by Calculated Risk on 5/18/2015 10:04:00 AM

Monday, May 18, 2015

NAHB: Builder Confidence decreased to 54 in May

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 54 in May, down from 56 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Falls Two Points in May

Builder confidence in the market for newly built, single-family homes in May dropped two points to a level of 54 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. It is a nine-point increase from the May 2014 reading of 45.

...

“Consumers are exhibiting caution, and want to be on more stable financial footing before purchasing a home,” said NAHB Chief Economist David Crowe. “On the bright side, the HMI component measuring future sales expectations has been tracking upward all year, mortgage rates remain low, and house prices are affordable. These factors should spur the release of pent-up demand moving forward.”

...

The index’s components were mixed in May. The component charting sales expectations in the next six months rose one point to 64, the index measuring buyer traffic dropped a single point to 39, and the component gauging current sales conditions decreased two points to 59.

Looking at the three-month moving averages for regional HMI scores, the South and Midwest each rose one point to 57 and 55, respectively. The Northeast fell by one point to 41 and the West dropped three points to 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 57.

Sunday, May 17, 2015

Sunday Night Futures

by Calculated Risk on 5/17/2015 08:58:00 PM

Monday:

• At 10:00 AM ET, the May NAHB homebuilder survey. The consensus is for a reading of 57, up from 56 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of May 17, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $59.79 per barrel and Brent at $66.90 per barrel. A year ago, WTI was at $100, and Brent was at $108 - so, even with the recent increases, prices are down 40%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.70 per gallon (down less than $1.00 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Goldman's Hatzius: "The Employment Gap Is Much Bigger than the FOMC's Current Estimate"

by Calculated Risk on 5/17/2015 11:42:00 AM

Some excerpts from a research piece by Goldman Sachs chief economist Jan Hatzius: The Employment Gap Is Much Bigger than the FOMC's Current Estimate of the Unemployment Gap

The Fed's most "official" view of excess labor market slack is the gap between the unemployment rate (currently 5.4%) and the midpoint of the FOMC's central tendency range for the "longer-term" rate (currently 5.1%), which is usually taken to be an estimate of the structural unemployment rate. Taken at face value, this implies that the US economy can only create an additional 500,000 jobs before the labor market starts to overheat. ... If this is the right perspective, it would be entirely sensible, and perhaps urgent, to start normalizing monetary policy soon.CR Note: Here is the Chicago Fed Research Hatzius references: Changing labor force composition and the natural rate of unemployment. It is difficult to estimate the amount of slack in the labor market. However, because the risks are not symmetrical (normalizing monetary policy too soon is more risky than normalizing too late), this is an argument for waiting until there are signs of a pickup in wages and inflation. However, as Yellen recently noted: "we need to keep in mind the well-established fact that the full effects of monetary policy are felt only after long lags. This means that policymakers cannot wait until they have achieved their objectives to begin adjusting policy."

But we think it is a misleading perspective, for two reasons. First, the FOMC's current estimate of the structural unemployment rate is likely to continue falling ... This would not only be in keeping with the trend over the past two years, but also with a new study by the Chicago Fed which argues that population aging is likely to push structural unemployment significantly lower over time. ... If the Chicago Fed estimates are correct, the economy would be able to create about 800,000 jobs before the labor market starts to overheat in the short term, and as many as 1.4 million jobs in the longer term. This would already imply significantly less urgency to start normalizing monetary policy than the 500,000 jobs gap implied by the current FOMC estimate of the structural unemployment rate.

Second, there is probably significant labor market slack outside the unemployment gap because there is an important cyclical element in the decline of the labor force participation rate since 2007. This is consistent with Federal Reserve Research. For example, we can use updated estimates of the "demographically adjusted" employment/population ratio by Samuel Kapon and Joseph Tracy at the New York Fed to calculate another, broader version of the current jobs gap. Under the assumption that the labor market was at full employment in the third quarter of 2005--in line with the CBO estimate used in the Chicago Fed estimate above--the Kapon-Tracy numbers imply that the employment/population ratio is currently 1.2 percentage points below its equilibrium level. Multiplying this number by the over-16 population of about 250 million, the implied jobs gap is as large as 3 million. This implies much less urgency to start normalizing monetary policy than the unemployment-based numbers discussed above, and it is an important reason why we think it would be better for the FOMC to wait until 2016 before starting the normalization process.

Saturday, May 16, 2015

An update on oil prices

by Calculated Risk on 5/16/2015 09:20:00 PM

Demand for gasoline has picked up significantly recently. In February, U.S. vehicle miles driven hit a new all time high. Gasoline prices have increased too (although some of the increase was due to refinery problems).

From the LA Times: Four-dollar gasoline returns to the L.A. area

On Friday, the average for a gallon of regular in the Los Angeles area was higher than $4 for the first time since July, according to daily fuel price reports by AAA and GasBuddy.com. The recent surge in regional fuel prices has left local drivers paying more on average than motorists anywhere else in the U.S.

Analysts attributed the rise to a supply pinch caused by problems at the state's refineries, and predicted relief may not arrive in time for Memorial Day weekend road trips.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices Friday added). According to Bloomberg, WTI was at $59.69 per barrel on Friday, and Brent at $66.81

Prices have increased sharply off the recent bottom, but are still down 40%+ year-over-year.

Schedule for Week of May 17, 2015

by Calculated Risk on 5/16/2015 08:55:00 AM

The key economic reports this week are April Housing Starts on Tuesday and April Existing on Sales on Thursday.

For manufacturing, the April Philly and Kansas City Fed surveys will be released this week.

For prices, April CPI will be released on Friday.

Also on Friday, Fed Chair Janet Yellen will speak on the U.S. economic outlook.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 57, up from 56 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. Total housing starts increased to 926 thousand (SAAR) in March. Single family starts increased to 618 thousand SAAR in March.

The consensus is for total housing starts to increase to 1.029 million (SAAR) in April.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: the Fed will release the FOMC Minutes for the Meeting of April 28-29, 2015.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 270 thousand from 264 thousand.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 8.0, up from 7.5 last month (above zero indicates expansion).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 5.22 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 5.19 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.20 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

11:00 AM: the Kansas City Fed manufacturing survey for May.

1:30 PM: Speech by Fed Vice Chairman Stanley Fischer, Past, Present, and Future Challenges for the Euro Area, At the ECB Forum on Central Banking, Linho Sintra, Portugal

8:30 AM: The Consumer Price Index for April from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core CPI.

1:00 PM: Speech by Fed Chair Janet L. Yellen, U.S. Economic Outlook, At the Greater Providence Chamber of Commerce Economic Outlook Luncheon, Providence, Rhode Island

Friday, May 15, 2015

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/15/2015 06:27:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in April.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase in foreclosures in Baltimore).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

From Lawler: Note: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). I am showing it separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the almost 85% YOY increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Apr-15 | Apr-14 | Apr-15 | Apr-14 | Apr-15 | Apr-14 | Apr-15 | Apr-14 | |

| Las Vegas | 7.2% | 12.4% | 8.3% | 11.4% | 15.5% | 23.8% | 30.4% | 41.4% |

| Reno** | 6.0% | 15.0% | 5.0% | 6.0% | 11.0% | 21.0% | ||

| Phoenix | 2.5% | 4.0% | 3.8% | 6.5% | 6.3% | 10.5% | 25.3% | 32.2% |

| Minneapolis | 2.9% | 5.1% | 9.2% | 16.0% | 12.0% | 21.1% | ||

| Mid-Atlantic | 4.5% | 5.9% | 12.9% | 10.0% | 17.3% | 15.9% | 17.2% | 19.5% |

| Baltimore Metro | 4.3% | 5.8% | 20.7% | 13.8% | 25.0% | 19.6% | ||

| Orlando | 4.8% | 9.1% | 24.7% | 23.7% | 29.5% | 32.8% | 37.4% | 42.4% |

| Chicago (city) | 20.3% | 27.3% | ||||||

| Hampton Roads | 22.2% | 24.4% | ||||||

| Chicago (city) | 20.3% | 27.3% | ||||||

| Northeast Florida | 28.9% | 38.0% | ||||||

| Toledo | 30.2% | 33.4% | ||||||

| Tucson | 27.1% | 30.5% | ||||||

| Des Moines | 13.8% | 17.1% | ||||||

| Peoria | 17.3% | 21.2% | ||||||

| Georgia*** | 21.6% | 34.3% | ||||||

| Omaha | 16.4% | 19.7% | ||||||

| Richmond VA MSA | 11.5% | 15.4% | 18.2% | 22.5% | ||||

| Memphis | 16.1% | 17.3% | ||||||

| Springfield IL** | 10.3% | 13.2% | 17.9% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Hotels: On Pace for Record Occupancy in 2015

by Calculated Risk on 5/15/2015 03:51:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 9 May

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 3-9 May 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy increased 1.3 percent to 67.0 percent. Average daily rate increased 4.8 percent to finish the week at US$120.59. Revenue per available room for the week was up 6.1 percent to finish at US$80.85.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the Spring travel period and business travel is solid.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above last year.

Right now 2015 is even above 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels. Note the solid gains for RevPAR too.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/15/2015 12:47:00 PM

From housing economist Tom Lawler:

Based on available local realtor association/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.20 million in April, up 0.2% from March’s pace and up 9.5% from last April’s seasonally-adjusted pace.

On the inventory front, local realtor/MLS reports suggest that the monthly gain in the inventory of existing homes for sale last month was smaller than last April’s huge jump, and I project that the NAR’s existing home inventory estimate for April will be 2.23 million, up 11.5% from March but unchanged from last April. I should point out that the NAR’s inventory estimate for April has for many years showed a larger monthly gain – and the May estimate a smaller gain/larger decline – than local realtor/MLS reports would suggest. I’m not sure why, but the differences may reflect different “pull dates” for the publicly-released reports relative to the “NAR” reports realtor associations/MLS send to the NAR.

Finally, local realtor/MLS reports suggest that the median single-family home sales price for April as estimated by the NAR was up about 8.5% from last April.

CR Note: The NAR is scheduled to release April existing home sales on Thursday, May 21st.

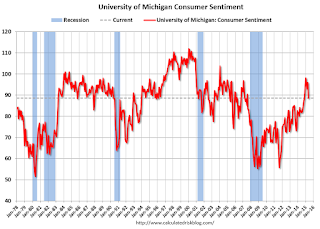

Preliminary May Consumer Sentiment declines to 88.6

by Calculated Risk on 5/15/2015 10:03:00 AM

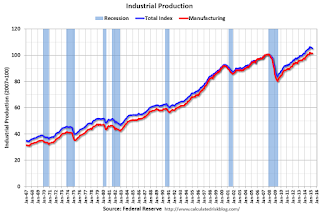

Fed: Industrial Production decreased 0.3% in April

by Calculated Risk on 5/15/2015 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.3 percent in April for its fifth consecutive monthly loss. Manufacturing output was unchanged in April after recording an upwardly revised gain of 0.3 percent in March. In April, the index for mining moved down 0.8 percent, its fourth consecutive monthly decrease; a sharp fall in oil and gas well drilling has more than accounted for the overall decline in mining this year. The output of utilities fell 1.3 percent in April. At 105.2 percent of its 2007 average, total industrial production in April was 1.9 percent above its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in April to 78.2 percent, a rate that is 1.9 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.2% is 1.9% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.3% in April to 105.2. This is 25.6% above the recession low, and 4.4% above the pre-recession peak.

This was below expectations of no change, although March was revised up - and much of the decline over the last few months was due to the "a sharp fall in oil and gas well drilling".