by Calculated Risk on 7/16/2015 02:05:00 PM

Thursday, July 16, 2015

Lawler: Early Read on Existing Home Sales in June

From housing economist Tom Lawler:

Based on reports released by various realtor associations/MLS from across the country, I predict that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.45 million in June, up 1.9% from May’s pace, and up 8.8% from last June’s seasonally adjusted pace. Unadjusted home sales should an even larger YOY increase, reflecting the higher business day count this June compared to last June.

Realtor/MLS data suggest that the inventory of existing homes for sale as estimated by the NAR should be about 2.33 million at the end of June, up 1.7% from May and up 1.7% from a year earlier.

And finally, realtor/MLS data are consistent with a year-over-year increase in the median existing single-family home sales price of about 6.5%.

CR Note: The sales rate in June will likely be the highest since early 2007.

Earlier: Philly Fed Manufacturing Survey decreased to 5.7 in July

by Calculated Risk on 7/16/2015 12:14:00 PM

From the Philly Fed: July Manufacturing Survey

Manufacturing activity in the region increased modestly in July, according to firms responding to this month’s Manufacturing Business Outlook Survey.This was below the consensus forecast of a reading of 11.5 for July.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 15.2 in June to 5.7 this month. ...

Firms’ responses suggest steady employment in July. The percentage of firms reporting an increase in employees in July was equal to the percentage reporting a decrease (12 percent). The current employment index fell for the third consecutive month, from a reading of 3.8 in June to -0.4.

emphasis added

Click on graph for larger image.

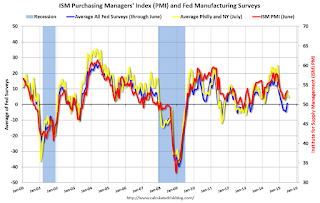

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys decreased in July, and this suggests a reading similar to June for the ISM survey.

NAHB: Builder Confidence at 60 in July, Highest Level Since November 2005

by Calculated Risk on 7/16/2015 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in July, unchanged from June (but June was revised up). Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Hits Highest Level Since November 2005

Builder confidence in the market for newly built, single-family homes in July hit a level of 60 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today while the June reading was revised upward one point to 60 as well. The last time the HMI reached this level was in November 2005.

...

“This month’s reading is in line with recent data showing stronger sales in both the new and existing home markets as well as continued job growth,” said NAHB Chief Economist David Crowe. “However, builders still face a number of challenges, including shortages of lots and labor.”

...

Two of the three HMI components posted gains in July. The component gauging current sales conditions rose one point to 66 and the index charting sales expectations in the next six months increased two points to 71. Meanwhile, the component measuring buyer traffic dropped a single point to 43.

Looking at the three-month moving averages for regional HMI scores, the West and Northeast each rose three points to 60 and 47, respectively. The South and Midwest posted respective one-point gains to 61 and 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 59.

Weekly Initial Unemployment Claims decreased to 281,000

by Calculated Risk on 7/16/2015 08:41:00 AM

The DOL reported:

In the week ending July 11, the advance figure for seasonally adjusted initial claims was 281,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 297,000 to 296,000. The 4-week moving average was 282,500, an increase of 3,250 from the previous week's revised average. The previous week's average was revised down by 250 from 279,500 to 279,250.The previous week was revised down by 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 282,500.

This was close to the consensus forecast of 282,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, July 15, 2015

Thursday: Unemployment Claims, Philly Fed Mfg, Homebuilder Survey, Yellen

by Calculated Risk on 7/15/2015 07:45:00 PM

From Jon Hilsenrath and Kate Davidson at the WSJ: Fed’s Yellen Aims to Move Rates Up Soon, but on a Slow Path

Fed officials have indicated they could move rates as early as September, though many investors expect the Fed to wait until December. Ms. Yellen, testifying Wednesday before a House panel, avoided being pinned down on a date, but did yield some insight into her tactical thinking on the timing.Goldman Sachs economist Kris Dawsey thinks the Fed will move in December:

She was more inclined to move rates up soon and proceed slowly than to wait a long time and move aggressively to catch up if the Fed finds itself behind the curve in preventing the economy or markets from overheating, she told the House Financial Services Committee. Moving soon and slowly, she said, could give the central bank flexibility as it proceeds.

Comments from Fed officials since the June meeting—including Chair Yellen's monetary policy testimony today—appear consistent with our forecast for a December rate hike. However, Fed officials are by no means "ruling out" September.Thursday:

...

On balance, we believe that recent Fedspeak has been broadly consistent with our expectation for a hike in December. That said, many Fed officials themselves do not appear to have high conviction views about September vs. December at this time. Amongst two hikers, Williams said he was in "wait-and-see mode" and Powell indicated that the odds of September vs. later were "roughly 50/50." Meanwhile, amongst those we expect would be one-hikers, the possibility of a September hike seems very much alive. Overall, we think that risk management considerations, continued concern about global developments, a prudent desire for the first hike after seven years of zero interest rates to be almost fully anticipated by the market, and persistently subdued realizations on core inflation will ultimately carry the day and result in a December hike.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 282 thousand from 297 thousand.

• At 10:00 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 11.5, down from 15.2 last month (above zero indicates expansion).

• Also at 10:00 AM, the July NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

CoStar: Commercial Real Estate prices increased in May

by Calculated Risk on 7/15/2015 05:13:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Property Price Indices Spring Forward In May

FOLLOWING SLOWDOWN IN APRIL, CRE PRICES REBOUNDED IN MAY WITH STRONG SHOWING ACROSS THE BOARD. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—gained 1.4% and 1.7%, respectively, in the month of May 2015. The value-weighted U.S. Composite Index advanced 12.2% in the trailing 12 months ended May 2015, and now stands 12% above its prior peak, reflecting the strong recovery of larger, higher-value properties. The equal-weighted U.S. Composite Index began its recovery later in the cycle but has increased at a faster rate of 14.1% in the trailing 12 months ended May 2015 as smaller commercial properties continued to gain favor with investors.

...

CRE SPACE ABSORPTION SOARED TO HIGHEST LEVEL YET IN RECOVERY. For the 12 months ended as of the second quarter of 2015, net absorption across the three major commercial property types — office, retail, and industrial — totaled 575.5 million square feet, a 39.3% increase over the 12-month period ended as of the second quarter of 2014, and the highest annual total on record since 2008.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index declined 1.4% in May and is up 12.2% year-over-year.

The equal-weighted index declined 1.7% in May and up 14.1% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Fed's Beige Book: Economic Activity Expanded, Respondents "optimistic about future growth"

by Calculated Risk on 7/15/2015 02:10:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Atlanta and based on information collected before July 3, 2015. "

All twelve Federal Reserve Districts indicated that economic activity expanded from mid-May through June. Activity in New York, Philadelphia, and Kansas City grew at a modest pace, while Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Dallas, and San Francisco saw moderate growth. Compared with the previous report, growth remained steady in Cleveland, and Boston reported conditions were stable or improving. Boston, Philadelphia, Atlanta, Kansas City, and Dallas reported that contacts were optimistic about future growth, while Chicago and San Francisco cited optimism coming from specific sectors. ...And on real estate:

Manufacturing activity was uneven across Districts from mid-May through June. Philadelphia, Richmond, Atlanta, and Chicago reported that business activity increased. Boston reported mostly positive conditions, and St. Louis indicated that plans for manufacturing activity were positive since the previous report. In contrast, Cleveland, Kansas City, and Dallas reported a decline in activity.

Reports on residential and commercial real estate markets were positive. Home sales increased for most Districts, although Philadelphia and Dallas reported sales were mixed, and New York reported a decline in sales volume. Most Districts noted home price appreciation. Residential construction activity varied across most of the country. Commercial real estate activity increased at a modest pace for several Districts, while non-residential construction, especially multifamily, was strong in many Districts.

emphasis added

Fed: Industrial Production increased 0.3% in June

by Calculated Risk on 7/15/2015 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.3 percent in June but fell at an annual rate of 1.4 percent for the second quarter of 2015. In June, manufacturing output was unchanged: The output of motor vehicles and parts fell 3.7 percent, but production elsewhere in manufacturing rose 0.3 percent. The indexes for mining and utilities advanced 1.0 percent and 1.5 percent, respectively. At 105.7 percent of its 2007 average, total industrial production in June was 1.5 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in June to 78.4 percent, a rate that is 1.7 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.4% is 1.7% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.3% in June to 105.1. This is 26.2% above the recession low, and 4.9% above the pre-recession peak.

This was above expectations of a 0.2% increase, and prior months were revised up. Much of the recent weakness has been due to lower oil prices - overall a solid report.

Yellen: "Prospects are favorable for further improvement in the U.S. labor market and the economy more broadly"

by Calculated Risk on 7/15/2015 08:34:00 AM

From Fed Chair Janet Yellen: Semiannual Monetary Policy Report to the Congress

Looking forward, prospects are favorable for further improvement in the U.S. labor market and the economy more broadly. Low oil prices and ongoing employment gains should continue to bolster consumer spending, financial conditions generally remain supportive of growth, and the highly accommodative monetary policies abroad should work to strengthen global growth. In addition, some of the headwinds restraining economic growth, including the effects of dollar appreciation on net exports and the effect of lower oil prices on capital spending, should diminish over time. As a result, the FOMC expects U.S. GDP growth to strengthen over the remainder of this year and the unemployment rate to decline gradually.

As always, however, there are some uncertainties in the economic outlook. Foreign developments, in particular, pose some risks to U.S. growth. Most notably, although the recovery in the euro area appears to have gained a firmer footing, the situation in Greece remains difficult. And China continues to grapple with the challenges posed by high debt, weak property markets, and volatile financial conditions. But economic growth abroad could also pick up more quickly than observers generally anticipate, providing additional support for U.S. economic activity. The U.S. economy also might snap back more quickly as the transitory influences holding down first-half growth fade and the boost to consumer spending from low oil prices shows through more definitively.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up 17% YoY

by Calculated Risk on 7/15/2015 07:00:00 AM

Note: Results for holiday weeks - and the following week - can be very volatile.

From the MBA: Refi Applications Up, Purchase Applications Down in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 10, 2015. The prior week’s results included an adjustment for the July 4th holiday. ...

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 8 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 17 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged from 4.23 percent, with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 17% higher than a year ago.