by Calculated Risk on 7/17/2015 07:15:00 PM

Friday, July 17, 2015

Mortgage News Daily: Mortgage Rates Near July Lows

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slowly Approach July Lows

Mortgage rates continued the recent trend of very small improvements today. Most lenders are essentially unchanged, and while a few rate sheets were higher than yesterday's, they were the exception. The average improvement was so small that it would have no effect on the contract rate in most cases. That means closing costs would be just slightly lower for the same rates quoted yesterday. While some of the most aggressive lenders are back to quoting conventional 30yr fixed rates of 4.0%, most remain at 4.125%. ...Here is a table from Mortgage News Daily:

emphasis added

Comments on June Housing Starts

by Calculated Risk on 7/17/2015 02:48:00 PM

Total housing starts in June were above expectations, and, including the upward revisions to April and May, starts were strong.

There was also a significant increase for permits again in June (mostly for the volatile multi-family sector).

Earlier: Housing Starts increased to 1.174 Million Annual Rate in June

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with weak housing starts in February and March, total starts are still running 10.9% ahead of 2014 through June.

Single family starts are running 9.1% ahead of 2014 through June.

Starts for 5+ units are up 14.9% for the first six months compared to last year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

The blue line (multi-family starts) was moving more sideways, but jumped up in June.

Multi-family completions are increasing.

Even with the surge in permits this over the last two months - and strong multi-family starts in June - I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A strong report.

Key Measures Show Low Inflation in June

by Calculated Risk on 7/17/2015 11:39:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in June. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for June here. Motor fuel was up sharply again in June.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.9% annualized rate) in June. The CPI less food and energy rose 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for May and increased 1.2% year-over-year.

On a monthly basis, median CPI was at 3.6% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI was at 2.2% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low, and a key question is: Will inflation move up towards 2%?

Preliminary July Consumer Sentiment decreases to 93.3

by Calculated Risk on 7/17/2015 10:08:00 AM

Housing Starts increased to 1.174 Million Annual Rate in June

by Calculated Risk on 7/17/2015 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,174,000. This is 9.8 percent above the revised May estimate of 1,069,000 and is 26.6 percent above the June 2014 rate of 927,000.

Single-family housing starts in June were at a rate of 685,000; this is 0.9 percent below the revised May figure of 691,000. The June rate for units in buildings with five units or more was 476,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,343,000. This is 7.4 percent above the revised May rate of 1,250,000 and is 30.0 percent above the June 2014 estimate of 1,033,000.

Single-family authorizations in June were at a rate of 687,000; this is 0.9 percent above the revised May figure of 681,000. Authorizations of units in buildings with five units or more were at a rate of 621,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in June. Multi-family starts are up sharply year-over-year.

Single-family starts (blue) decreased in June (because May was revised up) and are up about 14.7% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),This was above expectations of 1.125 million starts in June. And, with the upward revisions to prior months, and another surge in permits, this was another solid report. I'll have more later ...

Thursday, July 16, 2015

Friday: Housing Starts, CPI, Consumer Sentiment

by Calculated Risk on 7/16/2015 07:52:00 PM

Excerpts from a research piece by Goldman Sachs economist Zach Pandl on GDP:

Although most of the inputs used to calculate GDP are seasonally adjusted, the topline growth numbers still appear to fluctuate with seasonal patterns. The BEA intends to address this “residual seasonality” as part of its annual GDP revisions later this month. While the new estimates will be an improvement, they look unlikely to remove residual seasonality altogether.Friday:

According to our estimates, reported GDP growth tends to run about 1pp below other measures of real activity (like GDI or our CAI) in Q1 of each year. These estimates are statistically significant across a variety of samples. The BEA has said it will revise several components of GDP, rather than address residual seasonality at the aggregate level. We estimate that the likely revisions will affect Q3 and Q4 the most, with only modest effects on Q1 of about 0.3pp. Thus, our preliminary estimates suggest that Q1 GDP figures will remain about 0.7pp too low.

Residual seasonality is just one reason we track other measures of growth in conjunction with GDP. The BEA also seems to see the value in this approach, and with the revision will begin publishing other aggregate measures to “facilitate the analysis of macroeconomics trends”.

• At 8:30 AM ET, the Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core CPI.

• Also at 8:30 AM, Housing Starts for June. Total housing starts decreased to 1.036 million (SAAR) in May. Single family starts decreased to 680 thousand SAAR in May. The consensus is for total housing starts to increase to 1.125 million (SAAR) in June.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 96.2, up from 96.1 in June.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in June

by Calculated Risk on 7/16/2015 05:01:00 PM

Economist Tom Lawler sent me a preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in June.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Baltimore is up because of an increase in foreclosures).

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

As Lawler noted before: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). Baltimore is also shown separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the significant increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | Jun- 2015 | Jun- 2014 | |

| Las Vegas | 6.7% | 10.8% | 7.6% | 10.1% | 14.3% | 20.9% | 28.4% | 34.7% |

| Reno** | 5.0% | 10.0% | 3.0% | 7.0% | 8.0% | 17.0% | ||

| Phoenix | 23.0% | 26.6% | ||||||

| Sacramento | 5.8% | 7.0% | 4.6% | 6.5% | 10.4% | 13.6% | 17.8% | 19.8% |

| Minneapolis | 2.0% | 3.0% | 5.6% | 9.7% | 7.6% | 12.7% | ||

| Mid-Atlantic | 3.1% | 4.8% | 8.7% | 7.4% | 11.7% | 12.2% | 15.2% | 16.5% |

| Baltimore MSA**** | 3.1% | 4.3% | 14.3% | 10.7% | 17.4% | 15.0% | 20.7% | 19.8% |

| Orlando | 3.7% | 7.8% | 24.9% | 26.5% | 28.6% | 34.3% | 35.7% | 40.5% |

| Chicago (city) | 12.4% | 18.7% | ||||||

| Hampton Roads | 16.6% | 20.1% | ||||||

| Spokane | 10.7% | 14.1% | ||||||

| Northeast Florida | 25.6% | 32.4% | ||||||

| Toledo | 27.0% | 28.4% | ||||||

| Wichita | 21.9% | 22.6% | ||||||

| Des Moines | 14.4% | 14.6% | ||||||

| Tucson | 25.1% | 26.1% | ||||||

| Georgia*** | 20.3% | 24.6% | ||||||

| Omaha | 14.6% | 16.3% | ||||||

| Richmond VA MSA | 7.1% | 9.7% | 13.8% | 16.1% | ||||

| Memphis | 11.4% | 12.4% | ||||||

| Springfield IL** | 5.1% | 8.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/16/2015 02:05:00 PM

From housing economist Tom Lawler:

Based on reports released by various realtor associations/MLS from across the country, I predict that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.45 million in June, up 1.9% from May’s pace, and up 8.8% from last June’s seasonally adjusted pace. Unadjusted home sales should an even larger YOY increase, reflecting the higher business day count this June compared to last June.

Realtor/MLS data suggest that the inventory of existing homes for sale as estimated by the NAR should be about 2.33 million at the end of June, up 1.7% from May and up 1.7% from a year earlier.

And finally, realtor/MLS data are consistent with a year-over-year increase in the median existing single-family home sales price of about 6.5%.

CR Note: The sales rate in June will likely be the highest since early 2007.

Earlier: Philly Fed Manufacturing Survey decreased to 5.7 in July

by Calculated Risk on 7/16/2015 12:14:00 PM

From the Philly Fed: July Manufacturing Survey

Manufacturing activity in the region increased modestly in July, according to firms responding to this month’s Manufacturing Business Outlook Survey.This was below the consensus forecast of a reading of 11.5 for July.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 15.2 in June to 5.7 this month. ...

Firms’ responses suggest steady employment in July. The percentage of firms reporting an increase in employees in July was equal to the percentage reporting a decrease (12 percent). The current employment index fell for the third consecutive month, from a reading of 3.8 in June to -0.4.

emphasis added

Click on graph for larger image.

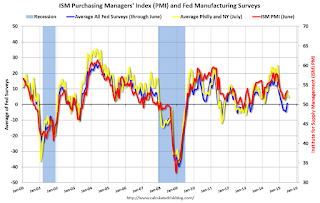

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys decreased in July, and this suggests a reading similar to June for the ISM survey.

NAHB: Builder Confidence at 60 in July, Highest Level Since November 2005

by Calculated Risk on 7/16/2015 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in July, unchanged from June (but June was revised up). Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Hits Highest Level Since November 2005

Builder confidence in the market for newly built, single-family homes in July hit a level of 60 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today while the June reading was revised upward one point to 60 as well. The last time the HMI reached this level was in November 2005.

...

“This month’s reading is in line with recent data showing stronger sales in both the new and existing home markets as well as continued job growth,” said NAHB Chief Economist David Crowe. “However, builders still face a number of challenges, including shortages of lots and labor.”

...

Two of the three HMI components posted gains in July. The component gauging current sales conditions rose one point to 66 and the index charting sales expectations in the next six months increased two points to 71. Meanwhile, the component measuring buyer traffic dropped a single point to 43.

Looking at the three-month moving averages for regional HMI scores, the West and Northeast each rose three points to 60 and 47, respectively. The South and Midwest posted respective one-point gains to 61 and 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 59.