cooled off.

So at the least, the drag from oil on the economy should diminish in the months ahead, putting U.S. growth on a better footing in the second half of the year. What’s more, consumers may start spending more of the money they have been saving at the pump.

• Schedule for Week of July 19, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are flat and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $50.78 per barrel and Brent at $56.99 per barrel. A year ago, WTI was at $103, and Brent was at $106 - so prices are down about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.76 per gallon (down about $0.82 per gallon from a year ago).

EIA: West Coast Gasoline Prices "likely to remain elevated until later this summer"

by Calculated Risk on 7/19/2015 11:38:00 AM

An interesting article from the EIA: California gasoline prices rise further as lengthier supply chain is strained. A few excerpts:

West Coast spot prices for conventional gasoline increased sharply last week, while falling slightly on the Gulf Coast and remaining flat on the East Coast. The Los Angeles, California, spot price for conventional gasoline increased nearly 90 cents per gallon (cents/gal) between July 6 and July 13, while San Francisco, California, and Portland, Oregon prices increased 24 cents/gal and 5 cents/gal, respectively (Figure 1). This most recent price rise results from a delay in receipts of waterborne imports of gasoline blending components and a decrease in total motor gasoline inventories within an already constrained supply chain.

Click on graph for larger image.

Click on graph for larger image.West Coast spot gasoline prices typically trade at a premium to prices in other regions of the country because of the region's unique product specifications and relative isolation from other domestic and international markets. As a result, West Coast gasoline markets are primarily supplied by in-region production, and prices react more quickly and strongly during times of local supply shortages. The West Coast gasoline spot price differential has been higher than usual for the past several months following a series of supply disruptions caused by an unplanned refinery outage in February and additional refinery outages in April. Also, West Coast gasoline demand is up 4% in the first four months of 2015 compared with the same time last year, putting additional pressure on the supply chain.

...

Other periods of price spikes have occurred in California, most notably in 2008, 2009, and 2012, that were similar in duration and magnitude to the current situation. By early June of this year, the other refineries were back in operation so only the Torrance refinery remains down. Prices will likely stabilize again when imports and inventories increase, but are likely to remain elevated until the repairs to the Torrance refinery are completed later this summer.

Saturday, July 18, 2015

Schedule for Week of July 19, 2015

by Calculated Risk on 7/18/2015 08:22:00 AM

The key reports this week are June New Home sales on Friday, and June Existing Home Sales on Wednesday.

No economic releases scheduled.

10:00 AM ET: Regional and State Employment and Unemployment for June.

10:00 AM: The Federal Reserve will release the Annual revision for Industrial Production and Capacity Utilization

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for May 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

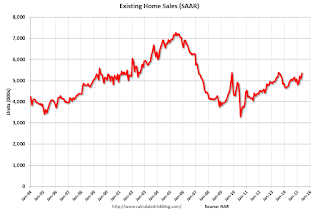

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 5.40 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 5.35 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.45 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 279 thousand from 281 thousand.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for July.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the April sales rate.

The consensus is for an increase in sales to 550 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 546 thousand in May.

Friday, July 17, 2015

Mortgage News Daily: Mortgage Rates Near July Lows

by Calculated Risk on 7/17/2015 07:15:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slowly Approach July Lows

Mortgage rates continued the recent trend of very small improvements today. Most lenders are essentially unchanged, and while a few rate sheets were higher than yesterday's, they were the exception. The average improvement was so small that it would have no effect on the contract rate in most cases. That means closing costs would be just slightly lower for the same rates quoted yesterday. While some of the most aggressive lenders are back to quoting conventional 30yr fixed rates of 4.0%, most remain at 4.125%. ...Here is a table from Mortgage News Daily:

emphasis added

Comments on June Housing Starts

by Calculated Risk on 7/17/2015 02:48:00 PM

Total housing starts in June were above expectations, and, including the upward revisions to April and May, starts were strong.

There was also a significant increase for permits again in June (mostly for the volatile multi-family sector).

Earlier: Housing Starts increased to 1.174 Million Annual Rate in June

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with weak housing starts in February and March, total starts are still running 10.9% ahead of 2014 through June.

Single family starts are running 9.1% ahead of 2014 through June.

Starts for 5+ units are up 14.9% for the first six months compared to last year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

The blue line (multi-family starts) was moving more sideways, but jumped up in June.

Multi-family completions are increasing.

Even with the surge in permits this over the last two months - and strong multi-family starts in June - I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A strong report.

Key Measures Show Low Inflation in June

by Calculated Risk on 7/17/2015 11:39:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in June. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for June here. Motor fuel was up sharply again in June.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.9% annualized rate) in June. The CPI less food and energy rose 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for May and increased 1.2% year-over-year.

On a monthly basis, median CPI was at 3.6% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI was at 2.2% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low, and a key question is: Will inflation move up towards 2%?

Preliminary July Consumer Sentiment decreases to 93.3

by Calculated Risk on 7/17/2015 10:08:00 AM

Housing Starts increased to 1.174 Million Annual Rate in June

by Calculated Risk on 7/17/2015 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,174,000. This is 9.8 percent above the revised May estimate of 1,069,000 and is 26.6 percent above the June 2014 rate of 927,000.

Single-family housing starts in June were at a rate of 685,000; this is 0.9 percent below the revised May figure of 691,000. The June rate for units in buildings with five units or more was 476,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,343,000. This is 7.4 percent above the revised May rate of 1,250,000 and is 30.0 percent above the June 2014 estimate of 1,033,000.

Single-family authorizations in June were at a rate of 687,000; this is 0.9 percent above the revised May figure of 681,000. Authorizations of units in buildings with five units or more were at a rate of 621,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in June. Multi-family starts are up sharply year-over-year.

Single-family starts (blue) decreased in June (because May was revised up) and are up about 14.7% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),This was above expectations of 1.125 million starts in June. And, with the upward revisions to prior months, and another surge in permits, this was another solid report. I'll have more later ...

Thursday, July 16, 2015

Friday: Housing Starts, CPI, Consumer Sentiment

by Calculated Risk on 7/16/2015 07:52:00 PM

Excerpts from a research piece by Goldman Sachs economist Zach Pandl on GDP:

Although most of the inputs used to calculate GDP are seasonally adjusted, the topline growth numbers still appear to fluctuate with seasonal patterns. The BEA intends to address this “residual seasonality” as part of its annual GDP revisions later this month. While the new estimates will be an improvement, they look unlikely to remove residual seasonality altogether.Friday:

According to our estimates, reported GDP growth tends to run about 1pp below other measures of real activity (like GDI or our CAI) in Q1 of each year. These estimates are statistically significant across a variety of samples. The BEA has said it will revise several components of GDP, rather than address residual seasonality at the aggregate level. We estimate that the likely revisions will affect Q3 and Q4 the most, with only modest effects on Q1 of about 0.3pp. Thus, our preliminary estimates suggest that Q1 GDP figures will remain about 0.7pp too low.

Residual seasonality is just one reason we track other measures of growth in conjunction with GDP. The BEA also seems to see the value in this approach, and with the revision will begin publishing other aggregate measures to “facilitate the analysis of macroeconomics trends”.

• At 8:30 AM ET, the Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core CPI.

• Also at 8:30 AM, Housing Starts for June. Total housing starts decreased to 1.036 million (SAAR) in May. Single family starts decreased to 680 thousand SAAR in May. The consensus is for total housing starts to increase to 1.125 million (SAAR) in June.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 96.2, up from 96.1 in June.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in June

by Calculated Risk on 7/16/2015 05:01:00 PM

Economist Tom Lawler sent me a preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in June.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Baltimore is up because of an increase in foreclosures).

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

As Lawler noted before: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). Baltimore is also shown separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the significant increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | |

| Las Vegas | 6.7% | 10.8% | 7.6% | 10.1% | 14.3% | 20.9% | 28.4% | 34.7% |

| Reno** | 5.0% | 10.0% | 3.0% | 7.0% | 8.0% | 17.0% | ||

| Phoenix | 23.0% | 26.6% | ||||||

| Sacramento | 5.8% | 7.0% | 4.6% | 6.5% | 10.4% | 13.6% | 17.8% | 19.8% |

| Minneapolis | 2.0% | 3.0% | 5.6% | 9.7% | 7.6% | 12.7% | ||

| Mid-Atlantic | 3.1% | 4.8% | 8.7% | 7.4% | 11.7% | 12.2% | 15.2% | 16.5% |

| Baltimore MSA**** | 3.1% | 4.3% | 14.3% | 10.7% | 17.4% | 15.0% | 20.7% | 19.8% |

| Orlando | 3.7% | 7.8% | 24.9% | 26.5% | 28.6% | 34.3% | 35.7% | 40.5% |

| Chicago (city) | 12.4% | 18.7% | ||||||

| Hampton Roads | 16.6% | 20.1% | ||||||

| Spokane | 10.7% | 14.1% | ||||||

| Northeast Florida | 25.6% | 32.4% | ||||||

| Toledo | 27.0% | 28.4% | ||||||

| Wichita | 21.9% | 22.6% | ||||||

| Des Moines | 14.4% | 14.6% | ||||||

| Tucson | 25.1% | 26.1% | ||||||

| Georgia*** | 20.3% | 24.6% | ||||||

| Omaha | 14.6% | 16.3% | ||||||

| Richmond VA MSA | 7.1% | 9.7% | 13.8% | 16.1% | ||||

| Memphis | 11.4% | 12.4% | ||||||

| Springfield IL** | 5.1% | 8.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||